-

The “Halloween Effect” in the markets: historically, equities tend to perform better between November and April than between May and October, although this seasonal pattern doesn’t always hold and depends heavily on the broader economic and political context.

-

Five risks threatening the current calm: rising oil prices, Federal Reserve decisions, the New York mayoral elections, a potential slowdown in artificial intelligence investment, and the fragility of China’s real estate sector could all limit investor optimism.

-

A season for caution: despite the statistical tailwinds supporting the market, the combination of geopolitical tensions, inflationary pressures, and economic imbalances suggests that prudence will be the best strategy in the months ahead.

-

The “Halloween Effect” in the markets: historically, equities tend to perform better between November and April than between May and October, although this seasonal pattern doesn’t always hold and depends heavily on the broader economic and political context.

-

Five risks threatening the current calm: rising oil prices, Federal Reserve decisions, the New York mayoral elections, a potential slowdown in artificial intelligence investment, and the fragility of China’s real estate sector could all limit investor optimism.

-

A season for caution: despite the statistical tailwinds supporting the market, the combination of geopolitical tensions, inflationary pressures, and economic imbalances suggests that prudence will be the best strategy in the months ahead.

Over the past few months, financial markets have experienced a strange mix of calm and tension. Stock indices have reached new all-time highs, and both gold and bitcoin remain at record levels — yet volatility hasn’t disappeared. The path has been far from smooth, with volatility standing out as one of the defining features of this period. The trade war, fiscal deficits, military conflicts, and political division across the West have all weighed on the markets, but none have been enough to scare investors away. In fact, this October marks the beginning of a period that many investors find particularly interesting: the famous Halloween Effect.

What is the Halloween Effect?

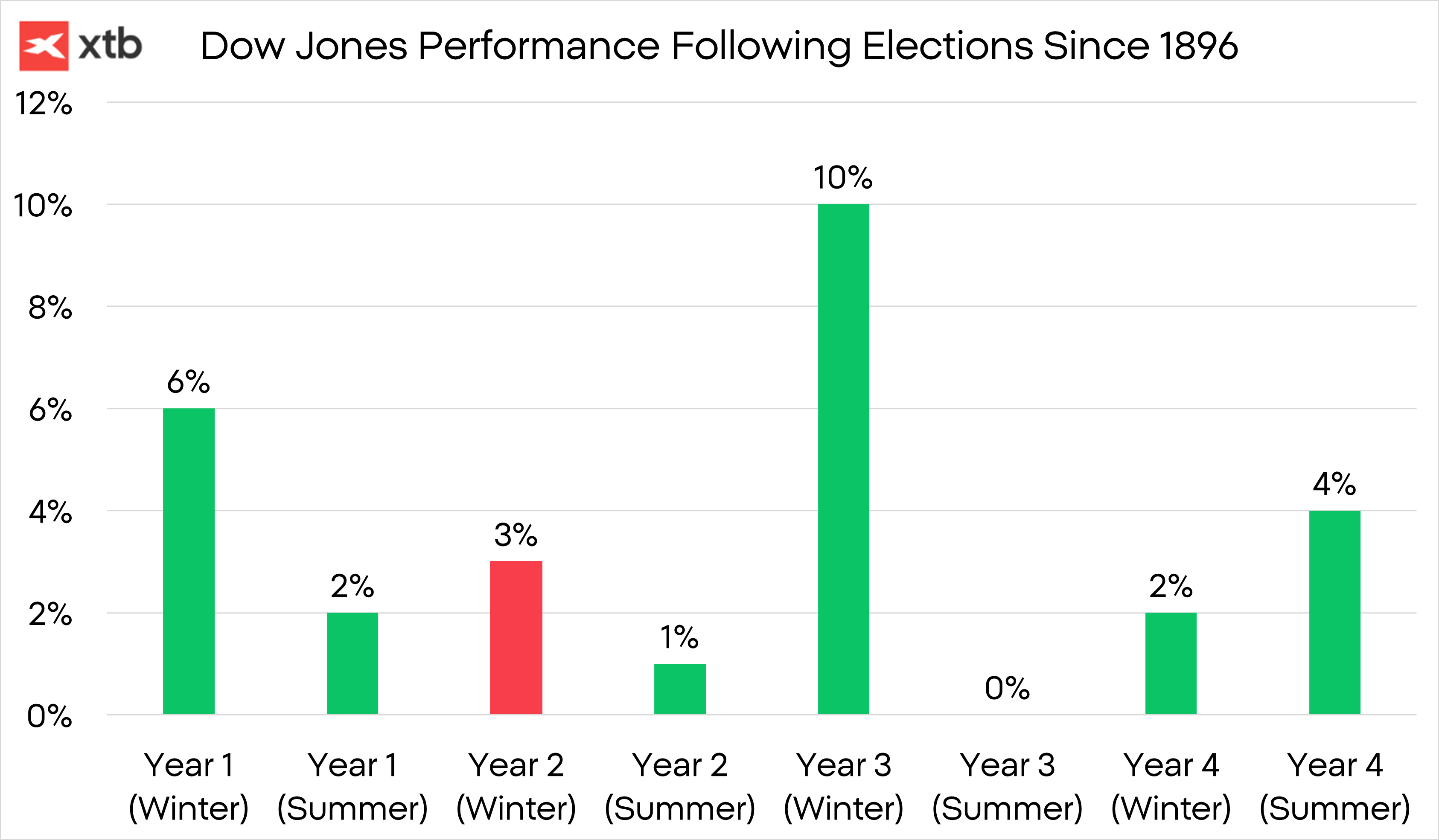

The Halloween Indicator is a strategy suggesting that stocks tend to perform better between November and April than they do between May and October. Developed in the late 1890s, this indicator has historically delivered an annualized return of 5.3% during the “winter months” (November to April), compared to just 1.9% during the summer months. However, as significant as this difference may seem, investors should be cautious about relying too heavily on this seasonal pattern—especially over the next six months.The Halloween Indicator only works in certain years. Much of its historical advantage comes from the unusually strong performance markets tend to show in the six months following the U.S. midterm elections—a period that will begin after next year’s Halloween, twelve months from now. During the winters of the other three years of the presidential cycle, stock market returns are typically positive but not extraordinary. In fact, looking at historical averages, the Dow Jones has tended to post a 3% average gain during the period we are about to enter.

This year, 2025, follows an unusually strong summer. While the Dow Jones has historically risen an average of 2% during the summer months since 1896, it has gained over 16% since May of this year.

Therefore, even though statistics favor investors during this time of year, the current context calls for caution. The global economy is walking a delicate line between growth and tension, and any escalation in key areas of uncertainty could shatter the markets’ apparent calm.

Here are five factors that could dampen the Halloween effect

The 5 Events That Could Limit the Halloween Effect

Although history suggests that winter tends to be favorable for equities, today’s environment is far from tranquil. Among the economic events that could shake the markets, the following five stand out:

1. Rising Oil Prices

Donald Trump’s recent sanctions on Russian oil companies have sent shockwaves through the energy market, and after a rough year, oil prices rose 7.5% last week. Such movements could have severe consequences for the economy.

At a time when U.S. inflation remains above 3%, driven by tariffs, monetary and fiscal stimulus, and a weak dollar, any such shock could push prices even higher — putting pressure on the Federal Reserve and other central banks worldwide.

If trade agreements stimulate demand during a seasonally strong period, and with OPEC countries cutting production, oil prices could easily move in the opposite direction of recent trends. Technically speaking, crude oil has just entered backwardation, a structure often interpreted as a signal of future price increases. However, going long on oil might be one of the most contrarian trades right now, given that short positions have dominated the market lately.

2. Federal Reserve Decisions

One of the main risks for financial markets—and a key factor behind the dollar’s recent weakness—are Trump’s attacks on the Fed’s independence. While the Trump administration continues to pressure Jerome Powell and other Fed members to cut interest rates, markets remain uneasy about the inflationary consequences of such policies. The president’s goal for months has been to refinance U.S. debt at lower rates to improve the fiscal deficit.

However, yesterday Powell challenged the president by closing the door to potential rate cuts at the upcoming December meeting — something the market had previously priced in at 100%. The ongoing disputes between the two could create an atmosphere of instability and undermine investor confidence.

3. The New York Mayoral Elections

This weekend marks the New York City mayoral elections, in the world’s most famous city and the heart of Wall Street. The Democratic candidate, Zohran Mamdani, 33, is the clear favorite after defeating former governor Andrew Cuomo in the June primaries. His main proposals include making city buses free, freezing rents on stabilized housing (which makes up about a quarter of the city’s housing stock), creating public supermarkets, and providing free childcare for all children aged six weeks to five years.

To fund these programs, Mamdani plans to raise taxes on the wealthy, a move that could create a climate of uncertainty in the world’s financial capital.

4. A Drop in Artificial Intelligence Stocks

So far, major tech companies have used their cash surpluses to invest in artificial intelligence development. However, some firms—without yet justifying their high valuations—have started issuing debt to cover these expenses, potentially creating a dangerous spiral. For the first time in years, earnings reports have raised doubts about the growth in capital spending among big tech firms, casting uncertainty on the optimism surrounding AI. Moreover, the massive energy demand required to power data centers could become the industry’s biggest bottleneck.

5. A Chinese Real Estate Meltdown

Despite Beijing’s efforts to revive its economy, the real estate sector remains its greatest vulnerability. Defaults among major developers, falling housing prices, and eroding consumer confidence continue to strain China’s financial system. This deterioration not only threatens to slow China’s growth—which accounts for nearly 30% of Asia’s GDP—but could also ripple through global financial markets via commodity prices and supply chains. Another wave of instability in China could amplify global market tensions and trigger a correction just as investors are banking on the strength of the bull cycle.

The Halloween Indicator has historically served as an optimistic guide for investors. But this year, the ghosts haunting the global economy—from oil to politics—could rewrite the script. More than ever, prudence may be the best costume to wear this financial Halloween.

ECB Conference: Global Uncertainty, Policy Stability 💶

BREAKING: EIA gas inventories change slightly above expectations. NATGAS increase after EIA data 📌

BREAKING: EBC keeps rates unchanged! ↔️💶

BREAKING: Germany's CPI above expectations! 💶🔥

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.