Europe’s largest company, the Dutch ASML, will report its results before the session on January 28. Some time ago, the market realized just how indispensable ASML is to the global economy and the technology sector. The company is coming off a period of impressive growth in both financial performance and valuation. The question remains: is there still room for further upside?

ASML has managed to beat profit expectations six quarters in a row. Will it be able to maintain its winning streak? Market expectations are elevated.

Consensus forecasts assume EPS of approximately USD 8.2 and revenues exceeding USD 11 billion. This represents growth of more than 50% on a quarter-on-quarter basis.

With the bar set so high, risks to both results and market reaction are increasing. Even ASML may struggle to deliver such strong growth over such a short period, especially given that sales constraints are occurring primarily on the customer side rather than within the company itself. This stems, among other factors, from delays in project execution or an insufficient number of so-called “clean rooms,” which are required for the installation and operation of the machines.

One area the market will be watching particularly closely is the “High NA” segment, representing the latest generation of lithography machines. This is a market segment in which ASML continues to hold a complete monopoly, while also being the segment to which the market attaches the greatest expectations.

Even if the company delivers the outstanding results anticipated by investors, its guidance may prove conservative. Strong results combined with “weak” guidance could trigger a short-term pullback in the share price.

A significant risk to the company’s long-term outlook may be the behavior of demand linked to the “AI revolution.” However, even in such a scenario, the inertia of ASML’s financial performance would be substantial, making it more likely that the market has not yet fully priced in the benefits for the company rather than beginning to discount potential risks.

A potential dark horse of the earnings call could be stronger-than-expected results or guidance driven by a massive increase in demand for RAM memory.

Ultimately, market reaction will be determined by the interaction between reported financial results and forward guidance.

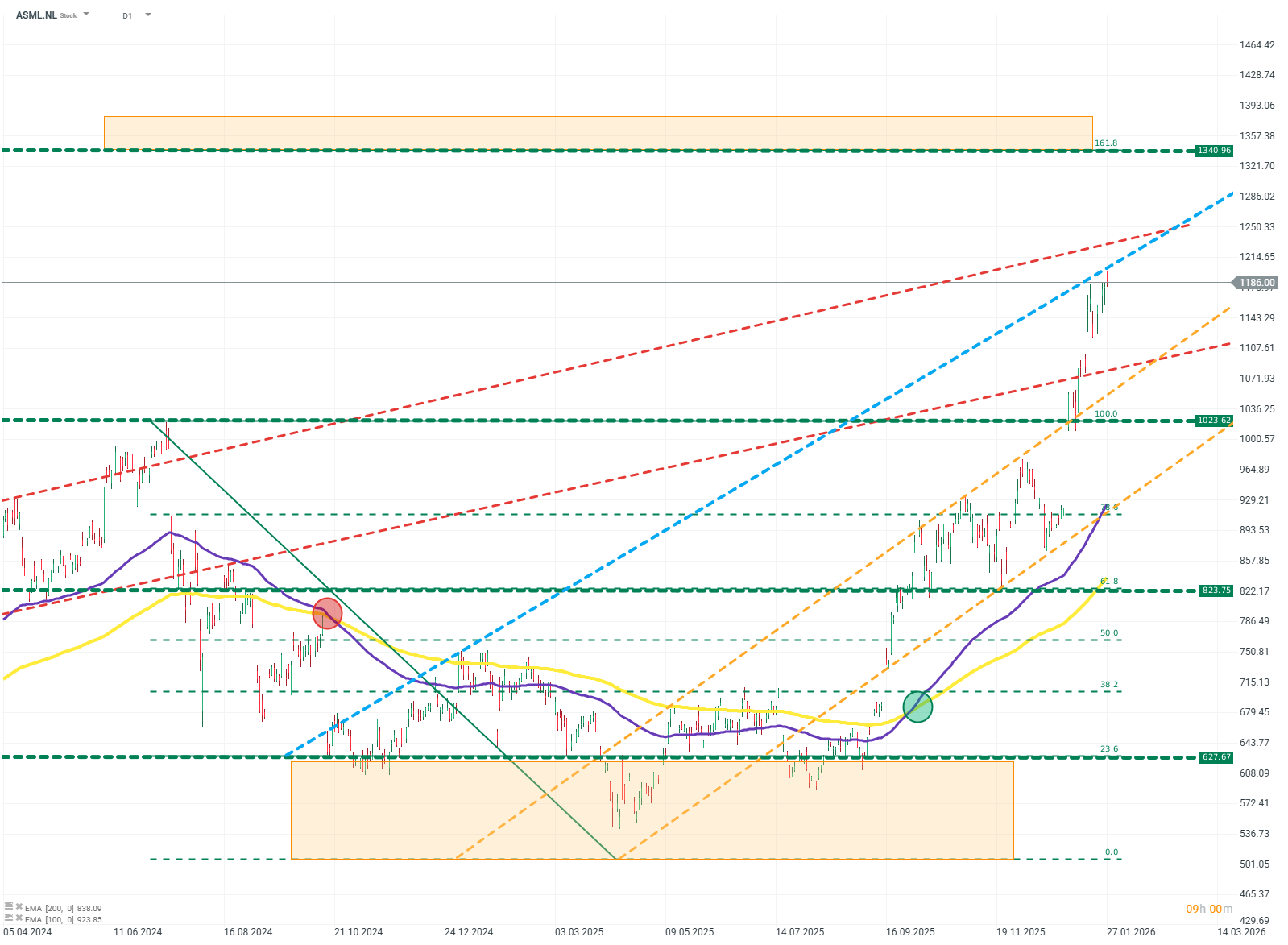

ASML.NL (D1)

The uptrend remains strong, and there are few indications that it is coming to an end, although the remaining upside appears increasingly limited. Source: xStation

Tesla Ahead of Earnings: Moderate Expectations and Weak Fundamentals

New front in the trade war: Greenland❄️Will Gold rise further❓

US OPEN: Bank and fund earnings support valuations.

⏬Oil and Silver Retreat on Trump

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.