Why is this reading important?

Retail sales are one of the key indicators of consumer health in the US, which accounts for most of the economic growth. The data, especially when excluding cars and fuel, allows for an assessment of the real strength of demand and the current pace of economic activity. Continued sales growth indicates consumer resilience despite high interest rates. From the Federal Reserve's perspective, this reading influences the assessment of demand pressure and expectations for future rate cuts, and for financial markets, it shapes the valuation of the dollar, bonds, and stocks and reduces concerns about a sharp economic slowdown.

Retail sales results for December

- Retail sales (m/m): actual 0% (forecast 0.4%; previous: 0.6%)

- Sales excluding cars (m/m): actual 0% (forecast 0.3%; previous: 0.5%)

- Sales excluding cars and fuel (m/m): actual 0% (previous: 0.4%)

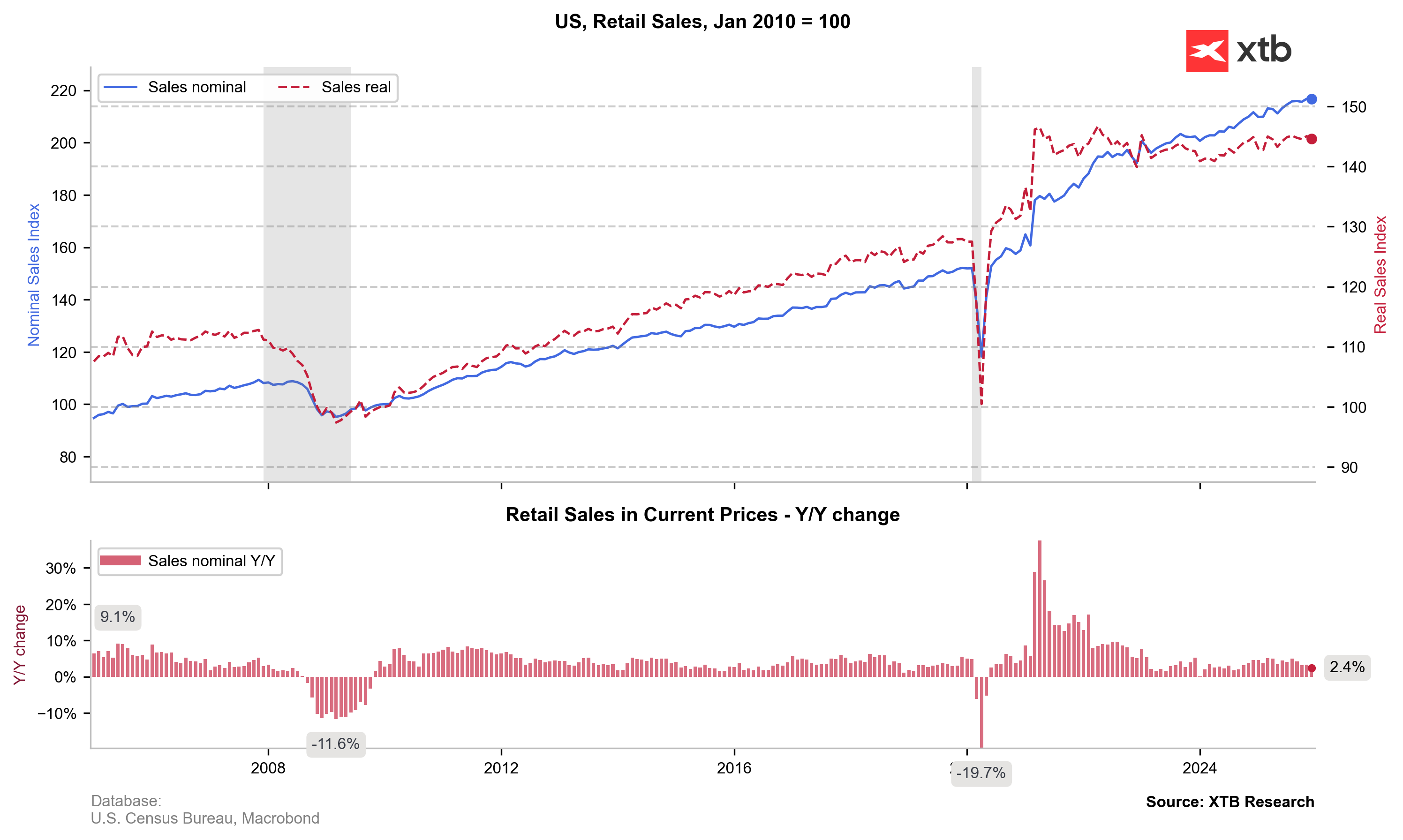

- Retail sales (y/y): actual 2,4% (previous 3.3%)

Source: XTB Research

Actual results

December US retail sales came in clearly weaker than market expectations. Headline retail sales were flat on a month-over-month basis, missing the 0.4% consensus forecast and slowing sharply from the previous 0.6% increase. Sales excluding autos also showed no growth, disappointing relative to expectations of a 0.3% rise and the prior 0.5% reading. More importantly, sales excluding autos and fuel stalled after a 0.4% increase in the previous month, pointing to a slowdown in underlying consumer demand. On a year-over-year basis, retail sales growth decelerated to 2.4% from 3.3%, confirming a loss of momentum in consumption toward year-end. Overall, the data suggest that tighter financial conditions are increasingly weighing on household spending and may reinforce market expectations for a more accommodative Fed policy stance in the coming months. As a result of this release, the US dollar weakened significantly, with falling Treasury yields and a clear reduction in the dollar’s rate advantage providing strong support for EUR/USD.

Source: xStation5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.