Chart 1: Uber’s share price hit a record on September 18, 2025

![]()

Source:XTB and Bloomberg. Past performance is not a reliable indicator of future results.

The stock was given a major boost after strong Q2 earnings, released earlier in the summer. Gross bookings grew by 17%, helped by strong delivery results, while car bookings grew by 16%. This strong double-digit growth is a sign of Uber’s resilience in an industry where competition is growing. The company is expanding market share in its mobility division. It is boosting both human drivers and its autonomous vehicle (AV) fleet, which gives it an edge over some smaller rivals including Lyft in the US and Bolt in Europe.

Strong fundamentals power Uber’s share price to record highs

Uber also announced that it had cut wait times for its customers, which is a massive benefit since few businesses are as vulnerable to wait times as ride sharing apps. Customers can easily cancel and try another provider, both in its mobility sector and its delivery services, so perfecting its algorithm to allocate drivers efficiently around their service area is crucial. These results suggest that Uber could pull ahead of its rivals if it continues making progress in this direction.

Subscription service success

Other positive areas of growth included its subscription service. Uber One has grown to 30 million members so far in 2025, which is a 60% growth rate YoY. The continued popularity of Uber One is positive for the longer-term outlook for Uber. It is a key plank of the company’s long-term growth strategy, and it dramatically increases cross selling opportunities. Members all over the world get access to a range of benefits by subscribing to Uber One, and this has led to a large divergence in customer spending. Uber One members now spend significantly more on the platform than non-members. It is particularly effective at driving delivery performance.

Earnings growth expected to continue

Analysts expect another strong set of results when the company releases its next earnings report on 31st October. Analysts don’t expect any tricks from Uber, and are currently estimating an increase in revenue to $13.24bn for the quarter, up from $12.65bn in Q2. Net income is also expected to rise. Earnings per share is expected to rise to $0.88, up from $0.63 in Q2. This would be a further sign that the company is boosting its profitability, which is likely to be welcomed by investors.

Uber measures its earnings (EBITDA) as a percentage of bookings, although small, they have shown consistent growth. At 4.5% in Q2 this year, it is expected to grow to 4.63% in Q3. Investors love an upwardly sloping trajectory, especially for earnings growth, so Uber’s share price increase is partly down to decent fundamentals.

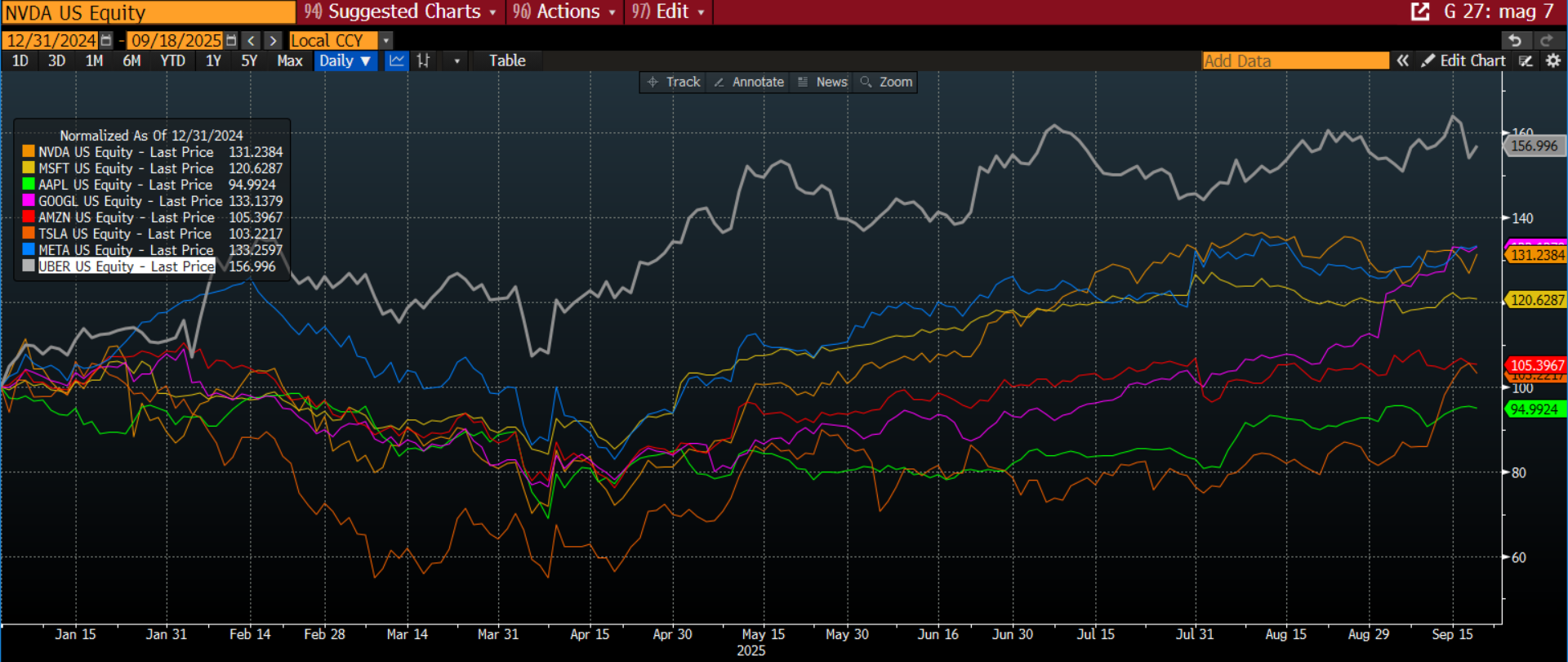

Uber’s record high share price comes at the same time as US tech stocks are back in demand. As a group, the magnificent 7 tech giants are also at record highs, along with the Nasdaq and the S&P 500. Uber has been able to ride this wave and has also benefitted from strong corporate fundamentals. As you can see in the chart below, Uber’s share price has actually outperformed the other Magnificent 7 stocks this year, suggesting that the slightly smaller cap tech stocks are leading the latest phase of the tech stock rally.

Chart 2: The Magnificent 7 and Uber (grey line)

![]()

Source: XTB and Bloomberg. Past performance is not a reliable indicator of future results.

Future risks for Uber

There are some risks to be aware of when trading Uber shares. The company’s P/E ratio looks stretched at 40 times earnings, so some investors may be put off by how expensive the stock price is. The company also has elevated debt levels. Interest expenses have been high, but they are starting to level off as revenues strengthen.

A dampener for Q3 earnings will be the FX effect. The company has a global footprint, but it reports earnings in dollars. The USD has sunk this year and its Q3 performance has been dismal. Analysts expect this have a slight moderating effect on earnings for next quarter.

There is intense competition in the area, and although Uber is riding high right now, competitors such as Lyft could soon catch up. This means that the company needs to be constantly focused on new innovations, which can be expensive and cause costs to rise. The executive team will need to be laser focused on costs in the coming months, otherwise investors may start to ask questions, especially since the stock price is at an elevated valuation.

Also worth noting are the regulatory risks facing Uber. The company has already said that a crackdown on immigration on both sides of the Atlantic could impact its business and cause it to raise costs. Added to this, the Autonomous Vehicle market is heating up, and Uber could face stiff competition from Tesla’s Robotaxi in the months and years to come.

Overall, Uber’s share price has had a stunning 2025 so far, and its results continue to entice investors. It is well positioned to extend gains as we move towards the final months of the year.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.