- OpenAI plans to invest over $1 trillion in AI infrastructure and services over the next five years, backed by partnerships with leading tech companies.

- Collaborations with firms like AMD, NVIDIA, Broadcom, and Oracle bring significant gains to both OpenAI and its partners, strengthening their positions in the tech ecosystem.

- OpenAI plans to invest over $1 trillion in AI infrastructure and services over the next five years, backed by partnerships with leading tech companies.

- Collaborations with firms like AMD, NVIDIA, Broadcom, and Oracle bring significant gains to both OpenAI and its partners, strengthening their positions in the tech ecosystem.

OpenAI has unveiled an ambitious five-year investment strategy, with planned spending exceeding $1 trillion. The initiative aims to develop advanced computing infrastructure and expand the company’s portfolio of AI-powered products and services.

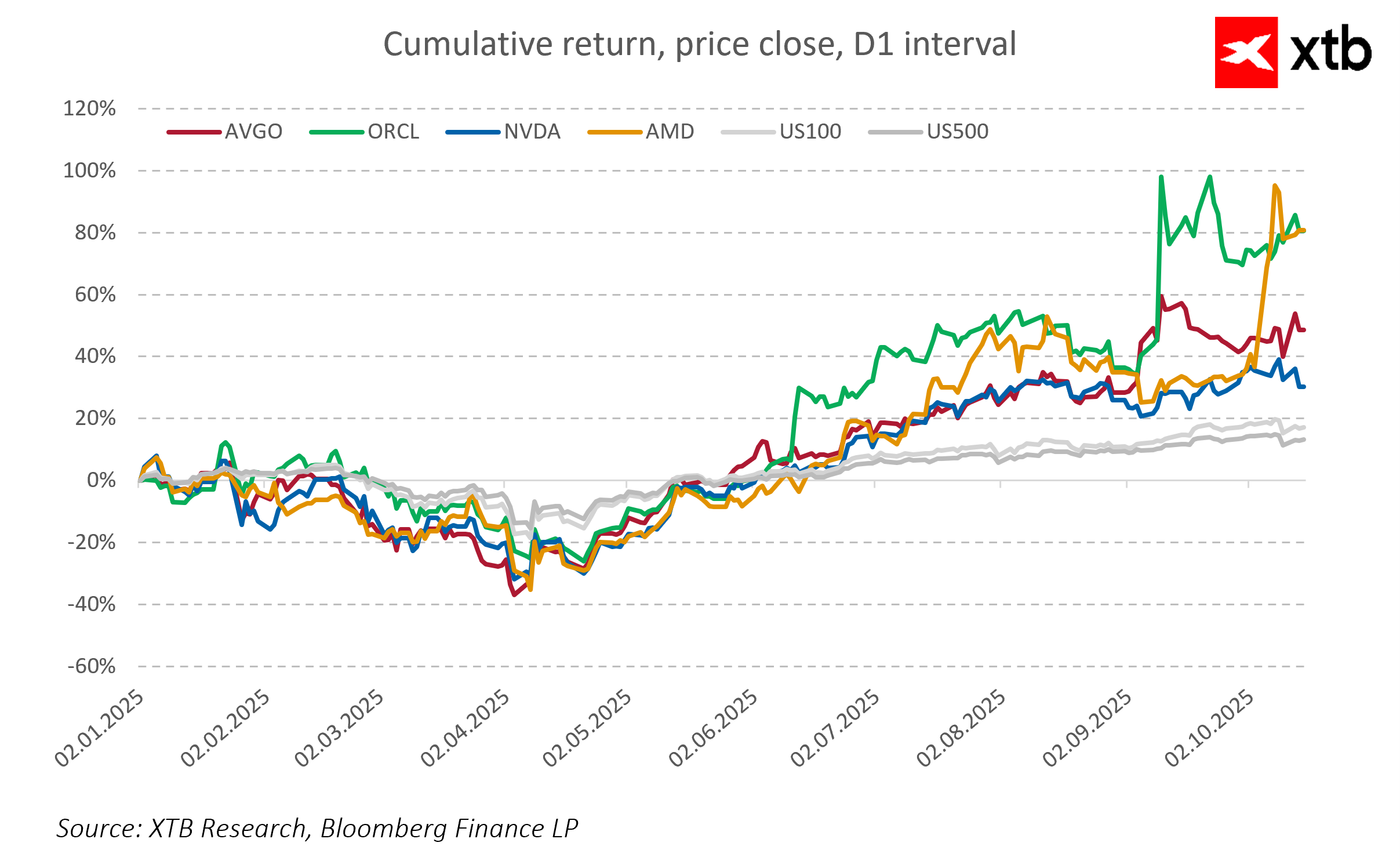

To finance this massive undertaking, OpenAI intends to establish new revenue streams, including expanding services for enterprises and public institutions, developing AI tools to support e-commerce, as well as creating autonomous AI agents and video generation technologies. Strategic partnerships with tech giants such as AMD, NVIDIA, Broadcom, and Oracle play a key role in this strategy. Notably, OpenAI has signed major agreements, including a deal with Broadcom to supply 10 GW of compute power, and a $300 billion data center development partnership with Oracle.

As part of the plan, OpenAI is also advancing "Project Stargate" — a global network of data centers designed to provide widespread access to cutting-edge AI technology and contribute to its global democratization.

Despite the high cost, OpenAI anticipates strong revenue growth, projecting up to $13 billion in annual income, the majority of which is expected to come from ChatGPT subscriptions. The company also plans to double its number of paying users and expand further into developing markets.

Importantly, OpenAI’s partnerships are mutually beneficial. Companies like AMD, NVIDIA, Broadcom, and Oracle are seeing significant returns through hardware and service contracts as well as infrastructure development tied to AI demand. These alliances are strengthening all involved players, accelerating innovation and driving growth in the technology sector.

Experts note that while OpenAI’s plans are highly ambitious and could transform the AI landscape, they come with challenges — including substantial financial demands, dependency on strategic partners, and the potential for increasing regulatory scrutiny.

If realized, this five-year roadmap could position OpenAI as one of the dominant forces in the AI industry, accelerating the development of technologies set to reshape multiple sectors of the global economy.

Cocoa Prices Stabilize Ahead of Processing Data: Has the Negative News Been Priced In?

TSMC Earnings Preview: Will the Key Semiconductor Supplier Surprise the Market?

US Open: American Indices Rally on Anticipated End of Fed Balance Sheet Reduction

Bank of America, Wells Fargo, and Morgan Stanley: Q3 2025 Earnings Overview

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.