- Macroeconomic data shapes the market movements

- CPI and PMI data send market to its new All-time-high

- University of Michigan consumer sentiment below expectations

- Ford recovers some of the lost capacity

- Macroeconomic data shapes the market movements

- CPI and PMI data send market to its new All-time-high

- University of Michigan consumer sentiment below expectations

- Ford recovers some of the lost capacity

The session on Wall Street opens on a positive note following the accumulation of key macroeconomic data. The compilation of the latest PMI and CPI readings creates a mixed, yet still optimistic picture for the markets regarding the economic situation in the United States. This is sufficient to push the main indices towards new historical levels right at the start of trading. US100 contracts are up by approximately 0.8%, US500 is up by 0.6%. Contracts on the Russel2000 index are performing better, rising by 1.3%.

Today's session remains under the influence of macroeconomic readings. Consumer inflation turned out to be lower than expected, which strengthens the narrative of the Federal Reserve's progress in combating price pressure and increases the likelihood of faster and potentially deeper monetary policy easing.

At the same time, a very good PMI signals a solid condition of the economy, which may prompt the Fed to adopt a more cautious schedule for rate cuts, especially if economic activity maintains its pace without further deterioration in the labor market.

An additional piece of the puzzle is the University of Michigan consumer sentiment reading, noticeably weaker than forecasts, but still above the neutral threshold of fifty points, which can be interpreted as sustained, albeit cautious, optimism among households.

In such an environment, investors will closely monitor bond yields, the dollar, and sector rotation, as these indicators may point the market towards the final conclusion from today's data.

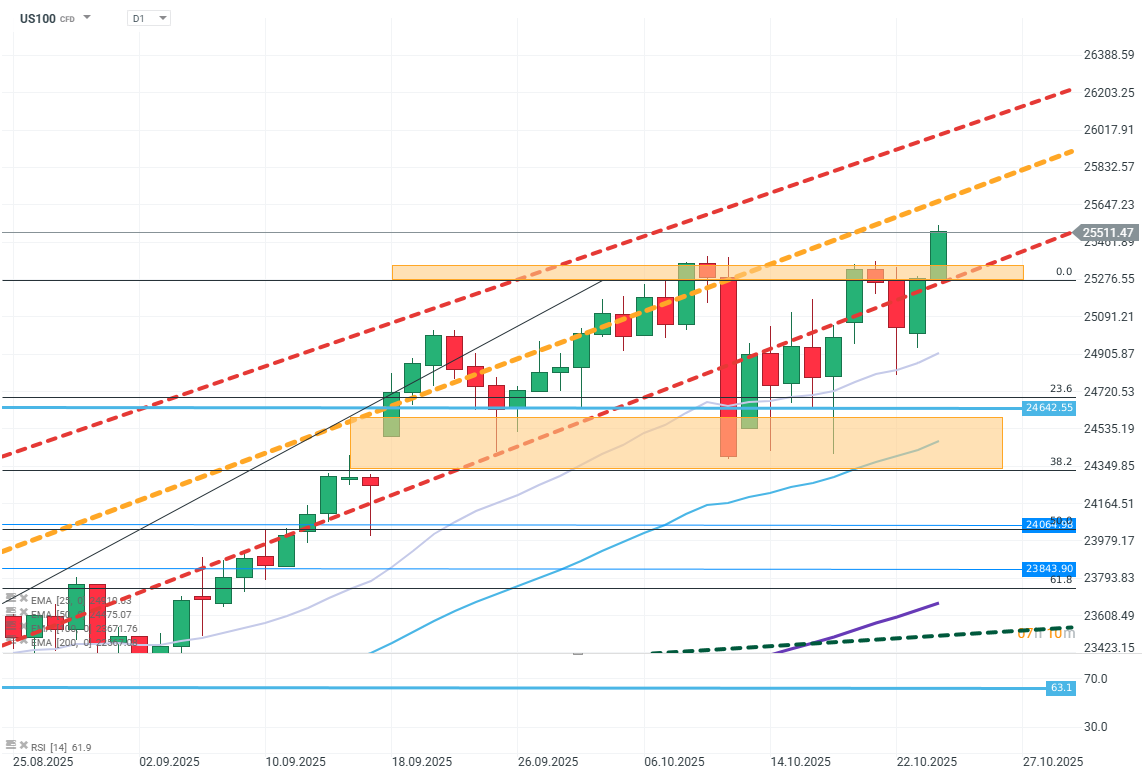

US100 (D1)

Source: xStation5

On the chart, a successful breakout of the peak can be observed after many attempts over the past week. The price defended the lower boundary of the upward trend, and the EMA averages indicate the continuation of the upward price direction. In the event of a temporary loss of initiative by buyers, the nearest support is at the level of 25270, determined by the last peak. Below, support can be observed at around 24720 where EMA25 runs and the FIBO level 23.6.

Company News:

Ford (F.US) — The automotive company is experiencing a huge increase, by as much as 9%. This is due to news from the company's management that the damage caused by the production halt at one of the company's plants will not be as deep and lasting as initially thought. The CEO assures that losses from this year will be recovered next year.

Alphabet (GOOGL.US) - Google and Anthropic have announced an expansion of their collaboration in cloud services. The new agreement is expected to provide AI access to approximately one million "Tensor" processors. Google shares are rising by about 3%.

Deckers Outdoor (DECK.US) — The footwear manufacturer is losing about 12% at the opening. This follows announcements by subsidiaries UGG and Hoka that net sales will be below market consensus.

Newmont (NEM.US) — The gold mining company announced that production will remain unchanged next year. This disappointed the market, which expected the company to take advantage of high commodity prices. As a result, the company is down by 6%.

Target (TGT.US) — The large US retailer announced a significant reduction in positions. Over 1800 positions, which constitutes 8% of the company's workforce. The stock remains unresponsive.

Kodiak Sciences (KOD.US) — The pharmaceutical company is up by as much as 15% at the session's opening, following a recommendation from JP Morgan. However, as trading continues, the stock erases most of the gains.

Procter & Gamble: After Earnings

"Mad Max" mode - Is Tesla in trouble?

Intel’s turnaround is showing results

3 markets to watch next week (24.10.2024)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.