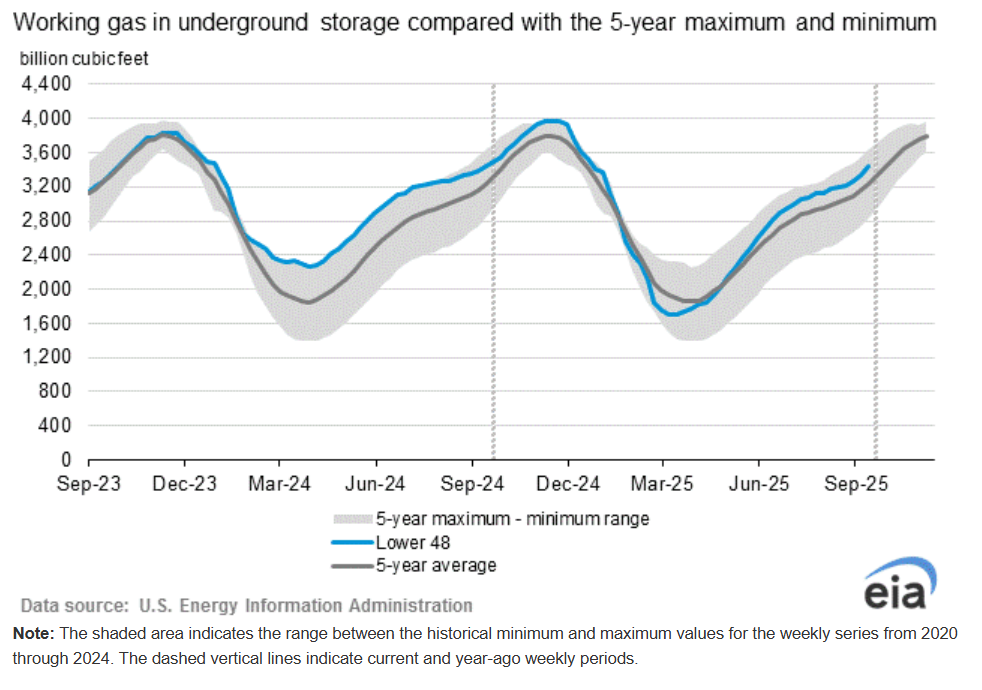

- EIA Natural Gas Storage: 90bn (Expected: 80bn, Previous: 71bn)

Today’s EIA Natural Gas Storage report showed a net injection of 90 Bcf for the week ending. Compared with expectations of around 80 Bcf. This reading is also well above the previous week’s build of 71 Bcf, highlighting stronger-than-anticipated inventory growth. The larger injection reflects continued mild weather conditions that limited demand for both cooling and heating, alongside steady domestic production and firm Canadian imports, which kept supply ample relative to consumption.

Source: US E.I.A

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appThe market reaction is likely to be bearish for natural gas prices, since injections consistently outpacing forecasts point to comfortable storage levels heading into winter. Traders will remain focused on short-term temperature forecasts, as only sustained heat or early cold snaps could offset the current bearish storage trend.

NATGAS Futures decline 2,8% after the publication.

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.