- Rates remain unchanged

- Global uncertainty persists

- Risk became more balanced

- Inflation remains within the target, but the outlook is uncertain

- ECB remains in "good place"

- Labor market and economy remains strong despite slow growth

- Rates remain unchanged

- Global uncertainty persists

- Risk became more balanced

- Inflation remains within the target, but the outlook is uncertain

- ECB remains in "good place"

- Labor market and economy remains strong despite slow growth

ECB Governing Committee has outlined monetary council views regarding the economy during a press conference:

- Chairman reassures that European economy and labor market remains strong despite tribulations

- European companies have increased their investments in IT infrastructure, software and digitalization

- Infrastructural and industrial investments related to defense industry and armed forces are boosting economy but might increase inflation

- "Households keep saving unusually large portions of their income"

- Long term inflation expectations stay around 2%, but outlook is "uncertain"

- Tariffs, geopolitical tensions, trade disruptions remain one of the primary threats to growth and are projected to remain

- Additionally, the importance of expansions and strengthening the Euro Area as well as European financial system was reiterated

- Credit conditions for business have moderately tightened

- Food inflation is easing, but energy inflation persist for longer than expected

- ECB is in "a good place" but that place is not "fixed"

- AI impact on EU job markets is "to be seen"

- Monetary transition is not hindered

- Risks to EU banking system are negligible, and bank profits are stable

- Risks to growth are now more balanced and the range has narrowed (upsides and downsides are now more equal and both are less severe)

It was reassured repeatedly that ECB maintains reactive, data driven policy. By which, investors most likely are meant to not expect further rate cuts not justified by a substantial decline in economic growth. During the question's session, ECB officials avoided direct answers regarding whenever hikes are equally likely as cuts. By that, officials likely wanted to prevent creating disrupting carefully created inflation expectations.

ECB maintains its commitment to stability first and foremost. The Governing Committee has carefully avoided creating unrealistic expectations for growth. While growth and labor market condition remains lackluster, it is good enough for ECB to focus more on addressing numerous local and global risks to European economy and financial system - much more severe than slow growth.

The "Good place" Chairman Lagarde keeps referring to is seemingly a place in which ECB is in the best possible position to address realized risks without depriving itself of opportunities to exploit more favorable conditions for growth.

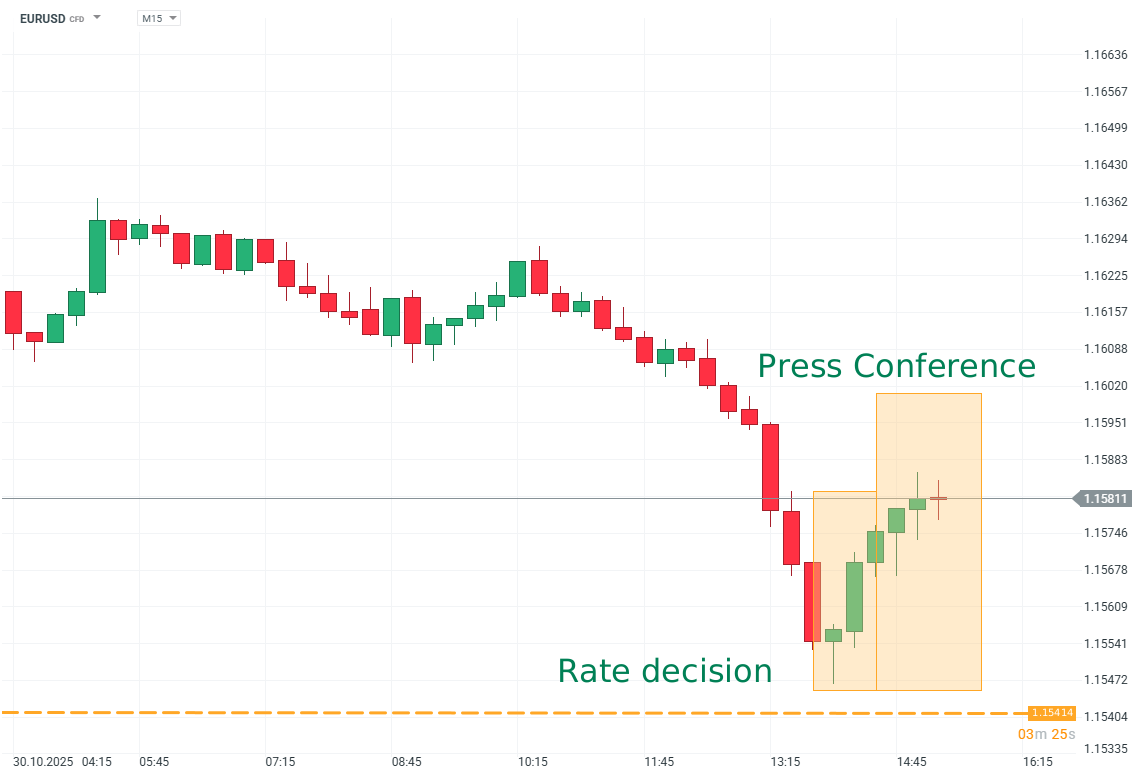

EURUSD (M15)

Source: xStation5

Euro erases some of its earlier declines after rates decision and press conference.

Daily Summary: ECB, FOMC and MAG7 - mixed signals and risk aversion

Chart of the day - Soybean (30.10.2025)

Morning wrap (30.10.2025)

🛢️WTI Crude Rises Over 2%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.