-

Soybeans surged before the Trump-Xi meeting in Busan due to hopes of a breakthrough and China’s first US purchases in a long time.

-

After talks, a lack of specifics from China on further purchases led to a more than 1% drop in prices.

-

Structurally, China sources most of its imports from Brazil, and the recent US soybean purchases were symbolic rather than a turning point.

-

Soybeans surged before the Trump-Xi meeting in Busan due to hopes of a breakthrough and China’s first US purchases in a long time.

-

After talks, a lack of specifics from China on further purchases led to a more than 1% drop in prices.

-

Structurally, China sources most of its imports from Brazil, and the recent US soybean purchases were symbolic rather than a turning point.

Futures contracts for soybeans in Chicago dropped by over 1% following the conclusion of the Trump-Xi meeting in Busan, despite earlier dynamic price gains driven by hopes for a trade agreement and a resumption of Chinese soybean purchases. Ultimately, state-owned COFCO purchased three cargoes of soybeans for December and January delivery as a goodwill gesture immediately preceding the talks, marking a clear signal of change after a period of boycotting US supplies.

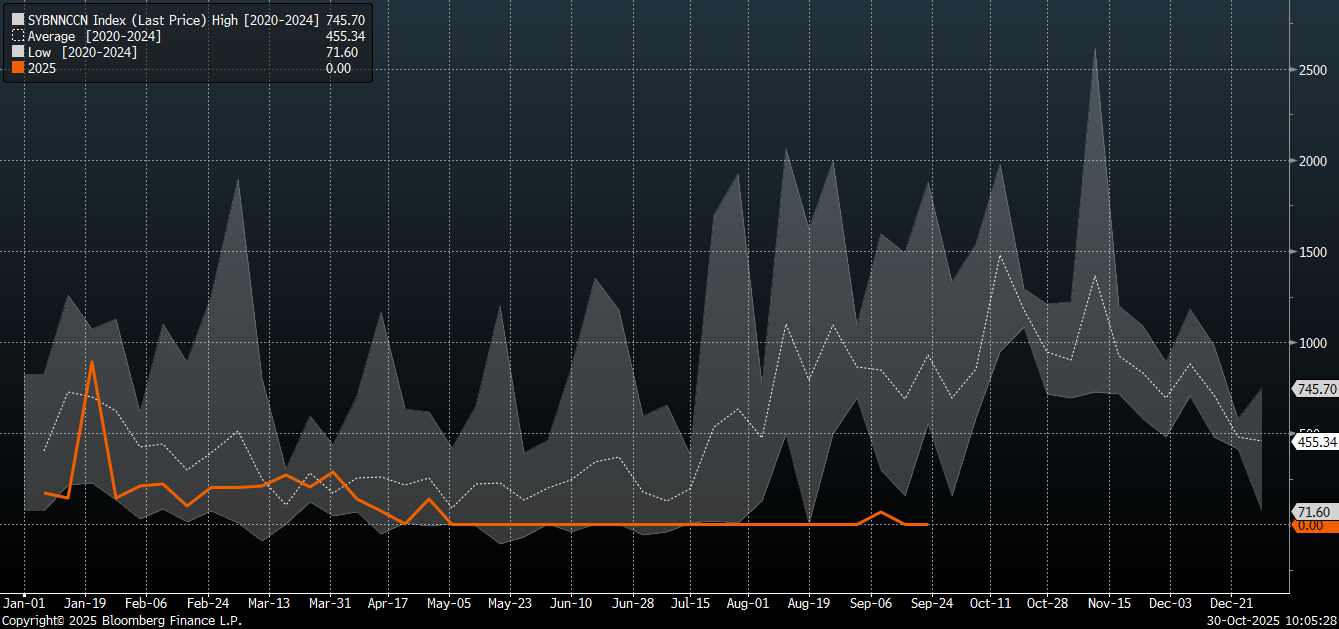

China has bought virtually no US soybeans since the trade war began in April. It is worth noting, however, that China has significantly diversified its sources of supply since the initial trade conflict. The current order may not indicate a total shift in procurement direction, as it coincides with the standard seasonal lull in supplies from South American countries. Source: Bloomberg Finance LP

Soybean prices have been rising since mid-October, and trading opened with a gap-up at the start of this week, reaching peaks near 1,100 cents per bushel—the highest level in 15 months. However, the price is reacting negatively following China's declaration. It is worth recalling that the 2020 declaration of strong purchases of soybeans and other agricultural products was never fully fulfilled. Until the details of the agreement are released, such as a full purchase schedule, investors may choose to book more profits. The position of speculators is also unknown; immediately before the US government shutdown, speculative investors maintained a net short position in soybeans.

It must be emphasized that structurally, the majority of Chinese imports are still sourced from Brazil, which met over 70% of China's demand in 2025 by exporting record volumes—an effect of the tariff war and political uncertainty. US farmers have borne the negative consequences of this policy, as historically, the peak selling season occurred in autumn. Some analysts stress that COFCO's purchases are strictly political in dimension and do not alter Brazil's position as the primary supplier. The 180,000 tonnes of soybeans bought by China are considered more of a gesture than a genuine reorientation of trade.

Technical Outlook

The price is currently rebounding from the 1,070 cents per bushel level, but a scenario where the gap created at the start of this week is closed cannot be ruled out. Key support is located at 1,058 at the 38.2% Fibonacci retracement of the last upward wave, and 1,042 at the 50.0% retracement.

Daily Summary: ECB, FOMC and MAG7 - mixed signals and risk aversion

ECB Conference: Global Uncertainty, Policy Stability 💶

Morning wrap (30.10.2025)

🛢️WTI Crude Rises Over 2%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.