The stock exchanges in the USA started the day on a slightly positive note – they are also recording slight gains today. Investors remain cautious, focusing on upcoming key inflation data and Oracle's results. US500 is up 0.2% at the opening, and US100 is up 0.1%.

After yesterday's close, Nasdaq set a new record. The indices continue their upward trend, driven by strong demand for technology and AI companies. Global market growth is sustained by rising expectations of Fed rate cuts – supported by weaker employment data, which lowered bond yields, and the dollar weakened to its lowest level in about seven weeks. Meanwhile, gold reached new highs.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app

In light of the upcoming CPI and PPI readings, investors will closely monitor clues regarding the Fed's next decisions – particularly whether weak data will confirm the scenario of rate cuts later this year. The market is also awaiting a revision of employment data, which is expected to be record-breaking, downward.

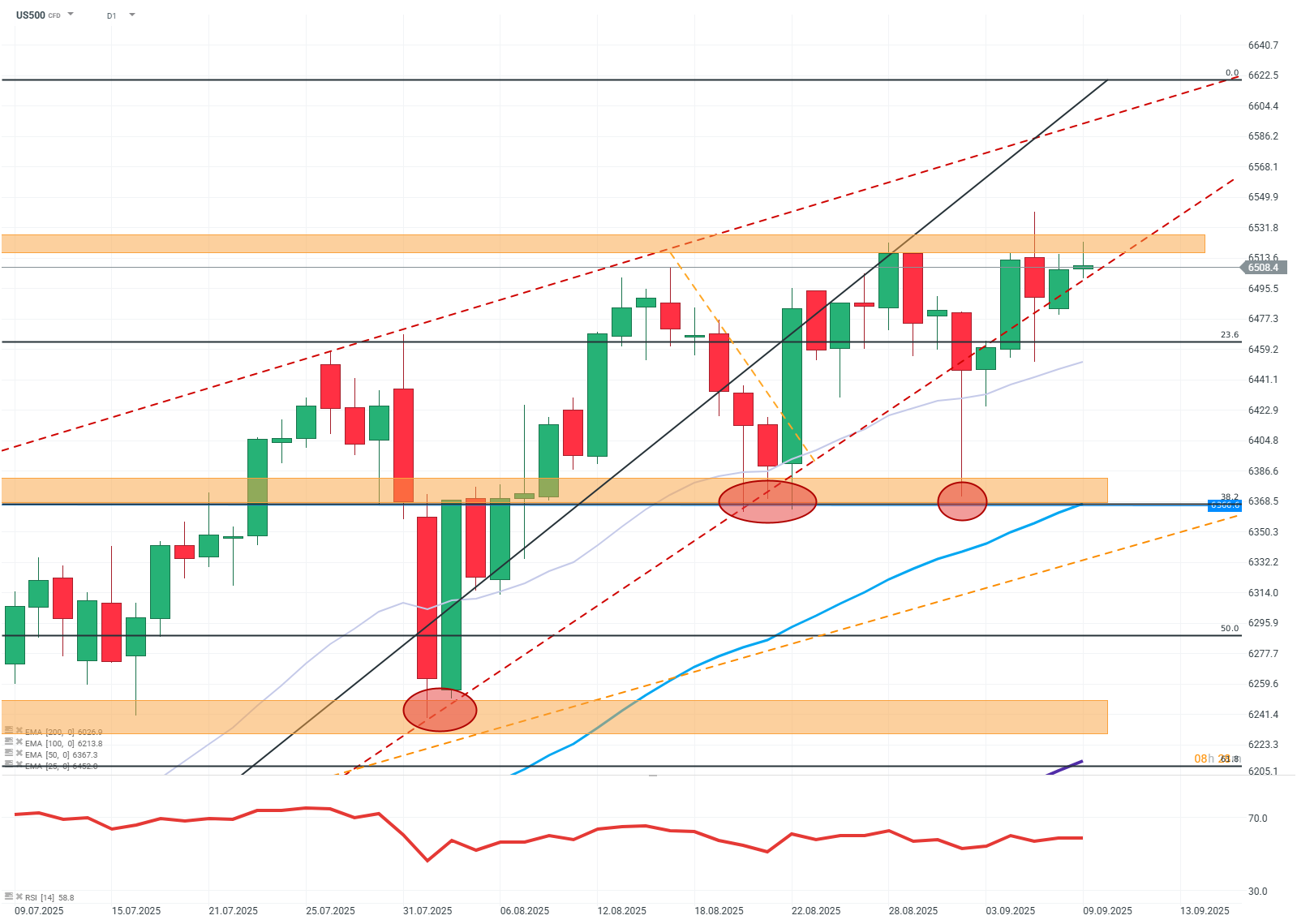

US500 (D1)

Source: Xstation

Buyers continue to demonstrate strength on the chart. The recent correction was quickly and fully recovered to resume the upward trend without major issues. The price returned above the lower boundary of the upward trend channel and is currently approaching the vicinity of the last ATH, which is currently the only obvious resistance for the price. In the event of a slowdown in growth and/or declines, it is highly likely to transition into a consolidation where the boundaries are between the last ATH and strong support around 6300 dollars.

Company News:

Robinhood (HOOD.US), Applovin (APP.US) — The company behind the Robinhood investment app and Applovin, which produces business applications, both rise by over 8%. This is due to the fact that both companies will join the S&P 500 index. This is not only a prestigious distinction but also brings tangible benefits in the form of capital allocation by investors and institutions focused on investing in the world's largest stock index.

Oracle (ORCL.US) — The cloud services giant publishes its results after today's session ends. The market is prepared for a slight decline in revenue and EPS.

Verizon (VZ.US), AT&T (T.US) — Telecommunications companies are losing significantly, averaging over 4%. This is due to the sale of Echostar SpaceX. This purchase significantly increases the competitiveness of SpaceX products, including Starlink. Everything indicates that traditional internet providers will lose another portion of market share.

Atlassian (TEAM.US) — The business software provider is up over 6% at the opening. The company announced that it will withdraw from the data center business and move its clients to the cloud.

Unitedhealth Group (UNH.US) — The leader in the health insurance market in the USA gains over 3% after receiving positive evaluations of its plans and recommendations from investment banks.