Yesterday's FED decision brought optimism to today's trading session in Europe. Major indices, including DAX and Euro Stoxx 50, are up by slightly over 1%. Technology and clothing companies are driving the market upwards, benefiting from improved forecasts, solid results from previous days, and expectations of improved consumer sentiment due to lower interest rates in the USA. Contracts DE40, FRA40, and AUT20 are up by over 1%.

An additional stabilizing factor is the agreement between the Italian banking lobby and the government to freeze deferred tax assets until 2026, which was positively received as a signal of regulatory predictability. At the same time, some investors remain cautious, as defensive positions are forming in the banking sector on the options market, suggesting that distrust of future fiscal burdens still persists. Contracts on Italian indices are up by over 0.4%.

Macroeconomic Data.

The Fed meeting concluded with a 25 basis point rate cut, which was in line with market expectations. The decision signals that the FED values the strength of the labor market and market stability, but also indicated that the U.S. economy is still strong and does not yet require further cuts to maintain growth.

In Europe, the Central Bank of Norway also decided on a 25 basis point cut, which was positively received by the market. The Norwegian krone is strengthening in light of the "hawkish cut."

Today, the Bank of England also made a decision to maintain the current level of interest rates. The market seems to suggest that the Bank of England overestimates the strength of the British economy or does not believe in the declared path of the bank's interest rates. The pound, despite maintaining rates, is losing against most major currencies.

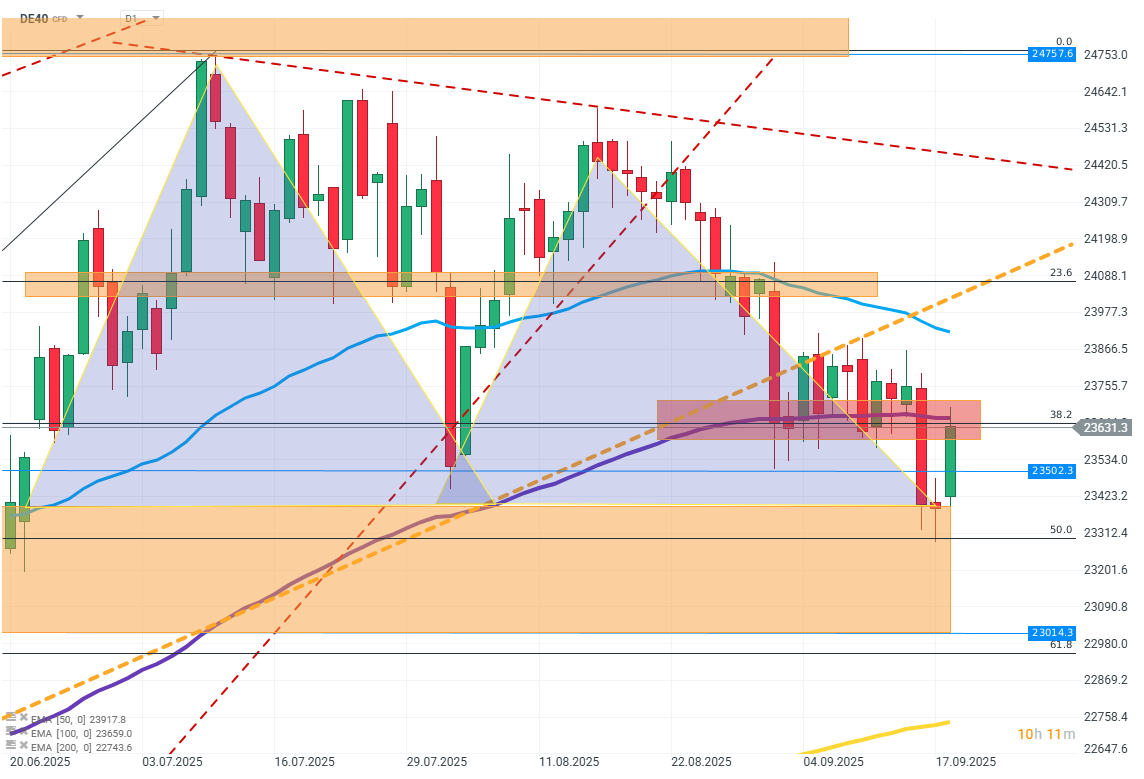

DE40 (D1)

Source: xStation

The chart shows an attempt to negate the head and shoulders pattern, where the market tried to rebound after breaking the neckline, but the current increases look like a classic retest from below. The FIBO setup and previous support levels, which have turned into resistance, strengthen the scenario of continued declines. A successful breakout and maintaining above the neckline could mean negating the pattern.

Company News:

Pets at Home Group (PETS.UK) - The valuation collapsed by several percent after the company's CEO left. The company also warned of risks to its revenues in light of deteriorating consumer sentiment.

The agreement between the Italian banking lobby and the government to freeze deferred tax assets until 2026. Unicredit (UCG.IT) is down about 1%.

Continental (CON.DE) - The tire manufacturer is losing over 20% of its valuation. This is due to the spin-off of "Aumovio," which will focus on the production of braking systems and automotive software.

Zalando (ZAL.DE) - The clothing company is up by almost 5% following the revelation of a large share purchase by one of the investors.

Daily summary: Sentiments on Wall Street stall at the end of the week🗽US Dollar gains

US100 loses 0.5% 📉Meta shares decline extends on AI CAPEX worries & Deutsche Bank remarks

Fed's Bostic and Hammack comment the US monetary policy 🔍Divided Fed?

Scott Bessent sums up the US trade deal with China🗽What will change?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.