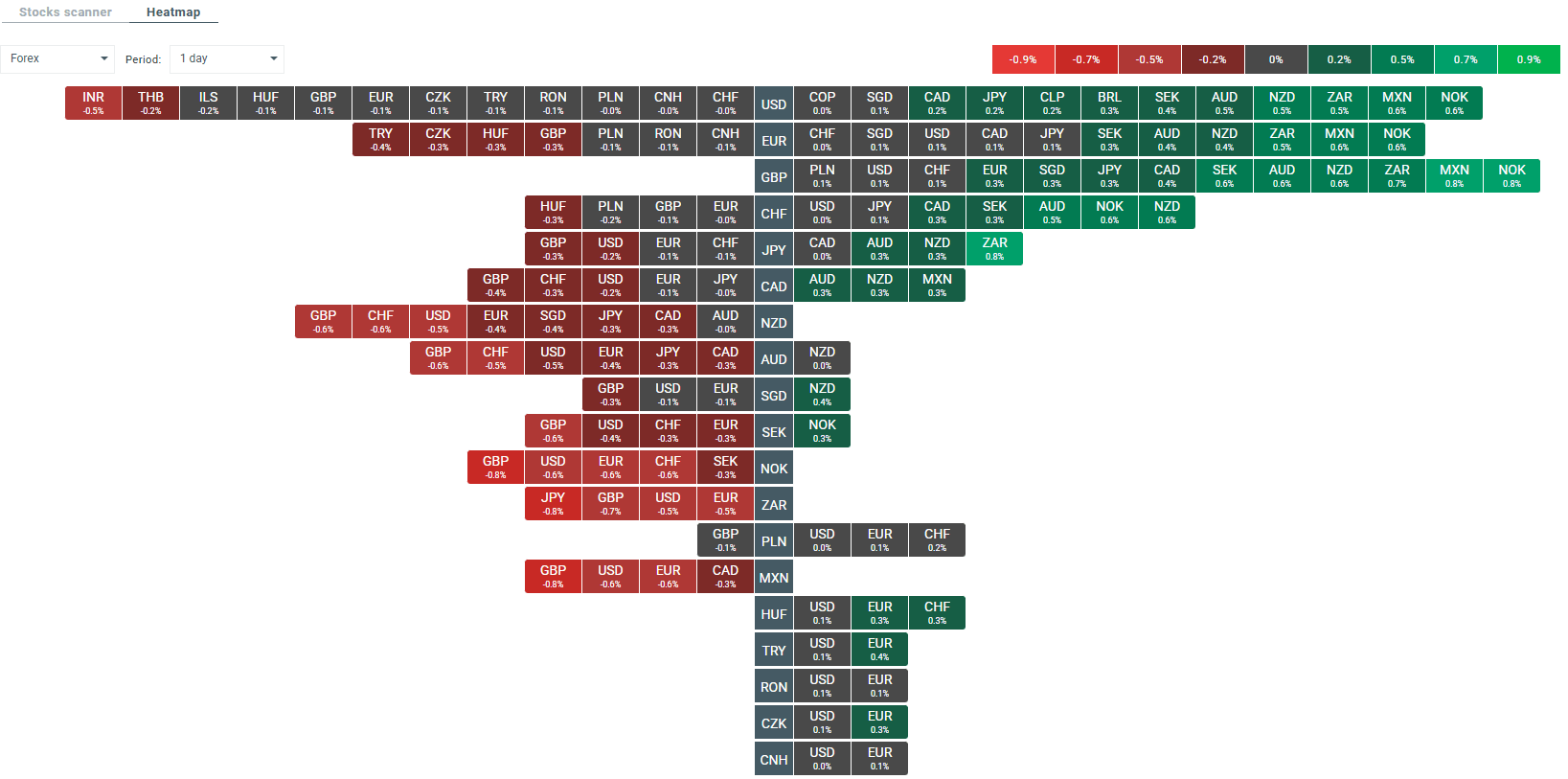

Heatmap of volatility on the FX market at present. Source: xStation

- The European session is relatively weak, with early signs of a rebound quickly being erased. At 1:30 p.m., Germany's DAX is down 0.95%, France's CAC40 is down 0.33% and Britain's FTSE100 is down 0.2%.

- The weakness is also affecting markets in Poland, where the key WIG20 index is down 1.33%, making it the leader in losses on the Old Continent.

- Danone shares plunged 5% after Dumex Dulac 1 infant formula was withdrawn from the Singapore market due to the presence of cereulide toxin in ARA oil. This is the largest one-day decline in six years, exacerbated by concerns about the company's reputation in the nutrition segment.

- Barry Callebaut is growing following the appointment of Hein Schumacher (former Unilever CEO) as head of the company – the world's largest cocoa supplier. The new leader is expected to help the company emerge from the crisis on the cocoa market.

- Burberry gains 5.3% thanks to better-than-expected sales results during the key holiday season. This demonstrates the resilience of the luxury retailer despite pressure on the sector.

- The main topic of today's trading is the speech by US President Donald Trump at the conference in the Swiss resort of Davos (2:30 p.m. CET).

- Bitcoin remains in consolidation after a correction of more than 30% in the fourth quarter, with risk aversion and correlation with the stock market limiting its upside potential. Attention in this regard has shifted to Davos, where cryptocurrency regulations in the US (CLARITY Act) are the subject of intense debate.

- Inflation in the UK accelerated for the first time in five months, reaching 3.4% y/y in December compared to 3.2% in November, slightly above economists' forecasts (3.3%). The rise in prices was mainly driven by an increase in tobacco excise duty and higher airfares.

- Antipodean currencies are currently performing best on the FX market. Meanwhile, the British pound and US dollar are experiencing declines.

- NATGAS is up 22% today amid the continuing cold spell in the US. Updated weather data from yesterday confirms the cooling trend that was already indicated on Monday.

- Oil is also regaining ground, with WTI currently up 1.5%. In this regard, investors will be paying attention to the API data, which will be released this evening and will provide clues as to changes in US oil inventories over the past week.

- Gold continues to perform well. The GOLD contract is up 2.2% today on renewed geopolitical concerns.

- Bitcoin is consolidating, remaining below £89,000.

Daily Summary: Trump signals restraint over Greenland, easing market jitters

⏫US500 climbs over 1%

US OPEN: Trump pivot lifts Wall Street sentiment

Trump ‘calms’ markets

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.