We begin Wednesday's session on the financial markets.

Equity markets: Asian stocks rose moderately, supported by stable investor sentiment. The Kospi index rose 0.8%, while the Hang Seng added 0.3%.

Japan: despite the bank holiday and the closure of cash markets, the yen strengthened, albeit without any clear new impetus.

USA: Statements by Hammack and Logan from the Fed were rather hawkish, undermining the narrative of rapid policy easing. Today, all eyes are on the NFP at 2:30 p.m.

China: Inflation data showed weaker CPI growth and persistent producer deflation, while the yuan remained stable thanks to the PBoC's actions. Chinese inflation data for January 2026 showed CPI growth of 0.2% y/y (below the forecast of 0.4% y/y and after 0.8% in December), with producer prices (PPI) falling by 1.4% y/y (slightly milder than the expected -1.5% and after -1.9% in December).

Australia: The Australian dollar reached new highs against major currencies following hawkish comments from the RBA and expectations of further interest rate hikes. RBA's Hauser reiterated that inflation is too high with visible supply constraints; after last week's rate hike to 3.85%, markets are pricing in a 70% chance of a further increase to 4.10% in May.

Just before the market opened in Europe, a number of companies presented their quarterly results:

-

ABN Amro (Q4 2025): Revenue €2.26 billion below forecast (€2.29 billion), profit €410 million below expectations (€497 million), NII €1.67 billion above estimate, NII forecast for 2026 at €6.4 billion below consensus.

-

Heineken (FY 2025): Adjusted operating profit of €4.39 billion slightly above expectations (€4.37 billion), beer volume -1.2% better than forecast (-2.48%), dividend €1.90 according to estimates, operating profit growth forecast for 2026 in the range of +2% to +6%.

-

Dassault Systèmes (Q4 2025): Non-IFRS revenue €1.68 billion below expectations (€1.74 billion), ex-FX growth +1% vs. forecast +3.49%, operating margin 37% close to estimates (37.3%), Q1 2026 forecast ex-FX +1-5%.

-

Siemens Energy (Q1 2026): Revenue of €9.68 billion below forecast (€9.83 billion), profit before one-offs of €1.16 billion above expectations (€992 million), orders of €17.61 billion well above estimates (€14.17 billion), confirmation of FY sales forecast +11-13%.

-

Commerzbank (Q4 2025): Revenue €3.14 billion above forecast (€3.07 billion), net profit €737 million better than expected (€629 million), operating profit €1.07 billion above estimates (€1.01 billion), NII €2.05 billion according to forecasts, net profit forecast for 2026 above €3.2 billion (est. €3.41 billion).

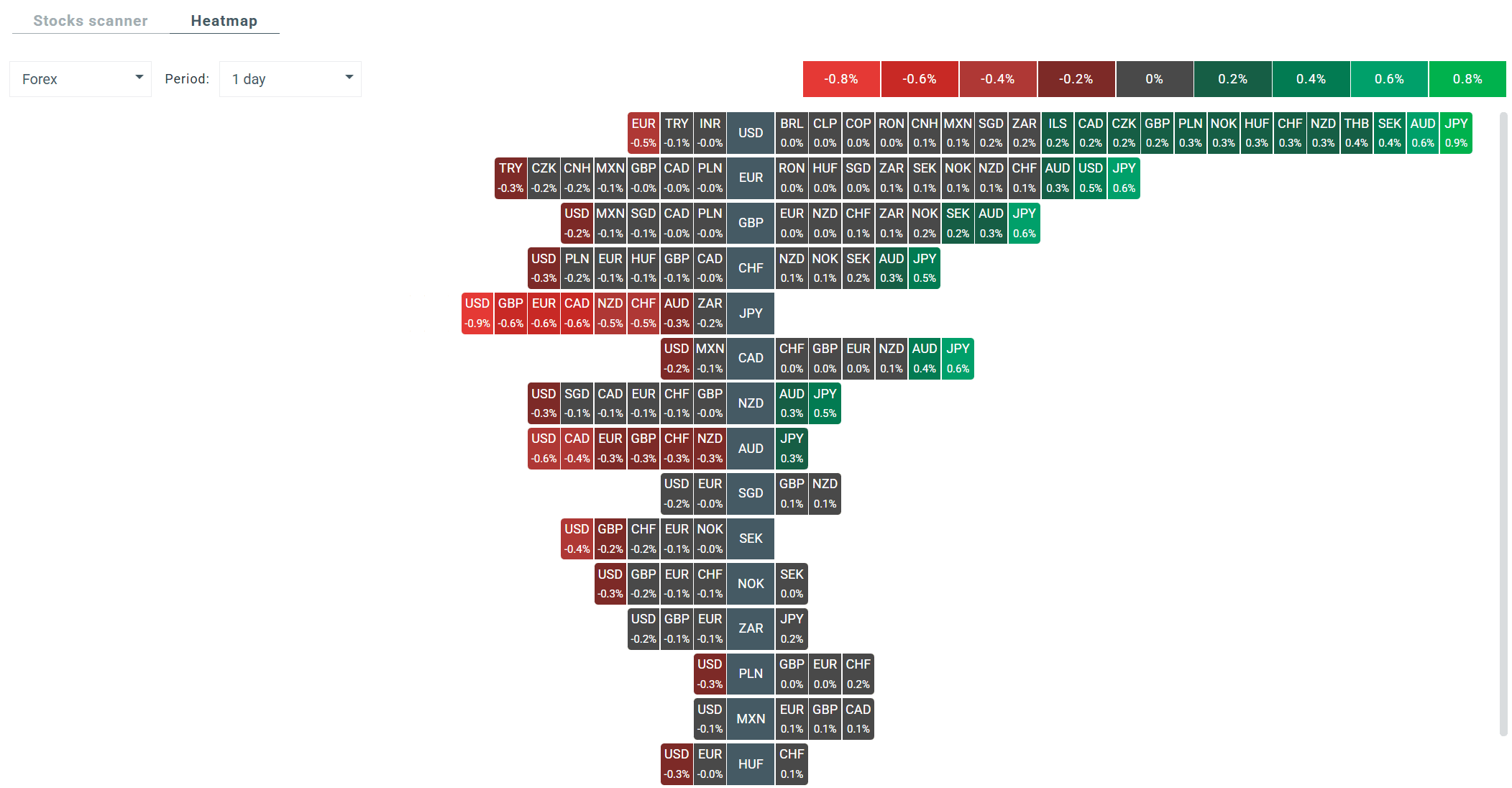

On the Forex market, we are seeing similar dynamics to those observed yesterday. The Japanese yen is currently performing best, rising against most of the world's currencies. Antipodean currencies are also performing relatively well. The US dollar continues to be under the greatest downward pressure.

Precious metals are currently recording moderate increases, but these are not extraordinary movements considering the overall dynamics of recent changes. SILVER is up 2.1% and GOLD is up 0.66%.

Bitcoin is down 2.3% at the time of writing and is trading in the £67,000 range.

Heatmap of volatility currently visible on the Forex market. Source: xStation

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.