- Markets set to surge on government shutdown hopes

- US government funding can kicked down the road to January

- Will November seasonality be in play in 2025?

- Big tech in focus

- US earnings reports are strongest in 4 years

- President Trump giveaway could spark inflation concerns

- Markets set to surge on government shutdown hopes

- US government funding can kicked down the road to January

- Will November seasonality be in play in 2025?

- Big tech in focus

- US earnings reports are strongest in 4 years

- President Trump giveaway could spark inflation concerns

Risk sentiment has been given a boost today, after news broke overnight that 8 Democrats had voted with Republicans to advance a procedural vote to bring the record-breaking 40 day government shutdown to an end.

Markets set to surge on government shutdown hopes

There are still more hoops to jump through before the 1.4 million federal workers get their jobs back, but this first step towards ending the lockdown has received a warm reception from financial markets. Stocks are higher across Asia, and futures markets are also higher, the Eurostoxx 50 index is set to open 1.4% higher later this morning, and futures also suggest that the S&P 500 could rise by 0.8% later today, which would go some way to erode last week’s losses. The gold price has surged higher by $70 per ounce and the price of oil is higher by approx. 1% this morning. The dollar index slumped, although it has picked up from its lows, as investors ditch safe havens like the dollar and government bonds.

US government funding can kicked down the road to January

The deal that has been passed by the Senate, still needs to pass the House of Representatives and get signed off by the President. Added to this, the bill will only extend funding for the Federal Government until the end of January, so we could be back in this spot in a few months. The issue is that most Democrats voted against this bill, and they may use a subsequent shutdown to push for funding for medical care. Thus, it is a win for the moderates today, but there could be another fight at the start of next year.

Will November seasonality be in play in 2025?

November is seasonally a strong month for risky assets like stocks, but 2025 has got off to a weak start. After a strong run in October, which is usually a weak month for equities, you get the feeling that 2025 is shaping up to be a unique year for risk assets.

Stocks and risk sentiment are in recovery mode on Monday, and we’ll be watching to see if stocks can recover as we move through November. The Nasdaq had its weakest weekly performance since the start of September last week, while the S&P 500 had its weakest weekly performance since August. The gold price was down slightly, the Vix, Wall Street’s fear gauge, crept higher, the price of oil was down by 2% and global sovereign bond yields were up only slightly.

Big tech in focus

There are plenty of reasons for markets to be jittery, the biggest factors that weighed on stocks last week included the momentum trade, which encompasses big tech, earnings revisions for next year, and size, with the biggest companies weighing on the overall index. The worst performing stocks on the S&P 500 last week included Super Micro Computer and other stocks linked to crypto currencies, which have also sold off in recent weeks. The Semiconductor sector lost 6%, as Nvidia lost 8% last week, although it managed to eke out a small gain on Friday. Palantir, the big data and AI firm, which triggered the sell off amid concerns about the company’s 200+ 12-month forward P/E ratio, fell 10% last week, but rose by more than 1.6% on Friday.

There were tentative signs of a stabilization in risk sentiment at the end of last week, and this has been turbo charged by the news of a potential end to the government shutdown, so hope remains that stocks can turn around earlier losses and post a strong monthly gain for November. Added to this, the Dow Jones Transportation Index, which is considered a lead indicator for global growth, bucked the trend last week and posted a 2% gain, with airlines reversing earlier losses. We expect the transport sector to extend Friday’s recovery as hopes rise that US air traffic will not need to be cut this month. Interestingly, even though UPS, the parcel delivery firm, said that it would cut 9% of flights due to a crash earlier in the week, the stock also bounced off recent lows on Friday, as it could lead to higher air freight costs boosting UPS’s margins.

US earnings reports are strongest in 4 years

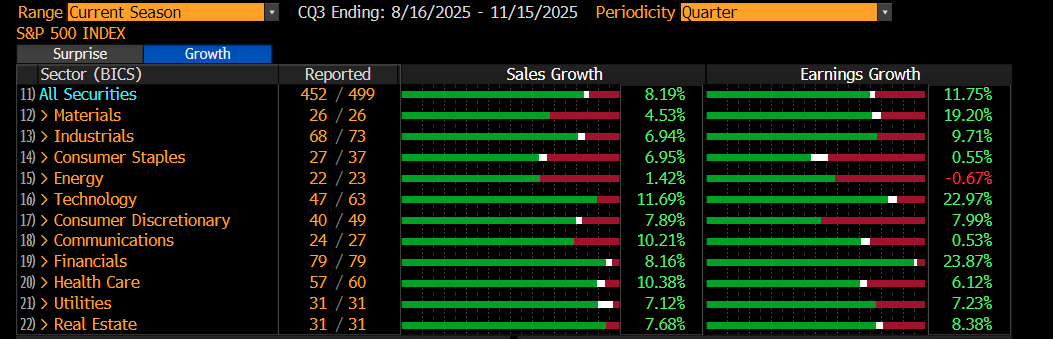

However, there are other drivers, which could boost stocks into year end, including news that US corporate earnings are growing at their fastest pace in 4 years, defying fears that US trade tariffs would decimate corporate profits. Median earnings growth across the broader US stock market spectrum is 11% in Q3, vs. 6% in Q2. Also, stronger earnings growth is broadening beyond just financial and tech stocks. All but one sector on the S&P 500 reported positive earnings growth in Q3, and all sectors reported positive sales growth, as you can see below.

Chart 1: S&P 500 sales growth and earnings growth, by sector for Q3.

Source: XTB and Bloomberg

Added to this, Nvidia will release its earnings report on 19th November, which could revitalize the tech trade. The chip maker’s earnings outlook, in particular, could be the next driver for tech stocks, after the AI trade suffered a wobble due to valuation fears last week.

President Trump giveaway could spark inflation concerns

In other news at the weekend, President Trump said that he could give Americans a $2,000 cheque, thanks to all of the tariff duties that he has collected since April. This pledge was watered down by the Treasury Secretary, who said that the ‘remittance’ could be given via tax cuts, rather than direct cash, which could raise fears of higher levels of inflation down the line. This is not impacting market sentiment today, as the focus remains on the potential end to the US government shutdown, but it does make for an interesting Fed meeting next month.

In the UK most of the headlines have been in a frenzy about the upcoming Budget. While this is important for financial markets, it is not the main driver. UK sovereign Gilt yields rose slightly last week, the FSTE 100 moved with global trends, and the pound managed to regain some earlier losses and found good support ahead of $1.30.

The upcoming economic data to watch this week includes:

1, UK labour market

This data could make it easier to justify a Bank of England rate cut next month, as the unemployment rate is expected to creep higher to 4.9%, the highest level since 2021. If analysts are correct to assume that the unemployment rate did rise in the 3 months to September, then it would mean that the unemployment rate has risen by 0.7% since Labour took office, which could heap more pressure on the Chancellor ahead of the Budget.

The labour market report is also expected to show that private sector wage growth is slowing sharply. The annual rate of growth is expected to be at 4.2% from 4.4%, the lowest level since late 2021.

Overall, this jobs data has the potential to push up expectations of a December rate cut, which currently stands at 71%. A weak labour market report on Tuesday could see this rise, and it could weigh on sterling, which staged a recovery vs. the USD last week although GBP/USD still remains below the 200-day sma.

2, UK GDP

The UK economy is expected to have grown by 0.2% in Q3, which suggests that the economy has slowed down after a strong start to the year. There are multiple drivers of economic weakness in the UK right now, including global trade concerns, a slowing UK labour market, and fears about tax rises in the budget that are weighing on confidence.

If GDP data is in line with expectations, then we could see the focus shift to 2026, when household spending could start to normalize and growth may return to the trend rate of 0.3% QoQ. Thus, if there is not a nasty surprise in the UK GDP data due on Thursday, the pound may continue to claw back recent losses vs. the USD.

3, US CPI

Financial markets are desperate for US economic data after University of Michigan consumer sentiment data fell to its lowest level since June 2022. In contrast, 1-year inflation expectations ticked higher to 4.7%. The question is, are consumers too pessimistic about the outlook for inflation? Sadly, we won’t find out this week, as the effect of the US government shutdown could delay economic data for another dfew months. This means that CPI for October is unlikely to be released this week. Even if the government shutdown ends, it is not likely to lead to enough time to collect the data for September and October’s CPI prints.

However, analysts believe that inflation could be moderating in the US. Analysts think, on average, that inflation rates remained on hold last month, which would suggest that any pass through effect from tariffs is not having a big impact on CPI.

There is a notable divergence in price growth, with prices for goods rising at a faster pace than service prices, due to recent declines in air fares and hotels.

Countdown to Black Friday 2025: Which Stocks Could Benefit?

Chart of the day - USDCAD (10.11.2025)

Rising demand for chips drives TSMC

Since October, over 40 million Americans are food insecure - What does this mean for the market?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.