- The third-quarter 2025 results of the three major U.S. banks demonstrate the financial sector’s strong resilience amid a challenging macroeconomic environment.

- The banks showed high capital profitability, solid credit portfolio quality, and better-than-expected performance in trading and investment banking.

- The third-quarter 2025 results of the three major U.S. banks demonstrate the financial sector’s strong resilience amid a challenging macroeconomic environment.

- The banks showed high capital profitability, solid credit portfolio quality, and better-than-expected performance in trading and investment banking.

Today we received the latest quarterly results from the largest U.S. banks: Bank of America, Wells Fargo, and Morgan Stanley. These reports provide fresh insights into the health of the U.S. banking sector, showing how these institutions are navigating macroeconomic challenges and a changing market environment.

In the following article, we will analyze the detailed results of each bank, highlighting the key financial indicators and outlooks for the future.

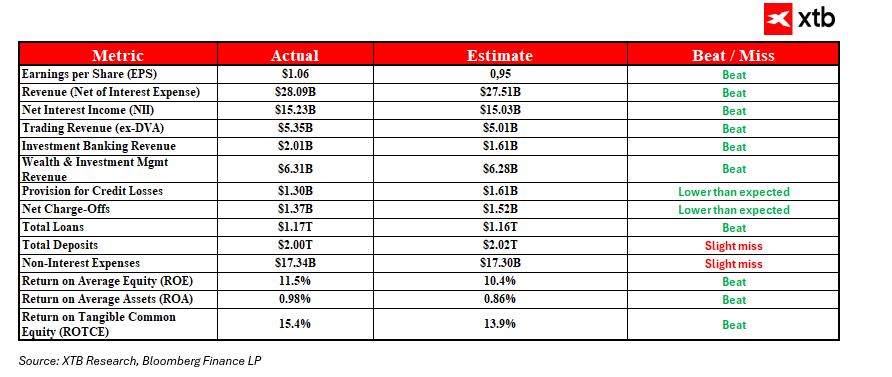

Bank of America – Key takeaways from Q3 2025 results

Revenues and net interest income beat expectations

The bank reported net revenues of $28.09 billion, clearly above forecasts ($27.51 billion). Net interest income reached $15.23 billion, also surpassing market expectations. This shows that Bank of America is managing its assets and liabilities well in a rising interest rate environment, which supports higher net interest margins.

Trading as a significant revenue growth driver

The trading segment generated $5.35 billion in revenue, beating estimates of $5.01 billion. Equity trading performed particularly well with $2.27 billion (vs. $2.08 billion expected). Increased market volatility and higher transaction volumes contributed to stronger results, demonstrating the bank’s ability to capitalize on market opportunities.

Improvement in credit portfolio quality

Provisions for credit losses declined to $1.3 billion, reflecting better risk control and improved asset quality. Lower reserves indicate the bank is less concerned about customer defaults, strengthening its financial stability.

Higher capital efficiency

Return on equity (ROE) reached 11.5%, and return on tangible common equity (ROTCE) was 15.4%, both exceeding analyst expectations. This means Bank of America effectively uses its capital to generate attractive returns for shareholders despite macroeconomic challenges.

Stable balance sheet with strong loan growth

The loan portfolio increased to $1.17 trillion, surpassing estimates and indicating growing demand for financing. Deposits remained solid at $2 trillion, highlighting strong customer trust and a stable funding base.

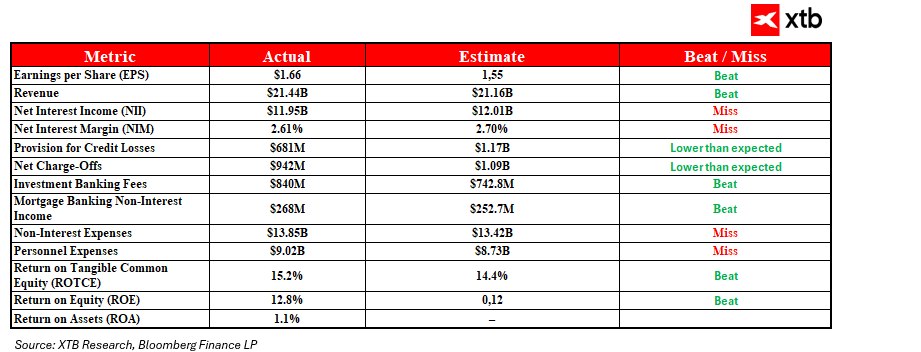

Wells Fargo – Key takeaways from Q3 2025 results

Stable revenues, net interest income slightly below expectations

Wells Fargo kept revenues close to forecasts, although net interest income was slightly lower at $11.95 billion compared to $12.01 billion expected. This reflects moderate loan portfolio growth and economic headwinds that slow expansion.

Significant improvement in asset quality

Provisions for credit losses dropped sharply to $681 million, well below the anticipated $1.17 billion. This is a clear sign the bank is effectively managing credit risk and its portfolio quality is improving.

Strong growth in investment banking revenues

The corporate and investment banking segment posted revenues of $4.88 billion, well above the $4.20 billion forecast. This was driven by increased M&A activity and a higher volume of transactions, generating meaningful advisory and transaction fees.

Rising operating costs impact efficiency

Operating expenses rose to $13.85 billion, above the $13.42 billion estimate, pushing the efficiency ratio (costs to revenues) up to 65%. The bank will need to focus more on cost control to maintain healthy margins.

Capital returns exceed expectations

ROE reached 12.8% (vs. 12% forecast), and ROTCE was 15.2% (vs. 14.4%), showing that despite rising costs, the bank improved efficiency and delivered higher returns to investors.

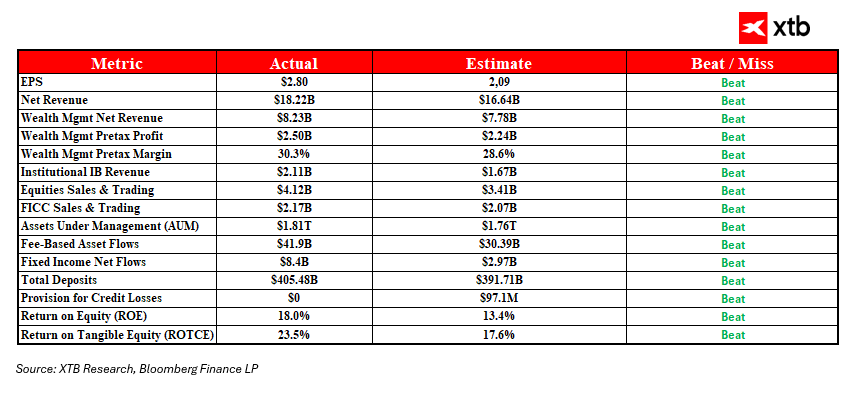

Morgan Stanley – Key takeaways from Q3 2025 results

Net revenues and wealth management segment surpass expectations

Morgan Stanley reported net revenues of $18.22 billion, well above estimates of $16.64 billion. The wealth management segment generated $8.23 billion, exceeding forecasts of $7.78 billion. This confirms the bank’s strong position in serving affluent clients and growing demand for wealth management services.

Record equity trading revenues

Equity trading revenues hit $4.12 billion, nearly 21% higher than expected. Increased market volatility and higher trading volumes enabled the bank to achieve excellent results in this segment.

Investment banking and advisory fees on the rise

Investment banking revenues increased to $2.11 billion, and advisory fees reached $684 million. A growing number of M&A deals and securities issuances point to a corporate activity rebound benefiting the bank’s results.

No need for additional credit loss reserves

Morgan Stanley did not increase its credit loss provisions, signaling portfolio stability and low risk — an important factor in the current economic environment.

High profitability and improved cost control

ROE reached an impressive 18%, well above expectations of 13.4%. This reflects efficient capital use translating into higher shareholder returns.

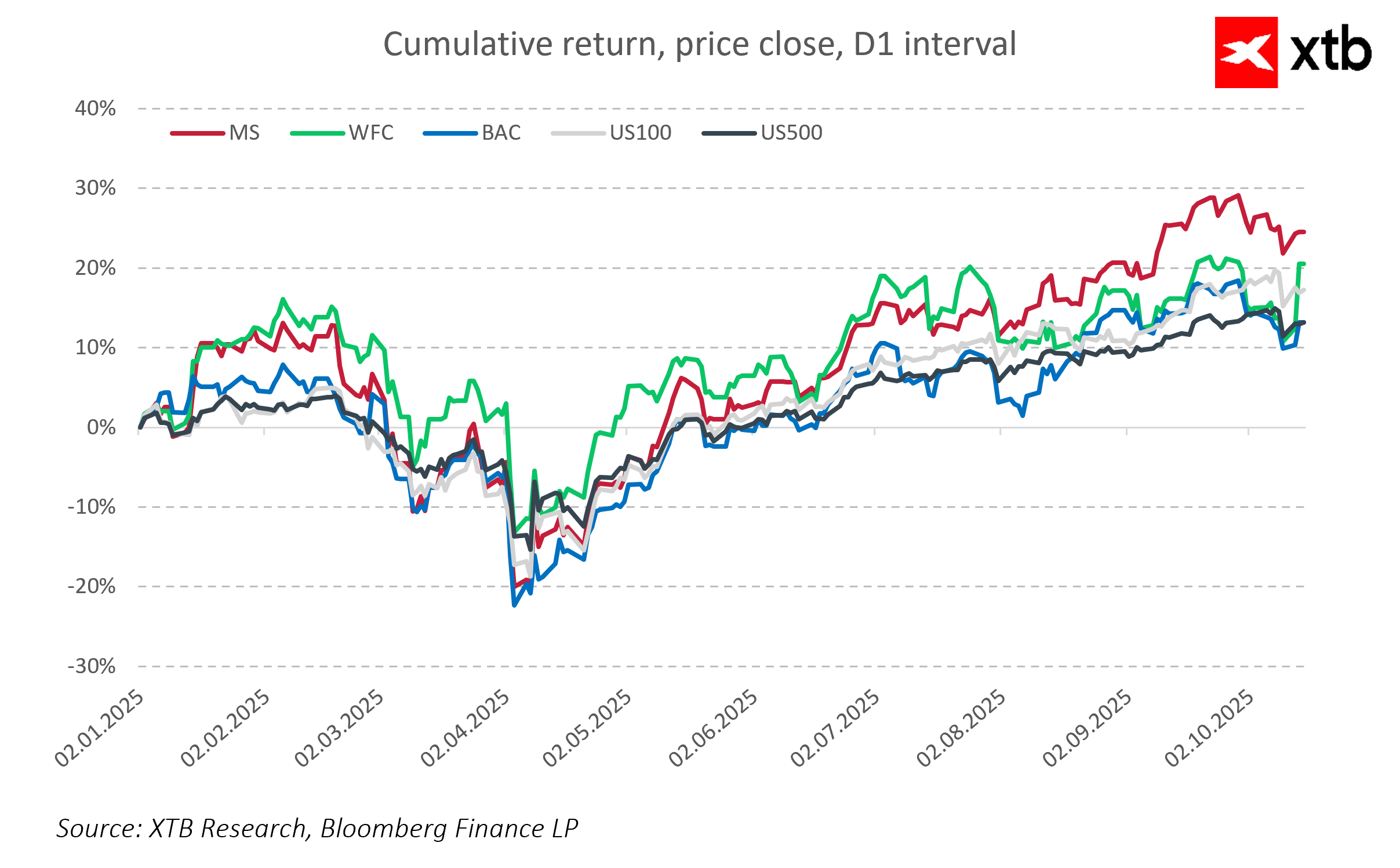

The third quarter of 2025 delivered solid results for the largest U.S. banks. Morgan Stanley stood out with strong wealth management revenues and record equity trading performance, highlighting its effective strategy and market position. Bank of America demonstrated skillful asset and liability management amid rising interest rates, driving revenue and net interest income growth. Wells Fargo confirmed financial stability and significantly improved credit portfolio quality, reducing credit risk.

While the returns of these banks are not as spectacular as those seen in the largest tech companies, they still clearly outperform key market benchmarks. Compared to the S&P 500 and Nasdaq 100 indices, the biggest U.S. banks show steady growth, proving their ability to generate value even in challenging market conditions. This makes them attractive options for investors seeking both stability and growth potential.

Daily Summary – Wall Street Rally Driven by Powell’s Promises

Cocoa Prices Stabilize Ahead of Processing Data: Has the Negative News Been Priced In?

TSMC Earnings Preview: Will the Key Semiconductor Supplier Surprise the Market?

US Open: American Indices Rally on Anticipated End of Fed Balance Sheet Reduction

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.