- Wall Street returns to gains following the bill that sparks hope for the end of government shutdown.

- Tech stocks lead rally, recovering almost all of recent losses.

- Potential changes to Obamacare weigh on health insurers.

- Wall Street returns to gains following the bill that sparks hope for the end of government shutdown.

- Tech stocks lead rally, recovering almost all of recent losses.

- Potential changes to Obamacare weigh on health insurers.

Wall Street rebounded sharply on Monday after the U.S. Senate passed a bipartisan deal to end the record 40-day government shutdown — the first major step toward reopening federal agencies. Futures on U.S. indices have regained nearly all of the past two sessions’ losses, with improving sentiment also reflected across crypto and bond markets (US100: +1.5%, US2000: +1.4%, US500: +0.9%, US30: +0.4%).

The U.S. government shutdown, now 41 days long, has left 1.4 million federal workers unpaid and disrupted key services, including air travel and food aid for 41 million Americans. A bipartisan Senate deal provides temporary funding through January 30, full-year appropriations for some agencies and back pay for federal employees.

However, several Democrats, including Senators Schumer and Warren, have already opposed it, citing lack of action on expiring healthcare subsidies, which are now scheduled for a December vote. The package also reimburses states for SNAP and WIC costs during the shutdown, but still faces hurdles in the House before reaching President Trump’s desk.

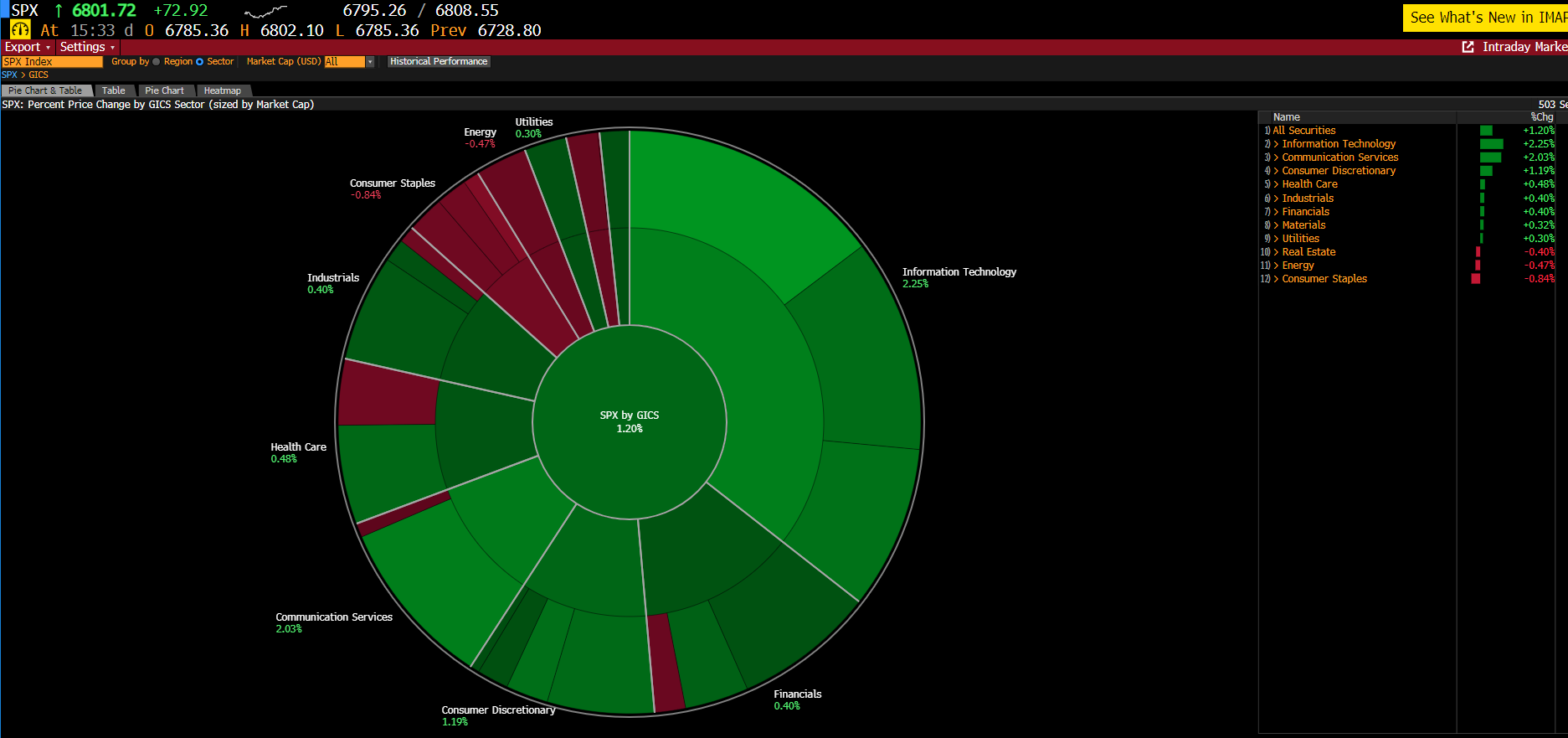

Tech stocks are championing today’s rally, with Mag7 driving significant gains in main U.S. indices. Nvidia is the biggest gainer in the group (NVDA.US: +3.6%), followed by Alphabet (GOOGL.US: +3.3%), Tesla (TSLA.US: +2.7%) and Amazon (AMZN.US: +2%). Significant gains are also seen in the other semiconductor stocks (AMD.US: +5.4%, MU.US: +7.1%, INTC.US: +2.5%).

The optimism is market-broad today, with defensive sectors (Consumer staples, Energy, Health services) giving up some in favour of more risk/growth-oriented stocks. Source: Bloomberg Finance LP.

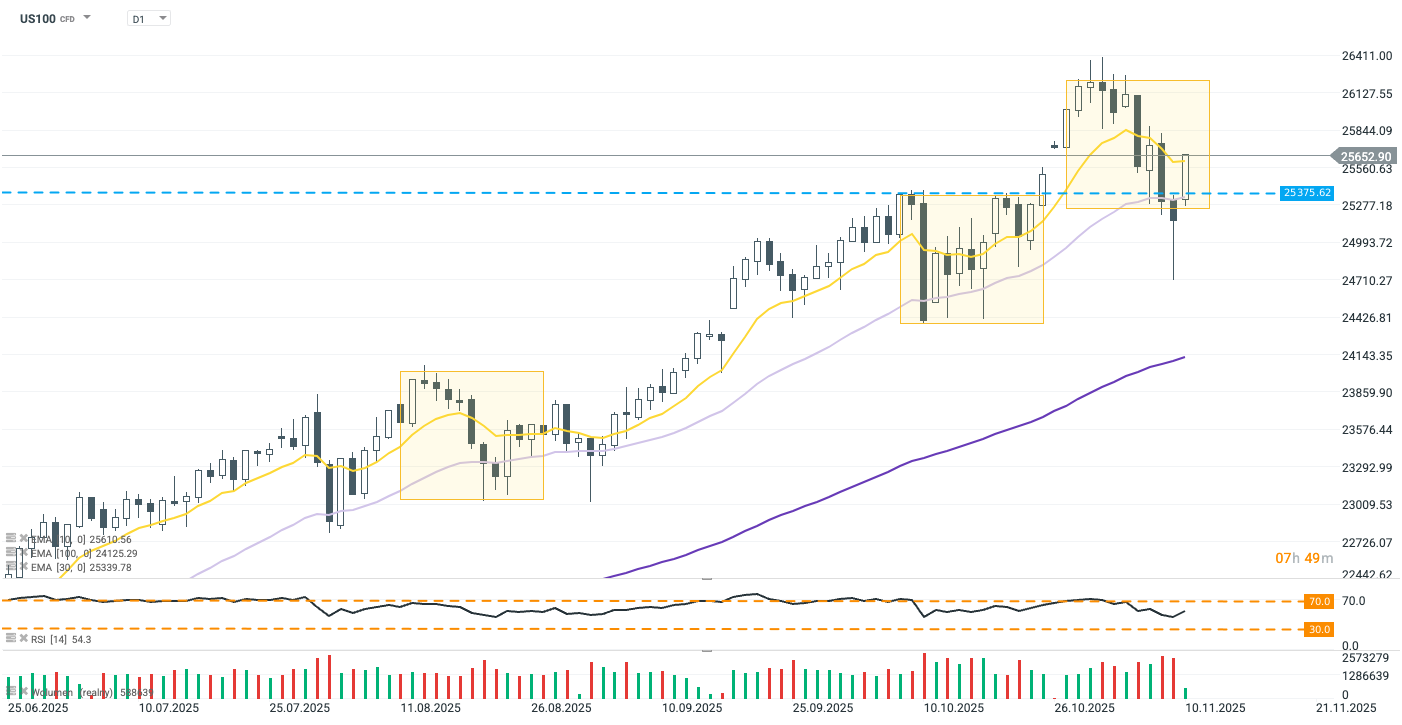

US100 (D1)

Nasdaq 100 futures rebounded strongly today, hovering just 0.3% below recouping losses from the past two sessions. The index has returned above recent resistance near 25,375 points and is attempting to leverage bullish momentum to break above its 10-day exponential moving average. With the price approaching the center of its typical trading range and a neutral RSI around 55, investors have room to adjust amid the latest government shutdown news and ongoing earnings season, with Nvidia in focus this week. Source: xStation5

Source: xStation5

Company news:

-

Health insurer stocks fell Monday after former President Donald Trump called for redirecting Obamacare subsidies directly to consumers. Shares of Centene slid 8.4%, Elevance Health 1.6%, and UnitedHealth 0.3%. The subsidies, set to expire year-end, were introduced during the pandemic to help low-income Americans but are now central to a 40-day federal shutdown over healthcare funding.

-

Monday.com shares plunged 16% despite record third-quarter results and a sharp narrowing of losses. Revenue rose 26% to $317 million, beating guidance, while adjusted operating profit hit a record $47.5 million. The company maintained its full-year forecast, but investor concerns over AI’s impact on workplace software continue to weigh on sentiment. The pessimism is driven by a narrowed full-year revenue forecast.

-

Nvidia (NVDA.US) CEO Jensen Huang requested more chip supplies from TSMC during a visit to Taiwan, raising robust AI demand. He credited TSMC’s support as vital to Nvidia’s success, noting all major AI memory suppliers have expanded capacity. Despite recent pressure on megacap tech stocks amid AI skepticism, Nvidia remains the world’s most valuable company. TSMC’s CEO C.C. Wei expects record sales to continue as demand outpaces supply.

-

Pfizer (PFE.US: +1%) clinched a $10 billion deal to acquire obesity drug developer Metsera, defeating Novo Nordisk in a heated bidding war. Metsera accepted Pfizer’s offer citing antitrust risks in Novo’s bid (NOVOB.DK: +2.2%). The deal gives Pfizer a long-sought foothold in the booming weight-loss drug market, though Metsera’s treatments are still years from launch. Novo said it will focus on advancing its own obesity pipeline.

-

Rumble (RMBL.US) shares jumped 9% after the video platform narrowed its third-quarter net loss to $16.3 million from $31.5 million a year earlier and boosted average revenue per user by 7% to $0.45. Revenue slipped slightly to $24.8 million, while monthly active users fell to 47 million. Investors welcomed signs of improved monetization and cost control despite user decline.

Beginning of the end of the shutdown leads to bounce in stocks, led by tech

Crypto news: Cryptocurrencies gain amid improving sentiment on Wall Street 📈

US100 gains 1.5% 📈

Countdown to Black Friday 2025: Which Stocks Could Benefit?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.