- Inflation CPI for July: 2.7% YoY (forecast: 2.8% YoY; previously: 2.7% YoY)

- Monthly inflation CPI: 0.2% MoM (forecast: 0.2% MoM; previously: 0.3% MoM)

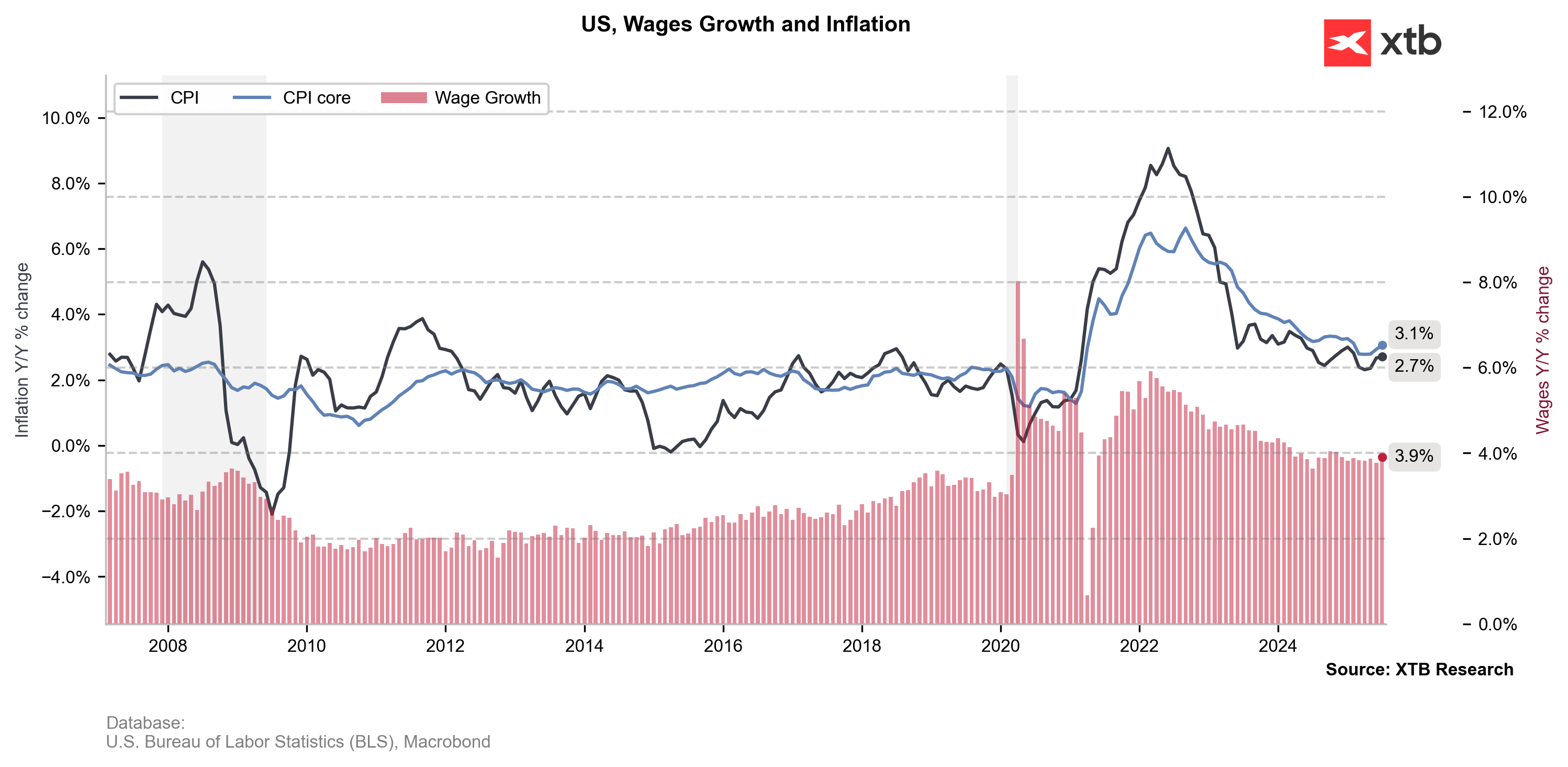

- Core Inflation CPI: 3.1% YoY (forecast: 3.0% YoY; previously: 2.9% YoY)

- Core monthly inflation: 0.3% MoM (forecast: 0.3% MoM; previously: 0.2% MoM)

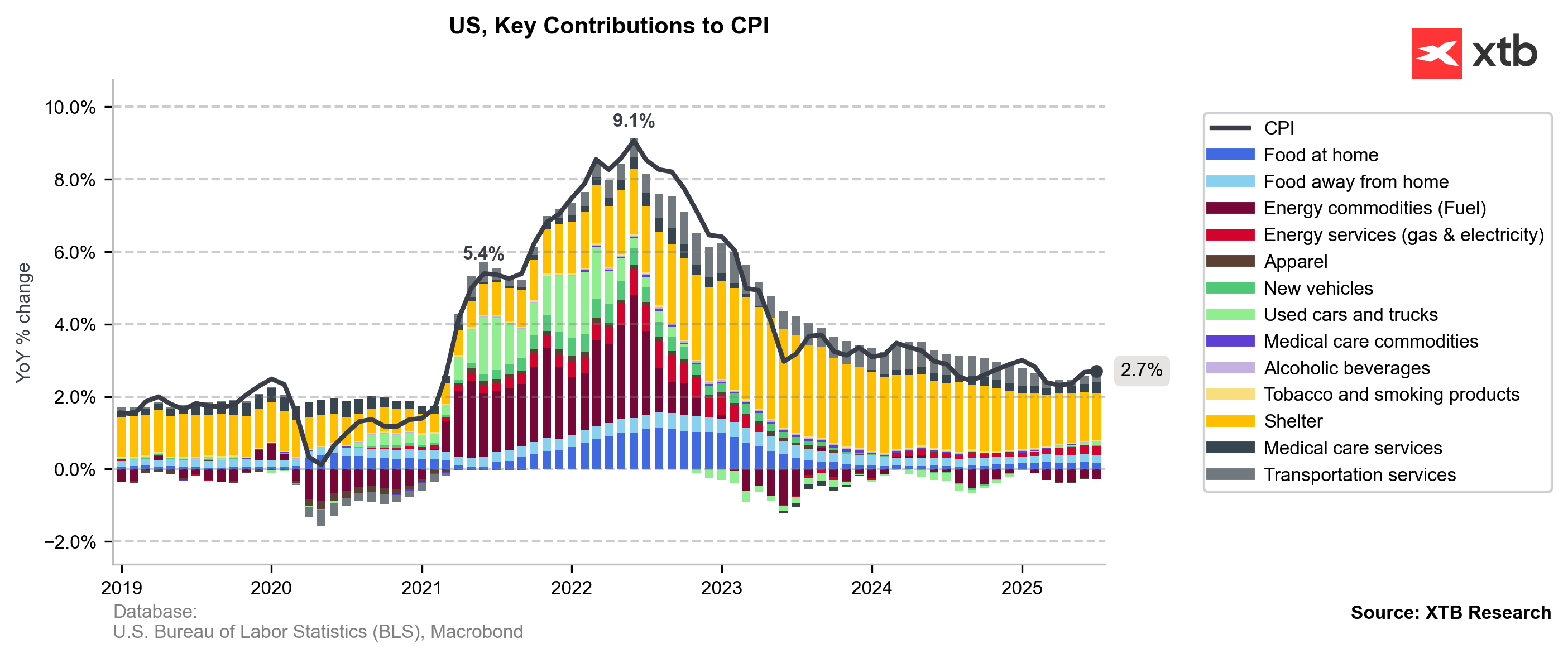

Headline inflation held steady at 2.7%, while core inflation surprisingly rose to 3.1%. On a monthly basis, prices also increased by 0.3%, marking the highest gain since February. Looking at contributions, shelter inflation had the largest contribution in July once again, but was a little bit lower than in previous months. Notably, the contribution from used cars saw a clear increase, though it remains minimal compared to other key inflation components. The annual inflation rate was primarily held back by fuel prices.

Despite the higher-than-expected core inflation reading, which is considered a crucial factor in the Federal Reserve's decisions, the EURUSD pair and major stock indices reacted with an initial increase. This market reaction appears to be driven by expectations that traders had priced in an even larger surge in inflation due to recent tariffs.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app