Black Friday marks more than just one day of promotions — it’s the symbolic beginning of the most lucrative period for global retailers, and especially for e-commerce platforms. While not every brand will see the same sales surge (everything depends on product mix and consumer tastes), one thing is certain — online spending continues to grow, and the e-commerce business keeps thriving, no matter how consumer behavior shifts. That’s why this time of year often gives stocks of companies like Amazon, Shopify, Zalando, or Allegro a noticeable boost of momentum.

When is Black Friday 2025 and what does it mean for investors?

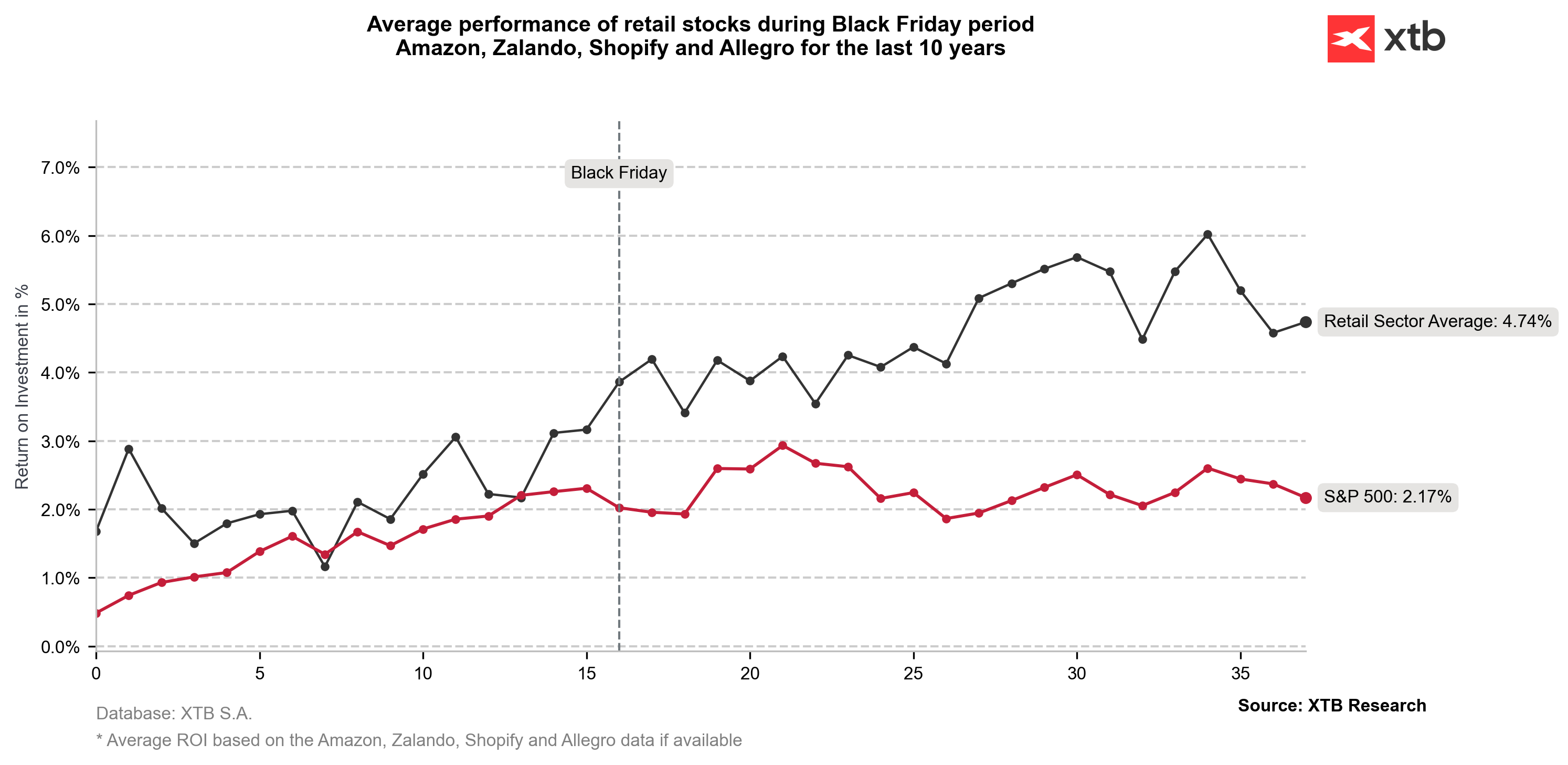

In 2025, Black Friday falls on November 29, and it’s the final week of the month that will see the most intense shopping activity before the holiday rush. Historically, retail and e-commerce stocks have outperformed the S&P 500 both in the weeks leading up to and after Black Friday — a trend that traders watch closely every year.

During the 2024 shopping season, global online sales climbed by about 5% year-over-year, reaching over $74 billion, while in the U.S. alone they surged more than 10% to $10.8 billion. According to Kepler Analytics, the Black Friday week of 2023 saw average retail sales 93% higher than a typical week — a remarkable spike in consumer engagement.

What does it mean for Wall Street and e-commerce stocks?

For investors, Black Friday is more than a sales bonanza — it’s a real-time pulse check of consumer confidence. Strong spending data can lift expectations for Q4 earnings across the retail and tech sectors, especially for companies with a large share of online sales.

Last year, Mastercard SpendingPulse reported that overall retail sales rose 3.5% year-over-year, but e-commerce sales skyrocketed 14.6%. That divergence clearly shows where the growth momentum is moving — into digital commerce.

What to expect in 2025?

Analysts at Bain & Company expect that the Black Friday–Cyber Monday weekend in the U.S. will account for around 9% of total holiday retail spending, with sales projected to rise ~11% year-over-year — signaling a strong shopping season ahead. Online sales during Black Friday 2025 in the U.S. could reach roughly $12 billion. Globally, total e-commerce spending in the last week of November could climb by about 8% year-over-year (adjusted for inflation), translating to around $80 billion, up from $74.4 billion in 2024.

Who stands to benefit most?

Over the past decade, selected e-commerce stocks have consistently outperformed the S&P 500 both before and after Black Friday. If history rhymes, platform giants like Amazon, Shopify, Allegro, and Zalando could once again be among the big winners of the season — fueled by global consumer appetite and the unstoppable growth of digital retail.

Source: XTB Research

Seasonality & Retail Stocks

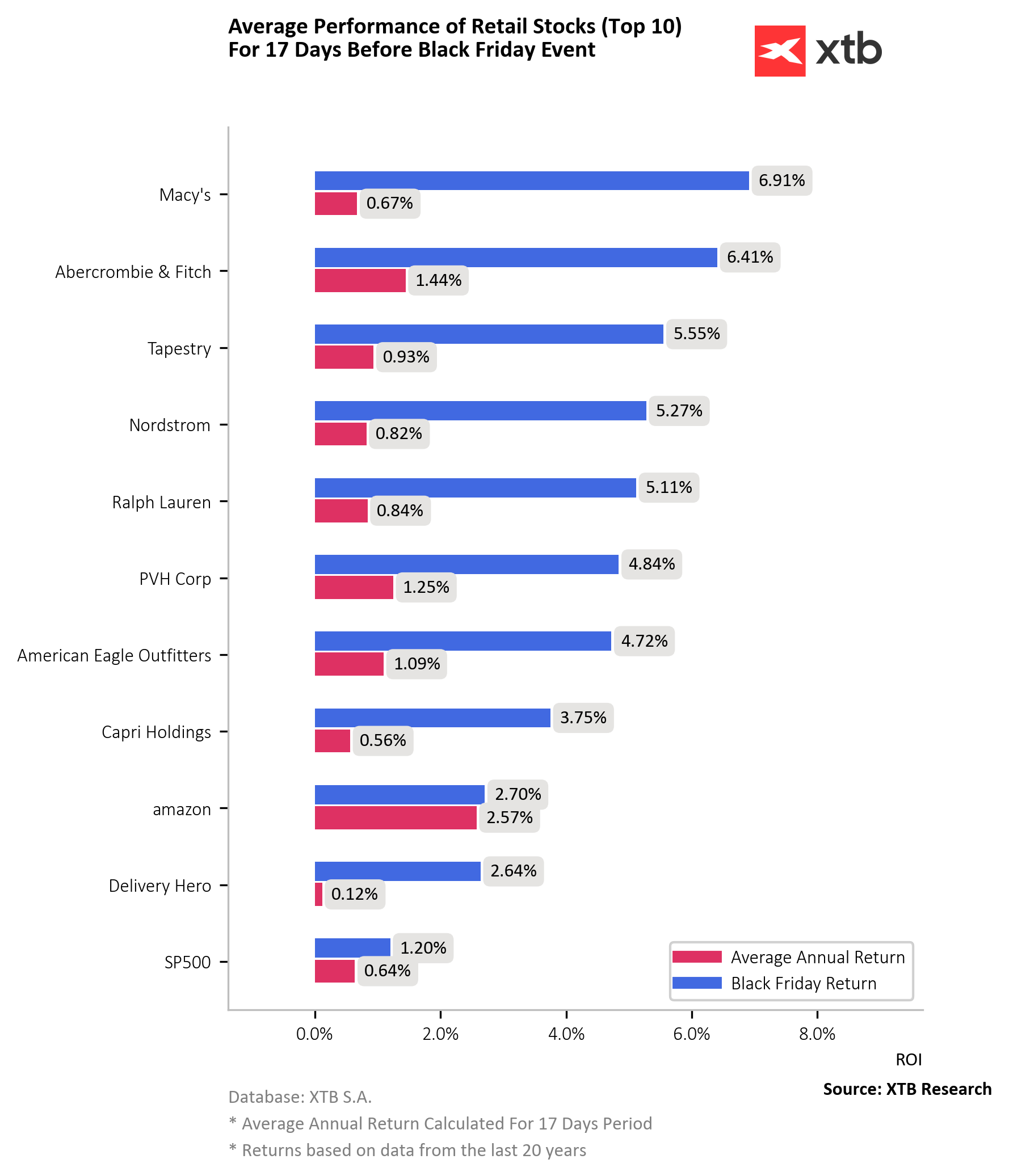

For the past 20 years, retail stocks have consistently outperformed the main equities benchmark—especially in the 17 days leading up to Black Friday. The business models of retailers such as Macy’s or Tapestry Inc. mean they tend to benefit more from a strong Q4 retail season than the one‐day event itself. But Black Friday still marks a key seasonal boundary.

Data covers 2004-2024. Source: XTB Research.

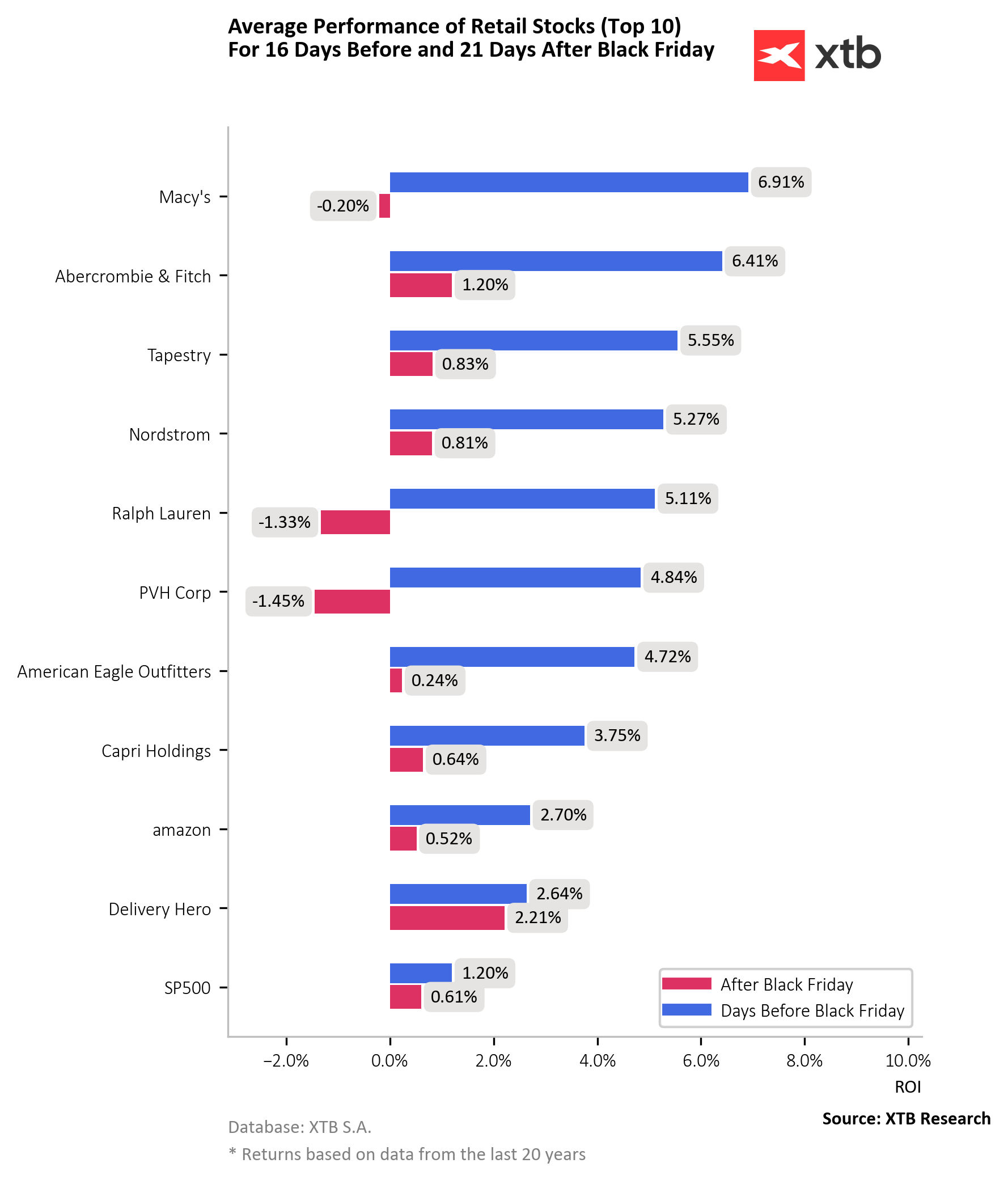

Data covers 2004-2024. Source: XTB Research.

Post‐Black Friday Performance

Even three weeks after Black Friday, retail stocks typically continue to outperform the market—but the gap begins to narrow. That suggests that as of 7 November 2025, we’re standing at the threshold of the best seasonal window for retail and e-commerce shares. Sure, part of this is due to the so-called “Santa Rally”, but the reason retail stocks are leading is obvious: they power the gift buying spree.

Data covers 2004-2024. Source: XTB Research.

E-commerce Platforms as Key Winners

What are the stocks that are likely to benefit the most this year? Our focus is on e-commerce platforms, because they feel the volume surge more directly, even when consumer trends shift.

- USA: Amazon.com Inc. & Shopify Inc. — massive scale, global reach.

- Europe / CEE: Zalando & Allegro — less appreciated by investors, but still with seasonality growth potential in 2025.

While Amazon and Shopify are already seen as solid, the European pair, with much lower valuation, may well be the dark horses this season. Beyond pure e-commerce platforms, companies like Nike, Inc. also stand to gain. Nike’s D2C (digital direct-to-consumer) channel has its peak season in Black Friday: strong e-commerce growth, brand power, and omnichannel rollout make it a compelling story. Similarly, keep an eye on names like Levi Strauss & Co. or L’Oreal S.A. for attractive upside.

Stock Charts

Amazon (AMZN.US, D1)

Amazon closed a stellar third quarter, once again proving that scale doesn’t kill growth. Despite being one of the largest companies on the planet, revenue surged at a double-digit pace, while profitability blew past Wall Street expectations. The company also issued an upbeat outlook for Q4, hinting that the holiday season could be another blockbuster.

From a technical standpoint, Amazon’s share price has pulled back from all-time highs and is now testing the post-earnings breakout zone near $242, which also aligns with the January 2025 peak.

This area could act as a strong demand zone before the next leg higher. The next key resistance lies around $255, where profit-taking might emerge — but the broader setup remains bullish.

Source: xStation5

Shopify (SHOP.US, D1)

Shopify’s shares have had a softer patch recently, retreating about 10 % from their record highs, yet they continue to respect the broader ascending channel. The company remains at the center of the global e-commerce ecosystem — powering millions of online stores — and seasonality could reignite buying interest just as price action approaches the lower trendline support.

A rebound from this zone would fit the historical pattern: November and December have repeatedly proven to be Shopify’s strongest performance window, driven by soaring merchant volumes during Black Friday and Cyber Monday.

Source: xStation5

Allegro (ALE.PL, D1)

Allegro remains the e-commerce powerhouse of Central and Eastern Europe, with operations spanning Poland and neighboring markets that have posted robust GDP and private consumption growth in recent years.

Falling interest rates from the National Bank of Poland and a steady upward trend in real wages may create a perfect environment for renewed consumer activity — and for Allegro’s dominant platform to benefit.

Technically, the stock is defending a major support zone around PLN 34, defined by the 200-day EMA (red line). A successful rebound here could confirm the return of bullish momentum in CEE retail tech leaders.

Source: xStation5

Zalando (ZAL.DE, D1)

Once a darling of Europe’s growth story, Zalando has struggled since 2021, unable to reverse its prolonged downtrend. Still, the company retains one of the strongest brand positions in European online fashion, serving millions of active customers and housing a powerful logistics network.

Black Friday could act as a catalyst for a trend reversal: any sign of improving order volumes or margin recovery might spark a short-term relief rally after multiple quarters of decline.

Investors often rediscover Zalando during seasonal peaks — and this year may be no exception.

Source: xStation5

Nike (NKE.US, D1)

Nike slipped back below its 200-day exponential moving average, resuming a period of sharp declines, yet the brand’s story remains far from over. The company enters the Black Friday window with the potential to surprise on both sentiment and fundamentals.

Historically, Black Friday marks Nike’s record period for direct-to-consumer (D2C) sales, powered by Nike.com and the SNKRS app. This omnichannel model — combining online reach, brand strength, and product exclusivity — continues to enhance margins by cutting out intermediaries.

Adding to the intrigue, the U.S. Supreme Court decision expected by January 2026 on tariff policy changes announced by Donald Trump could favor companies heavily exposed to import duties, potentially boosting Nike’s profitability outlook. With strong brand equity and seasonal tailwinds, the stock may soon find its footing again.

Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

Brent tops $90 per barrel

RyanAir shares under pressure amid Middle East conflict 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.