Braze (BRZE.US) surged as much as 19% pre-market after a strong Q2 fiscal beat and better-than-expected Q3 guidance. However, during the session gains narrowed to 12%. Management highlighted support from AI-driven personalization and the first-party data trend. The company also surprised positively in contract renewals and improved conversion of large deals.

Financial summary (key metrics)

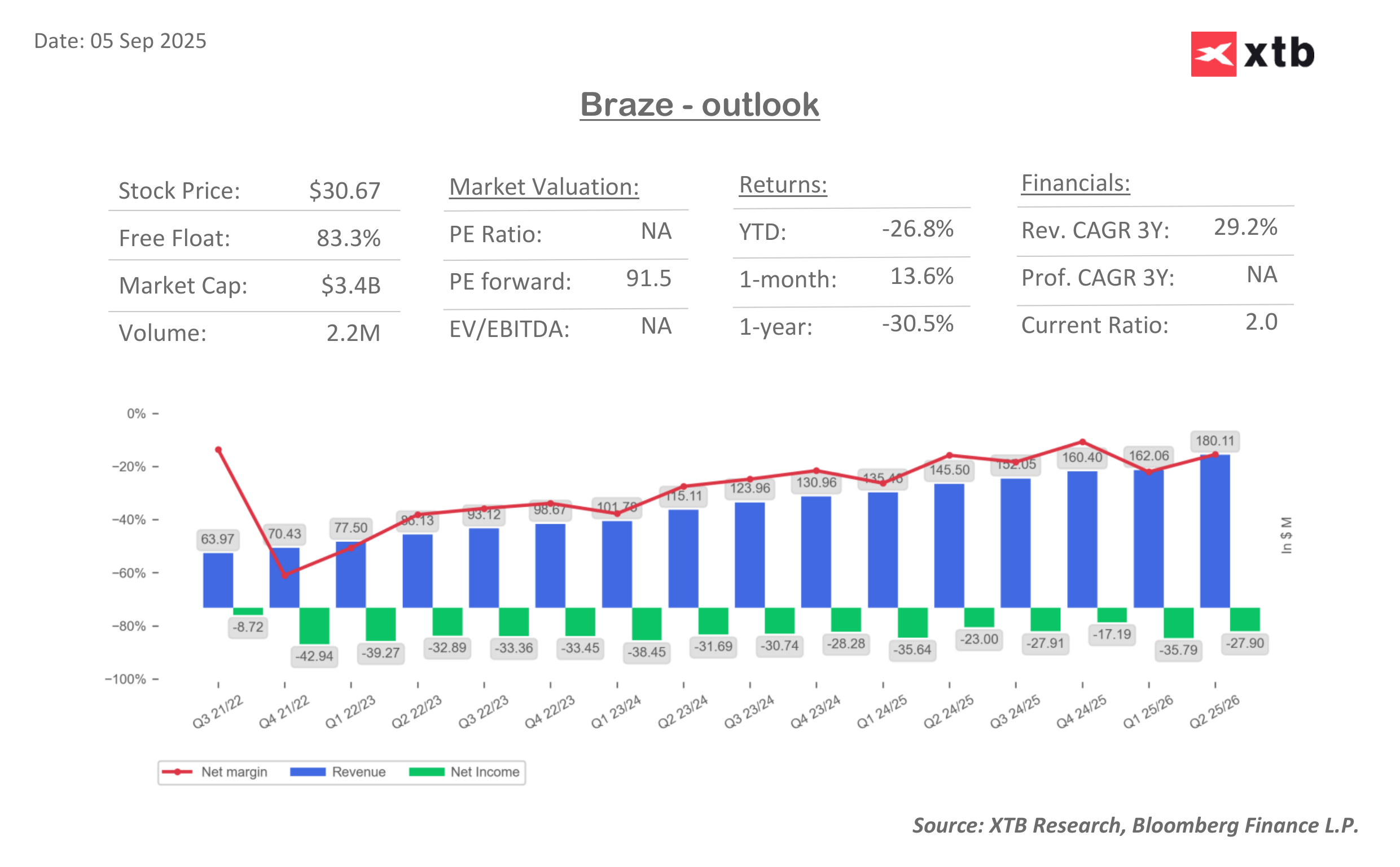

- Q2 revenue: $180.1m vs $171.7m est. (+$8.4m beat)

- Q2 adjusted EPS: $0.15 vs $0.03 est. (+$0.12 beat)

- Q2 net loss: $27.9m

- Adjusted gross margin: 69.3% (vs 69.7% est.)

- Q3 revenue guidance: $183.5–184.5m (vs $180.3m cons.; ~+$3.2–4.2m higher)

- Q3 adjusted EPS guidance: $0.06–0.07 (vs $0.02 cons.)

- FY26 revenue guidance: $717–720m (raised from $702–706m; vs $704.4m cons.)

- FY26 adjusted EPS guidance: $0.41–0.42 (raised from $0.15–0.18; vs $0.17 cons.)

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appA key watchpoint is profitability — gross margin declined y/y and came in slightly below consensus — though operational execution seemed to offset this, with net revenue retention (NRR) declines described as easing through the quarter. Overall, the release suggests Braze is navigating a mixed macro backdrop while sustaining subscription growth in the mid-teens range. Importantly, the company raised guidance for both Q3 and FY26, signaling durable client demand for AI and first-party data–driven personalization.