- Tesla plunges over 12% after Q2 2024 earnings

- Company's Q2 profits disappointed significantly

- Big deterioration in core automotive margin

- Revenue surge in Energy segment helps beat revenue expectations

- Analysts expect lower costs in H2 2024 will allow for margin expansion

- Company still looks very expensive compared to peers

- A look at the chart

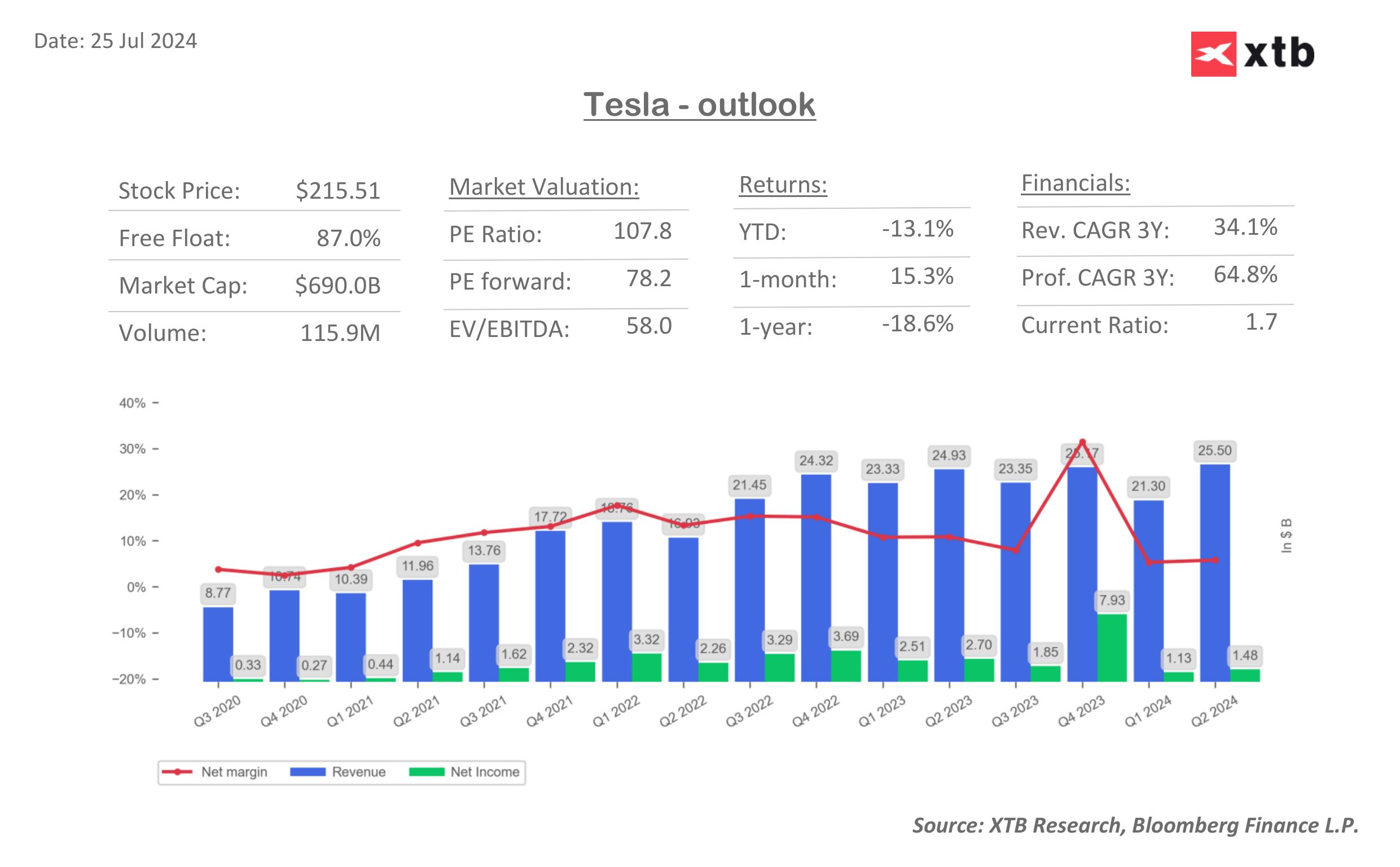

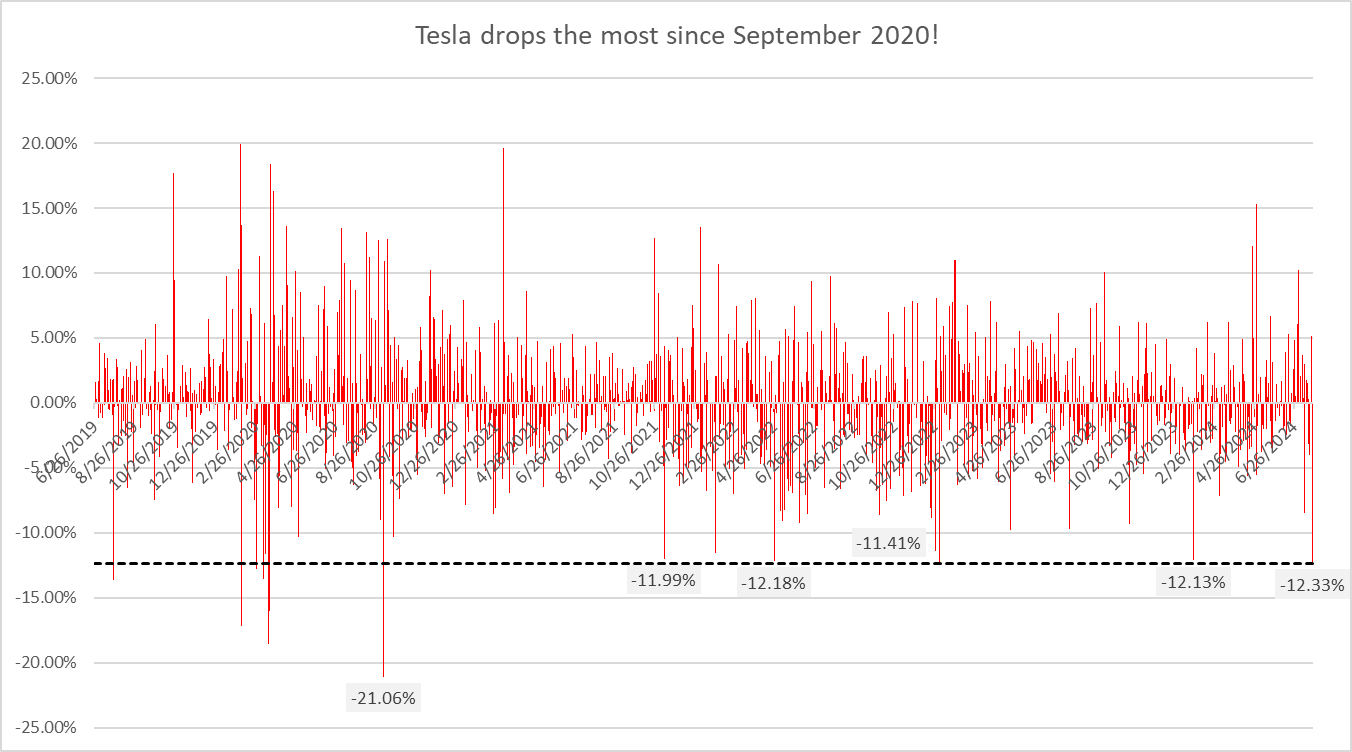

Tesla (TSLA.US) took a hit this week after reporting earnings for Q2 2024. Stock slumped over 12% on Wednesday, marking the biggest single-day drop since September 2020! The report was disappointing, but was it really that bad to justify a drop of such magnitude? Let's take a look at the release, Tesla's peer valuation and situation on the chart!

Tesla disappoints with Q2 results

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appTesla reported second quarter earnings on Tuesday after close of Wall Street session. Report has been mixed. On one hand, company reported higher-than-expected revenue, with sales climbing 2.3% YoY compared to a year ago quarter. This is certainly a positive as analysts expected Tesla to report an around-1% drop in sales. However, cost of revenue growth outpaced revenue growth and, while gross profit turned out to be higher than expected, company's gross margin deteriorated.

Things get worse the further we go into the report with operating expenses spiking nearly 40% YoY, paving the way for an over-30% plunge in operating income. Operating margin dropped over 300 basis points compared to Q2 2023! Company explained that a big increase in operating expenses this quarter was largely related to AI projects. However, while operating expenses increased nearly 40% YoY, R&D spending was just 13% YoY higher. Non-operating income was almost two times lower than a year ago.

Lower pre-tax income, combined with higher income tax expense, resulted in an over-45% YoY plunge in net income, to $1.48 billion. Analysts expected net income to drop, but not by as much. Diluted EPS dropped from $0.79 in Q2 2023 to $0.42 in Q2 2024, and was around 14% lower than $0.49 expected by analysts.

Tesla Q2 2024 results

- Revenue: $25.50 billion vs $24.63 billion expected (+2.3% YoY)

- Cost of Revenue: $20.92 billion vs $20.05 billion expected (+2.6% YoY)

- Gross Profit: $4.58 billion vs $4.20 billion expected (+1.0% YoY)

- Gross Margin: 18.0% vs 17.4% expected (18.2% a year ago)

- Operating Expenses: $2.97 billion vs $2.50 billion expected (+39.3% YoY)

- Operating Income: $1.61 billion vs $1.81 billion expected (-33.1% YoY)

- Operating Margin: 6.3% vs 7.3% expected (9.6% a year ago)

- Pre-tax Income: $1.89 billion vs $2.07 billion expected (-33.8% YoY)

- Pre-tax Margin: 7.4% vs 7.9% expected (11.8% a year ago)

- Net Income: $1.48 billion vs $1.70 billion expected (-45.3% YoY)

- Net Margin: 5.8% vs 6.9% expected (10.8% a year ago)

- Diluted EPS: $0.42 vs $0.49 expected ($0.78 a year ago)

- Cash from Operations: $3.61 billion vs $4.47 billion expected (+17.9% YoY)

- Capital Expenditures: $2.27 billion vs $2.54 billion expected (+10.2% YoY)

- Free Cash Flow: $1.34 billion vs $1.92 billion expected (+33.5% YoY)

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

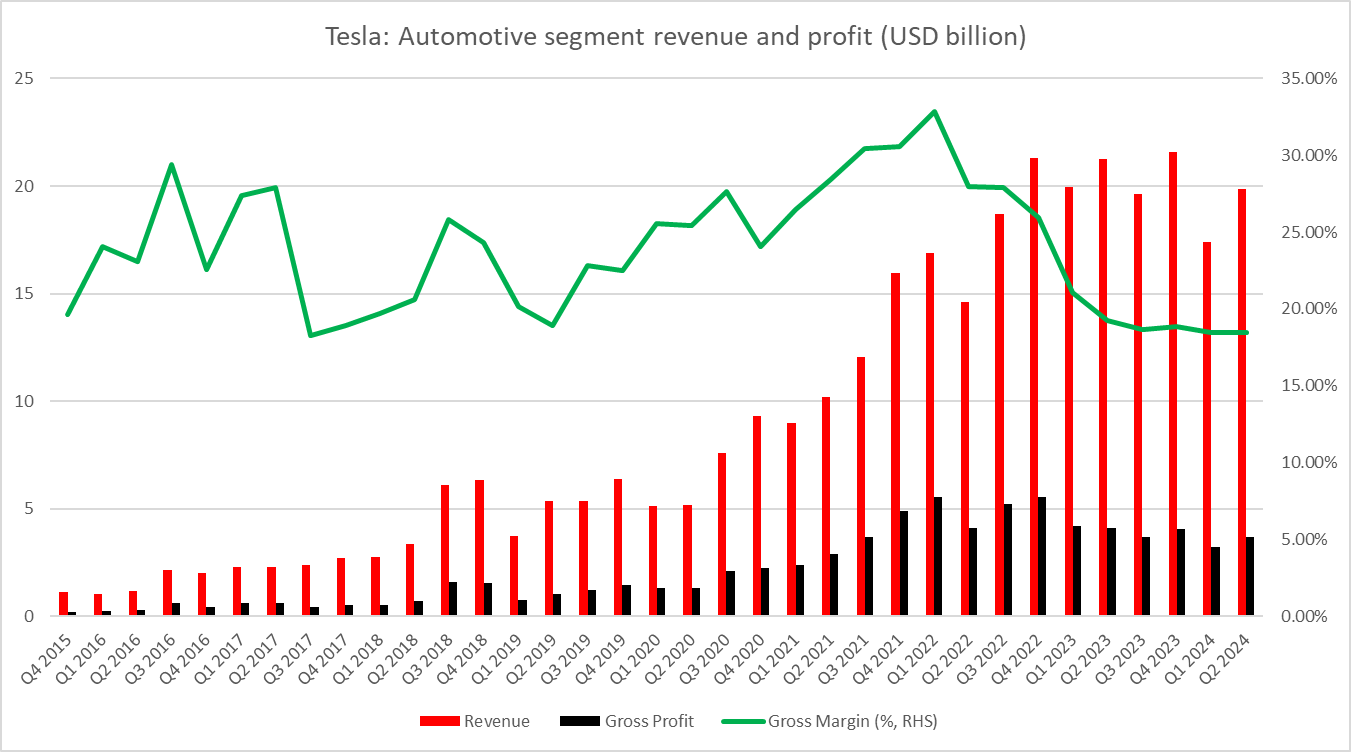

Automotive margins disappoint, but analysts stay positive

Margin deterioration is a negative highlight of Tesla's Q2 2024 earnings report. While gross margin deteriorated by 20 basis points, from 18.2% to 18.0%, company's gross margin in its key automotive segment remained more or less flat at around 18.5-19.0% for the fifth quarter in a row. However, Tesla said that it has recognized record revenue from regulatory credits during the quarter. Company's core automotive margin, excluding impact of sales of regulatory credits, actually came in at just 14.6% in Q2 2024!

However, analysts did not see it as that big of a deal. While disappointment was large, the word on the street is that material costs are expected to be lower in the second half of the year, what should allow Tesla to improve its margins in the coming quarters. Also, Tesla just like other EV manufacturers, is facing a slowdown in EV demand, so weakness in its automotive segment should not come as a big surprise.

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

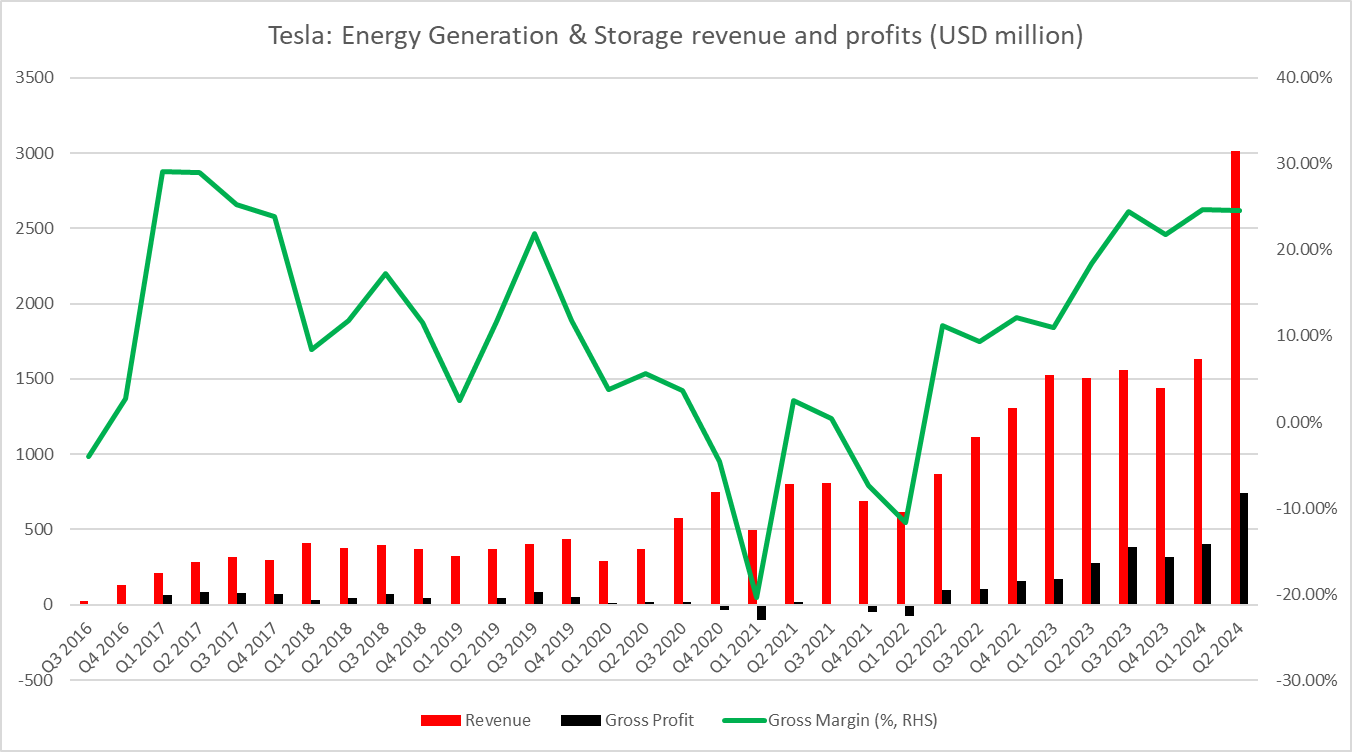

Energy segment saves the day!

Taking a look at headline results, one may wonder where the beat in revenue comes from if Tesla suffered a noticeable deterioration in its automotive business. The answer is Energy Generation & Storage segment. This is the segment that includes Tesla's solar energy generation and battery storage systems. This segment's revenue growth reached almost 100% YoY in Q2 2024 as the company made record 9.4 GWh of deployments during the quarter. A spike in revenue was also accompanied by a spike in segment's gross profit, with segment's gross margin staying virtually unchanged from Q1 2024. However, compared to a year ago quarter (Q2 2023), Energy Generation & Storage segment gross margin improved by around 600 basis points!

While this certainly looks promising, a word of caution is needed. Energy Generation & Storage segment is relatively small compared to Tesla's main business segment. It has accounted for just around 18.2% of total revenue in Q2 2024. However, should the company managed to grow this segment as quickly in the future as it does now, it may turn out to be a solid source of diversification of business risk for Tesla.

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

Tesla plunges the most since September 2020!

Release of the report trigger a big plunge in Tesla's share price. Company's stock slumped around 8% in the after-hours trading on Tuesday and continued to drop during Wednesday's cash session on Wall Street. Shares finished Wednesday's trading 12.3% lower! While Tesla has experienced a few drop of similar magnitude in 2022, 2023 and at the beginning of 2024, in order to find a bigger single-day drop we would have to go back as far as to 2020, when shares closed over 21% lower on September 8, 2020.

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

What comes next?

As we have already mentioned, analysts expect material costs to drop in the second half of the year, what should allow for improvement in Tesla's margins. Tesla itself expects a sequential increase in production in Q3 2024, although full-2024 volume growth rate is still expected to be notably lower than in 2023. However, the expected lower volume is to some extent driven by rollout of new products, including more affordable vehicles. Company said it remains focused on wide cost reduction and still plans to begin production of new vehicles in the first half of 2025. Cybertruck production is expected to turn profitable by the end of this year.

Overall, Q2 2024 earnings report was a disappointment, but the general feeling is that business improvement and recovery is in sight. The whole EV sector is undergoing a kind of recession right now as demand for those type of vehicles faltered. However, rollout of new vehicles, especially more affordable models, may help turn the tide for the company and allow it to better compete with Chinese rivals, whose products come with much lower price tag than current Tesla's products.

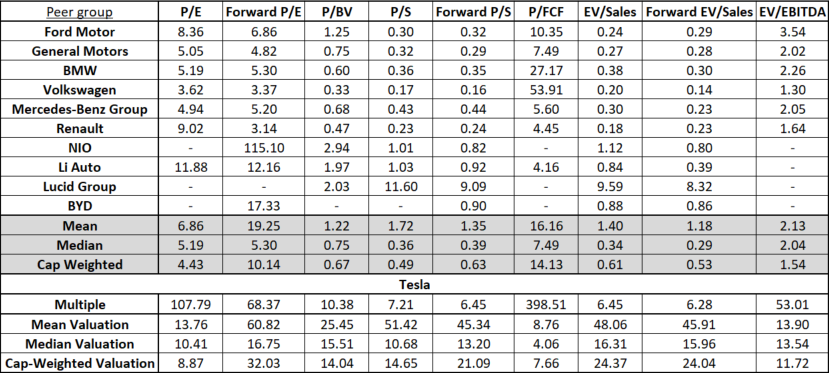

Tesla still looks expansive compared to peers

Even as Tesla's business is expected to improve going forward, investing in the stock carries a big risk. The main one being its very high valuation. Multiples for Tesla and its peers, as well as valuations based on those multiples, can be found in the table below. As one can see, even after yesterday's sell-off Tesla is trading at much higher stock multiples than traditional carmakers (Ford, GM, BMW, Volkswagen, Mercedes, Renault) or EV manufacturers (NIO, Li Auto, Lucid Group, BYD). Difference between Tesla multiples and means, medians and cap-weighted multiples for peer group is massive. Note that using even the highest valuation based on mean Forward P/E multiple ($60.82 per share), suggests an over-70% downside from current market prices!

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

A look at the chart

Taking a look at Tesla chart (TSLA.US) at D1 interval, we can see that the company launched yesterday's post-earnings session with a big bearish price gap and continued to move lower during the session. Stock finished yesterday's trading over 12% lower and closed near the earlier-broken downward trendline, that has been limiting upward move on the stock since November 2021. It looks like the recent jump above the trendline may have been just a false breakout, and the main trend remains bearish. Should the stock continue to move lower, the first near-term support to watch can be found in the $210 area, marked with previous price reactions and the 200-session moving average (purple line). The next supports levels in-line can be found in the $185 and $165 areas.

Source: xStation5

Source: xStation5