- Record Alphabet CAPEX, are they no longer enough?

- Gloomy picture of labor market

- Qualcomm recovers from initial decline amid bad forecasts

- Broadcom benefits from CAPEX race

- Record Alphabet CAPEX, are they no longer enough?

- Gloomy picture of labor market

- Qualcomm recovers from initial decline amid bad forecasts

- Broadcom benefits from CAPEX race

US indices remain under selling pressure in Thursday’s session. Since the start of the week, the main Wall Street indices have already fallen by more than 6%. The key drivers are disappointments regarding earnings from some technology giants, as well as doubts about the justification and pace of the next interest-rate cut cycle in light of incoming data.

At the US session open:

- S&P 500 futures are down approx. 1.5%.

- Nasdaq 100 futures are down approx. 1.2%.

- Russell 2000 futures are down approx. 0.7%.

- Dow futures are down 0.4%.

Macroeconomic data:

- Challenger published its layoffs report. The reading rose in January from 35k to 108k.

- Initial jobless claims data in the US were also released. The initial claims figure came in above market consensus. Investors expected an increase to 213k, but the reading showed 231k.

- Continuing claims came in below expectations. They also increased, but only to 1.844 million versus 1.850 million expected.

- JOLTS has also shown greater than expected cooling: 6,5 milion vs expected 7,2 milion jobs were added. This registers decline from 6,9 milion month prior.

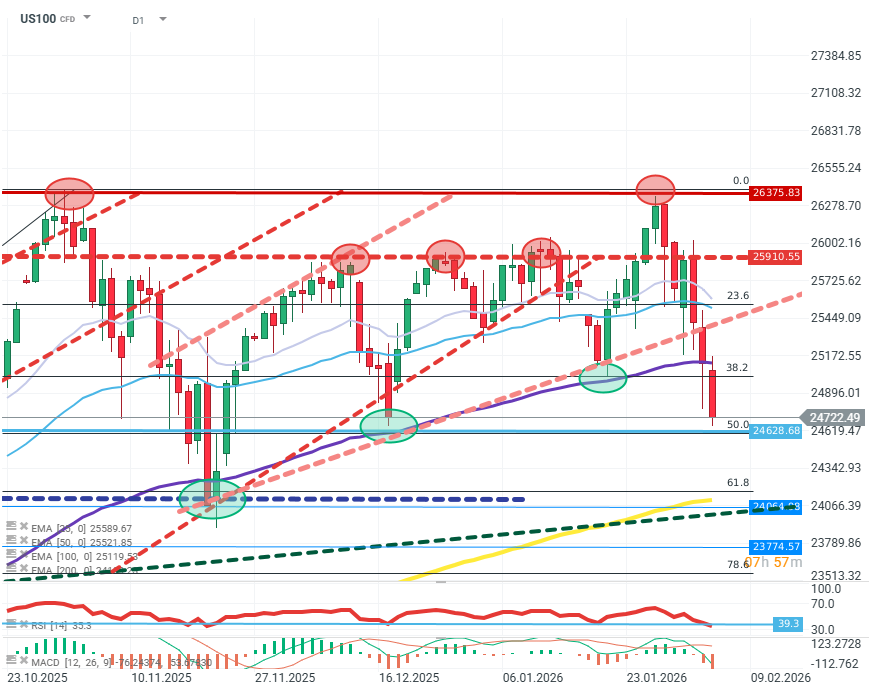

US100 (D1)

Source: xStation5

The index price clearly and sharply broke the uptrend line that had been in place since November 2025. Sellers decisively took control, moving below the 38.2% Fibonacci support level and the 100-period EMA as well. The first strong resistance zone encountered is the 50% Fibonacci level. If buyers want to halt potential declines, a quick return above the 38.2% Fibonacci level will be necessary. If that fails, a further drop toward the 61.8% Fibonacci level is likely.

Company news:

- Alphabet (GOOGL.US): Shares are falling after the announcement of massive capital expenditures—up to USD 185bn in 2026. The stock is down nearly 4%.

- ARM Holdings (): The company initially declines after earnings on the back of weak sales guidance, especially in the smartphone market, but later recovers losses. The price is up around 2%.

- Hershey Company (): The food conglomerate posted results above expectations. The company points to rising prices, new product lines, and resilient consumers.

- Qualcomm (): During its earnings call, the company delivered exceptionally disappointing sales guidance. Management notes that memory prices have entered a demand-destruction phase, weighing on the broader electronics device market. Shares are down nearly 10%.

- Broadcom (): The semiconductor manufacturer gains as much as 4% on the back of new, record-high capex plans from technology giants.

- Carrier Global (): The HVAC solutions maker posted weak sales results; the stock is down more than 6%.

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

Palo Alto earnings: Is security cheap now?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.