- Equities remain on an upward track: global stock benchmarks extended the rally, with the broad MSCI All Country World Index up roughly 0.2% to a fresh record. Asia delivered a stronger impulse, rising about 1.3% and also pushing toward all time highs. US and European equity-index futures are flat, while the S&P 500 finished the prior session near local highs. US equities are elevated, but the tape still does not feel “fully convinced.”

- Growth engine: tech is back in play: the rebound in US technology stocks has eased pressure after the recent wave of concerns about “overheating” AI spending. In Asia, tech names set the tone, with standouts including SoftBank, which has exposure to OpenAI and Oracle. Risk appetite is tilting back toward buyers.

- US macro in focus: traders are positioned for key US data that could reshape expectations for the Fed’s rate path. At 10:30 AM GMT we get the NFIB Small Business Optimism report. At 12:15 PM GMT ADP employment change follows. At 12:30 PM GMT, markets digest US retail sales alongside export and import prices. Commodity traders will also watch the USDA WASDE report scheduled at 3 PM GMT for updated supply and demand estimates in agricultural markets.

- FX: yuan firmer, dollar stuck in place: CNY strengthened to its highest levels since May 2023 following reports that China has encouraged banks to reduce exposure to US Treasuries. The DXY (USDIDX) is consolidating today with no clear direction.

- Metals: gold sees profit-taking: after two sessions of gains, gold pulled back, a classic round of profit-taking in a higher-volatility tape. The market is still trying to build a stable base after the earlier sharp selloff. A similar move is visible across silver, platinum, and palladium.

- JPY: modest strengthening after weekend politics: following Prime Minister Takaichi’s high-profile election victory, the yen gained around 0.4%, still trading near 155 per dollar. The key question now is whether this becomes a more durable trend or fades as a one-off reaction.

- Crypto: cooling off after strong levels: Bitcoin dipped below $70,000 on Monday and has so far failed to reclaim that level, consistent with a more cautious risk stance after a run of sharp moves. Ethereum is trading near $2,000. After the recent pullback, crypto vehicles BitMine Immersion and Strategy absorbed additional supply, purchasing roughly $80 million worth of ETH and BTC, respectively.

- Trump–Xi summit in early April and Fed commentary: the White House has not confirmed the initial reports published by Axios. Fed’s Miran noted that tariffs may allow interest rates to be lowered over time and are not currently a key driver of inflation. Meanwhile, Fed’s Bostic said that the latest weak labor market data argue for caution in the central bank’s decision-making process.

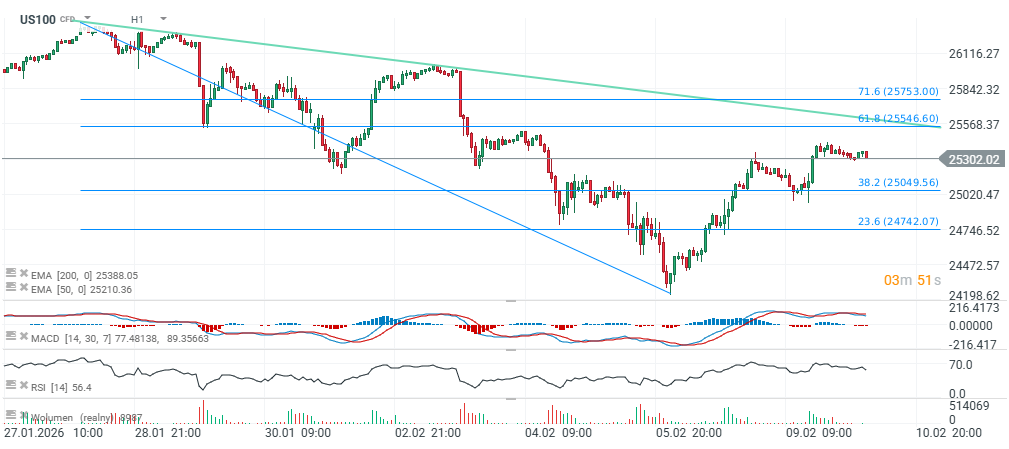

US100 (H1 interval)

Looking at the technical chart of Nasdaq 100 futures (US100), the index has not yet reached the hourly trendline. The 25,550 level is reinforced both by this trendline and by the 61.8% Fibonacci retracement of the most recent upward impulse that pulled the index back from near record highs. This area may act as a potential zone of strongest resistance. On the other hand, the 38.2% Fibonacci retracement around 25,000, supported by prior price reactions, stands out as a potentially important support level.

Source: xStation5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.