Apple shares (AAPL.US) are up 4% today, making them the strongest-performing component of the major U.S. indices. Recently, several research firms have upgraded their ratings on the company, citing strong product-related catalysts — including the launch of the iPhone Air, the upcoming iPhone 20 next year, and new AI-powered products. The most recent upgrade came from Melius Research, which sees upside potential to $260 per share for the Cupertino-based giant.

- Despite the rally, Apple shares still trade 15% below their previous highs near $260. The latest quarterly results showed a 10% year-over-year increase in sales — the strongest growth since December 2021.

- Sales in China rose 4% YoY, surprising the market and beginning to contribute not only to overall growth but also to a shift in investor sentiment toward Apple’s business prospects in the region.

- Apple is set to unveil new AI features in its products, while iPhone sales grew 13% YoY in the latest quarter. Meanwhile, Mac sales came in 10% above market expectations, reaching $8 billion for the quarter.

- The company is also likely to avoid Trump-era tariffs, thanks to its pledge to invest $600 billion in U.S.-based manufacturing over the next four years.

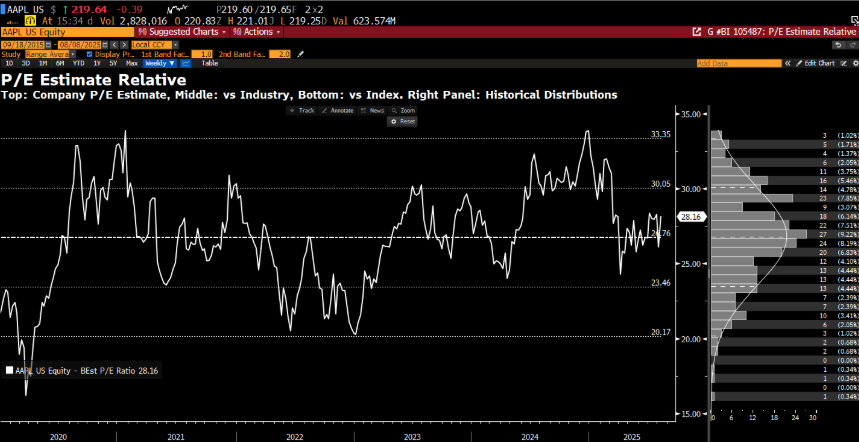

Both net income and revenue came in over 5% above Wall Street estimates, and it appears a significant portion of customers may still be waiting to purchase Apple products to test out the upcoming AI functionalities. On the one hand, this presents a notable opportunity to improve margins and monetize high-margin services. On the other hand, if the new features disappoint, Apple could struggle to maintain its status as a growth stock — especially with a price-to-earnings ratio hovering around 30.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appFrom a historical perspective, Apple’s valuation is currently around its long-term average, while the company still faces multiple growth catalysts: improved sales in China, robust demand for the iPhone, a packed product pipeline, and AI innovations.

Source: Bloomberg Finance L.P.

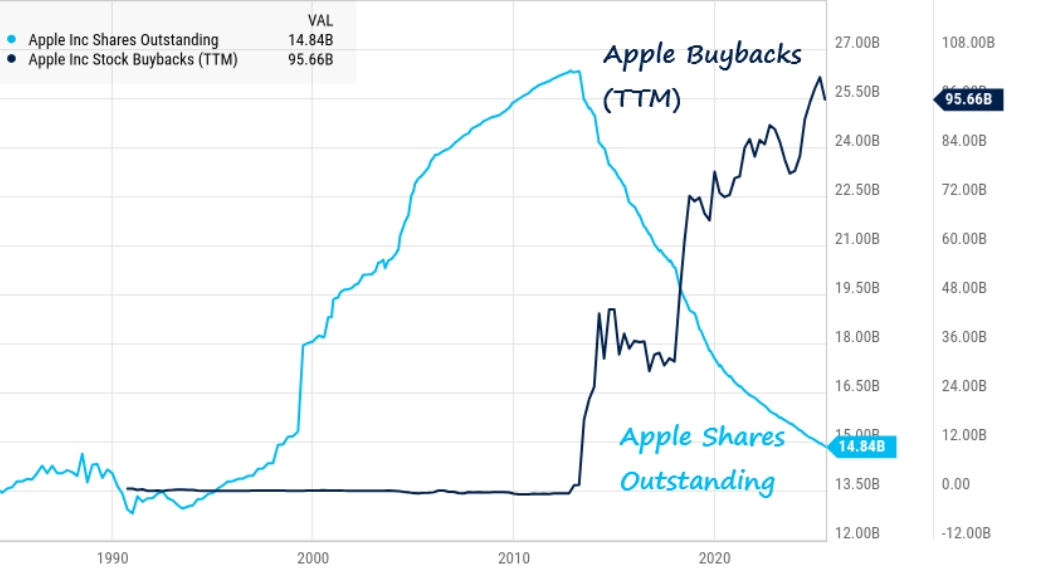

Apple continues its consistent share buyback strategy, gradually reducing the number of shares in circulation.

Source: Charlie Bilello, X

Today’s rally in Apple shares is helping drive the US100 index to 24,700 points.

Source: xStation5