Asset prices in financial markets largely depended on the emotions of market participants. Their fluctuations mean that periods of temporary panics and euphoria are cyclical. They are part and parcel of the “mechanics” of the market, and since human psychology has not changed significantly over the past hundreds of years, financial crises and crashes happen periodically. And they are likely to continue to happen, in the future. Usually, a crisis is preceded by a period during which most investors are wrong, driven by greed. Such situations may lead to a crash and can herald a prolonged crisis, fuelled by investors' fear. Most spectacular examples include the 2020 crash caused by the Covid-19 virus, the dot-com bubble of the 2000s, and the Great Depression of 1929, after which the US stock market took nearly 25 years to recover.

In good times, investors overestimate the value of some companies and underestimate the risk. This is a characteristic element of a great economy, during which no one worries about the future. Risk control and uncertainty recede into the background. Usually, however, an unexpected event shows that reality is not so great. It could be a systemic problem in the financial sector like the subprime loans in 2008, a war or a period of economic downturn. During a recession, corporate profits and revenues begin to fall. The effect? In the end, euphoria turns into panic and leads to drastic price drops. During them, the market gets rid of assets it loved until recently. Investors see the future in black. They believe that there is no price too low for the things they own. Over time, they are proven wrong again, and the market begins to recover.

Asset prices in financial markets largely depended on the emotions of market participants. Their fluctuations mean that periods of temporary panics and euphoria are cyclical. They are part and parcel of the “mechanics” of the market, and since human psychology has not changed significantly over the past hundreds of years, financial crises and crashes happen periodically. And they are likely to continue to happen, in the future. Usually, a crisis is preceded by a period during which most investors are wrong, driven by greed. Such situations may lead to a crash and can herald a prolonged crisis, fuelled by investors' fear. Most spectacular examples include the 2020 crash caused by the Covid-19 virus, the dot-com bubble of the 2000s, and the Great Depression of 1929, after which the US stock market took nearly 25 years to recover.

In good times, investors overestimate the value of some companies and underestimate the risk. This is a characteristic element of a great economy, during which no one worries about the future. Risk control and uncertainty recede into the background. Usually, however, an unexpected event shows that reality is not so great. It could be a systemic problem in the financial sector like the subprime loans in 2008, a war or a period of economic downturn. During a recession, corporate profits and revenues begin to fall. The effect? In the end, euphoria turns into panic and leads to drastic price drops. During them, the market gets rid of assets it loved until recently. Investors see the future in black. They believe that there is no price too low for the things they own. Over time, they are proven wrong again, and the market begins to recover.

How do you survive and navigate in such crazy times? Let's review strategies and tips for successful investing during a crisis. Can you learn the tools necessary to make decisions and protect your portfolio in turbulent times? In this article, we will analyse the stock market as a best benchmark for “crisis analysis”. Let's begin this journey.

Fear and greed - the market pendulum

The crisis is better interpreted and understood as a process in which each successive event results from the other. Moreover, as in the movement of a pendulum, its position is shaped by “physical forces”. Over hundreds of years, countless books have been written that treat greed and fear. These two, extreme emotions powerfully influence investor behaviour - and consequently prices. For example, if corporate revenues or profits fall by a few percent, stock prices can fall by tens of percent.

Conversely, if the GDP index rises by a few percent and revenues and profits increase by several tens of percent, stock prices can rise by two, three or five times. This perfectly captures the nature of the market, which tends to overreact - to both bad and good news. However, as Charlie Munger, co-founder of Berkshire Hathaway and friend of Warren Buffett, puts it: “In the short term the market is a voting machine, in the long term a weighing machine”. But what really follows from these words?

How to use a crisis as an opportunity?

The crisis is making investors pessimistic. Long-term investors who want to buy stocks at lower prices can only wait. Why? To buy shares in companies cheaper, a buyer must meet a seller willing to sell them cheaper. In good times, investors are reluctant to sell shares at a lower price.

Thus. Looking for opportunities in the market as a rule means buying stocks at a time when sentiment is very bad and risk aversion is widespread. However, you need to know what stocks to buy and how to price them to acquire confidence. This skill can mean an ability to do fundamental analysis, a deep understanding of risk, psychology, and what Howard Marks calls “second level thinking”. What helps investors buy stocks cheaper?

- A cool mind and not giving in to emotions such as greed and fear

- The ability to assess market sentiment and the cycle

- Risk management

- Knowledge of fundamental analysis

- Justified investing aggression (when the risk premium rises and the margin of safety increases)

Panic times usually bring large declines that can last a relatively short time. So time for decision-making may also be limited. Manager and co-founder of the Oaktree Capital fund, Howard Marks explained how cycles occur in the stock market, in three phases.

Three phases of the market

- At the beginning of a bull market, when the market is coming out of a price bottom and depression only a few, thinking differently than everyone else, investors buy stocks, and see the potential for a future improvement in sentiment.

- Stocks slowly start to rise, and more and more investors see that an improvement is actually taking place.

- In the final phase, all investors agree that the situation has improved. At this point in the cycle, many expect the situation to only get better. The latest buyers accept the lowest premium, for the risk they are taking (stock valuations are already high).

Investors react to events in an extreme manner, but in the long term, stock prices follow the actual state of affairs and the financial conditions of companies.

Exceptional situations of panic and euphoria can create opportunities for those who can identify them and use them to their advantage.

At the same time, not every crash (a period during which prices fall dramatically) turns into a crisis (an extended period during which the situation is generally considered bad). And not every crisis results in a crash. The coronavirus pandemic caused a massive crash in 2020, during which the US stock market lost almost as much in percentage terms as it did during the 1987 “Black Monday” panic. However, it turned out that the virus was contained relatively quickly, thanks to vaccines.

Central banks implemented extensive stimulus programs that kept the economy from economic depression. And the pharmaceutical companies supplying the vaccines made hundreds of billions of dollars. So panic fear was turning into uncertainty. This uncertainty gradually evolved into optimism and eventually euphoria. This process varies over time (sometimes it takes less time, sometimes longer) but has characterised all past crises.

How to take advantage of cycles?

An investor who wants to make money in a crisis should be optimistic. In distressing moments in the market, it seems that there are no reasons to risk buying stocks. Meanwhile, such situations are often even synonymous with opportunity. Of course, optimism should be justified first by choosing the right company, at ‘good’ (cheap) price. What’s more, it should also be balanced with a conscious risk taking approach.

Remember that buying companies cheaper may not be a short term key to achieve superior results. There is no one method that can guarantee investing success. Investing contrary during stock crashes is not easy and may be addressed especially to professional investors, who have higher confidence about their investment choices.

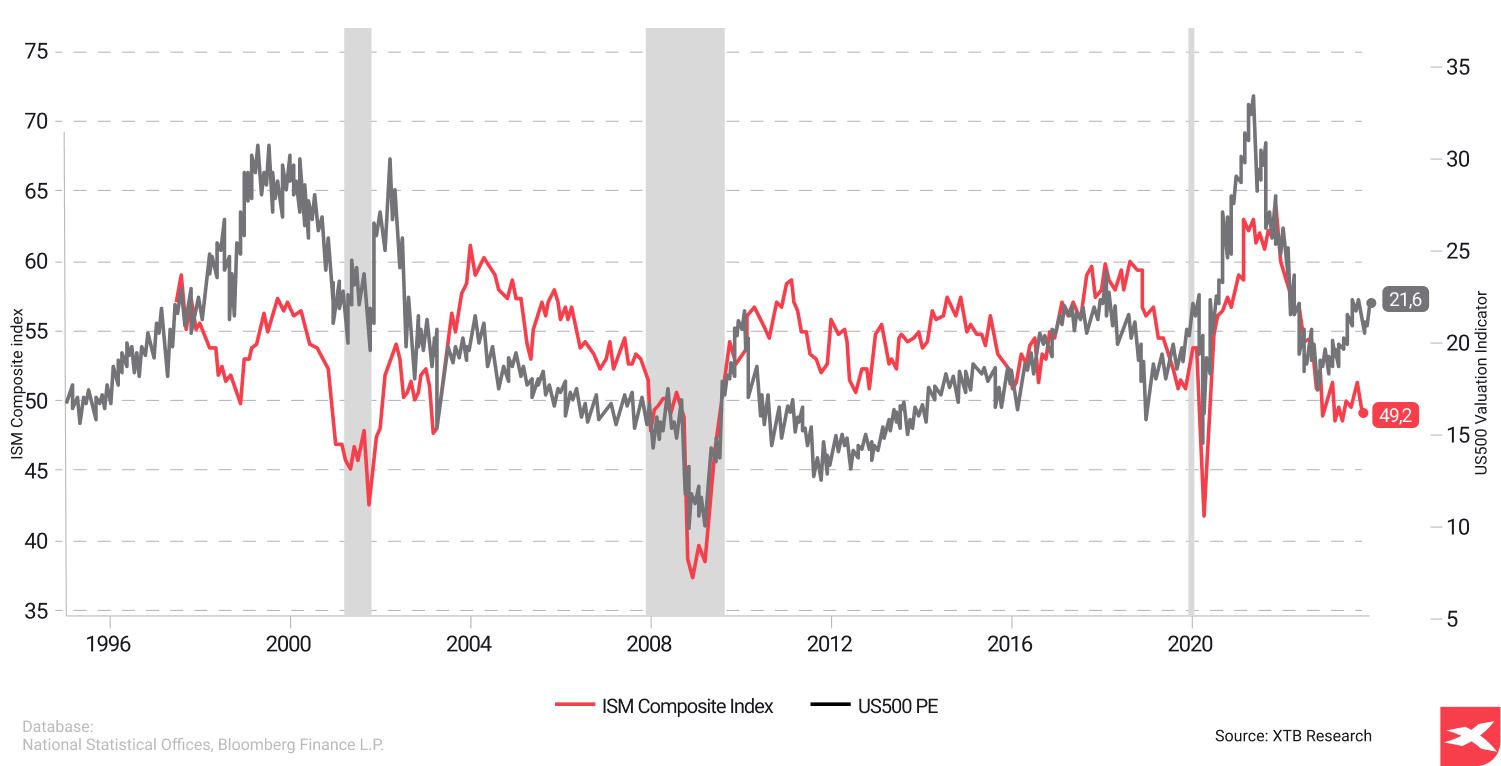

During recessions, the US Composite Index weakened and S&P 500 companies' valuation multiples (price/earnings ratio) were also lower, weighing on stock market performance. In the long term, the stock market needs economic expansion to rise.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Source: XTB Research

Signs of a crisis

The first step to successful investing during a crisis is to recognise the signs that a storm is brewing. Financial crises often result from a combination of factors, including excessive risk-taking, increased borrowing, and regulatory failures within the financial system. Staying well-informed and alert can provide you with insights into the economy's state and the potential for an upcoming crisis, as well as the impact on financial firms and the prevalence of risky loans. Understanding the indicators of a potential crisis involves examining three key areas, such as:

- economic data

- market trends

- geopolitical events

Remember, however, that what characterises a crash in the first place is its “unpredictability”. Since we can say, according to the theory of market efficiency, that stock prices reflect almost all available information at any given time, if an event occurs that leads to a 10 or 15% crash of entire indices in one day - it must be caused by an unknown factor. It is slightly different with a crisis. It's true that it's hard to predict the exact time of its onset, but we can spot worrying signals earlier. They can be, for example:

- decline in optimism among CEOs and businessmen

- rising unemployment and falling GDP figures, contrasting with the restrictive monetary policy of central banks

- increasingly lower PMI and ISM figures contrasting with historically high stock valuations

- rising geopolitical tensions, high oil market volatility

- inversion of the bond market yield curve

Leading indicator - the yield curve inversion?

All five previous U.S. recessions since the 1980s have been preceded by an inversion of the yield curve. Of course, there is no 100% probability of events on financial markets, so extrapolation of historic events may be not accurate. But what is inversion, and when does it take place?

All five previous U.S. recessions since the 1980s have been preceded by an inversion of the yield curve. Of course, there is no 100% probability of events on financial markets, so extrapolation of historic events may be not accurate. But what is inversion, and when does it take place?

When interest rates on 10-year bonds turn out to be lower than short-term, 2-year bonds. Those purchasing debt securities that pay a return after 10 years (which carries a higher risk) receive less than those who receive it after 2 years. Borrowing in the short term is more expensive than in the long term. In such a situation, companies defer investments because of higher costs. Debt service costs rise, spending falls, unemployment rises. Finally, the economy shrinks.

Important: Historically, US recessions have started 18 months after a yield curve (sometimes even 2 years after it). For sure, a yield curve inversion is worth watching for speculators and long term investors.

Economic Data

Monitoring key economic indicators like GDP growth, unemployment rates, and inflation is vital in identifying a crisis. These indicators offer insights into the economy’s health and hint at possible downturns. For instance, a country is generally considered to be in a recession when its GDP has declined over two consecutive quarters, which can negatively impact economic growth.

During the Great Recession of 2007-2009, economic data such as residential investment and employment in residential construction reached their highest points in 2006, while the overall economy peaked in December 2007. Closely tracking economic indicators enables investors to spot warning signs of an upcoming crisis and adapt their investment strategies as needed.

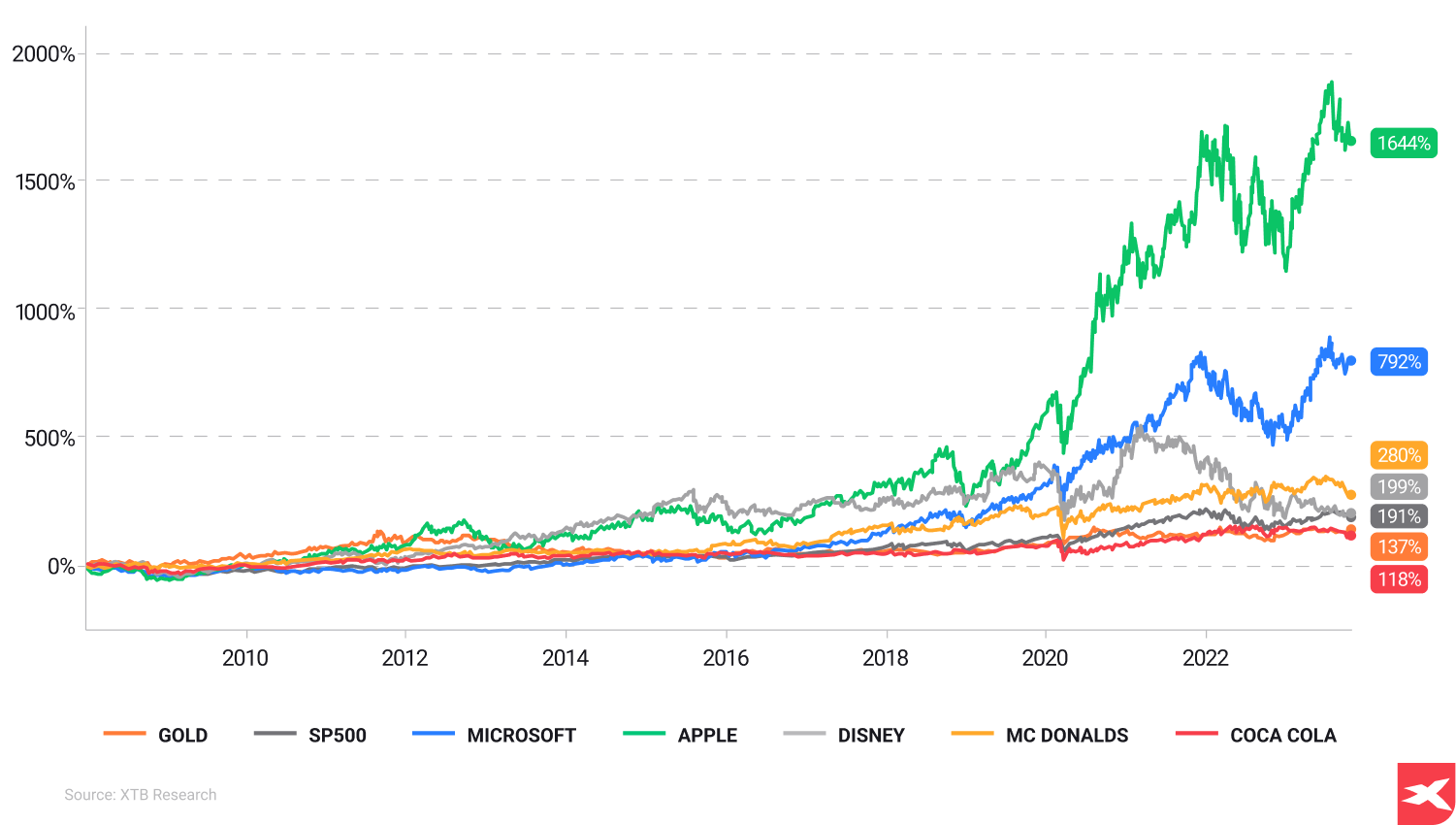

After the stock market crash and 2008 crisis, stocks as well as gold surged. Successful escaping the very deep crisis environment finally led to market euphoria.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Source: XTB Research

Market Trends

Besides economic data, watching market trends is pivotal in foreseeing potential crises. Market trends include patterns of activity in the stock market, economic indicators, and other variables that can signal a recession or financial downturn. For example, a yield curve inversion, where long-term interest rates fall below short-term rates, is often seen as a precursor to an economic crisis or recession.

Examples of market trends from past crises include the stock market crash of 2008 during the Global Financial Crisis, and the sharp decrease in stock prices and heightened volatility in the stock markets. Keeping a close eye on market trends allows for a better assessment of a crisis’s likelihood and aids in making knowledgeable investment decisions. Global events, such as political instability and natural disasters, can also have a profound impact on financial markets and trigger crises. Some examples of geopolitical events that have triggered financial crises include:

- The global financial crisis of 2008

- The European debt crisis of 2011

- The Russian financial crisis of 1998

- The Asian financial crisis of 1997

To stay informed about global events that can impact financial markets, investors can access investor briefings, trading industry news platforms, and geopolitical risk management resources. Staying updated on geopolitical events aids in understanding the factors contributing to financial crises and making knowledgeable investment decisions during volatile times.

10 key aspects for crisis management

- Don't react emotionally and try to act like a professional

- Accept the fact that the future is de facto uncertain and remain allergic when everyone sees it in black colours and is a big pessimist

- Accept risk only if you think the premium for taking it is high enough. Ask yourself, why do you think so?

- Consider how much you stand to lose if things don't go your way. The market surprises - not always positively

- Remember, if you want to buy very cheap - you have to buy stocks from very scared sellers

- Be brave at a time when pessimism is widespread and risk aversion dominates the markets. Remember, however, that there is usually a seemingly “good reason” for this - ask yourself what is the market so afraid of?

- The number of opportunities for buying when times are good and the market has no “serious worries” can be difficult

- Investors can be wrong and misjudge even powerful, well covered companies by analysts

- The financial press is famous for “negative headlines” - don't suggest them

- Remember that cooperating and exchanging constructive conclusions and thoughts with other investors can help you

10 important things about investing during a crisis

Having discussed the importance of recognising crisis signs, it’s time to examine some effective crisis investing strategies. Implementing well-thought-out investment strategies, such as diversification, risk management, and focusing on long-term goals, can help you navigate financial crises and protect your portfolio. The subsequent sections will delve deeper into each strategy, offering practical tips and insights to optimise your investments during challenging times.

10 important things

- The future is unknown but very bad things and crises historically changed into good and sometimes very good times (over time)

- A potential of trend reversal rises as market pendulum approach extreme phases (panic sell, greedy buy)

- You never know when panic or rally end but FOMO (Fear Of Missing Out) event are characteristic for mania periods (which sometimes are extended in time)

- Contrarian investing may not be for every investor. Some investors feel better with “going with trend” and this strategy may be perfect - especially when bullish trend reversal will be recognized relatively early

- It's hard to predict a market bottom, and there is no need to do so. Just saying are some assets very cheap or very expensive

- It's not simple to take advantage during a crisis. Outperforming the market is not

- Macro data are very important but investing on macro basis may be not effective

- You can use macro readings to better know where current cycle - like Howard Marks says, “You can don't know where you're going, but you have to know where you are”

- Gaining financial knowledge may help you to achieve satisfying investment results

- Remember that financial markets are risky and volatile - don't expect fast returns. Always be patient

Diversification

Diversification is the practice of spreading your investments across different asset classes, sectors, and regions to reduce risk. During a crisis, diversification becomes a necessity, as it helps to limit the risk of losses from a single investment. A well-diversified portfolio can provide a safety net during turbulent times, allowing you to weather the storm and emerge stronger on the other side.

To construct a diversified portfolio, consider investing in a variety of companies across multiple industries, including those that are recession-resistant, such as blue-chip stocks. By spreading your investments across various asset classes and sectors, you can create a more resilient portfolio that is better equipped to withstand the challenges of a crisis. However, investing is risky and investors should rely on their own knowledge and experience.

Risk Management

Risk management is the practice of assessing and managing the risks associated with investments. Effective risk management becomes vital during a crisis, as it provides an understanding of your investments’ nature and enables you to make knowledgeable portfolio decisions. By identifying and analysing the potential risks and rewards of an investment, you can make educated choices that align with your financial objectives.

Some tools and strategies for risk management in crisis investing include:

- Downside risk management techniques within a portfolio context

- Hedging strategies to reduce portfolio volatility and risk

- A comprehensive risk management strategy comprising knowledge, protection, insurance, and coping

By implementing the mentioned strategies, you can better protect your portfolio during a crisis. Remember, that future is still uncertain and the effects of every strategy can’t be predicted with 100% accuracy.

Long-term Goals

Keeping a long-term investment perspective during a crisis is important. It allows you to benefit from the market recovery by remaining invested and enduring the downturn. Focusing on your long-term goals can help you avoid making impulsive decisions based on short-term market fluctuations, which can result in losses and missed opportunities for recovery.

During a crisis, it’s important to remain patient and wait for the market to stabilise. By sticking to your long-term investment plan and resisting the urge to make rash decisions, you can better navigate the ups and downs of the market and come out stronger in the end.

Asset classes during a crisis

Along with implementing effective investment strategies, exploring your investment options during a crisis is pivotal. Some asset classes, such as bonds, gold, and defensive stocks, tend to perform well during financial crises and can provide stability and income when other investments falter.

The subsequent sections will detail these asset classes, offering insights into their performance during crises and their role in protecting your portfolio during challenging times.

Bonds

Bonds are a type of security that pays a fixed rate of interest over a predetermined period of time. They can offer stability and income during crises, as they typically outperform stocks in a recession and provide a steady income stream. Some key points about bonds include:

- They pay a fixed rate of interest

- They have a predetermined period of time

- They offer stability and income during crises

- They outperform stocks in a recession

- They provide a steady income stream

Government bonds, in particular, are considered less risky than corporate bonds, making them an attractive option for investors seeking stability during a crisis. Central banks and other financial institutions often invest in these low-risk assets, as well as in money market mutual funds, mortgage backed securities, and mortgage loans to maintain financial stability, even for subprime borrowers.

To invest in bonds during a crisis, consider purchasing government or high-quality corporate bonds with strong credit ratings. These bonds can provide a reliable source of income and help to safeguard your capital during tumultuous times. Remember that even bonds may be risky. Countries may default and as history shows even large corporations and huge banks, with long history such as Credit Suisse may lead to bondholders losses (AT1).

Gold

Gold is a precious metal that is often viewed as a safe-haven asset during crises due to its historical store of value and limited correlation with other asset classes. During times of economic instability, gold can provide protection to investors’ portfolios and has historically exhibited favourable performance during financial crises. To invest in gold during a crisis, consider purchasing physical gold bars or coins, or invest in gold through Exchange Traded Funds (ETFs). Gold as a “safe haven asset” may be an attractive investment option for those seeking stability and protection during times of economic uncertainty. It’s worth noting that in the long term, gold may be outperformed by stocks and other assets. Also, stronger US dollar and escaping the crisis may lead to sluggish gold performance.

Defensive Stocks

Defensive stocks, such as those in healthcare, consumer staples, and utilities, tend to be more resilient during economic downturns due to their stable performance and non-cyclical industries. These companies provide essential products or services that remain in demand regardless of economic conditions, making them less vulnerable to downturns. To invest in defensive stocks during a crisis, consider allocating a portion of your portfolio to companies in stable, non-cyclical industries that have a history of consistent earnings growth and reliable dividend payouts.

By doing so, you can create a more resilient portfolio that can better withstand the challenges of a crisis… But even that is not a 100% recipe. Defensive stocks may also be stock downturn ‘victims’ as investors sell everything just to jump in cash. Also, if the market conditions improve and people will become optimistic again, defensive stocks usually underperform ‘growth stocks’ with scalable business models and other moats.

4 common investing mistakes

Understanding past errors is pivotal to successful crisis investing. Understanding the common pitfalls encountered by investors during financial crises allows you to evade similar mistakes and safeguard your investments. In this section, we’ll discuss three common mistakes in crisis investing: panic selling, market timing, and overconcentration. Recognizing and avoiding these common mistakes allows you to navigate crisis challenges more effectively and safeguard your portfolio during volatile times.

Understanding past errors is pivotal to successful crisis investing. Understanding the common pitfalls encountered by investors during financial crises allows you to evade similar mistakes and safeguard your investments. In this section, we’ll discuss three common mistakes in crisis investing: panic selling, market timing, and overconcentration. Recognizing and avoiding these common mistakes allows you to navigate crisis challenges more effectively and safeguard your portfolio during volatile times.

Panic Selling

Panic selling occurs when investors hastily sell their holdings during a market downturn, causing prices to drop sharply and resulting in losses for those who sell. It can be detrimental to your long-term investment goals, as it can lead to missed opportunities for recovery when the market rebounds. To avoid panic selling during a crisis, it’s important to remain patient and wait for the market to stabilise. By resisting the urge to sell during market downturns, you can protect your investments from unnecessary losses and capitalise on potential gains when the market recovers.

Market Timing

Market timing, or attempting to predict and capitalise on short-term market movements, is another common mistake in crisis investing. This strategy is challenging to execute successfully, as it is nearly impossible to accurately predict market movements during a crisis. In fact, studies have shown that investing in a well-diversified portfolio over the long term generally yields better results than attempting to time the market. Instead of trying to time the market, focus on maintaining a well-diversified portfolio and buying great companies when stocks are much cheaper. By doing so, you can better navigate the ups and downs of the market and come out stronger in the end.

Important: Having uncorrelated assets in a portfolio may make it less risky. Also, companies with no debt and strong cash flows may be stronger during market downturns. Especially from non-cyclical sectors such as freight stocks or consumer discretionary, which can be extremely vulnerable to recession.

Overconcentration

Overconcentration, or having a large portion of your investment portfolio allocated to a single stock, sector, or asset class, can amplify the risk of your portfolio and make it more vulnerable to volatility and potential losses. To avoid overconcentration, it’s essential to diversify your investments across different stocks, sectors, and asset classes. By maintaining a well-diversified portfolio, you can reduce the risk of your investments being disproportionately affected by the performance of a single asset class or sector. This can help protect your portfolio during a crisis and ensure that you are better positioned to weather the storm.

Buying during mania

By buying overvalued, rising stocks, investors take higher risk. Especially when a company is leveraged and has a relatively high level of debt. When markets go down, most overvalued and “loved” companies usually lose the most because market disappointment is so big. This leads to a crash and panic selling. Try to avoid buying stocks “just because they are rising”. Focus on cash flows, understanding business models and future opportunities. Don't forget about risk management. Sometimes it's better to stay aside the market and focus on sectors which are cheap if your knowledge level is too low to decide with enough level of certainty whether stock X is cheap or expensive.

Important: Remember, stock price is not guaranteed that the company is very expensive, as well as it's not enough information to tell you that stock is cheap.

Learning from Past Crises

Market cyclicality warns investors about history lessons. Examining previous financial crises can offer useful insights and lessons for investors. By understanding the causes and consequences of past crises, such as the Global Financial Crisis or COVID-19 pandemic, you can better prepare for and respond to future challenges.

Global Financial Crisis

The 2008 Global Financial Crisis was a result of a combination of factors, including the decline in the US housing market, losses on mortgage-related financial assets, excessive risk-taking, increased borrowing, and regulatory failures. One of the major factors was subprime lending, which contributed to the crisis and had a significant impact on global financial markets, causing a decrease in economic activity in numerous countries, tensions in the global financial system, and a recession in the US economy. The widespread issuance of subprime mortgages played a crucial role in exacerbating the housing market collapse. By understanding the causes and consequences of the Global Financial Crisis, we can gain valuable insights into the factors that contribute to financial crises and make more informed investment decisions during future crises. Lessons learned from the crisis include:

The importance of analysing investment fundamentals

- Investing in well-managed companies

- Maintaining a diversified portfolio

- Capitalising on market downturns

- Issuing equity instead of taking on additional debt

COVID-19 Pandemic

The COVID-19 pandemic presented unique challenges and opportunities for investors, as it caused a rapid market downturn, followed by a subsequent recovery. The pandemic had a considerable economic impact on global markets, resulting in increased market volatility, reduced supply and demand. By examining the unique challenges and opportunities presented by the COVID-19 pandemic, we can better understand how to navigate future crises and capitalise on the lessons learned. Some common mistakes made by investors during the pandemic include:

- Failing to appreciate the influence of the pandemic on global share prices

- Making abrupt pivots or alterations in investment strategies without thorough contemplation

- Neglecting to take lessons from prior crises when devising recovery strategies

- Disregarding potential risks in popular investment sectors during the pandemic

In the end of a story, pharmaceutical companies like Pfizer, Biontech and Moderna created Covid vaccines and people achieved immunity. Central banks such as the US Federal Reserve or European Central Bank helped economic growth, risking higher inflation numbers, but huge interest rate cuts and QE programs with high levels of people savings made post-Covid rebound very strong after demand came back on markets much stronger and faster than expected. Pandemic proved that companies are here to solve problems and even during dark times the financial world can evolve.

Lessons from Nifty 50 and dot-com bubble burst

A Nifty 50 bubble burst from the 70s may be the most underrated example of optimism concentration risk. The Nifty 50 were the biggest, fastest growing US companies listed on stock exchanges and in the 60s and 70s XX century analysts were sure that nothing bad can happen with their valuations. In the effect, valuations of companies like Kodak, Xerox or Polaroid were extremely high because investors thought that “there is no price too high”. After the 70s recession and stock market sell-off, stock prices of most of them never returned to all-time high, except Coca-Cola or General Electric.

After the internet was invented, the stock market became crazy about technology stocks and new on-line business opportunities. In the effect of that, investors become optimistic about cash flows and demand for internet products. Finally, stock valuations and prices reached euphoric levels, but fundamentals were more in people's minds than in companies' results so... In the end bears won on Wall Street with Nasdaq falling more than 36% consecutively in 2001, 2003 and 2003 after a 101% rally in 1999 and no negative yield year in the 90s. At the same time some companies as Amazon, Apple or Microsoft came back to investor favours and reached new all-time high several years later after real internet and new technology adoption. But the Nasdaq 100 index needed 15 years to reach levels from the 2000 inflection point.

Important: In conclusion, investing during a crisis is challenging, but by understanding the indicators of an impending crisis, implementing effective investment strategies, and learning from past events you can try to navigate the turbulent waters of financial crises. The key to successful crisis investing lies in recognising the signs of a crisis, diversifying your portfolio, managing risk, focusing on long-term goals, and learning from the past. By applying the insights and lessons gleaned from this guide, you can make more informed investment decisions and protect your portfolio during times of economic uncertainty. As the saying goes, 'fortune favours the prepared' and armed with this knowledge, you can face future financial crises. But remember that the next crisis may be much different, and each of them is fueled by different factors.

FAQ

Investing during a recession can be a good idea if you have enough savings and look for companies with strong balance sheets or steady business models, such as utilities, consumer goods conglomerates, and defence stocks. Certain stock market sectors, such as health care and consumer staples, tend to perform better than others in a recession. Investing in broad funds can also help reduce risk through diversification.

During a crisis, you should be very cautious when needed and aggressive if market valuations are very low and people are highly pessimistic about stock market and future returns. You should invest in healthy companies with proven business models and very low debt levels.

Invest regularly in a balanced mix of stocks and bonds, don't panic sell when stocks are down. You should have accumulated cash to react to stock market downturns and buy cheaper companies.

During a crisis, investors usually focus on safe haven assets such as gold or consumer staples stocks. You can consider stock from these sectors with steady business models and strong balance sheets to make your investments during a recession.

A recession occurs when a region's economy declines, leading to decreased economic output, lower consumer demand, and rising unemployment. People may lose their jobs or find it difficult to get hired or promoted, while incomes stagnate or drop and inequality may worsen. Company earnings usually decline, leading to lower stock market prices.

Key indicators of an impending financial crisis include economic data, market trends, and geopolitical events such as GDP growth, unemployment rates, inflation, stock market performance, yield curve inversions, political instability, and natural disasters. You can closely watch US jobless claims reports monitoring unemployment trends in the world's biggest economy, US Conference Board index, University of Michigan consumers data or US Schiller indices published by Yale University.

Utilities, Homebuilders, Healthcare & Tech firms: Stocks To Look Out For ahead of the UK General Election

Climate change investments: Maximising impact

US Presidential Election 2024: Kamala Harris vs Donald Trump. Which candidate is better for stock markets?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.