Bitcoin hovers around $115,000, holding on to recent gains as the week begins. The sentiment weakened slightly after Nasdaq and S&P 500 futures dipped on reports of an antitrust investigation into Nvidia. Ethereum is down more than 2.5%, falling to $4,500.

-

The U.S. dollar is weakening, but this has not translated into crypto gains on Monday.

-

The Fed is almost certain to cut rates by 25 bps on Wednesday.

-

Crypto sentiment remains highly sensitive to movements in equity indices.

On the optimistic side, if the U.S. bull market continues and gold prices keep rising (alongside falling bond yields and Fed rate cuts), there is a strong chance that Bitcoin could head toward new all-time highs later this year. However, U.S. equities are already heavily “overbought,” and the market may reassess sentiment while awaiting signals from the Fed and upcoming U.S. data. These could still suggest that labor market challenges may not be “quickly eased by rate cuts,” raising the risk of recession — a scenario that would almost certainly weigh negatively on Bitcoin as well as Wall Street.

Start investing today or test a free demo

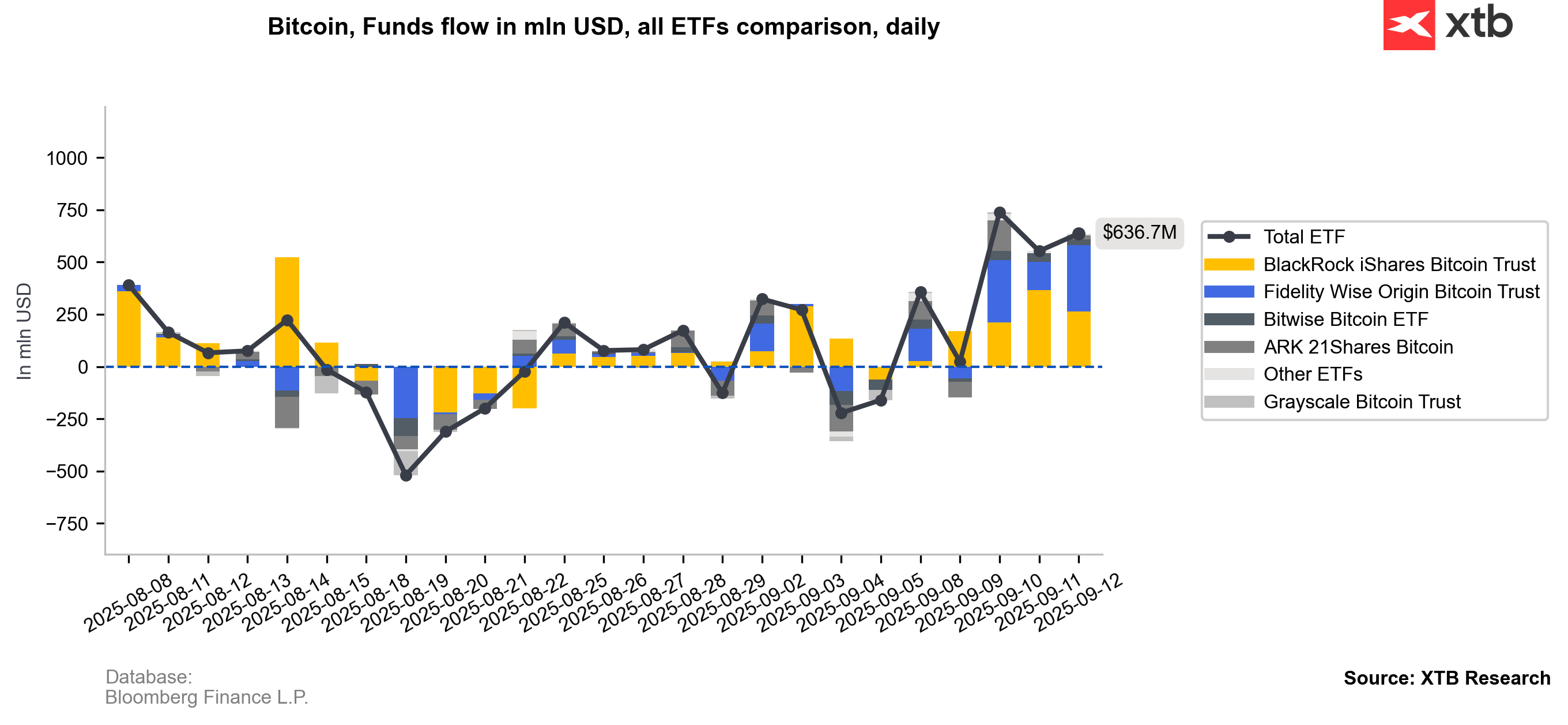

Create account Try a demo Download mobile app Download mobile appBitcoin ETF inflows accelerate

Last week saw a clear acceleration in net inflows into Bitcoin ETFs, driven by Wall Street optimism, a weaker dollar, and rising expectations of Fed rate cuts. The Federal Reserve is almost certain to cut rates on Wednesday, but historical patterns provide no guarantee that such a decision will translate into short-term gains in equity indices. Theoretically, a bull run on gold should support Bitcoin in medium term, as the BTC price lags gold in approximately 3-months.

Source: XTB Research, Bloomberg Finance L.P.

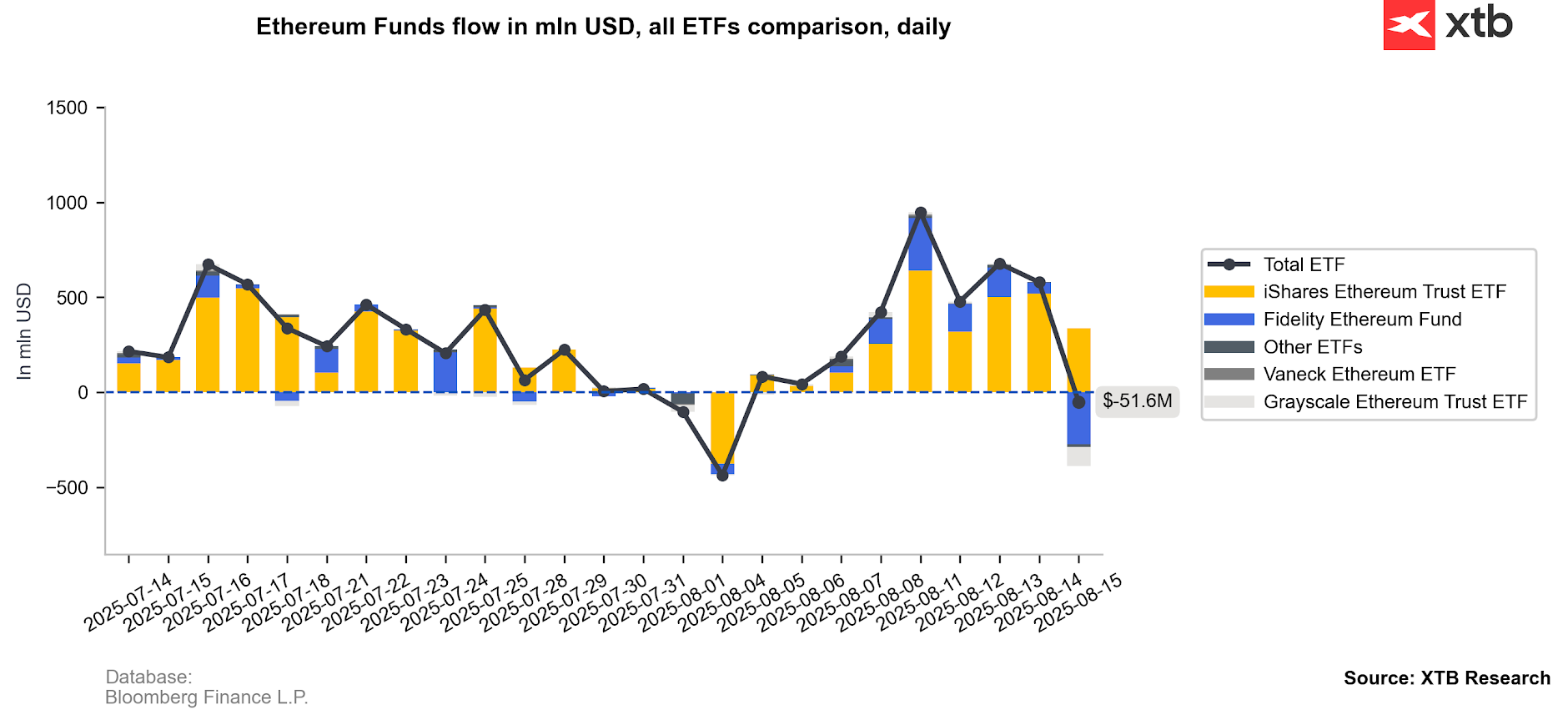

On the other hand, on Friday we saw net outflows from ETFs on Ethereum.

Source: XTB Research, Bloomberg Finance L.P.

Bitcoin & Ethereum Charts (D1 interval)

Bitcoin is fighting to stay above its 50-day exponential moving average (EMA50, orange line) near $114,500. If momentum holds, a move above $120,000 remains possible. On the downside, a break below EMA50 would likely open the way to a test of $108,000 and the 200-day EMA.

Source: xStation5

The technical outlook for Ethereum is also mixed. If selling pressure accelerates from current levels, a drop toward $4,100 (neckline) would likely confirm a bearish head-and-shoulders (H&S) pattern breakout.

Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.