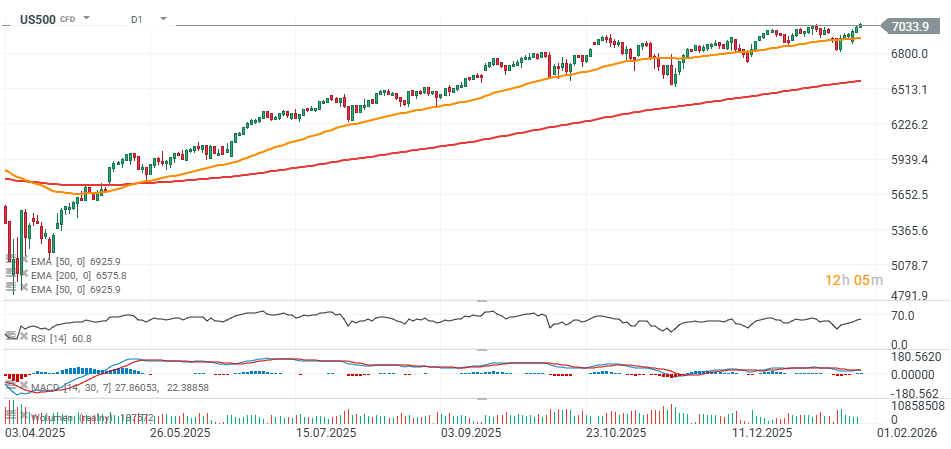

The S&P 500 contract (US500) hit a record high today around the 7,040 mark as markets brace for the Fed decision scheduled for 6 PM GMT. This week, four “Magnificent 7” companies are set to report Q4 results: Meta Platforms and Microsoft (both after the US session today), as well as Apple and Tesla. That setup suggests US500 could see elevated volatility - in both directions.

Source: xStation5

What about Big Tech earnings?

After today’s US close, two leading US tech giants — Microsoft and Meta Platforms — will report earnings. Market expectations are high.

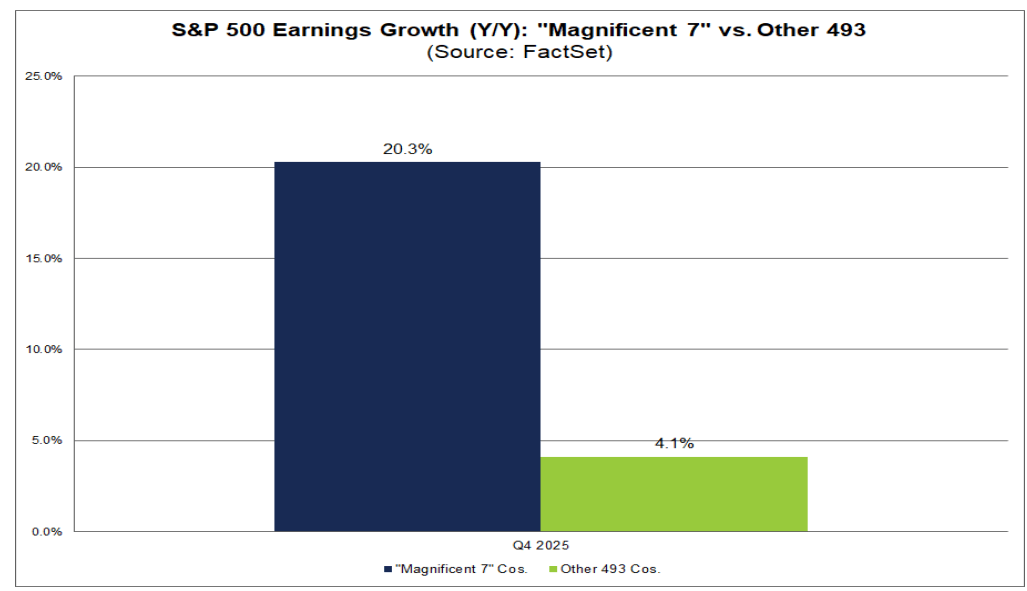

- In recent quarters, the so-called “Magnificent 7” have often been among the strongest drivers of year-over-year earnings growth for the entire S&P 500. The question is: how many of them are expected to rank among the top five contributors to earnings growth in Q4 2025?

- Consensus for the full S&P 500 points to +8.2% y/y blended earnings growth in Q4 2025. If this figure holds, it would mark the 10th consecutive quarter of earnings growth for the index.

- At present, the top five companies contributing the most to year-over-year earnings growth for the index in Q4 (ranked by contribution) are: Nvidia, Boeing, Alphabet (Google), Micron Technology, and Microsoft.

- This means three out of the five largest contributors to Q4 earnings growth are expected to be “Magnificent 7” names: Nvidia, Alphabet, and Microsoft, which reports today.

- Boeing (outside the “Magnificent 7”) is benefiting mainly from an easy base effect: a year ago the company posted a large loss (including charges and other expenses reflected in non-GAAP EPS).

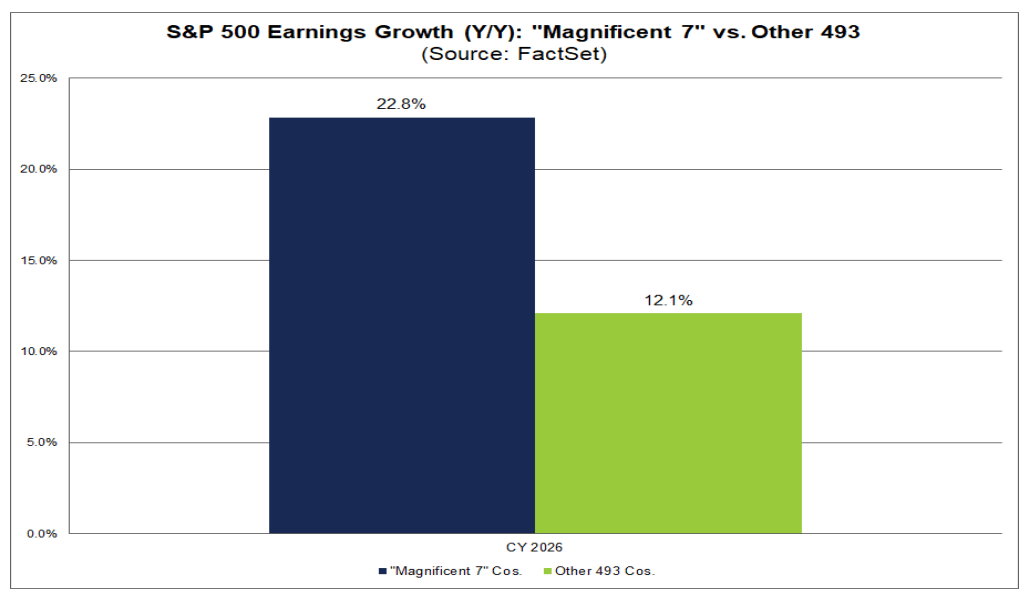

- Looking ahead, analysts expect double-digit earnings growth in 2026 for both the “Magnificent 7” and the rest of the index. Moreover, growth for the Mag7 is projected to accelerate to nearly +23% y/y, versus +12.1% for the remaining S&P 500 companies. If these estimates prove accurate — or even slightly conservative — the index could deliver solid performance this year.

The market is pricing in at least ~20% EPS growth for the Mag7 in Q4 2025, compared with only ~4% for the other 493 S&P 500 companies.

Source: FactSet Research

According to FactSet data as of January 23, about 13% of S&P 500 companies have reported results so far. 75% beat EPS expectations (positive surprise), while 69% beat revenue expectations.

- Estimate revisions: as of December 31, the market expected +8.3% y/y earnings growth for Q4; it is now marginally lower at +8.2%.

- Four sectors currently have lower earnings expectations than at the end of December, due to downward EPS revisions and negative earnings surprises.

- Guidance (Q1 2026): so far, six S&P 500 companies have issued negative EPS guidance for Q1, while four have issued positive guidance.

- Valuation: the S&P 500’s forward 12-month P/E stands at 22.1. That is above both the 5-year average (20.0) and the 10-year average (18.8). The market is relatively expensive versus history, but double-digit y/y earnings growth expected in 2026 provides a meaningful argument for an earnings “premium” in valuations.

Source: FactSet Research

Microsoft Preview: Azure, AI, and a Test of Growth Quality

Gold surges 2% testing $5300 level amid weakening US dollar 📈

AUDUSD: Will the RBA be the next central bank to return to rate hikes?

Daily summary: Wall Street and EURUSD rise ahead of tomorrow’s Fed decision 🗽 Oil gains

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.