Tonight, another central bank monetary policy meeting will take place, concluding the busiest week of monetary policy of the entire year. In principle, the Bank of Japan will leave interest rates unchanged at 0.5% given the political, economic, and social uncertainty the country is experiencing.

Japan's Economic Situation

Since the last meeting in July, there have been major developments in both the economic and political arenas in the Land of the Rising Sun.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appOn the economic front, the latest data released show higher-than-expected GDP growth, at 2.2% annual growth, adding a factor that supports the possibility of a short-term rate hike.

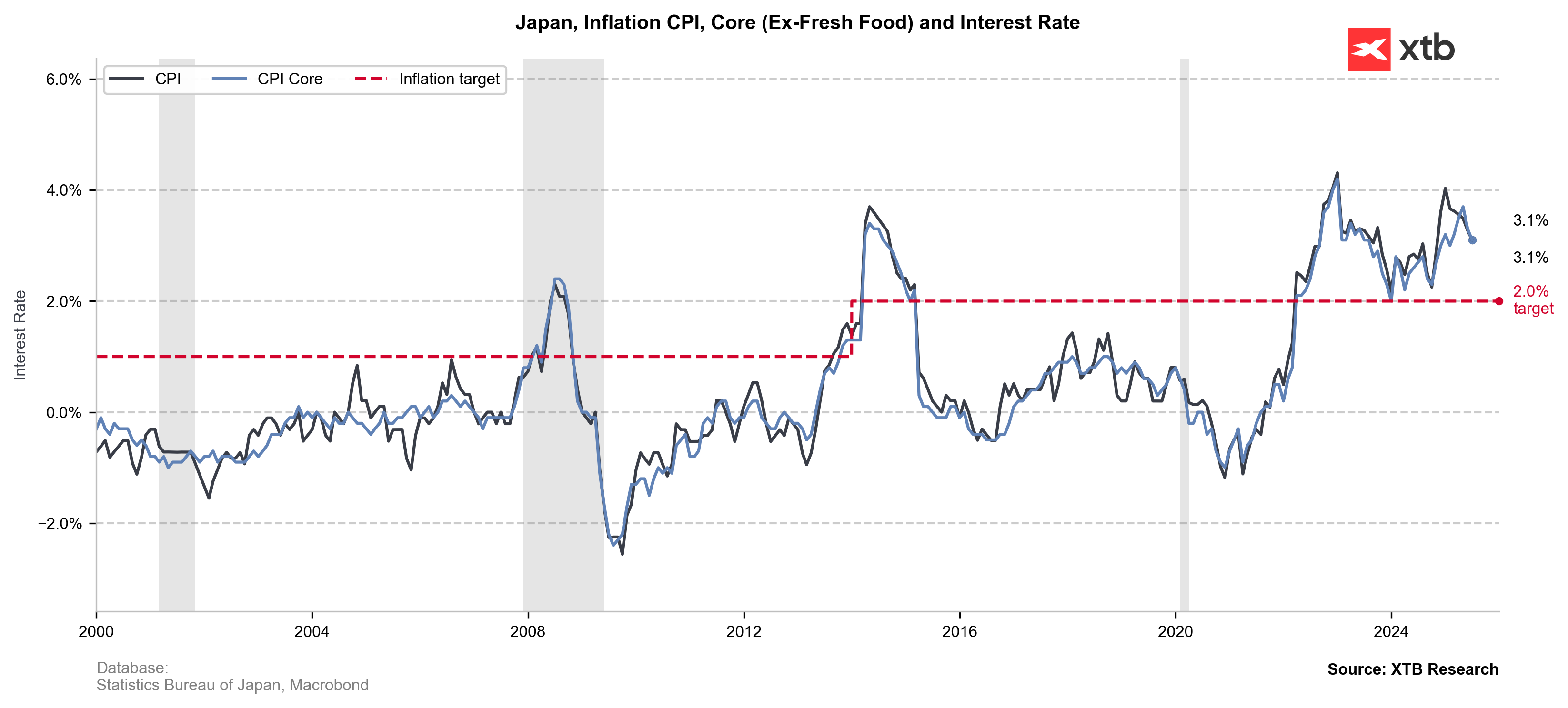

Inflation has been above 2% for more than three years. Although there has been some disinflation since February, the level remains high, adding pressure to the BoJ to raise rates. The point supported by advocates of more flexible monetary policy is that the latest reported data shows a 3.1% increase, and surveys project that the new inflation data due this morning will show growth falling to 2.8%.

CPI and CPI core in Japan. Source: XTB

This data, coupled with the trade agreement reached with the US, which reduced overall uncertainty, suggested an interest rate hike at tonight's meeting.

However, those expectations faded earlier this month when Prime Minister Shigeru Ishiba announced his resignation, sparking some concerns about political instability and the possibility that the new administration might prefer a more flexible monetary policy.

Investors believe that Agriculture Minister Shinjiro Koizumi, who officially joined the race for the LDP presidency on Tuesday, is more in favor of rate hikes than his likely rival, Sanae Takaichi, who is considered a proponent of monetary easing and a more flexible fiscal policy. The LDP, the ruling coalition's largest party, will hold its leadership vote on October 4.

Stock Market, Bond, and Yen Performance

The country's stock index, the Nikkei 225, has just broken its all-time high. This is the fifth record so far in September, following four in August. It was also the first time in history that the benchmark index closed above 45,000 points. The Nikkei has risen more than 15% so far this year and nearly 25% in the past 12 months.

This time, it has been boosted by gains in the real estate, technology, and other export-related companies after the Fed's decision to cut rates calmed concerns about the US economic outlook.

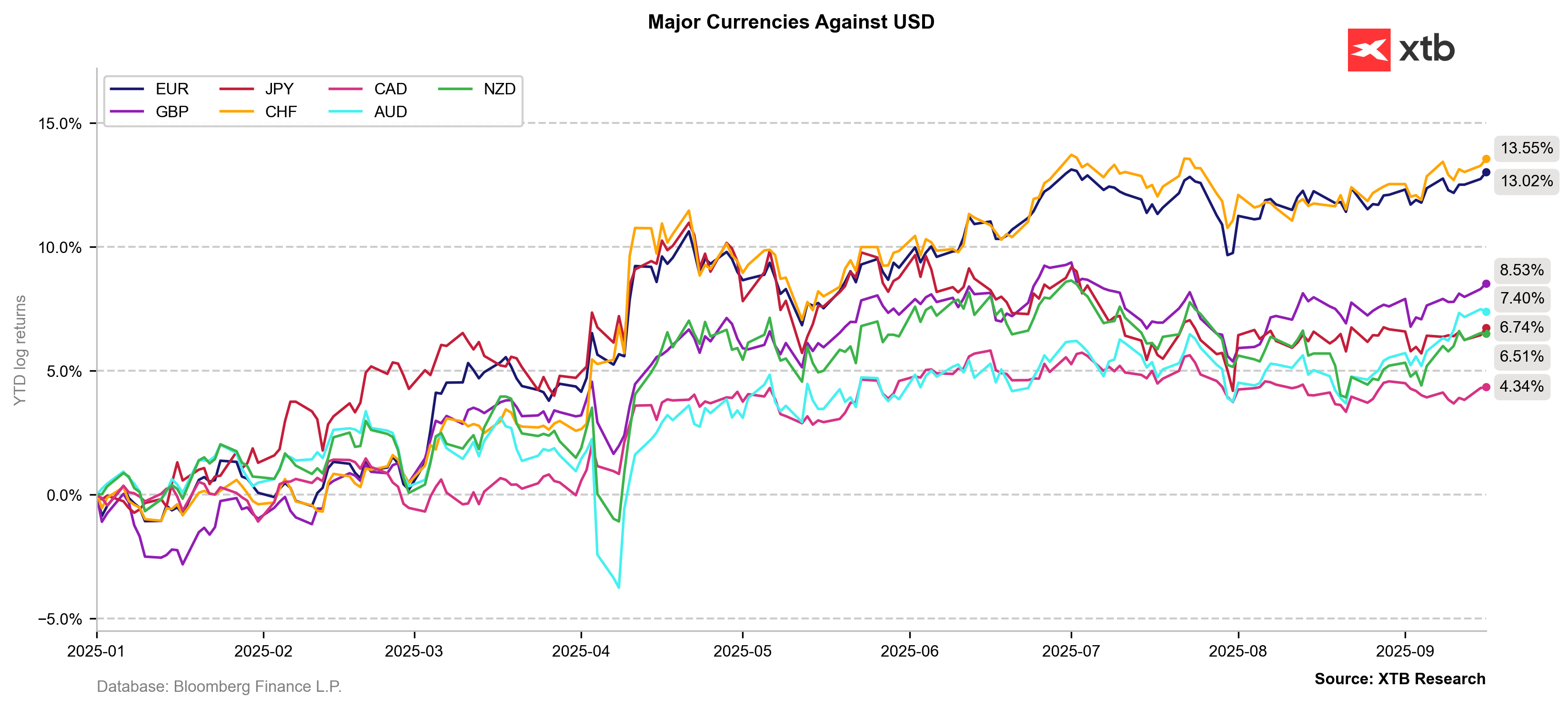

On the currency front, the US dollar has become the scapegoat for Donald Trump's policies. This has caused international investors to seek alternative currencies, as has happened with the Japanese yen, which has accumulated gains of 6.74% since the beginning of the year against the US dollar.

Currency performance against the dollar since the beginning of the year. Source: XTB

Rate cuts by most of the world's central banks could generate further increases in the Japanese currency at a time when it is near key levels closer to 147 on the dollar-yen pair.

Source: Xstation

A rapid appreciation of the Japanese currency could exacerbate the reduction in profit margins for Japanese companies. On the other hand, this would increase inflationary pressure, which could force the Bank of Japan to implement rapid rate hikes.

One of the key aspects of the markets in recent months has been concerns about global fixed income. Political and fiscal uncertainty has pushed up very long-term bond yields. The 30-year bond reached an all-time high of 3.285% earlier this month, amid investor distrust of government policies, high debt levels, and the possibility of rate hikes by the Bank of Japan.

The market now appears to be calming due to the latest auctions, but it could be a one-time event. Japanese 20-year bonds rose after an auction attracted the highest demand since 2020, offering some respite to investors facing heightened political and fiscal risks.

Key Questions at the Meeting

Although the market is 100% pricing in no change in the monetary policy adopted, the subsequent press conference and the explanations offered by Governor Kazuo Ueda will be especially important. Among the key points, we highlight the following:

- What will the next steps be? Currently, there is a 67% probability of a rate hike before the end of the year, with October being the main focus of attention, with a 30% chance of a 25 basis point hike.

- Is politics influencing decision-making? The central bank is unlikely to discuss the implications of Ishiba's resignation as it seeks to reassert its independence from the government. Still, the political impact will likely be part of the meeting.

- How will the Fed's decision influence the Fed? Decisions made by the world's most important central banks have repercussions for the rest of the world. While the next move in Japan should be a rate hike, the US is expected to see two additional rate cuts later this year

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.