- Consensus: ~50k jobs in November (no forecast for October); unemployment rate up to 4.5%; wages +0.3% m/m.

- Data distortion risks: The release covers two months (Oct–Nov) after the shutdown → higher volatility, lower overlap in the household survey sample, and no October unemployment rate.

- Leading indicators mixed: ISM Services employment improved but remains <50; ISM Manufacturing weaker; ADP negative; jobless claims slightly better; NFIB hiring plans also slightly higher.

- Implications for the Fed: The market prices only a 28% chance of a January cut; a positive NFP may support the USD but won’t change policy unless the report shows a clear trend.

- Consensus: ~50k jobs in November (no forecast for October); unemployment rate up to 4.5%; wages +0.3% m/m.

- Data distortion risks: The release covers two months (Oct–Nov) after the shutdown → higher volatility, lower overlap in the household survey sample, and no October unemployment rate.

- Leading indicators mixed: ISM Services employment improved but remains <50; ISM Manufacturing weaker; ADP negative; jobless claims slightly better; NFIB hiring plans also slightly higher.

- Implications for the Fed: The market prices only a 28% chance of a January cut; a positive NFP may support the USD but won’t change policy unless the report shows a clear trend.

We are moments away from the delayed U.S. labor-market release. The NFP report will cover two months and comes at a moment of exceptionally high uncertainty around interpreting the condition of the U.S. labor market. The consensus expects around +50k jobs in November, but private forecasts cover a wide range from +20k to +100k due to unusual distortions caused by the shutdown. October’s payrolls will likely show a small decline, but they will not include an unemployment-rate reading from the household survey. For November, markets expect unemployment to rise to 4.5%, reflecting both weaker employment and statistical noise following the closure of statistical agencies.

What do macroeconomic indicators suggest?

Leading macro indicators suggest a labor market that is stabilizing. They do not indicate a major downturn, although several signals are mixed.

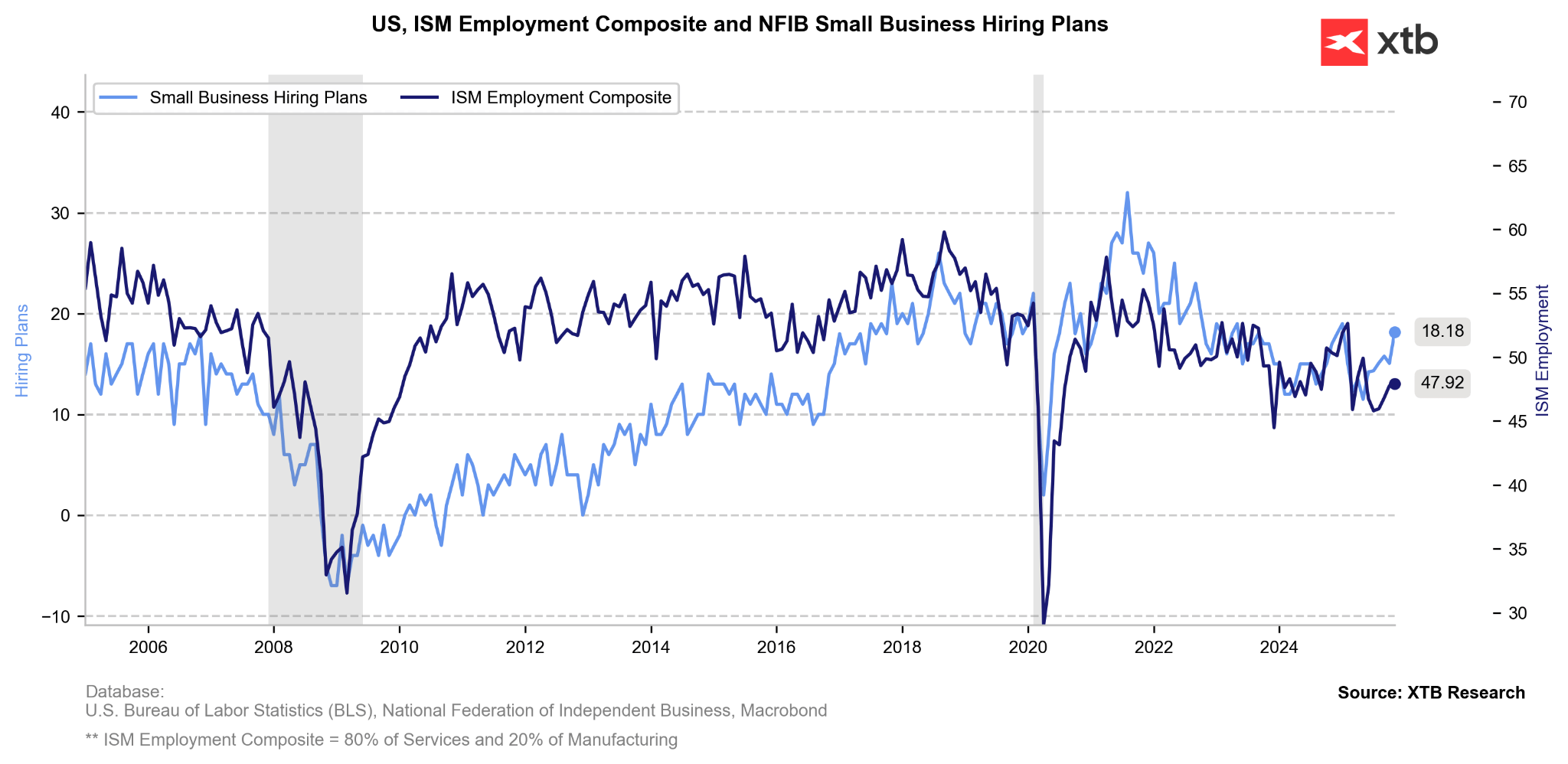

The ISM composite employment index — consisting of ISM Services (80% weight) and ISM Manufacturing (20% weight) — points to a moderate improvement while still remaining in contraction territory. It is important to note the much stronger situation in the services sector, which due to its larger weight pulls the composite index slightly upward. A similar, more decisive trend is also indicated by small-business hiring plans.

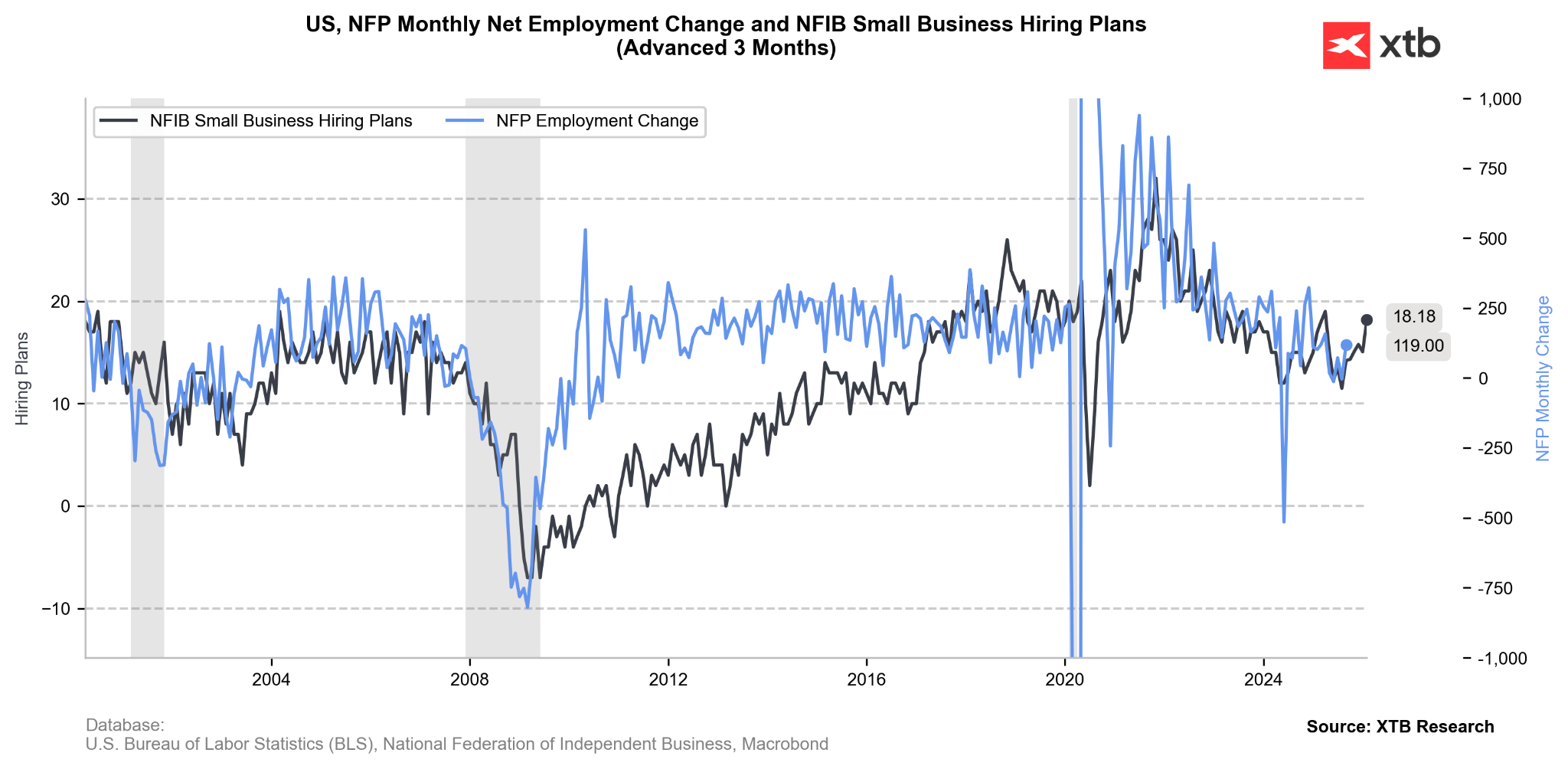

As we can see in the chart below, NFIB hiring plans correlate closely with changes in U.S. employment. The data therefore suggest potentially good numbers.

The 4-week average of new jobless claims has also improved slightly.

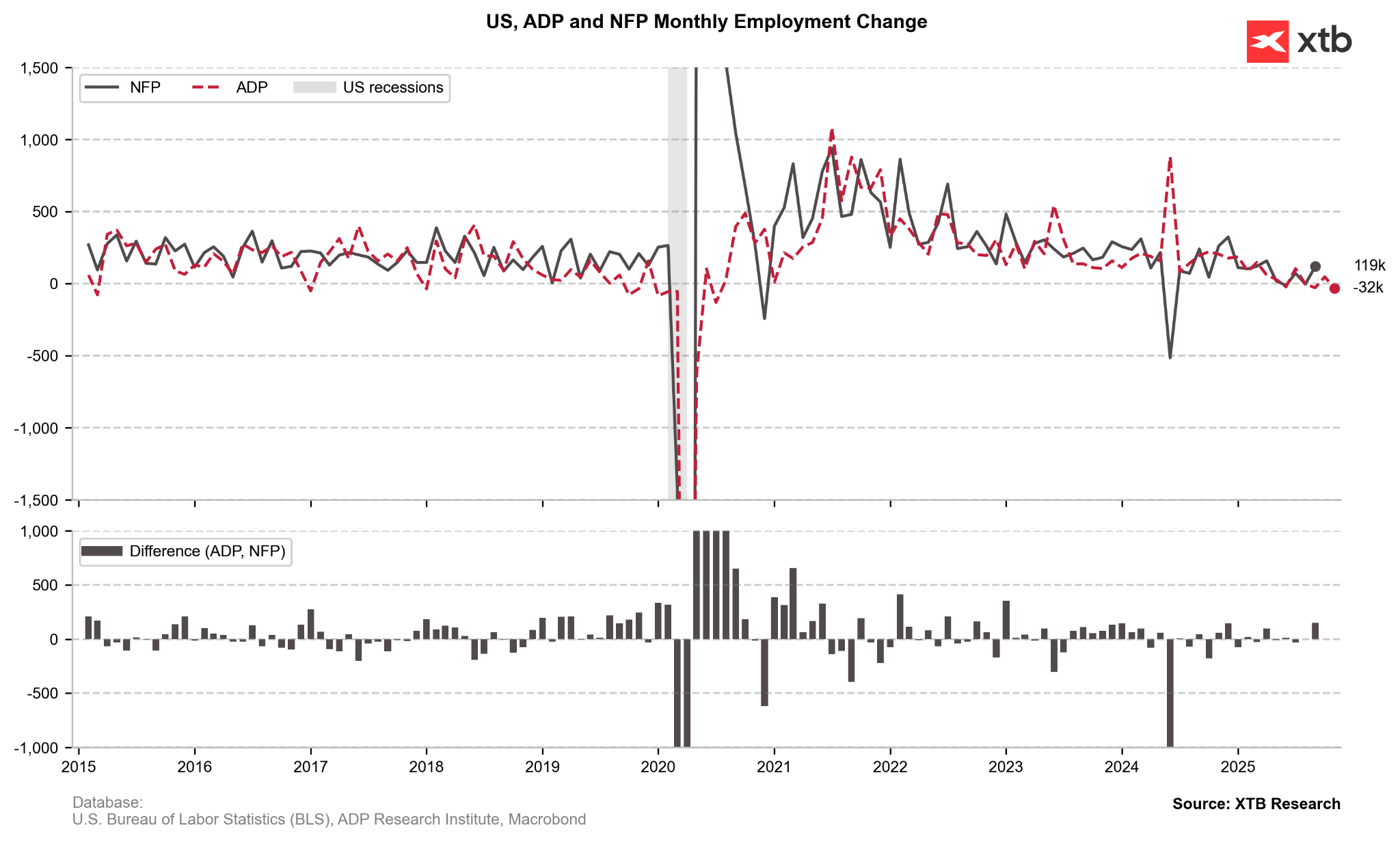

However, weak ADP readings in recent months (including for October and November) point in the opposite direction. It should be remembered that ADP covers only the private sector, while NFP also includes the significant government sector. ADP, being a private analytics provider, was able to publish data during the government shutdown.

Wages and labor force participation

Beyond the headline figure, wage growth and labor-force metrics will be key. Wages are expected to rise 0.3% m/m, consistent with easing wage pressures but still above levels typical for the Fed’s 2% inflation target. Additionally, due to the shutdown’s impact — smaller survey sample and shortened November data-collection window — the unemployment-rate reading will carry a significantly higher standard error, making interpretation more difficult.

Fed expectations

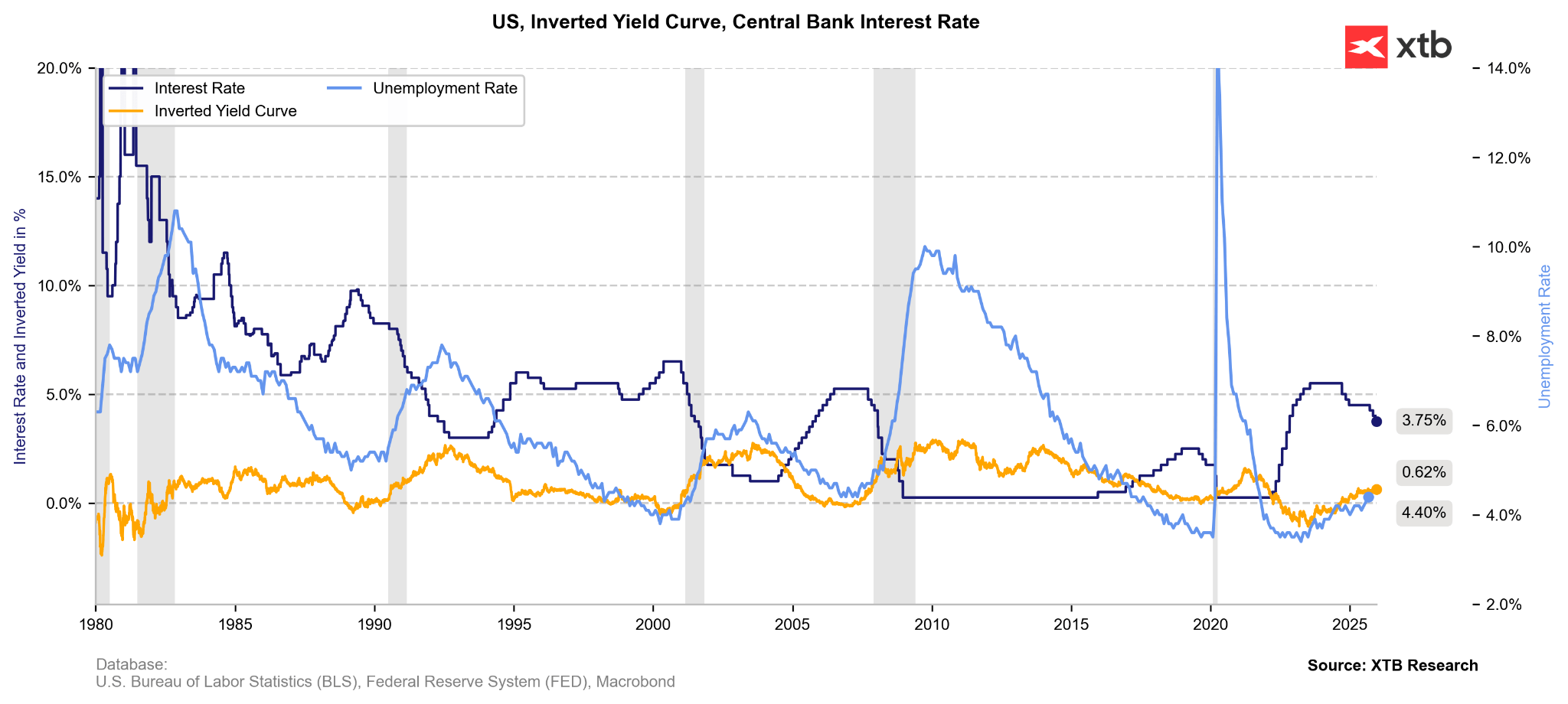

For markets and the Fed, today’s report may generate more uncertainty than clear signals. The Fed has already acknowledged that previous payroll reports may have been overstated by ~60k per month, implying caution when interpreting incoming data.

Before the January 27–28 FOMC meeting, we will still get full CPI and employment reports. The market currently prices a 28% probability of a January rate cut, and today’s data would need to show either a clear acceleration or a major deterioration to meaningfully shift those expectations. Over the past few days, expectations of a January cut have been gradually increasing.

EURUSD

EURUSD continues to climb ahead of the key NFP release. The pair is testing its highest levels since September, having firmly broken above the 61.8 retracement level yesterday. Interestingly, the rally has extended despite the negative tone of the European PMI data. Investors will focus today on the November print. If it comes in around 50k, volatility should remain limited. However, a strong reading could even trigger an attempt to test 1.17. A weaker-than-expected number would open the door for a move toward 1.18.

Daily summary: Dollar loses ground after NFP; OIL.WTI at its lowest since 2021 💡

OIL.WTI loses 2.5% 📉

From Euphoria to Correction: CoreWeave and the Future of AI Infrastructure

EU Fines for Tech Giants — Their Role in EU/USA Competition

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.