After yesterday's session, which ended with declines in the banking sector, Western European markets are recording gains today. Investors are focusing on the Federal Reserve's decision, which will be announced in the evening.

Trading is taking place in a calmer atmosphere, and the main indices in Europe are in positive territory, signaling a partial rebound after previous declines. However, turnover remains limited as the market awaits signals from the USA regarding further monetary policy.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app

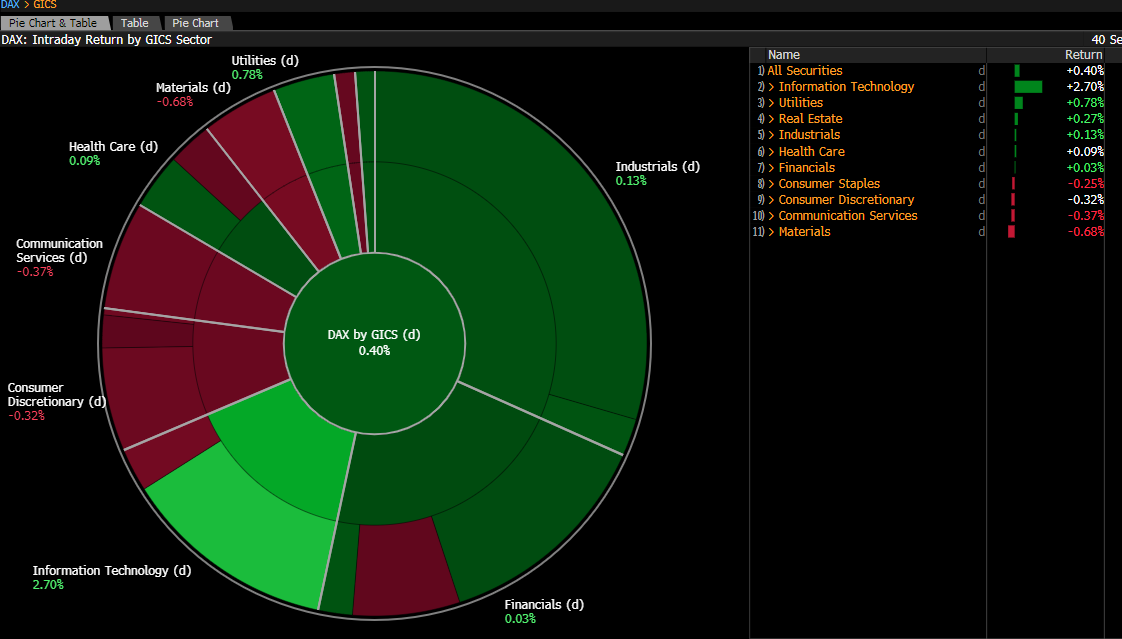

Source: Bloomberg Finance LP

The German index is rising today on the wave of positive sentiment in technology stocks.

Macroeconomic Data:

From a macroeconomic perspective, attention was drawn to the final inflation data, which turned out to be slightly lower than the initial reading. The market may interpret this as a signal that price pressure is gradually decreasing.

Market consensus assumes that the Fed will decide today to lower interest rates by 25 basis points. However, the most significant impact on the future direction of the markets will come from the message contained in the statement and at the press conference, particularly regarding inflation prospects and economic growth.

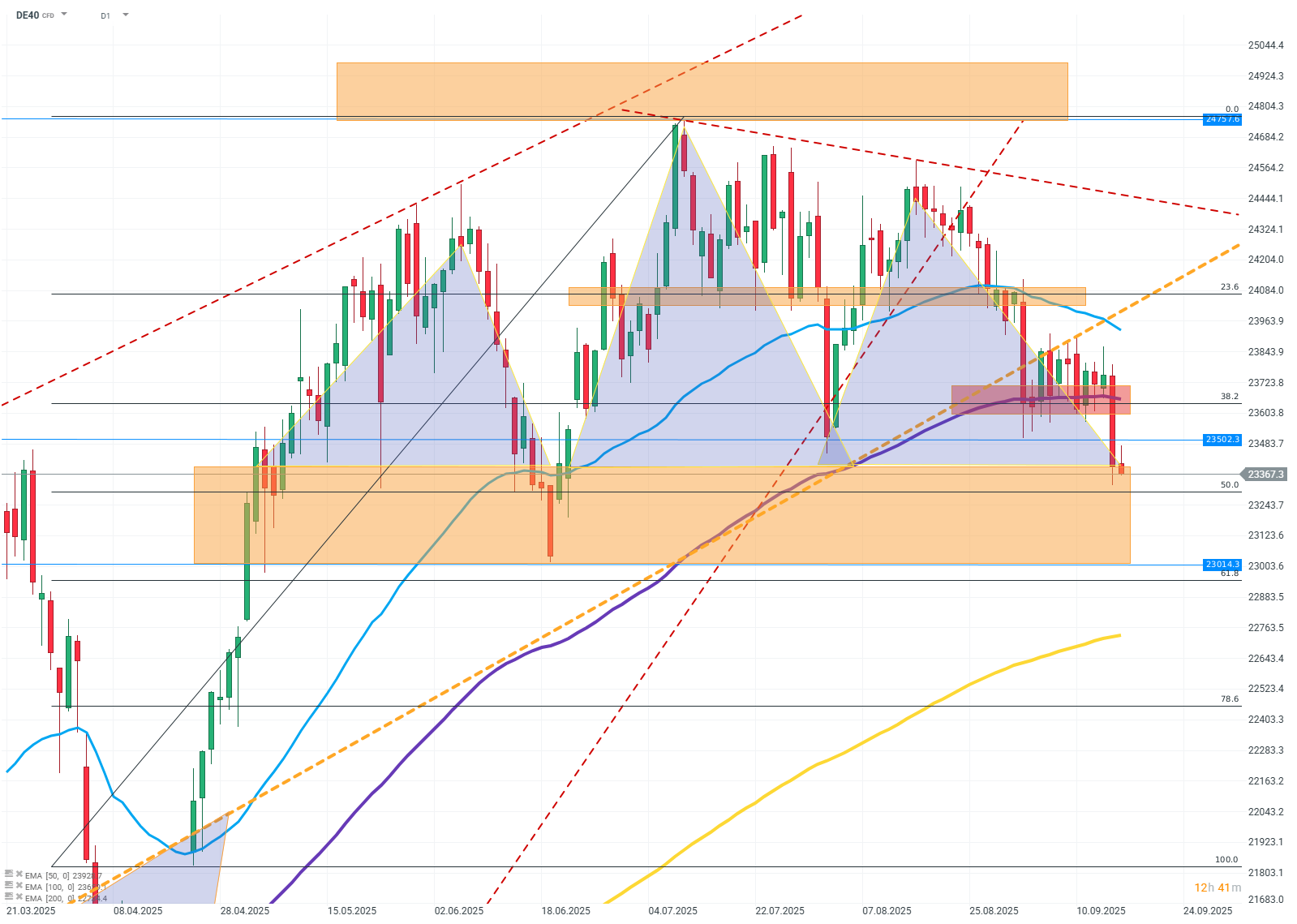

DE40 (D1)

Source: Xstation

The chart clearly outlines a head and shoulders pattern, signaling a potential reversal of the upward trend. The neckline is defined by previous support, which has been breached, reinforcing the negative tone of the technical setup. Additionally, the price has fallen below the EMA100, confirming the selling advantage. The entire setup indicates the risk of deepening the correction, with the market's behavior in the area of subsequent support zones being crucial to halting the downward momentum. If buyers want to regain initiative, a quick return above 23,700 points will be necessary.

Company News:

Centrica (CNA.UK) – The company gained support after JPMorgan raised its recommendation, improving sentiment towards the energy sector in the UK. The stock price rose by over 1% today.

Beiersdorf (BEI.DE) – The consumer goods producer came under selling pressure after yesterday's downgrade by Jefferies, maintaining a negative tone around the company. The stock price fell by about 1.5% at the opening.

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.