Tesla will publish its Q4 2025 results after the close of trading on Wednesday, January 28. Expectations for the automotive giant’s earnings do not appear to reflect the enormous hopes placed in the company. Referring to Tesla as an “automotive giant” is accurate, but in this context it carries a negative connotation. The company stopped being valued like a car manufacturer long ago, it is valued like a technology company, despite negligible success in that area. At the same time, the company’s fundamentals, the automotive segment that is supposed to serve as the foundation for further, more advanced ventures, are showing clear signs of strain.

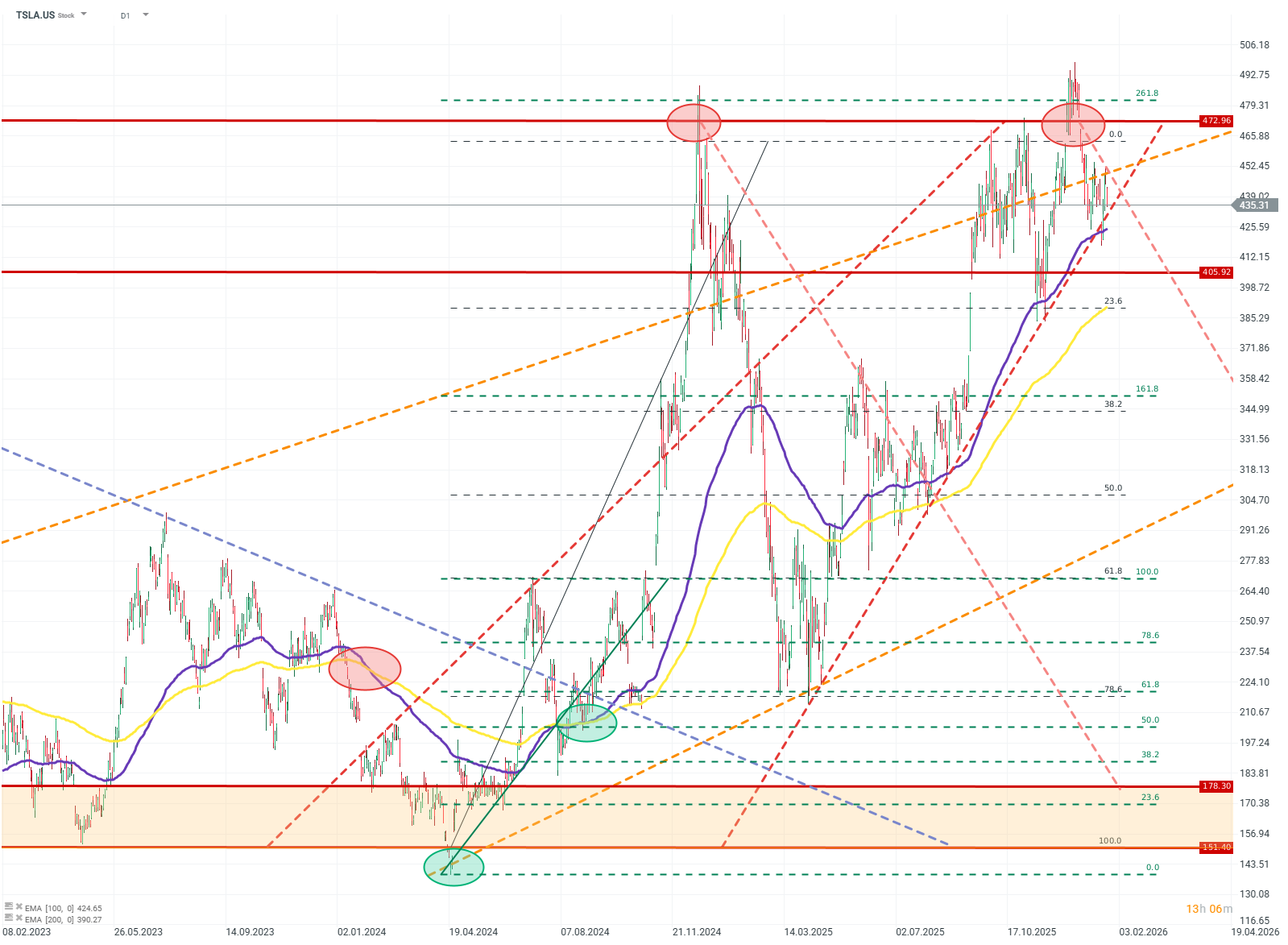

Since the last peak, Tesla’s share price has fallen by around 12%, yet it remains very high within its long-term price channel. Previous results do not justify this. In most of the last dozen earnings releases, Tesla disappointed analysts’ expectations on both EPS and revenue. Will it be different this time?

Ahead of the earnings release, Tesla published its vehicle delivery report. In the fourth quarter, the company recorded the largest drop in its history—down 16% year over year. The consensus for vehicle deliveries was around one million units. Tesla managed to deliver only 418,000.

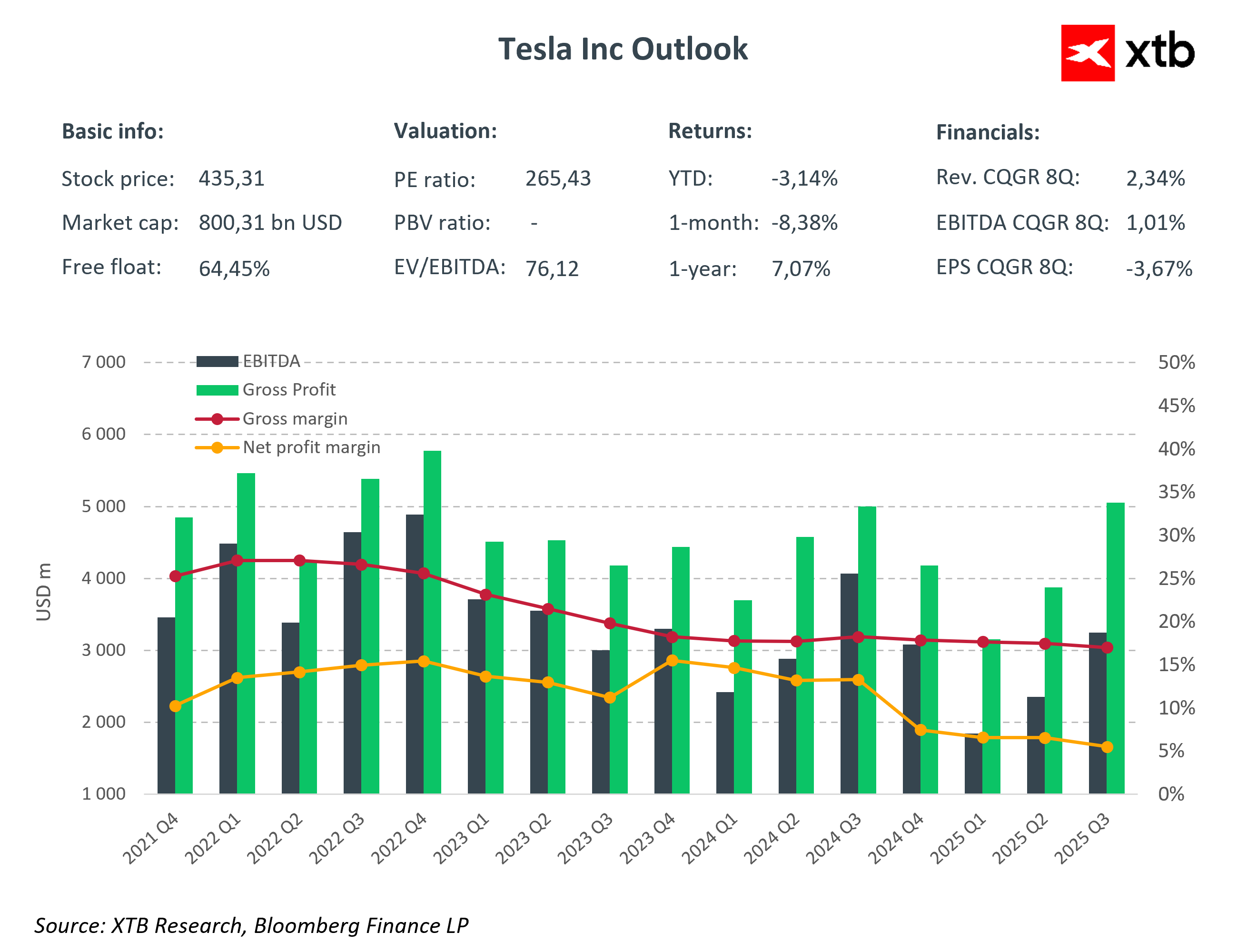

EPS expectations for Q4 are around USD 0.45. This represents a decline of more than 50% compared with 2022. This deterioration is also visible in the company’s margins.

Revenues look somewhat better: the market expects USD 24.7 billion, which is close to the quarterly average. However, this is still lower than in the corresponding periods of 2025 and 2024.

A significant portion of investors has stopped paying attention to financial ratios or hard data. There is a sizeable group of shareholders focused primarily on further announcements regarding the development of FSD and "robo-taxis". Tesla will have great difficulty meeting even these conservative earnings expectations. However, if the company presents promising indicators related to FSD and robo-taxis, it may temporarily sustain current valuations—or even see a rise. The absence of such signals, on the other hand, could lead to a significant sell-off following the earnings release.

Just a few days ago, Tesla introduced changes to access and distribution of its “Autopilot” and FSD, which may allow the company to show growth—if not in FSD subscriptions themselves, then at least in expectations surrounding them.

TSLA.US (D1)

Price has declined from its recent high. A return to growth may be difficult, and there is plenty of room for a correction. Source: xStation5

ASML: Will Europe’s technology hegemon beat expectations once again?

New front in the trade war: Greenland❄️Will Gold rise further❓

US OPEN: Bank and fund earnings support valuations.

⏬Oil and Silver Retreat on Trump

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.