- Intel returns to profitability, achieving Q3 2025 revenue of $13.7B and net income of $4.1B (EPS $0.90), confirming the effectiveness of restructuring.

- The company invests in AI, foundry services, and advanced production processes, supported financially by the U.S. government, Nvidia, and SoftBank, strengthening high-margin segments.

- Q4 2025 guidance: revenue of $12.8–13.8B and non-GAAP EPS of $0.08; investors are confident in the recovery’s success, reflected in stock performance exceeding benchmarks.

- Intel returns to profitability, achieving Q3 2025 revenue of $13.7B and net income of $4.1B (EPS $0.90), confirming the effectiveness of restructuring.

- The company invests in AI, foundry services, and advanced production processes, supported financially by the U.S. government, Nvidia, and SoftBank, strengthening high-margin segments.

- Q4 2025 guidance: revenue of $12.8–13.8B and non-GAAP EPS of $0.08; investors are confident in the recovery’s success, reflected in stock performance exceeding benchmarks.

Intel is rebounding after a period of challenges and transformation, rebuilding its market position and investor confidence. The results for the third quarter of 2025, published on October 23, show a clear sign of stabilization, as the company reported growth in both revenue and net income, confirming the effectiveness of its restructuring efforts.

Intel is focusing on strategic areas for future growth, such as artificial intelligence, foundry services, and operational cost optimization. A key element of this strategy has also been significant capital investments, including $8.9 billion from the U.S. government, $5 billion from Nvidia, and $2 billion from SoftBank, which strengthened the company’s liquidity and support the development of key technology projects.

This commentary takes a closer look at Intel’s Q3 2025 financial results, examines the factors influencing the current figures, and reviews initiatives aimed at maintaining a positive trend in the coming months.

Financial Results

-

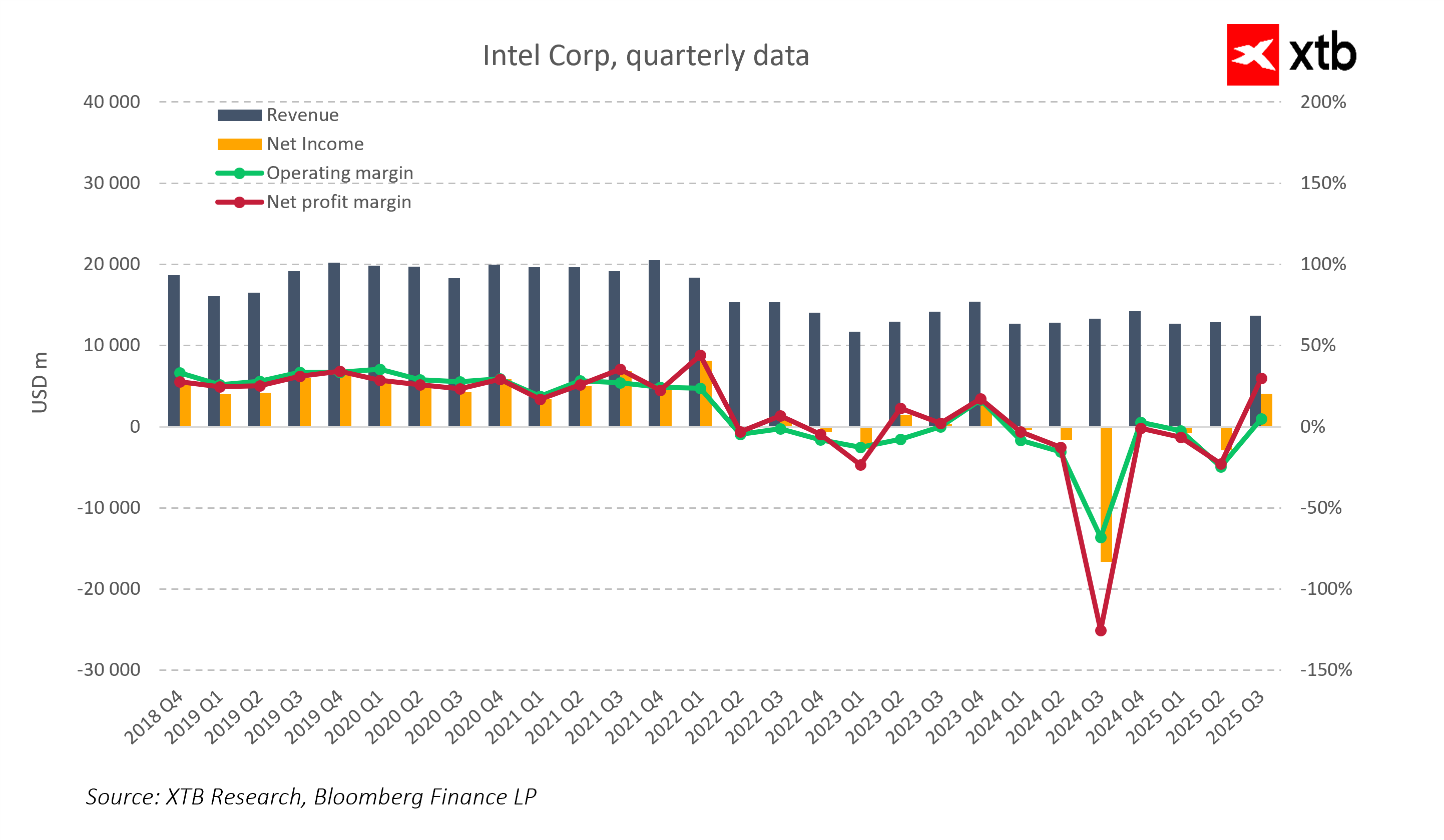

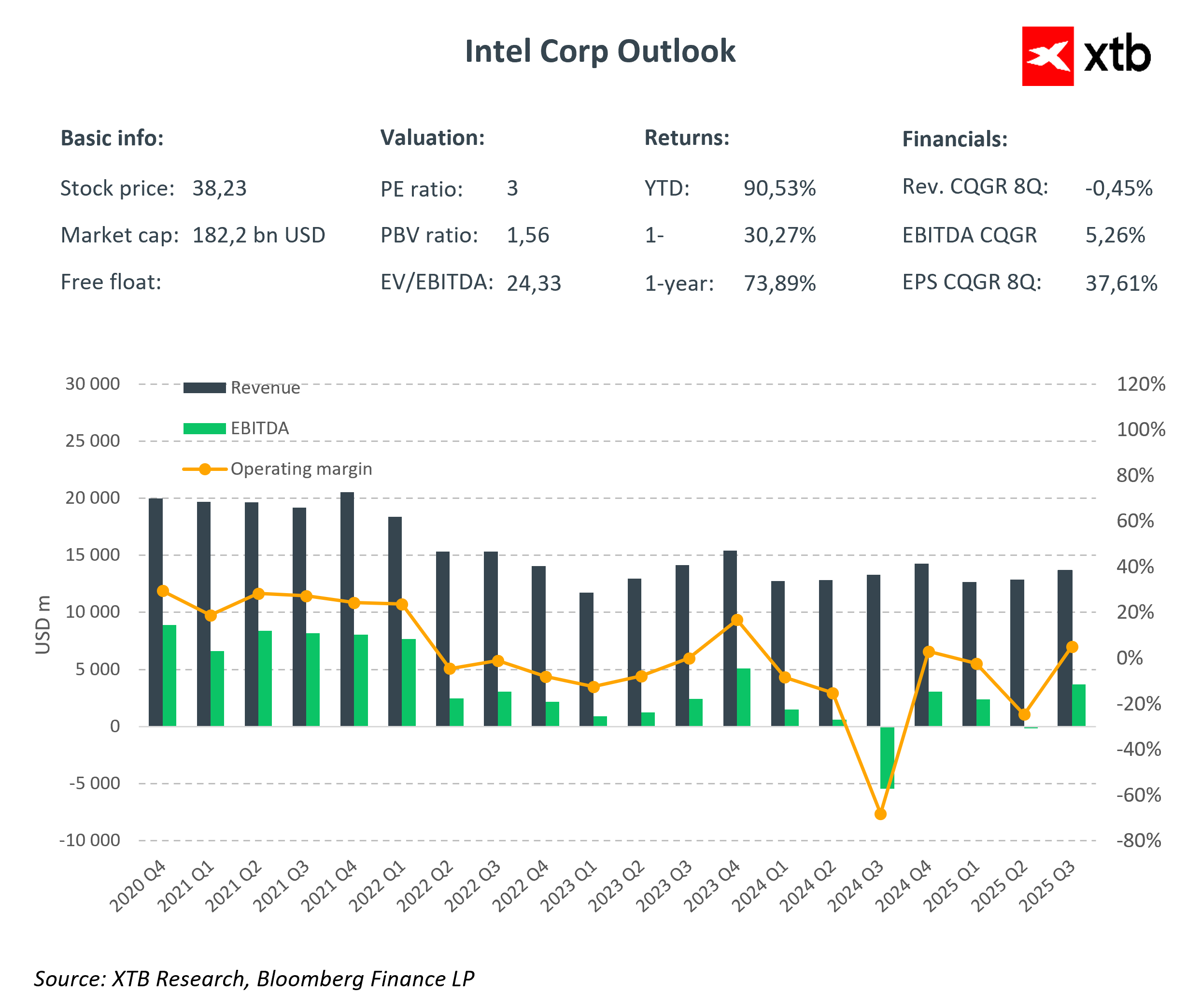

Revenue: $13.7 billion, up 3% year-over-year. Revenue growth was driven primarily by rising demand for data center chips and a gradual recovery in the PC segment, which is slowly stabilizing after a period of slowdown.

-

Net Income: $4.1 billion ($0.90 per share), returning to profitability after last year’s loss of $16.6 billion. The result exceeded analyst expectations, confirming the effectiveness of cost-cutting measures and margin improvements.

-

Gross Margin: 38.2% (non-GAAP 40%), a significant increase compared to last year’s 15%. Margin growth was driven by both production cost reductions and a higher revenue share from high-margin segments, including data centers and AI-supporting chips.

Key Factors Driving Results

-

Operational Cost Reduction: Lowering operating expenses by approximately 20% to $4.4 billion improves efficiency and allows savings to be redirected to the development of new technologies, including the 18A production process and AI solutions.

-

Strategic Support: Intel secured $8.9 billion from the U.S. government, $5 billion from Nvidia, and $2 billion from SoftBank, accelerating investments in fabs, innovative technology development, and strengthening its position in the foundry services segment.

-

High-Margin Segment Growth: Strong demand for data center and AI chips boosts Intel’s margins, enabling the company to compete in key technology areas and support long-term revenue growth.

-

PC Market Stabilization: Higher revenue in the Client Computing Group indicates a gradual recovery of the PC market and Intel’s return to laptop and desktop market share, strengthening the company’s revenue base.

Outlook for Q4 2025

Intel expects revenue between $12.8 and $13.8 billion and non-GAAP EPS of around $0.08. For the full year, the company plans to invest approximately $27 billion in capital expenditures. In Q3 2025, GAAP EPS was $0.90, confirming a return to profitability after a period of losses.

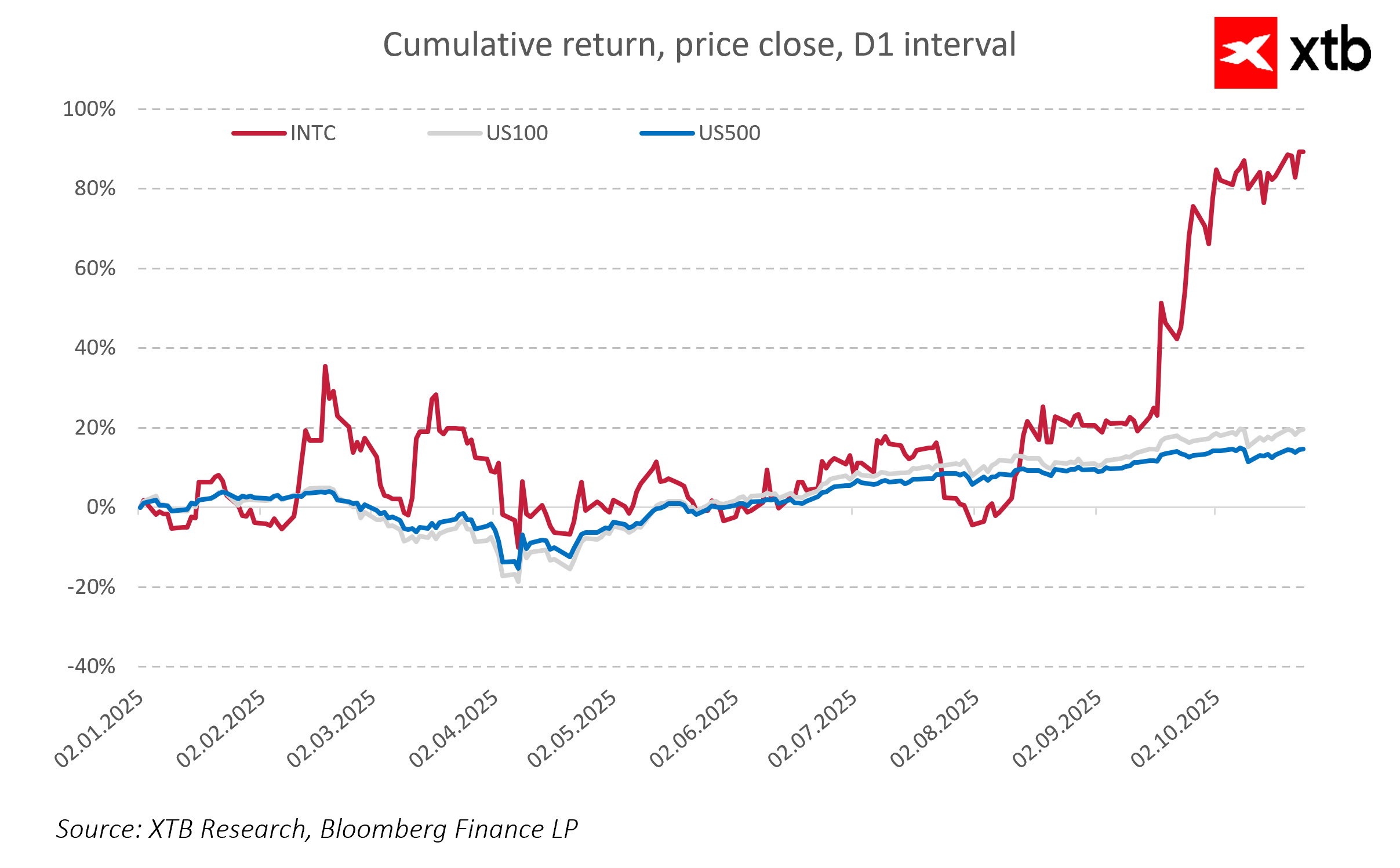

The Q3 2025 results confirm the effectiveness of Intel’s restructuring and the rebuilding of investor confidence. Improving profitability, better cost control, and stabilization in key business segments indicate the company is entering a phase of sustainable improvement. Rising sales in AI and data center areas show that Intel is successfully adapting to the latest technology trends and turning them into a real competitive advantage.

Despite challenges in implementing new production processes and strong competition in the semiconductor market, the company shows clear signs of stabilization and determination to continue growing. Intel is increasingly seen as an example of a company that, through consistent restructuring, strategic partner support, and focus on innovative, high-margin business segments, can rebuild its industry position. Importantly, investors appear confident that Intel’s recovery will succeed. Since the beginning of 2025, the company’s shares have significantly outperformed major market benchmarks, reflecting growing market conviction that the strategy is delivering expected results.

Daily Summary: CPI down, Markets Up

Procter & Gamble: After Earnings

"Mad Max" mode - Is Tesla in trouble?

3 markets to watch next week (24.10.2024)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.