- Inflation stayed hot, with headline CPI at 3.8% y/y and core around 3.4% y/y, remaining above the RBA’s target

- Price pressures are broad-based, led by strong services and housing inflation

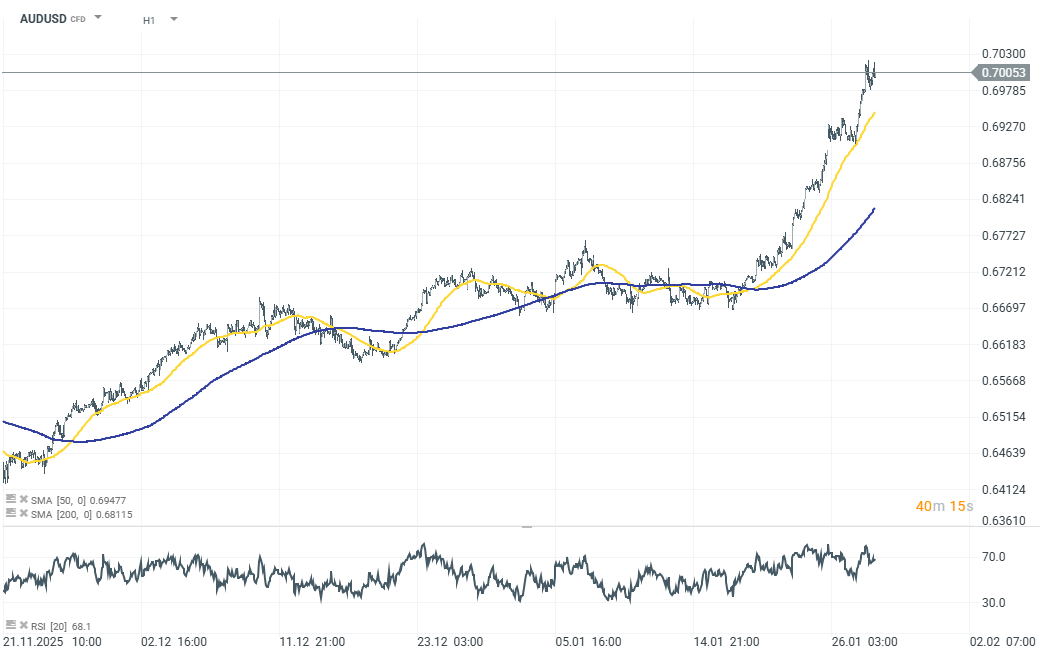

- February RBA hike is now the base case, lifting AUD and pushing AUDUSD above 0.70

- Inflation stayed hot, with headline CPI at 3.8% y/y and core around 3.4% y/y, remaining above the RBA’s target

- Price pressures are broad-based, led by strong services and housing inflation

- February RBA hike is now the base case, lifting AUD and pushing AUDUSD above 0.70

The Australian dollar (AUD) remains one of the stronger currencies following higher-than-expected inflation data. The latest CPI reading surprised to the upside in both headline and core inflation, reinforcing the view that price pressures remain too elevated for the Reserve Bank of Australia (RBA) to adopt a dovish — or even neutral — stance anytime soon.

Headline inflation accelerated to 3.8% y/y in December, while core inflation (trimmed mean) rose to around 3.4% y/y, clearly above the RBA’s 2–3% target and confirming that the disinflation process has stalled rather than progressed steadily. On a quarterly basis, core inflation came in at 0.9% q/q, which also does not support a smooth return to target.

Key inflation data

- Headline CPI: 3.8% y/y (from 3.4%)

- CPI trimmed mean: ~3.4% y/y, above expectations

- Core inflation: 0.9% q/q, maintaining strong momentum

- Services inflation accelerated to 4.1% y/y

- Housing costs remain the biggest driver: +5.5% y/y

The inflation mix is particularly uncomfortable for the RBA. Services inflation has re-accelerated, reflecting strong domestic demand, a tight labour market, and persistent pressure from rents and travel costs. At the same time, goods inflation has picked up again, partly due to a sharp rise in electricity prices. Combined with unemployment around 4% and solid economic growth, the data suggest inflation pressures are becoming increasingly entrenched across key sectors of the economy rather than driven by temporary or imported factors.

Main sources of price pressure

- Strong services inflation (rents, travel, market services)

- High housing costs weighing on households

- Rising energy prices boosting goods inflation

- Tight labour market sustaining wage pressures

In response to the data, Australia’s largest banks — including Westpac and ANZ — have begun to expect a 25 bp rate hike from the RBA at the 2–3 February meeting, arguing that inflation has effectively cast the “decisive vote” for tighter policy. Markets are now pricing in over a 70% probability of such a move. While most see it as a one-off hike rather than the start of a full tightening cycle, the RBA is expected to maintain a conditionally hawkish stance, with future decisions tied closely to incoming inflation data. The central bank has also made it clear that inflation above 3% remains “too high,” effectively ruling out near-term rate cuts.

RBA outlook after CPI

- February hike increasingly viewed as the base case

- Cash rate could rise to around 3.85%

- Possible pause thereafter, but with a hawkish bias

- Further tightening possible if inflation remains persistent

Market reaction

The Australian dollar surged sharply after the release — AUD reached its highest level since early 2023, and AUDUSD broke above 0.70, extending a strong start to the year. Investors have begun positioning for a more hawkish RBA relative to other major central banks. Recent gains in AUDUSD have also been supported by broad weakness in the US dollar.

Gold surges 2% testing $5300 level amid weakening US dollar 📈

Economic calendar: Fed decision – markets sharply scale back rate-cut expectations 🔎

Morning wrap (28.01.2026)

Daily summary: Wall Street and EURUSD rise ahead of tomorrow’s Fed decision 🗽 Oil gains

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.