Wall Street is almost unanimously expecting the Federal Reserve to cut interest rates by 0.25 percentage points at the upcoming meeting. Investors are also counting on Fed Chair Jerome Powell to signal further rate cuts aimed at supporting the weakened stock market and stabilizing economic growth amid rising global risks.

In recent weeks, U.S. stock indices, including the S&P 500, have reached historic highs; however, tensions related to rising inflation and geopolitical uncertainty continue to pressure investors. Analysts predict that the S&P 500 index may rise by about 0.7% on the day of the Fed’s announcement, though they warn that the market is particularly sensitive to any signals from the Fed regarding future monetary policy.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appIt is worth emphasizing that Fed officials will update their forecasts for interest rates and economic growth prospects during the meeting. Jerome Powell’s tone will be crucial. A more hawkish stance, suggesting maintaining or even returning to rate hikes, could trigger a sharp correction in equity and bond markets. Conversely, a clear signal of continued monetary easing will be perceived as support for the market but may raise concerns about further inflation risks.

Current market forecasts indicate that over the next twelve months, interest rates may be cut by a total of about 150 basis points, mainly through several staged cuts of 25 basis points each. However, the situation remains volatile and depends on incoming economic data, so investors are prepared for unexpected twists.

Dovish monetary policy expectations are supporting gains in smaller companies. Today’s capital reallocation is minor, but if the Fed meets the market’s dovish expectations, more decisive moves could follow. Lower interest rates will mainly benefit smaller businesses, given their higher reliance on debt markets and lower financial liquidity.

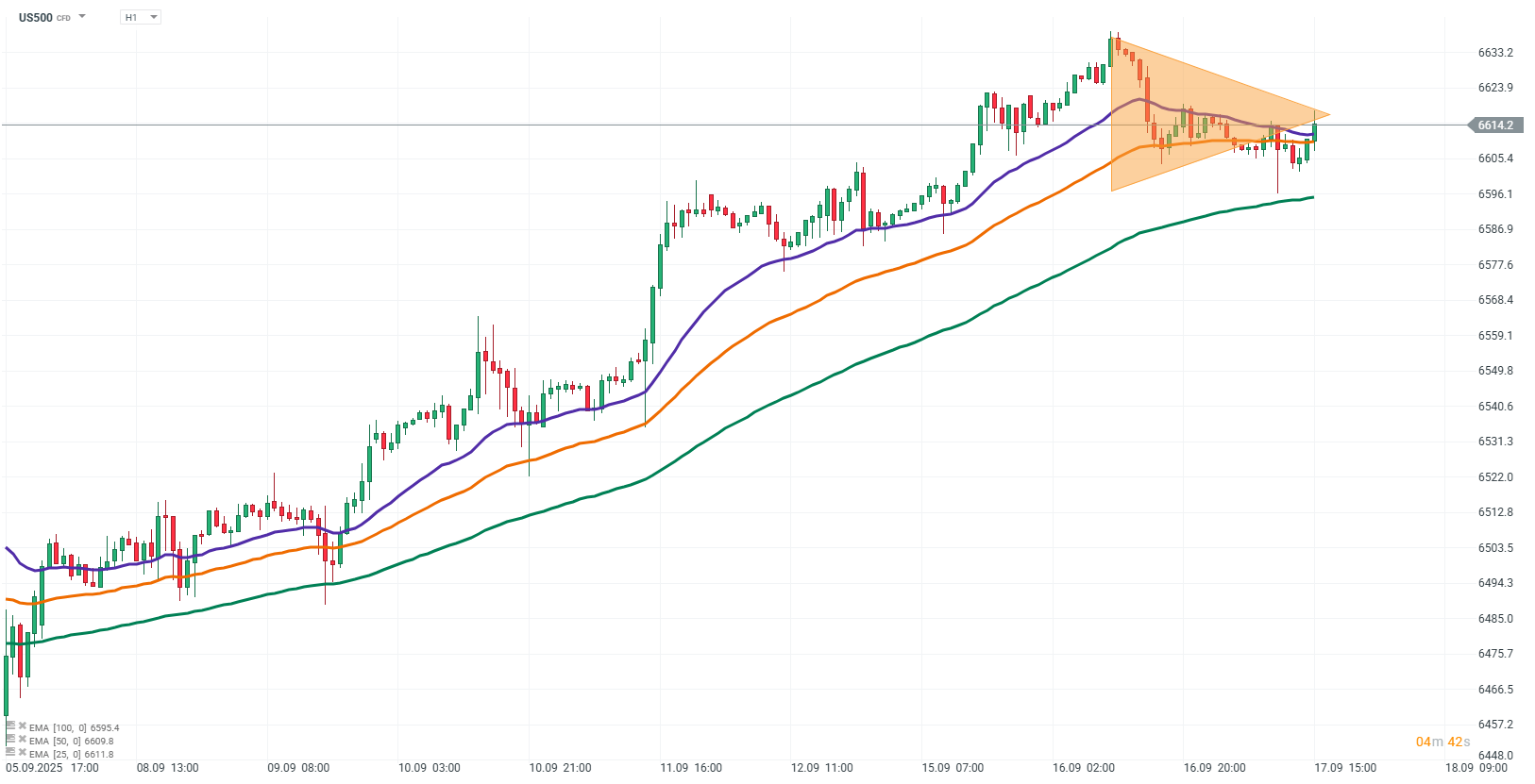

US500 (H1 interval)

Contracts on the S&P 500 index (US500) today remain around yesterday’s closing level from the U.S. session. The market is showing patience and calm, waiting for key information to be released during today’s session. The main event is the Federal Reserve’s interest rate decision scheduled for midday.

Source: xStation5

Company news:

-

Workday (WDAY.US) rises 9% after Guggenheim upgraded its recommendation, highlighting improvements in key areas of the company’s operations. Additionally, the company’s $4 billion share buyback program and the involvement of activist investor Elliott Management, holding $2 billion worth of shares, positively influence the stock. Analysts appreciate Workday’s progress in developing its cloud platform, especially in artificial intelligence, and raised revenue forecasts for 2026 by 14%.

-

Rithm Capital (RITM.US) gains 3.5% following news of the planned acquisition of Paramount Group (PGRE) for $1.6 billion. The deal includes a portfolio of office properties located in New York and San Francisco. Paramount, owner of prestigious buildings in these cities, had been seeking a buyer for some time, with firms such as Blackstone participating in the sale process.

-

Manchester United (MANU.US) drops 6% after reporting results for the first quarter of fiscal year 2025, showing a revenue decline of 8.9% to £143.1 million. Nonetheless, the club recorded a net profit of £1.4 million, improving compared to a loss the previous year. Financial stability is also supported by a 1.7% increase in EBITDA. Analysts point out the decline in broadcasting and matchday revenues, partly due to the team playing in the Europa League instead of the Champions League. The club confirmed full-year forecasts, expecting revenues between £650-670 million and adjusted EBITDA profit between £145 and £160 million.

-

Netflix (NFLX.US) is up 1.5% today despite a decline in its streaming market share in August. Investors are counting on a rebound, anticipating that upcoming premieres and new content will encourage customers to return to the platform. Increased user engagement and attracting new subscribers could improve the company’s financial results in the coming months.

-

New Fortress Energy (NFE.US) +42% surged after securing a $4B, seven-year LNG supply deal with Puerto Rico, which includes a three-year extension option and safeguards ensuring terminal access if deliveries fail.

-

Oruka Therapeutics (ORKA.US) +10.85% rose after Phase 1 data showed its psoriasis drug ORKA-001 outperformed AbbVie’s Skyrizi with a ~100-day half-life, enabling annual dosing. Also announced a $180M private placement.

-

Lyft (LYFT.US) +14.50% jumped after partnering with Waymo to launch autonomous ride-hailing in Nashville by 2026, including a dedicated AV facility and integration into Lyft’s platform.

-

LightPath Technologies (LPTH.US) +4.40% gained on $22.1M in follow-on orders for infrared camera systems, bringing total commitments for 2026–2027 to $40.3M.

-

Baidu (BIDU.US) +7.60% climbed after unveiling its upgraded AI model Ernie X1.1, highlighting advances in factual accuracy, instruction following, and agentic capabilities.

-

Forward Industries (FORD.US) -11.0% dropped after filing for an at-the-market offering of up to $4B in stock, with proceeds earmarked for general corporate use including a Solana token strategy.

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.