- Around 12% of S&P 500 companies have reported their Q3 results until 17 October.

- Up to 17 October, 84% of reporting S&P 500 companies have posted revenues above expectations — well above long-term averages.

- 86% have reported earnings per share (EPS) above analysts’ estimates — higher than both the five-year (78%) and ten-year (75%) averages.

- The S&P 500’s forward 12-month price-to-earnings (P/E) ratio stands at 22.4 — elevated compared to its five-year average (19.9) and ten-year average (18.6). It's slightly lower from 22.8 recorded at the end of September.

- Around 12% of S&P 500 companies have reported their Q3 results until 17 October.

- Up to 17 October, 84% of reporting S&P 500 companies have posted revenues above expectations — well above long-term averages.

- 86% have reported earnings per share (EPS) above analysts’ estimates — higher than both the five-year (78%) and ten-year (75%) averages.

- The S&P 500’s forward 12-month price-to-earnings (P/E) ratio stands at 22.4 — elevated compared to its five-year average (19.9) and ten-year average (18.6). It's slightly lower from 22.8 recorded at the end of September.

The third-quarter 2025 earnings season for the S&P 500 is underway, and early results show a mixed picture. While most companies are beating expectations, the size of these beats is smaller than usual. Still, the index continues to post strong growth, marking its ninth consecutive quarter of rising earnings. Here, we will analyse the earnings season data up to 17 October, using FactSet Research data.

-

Around 12% of S&P 500 companies have reported their Q3 results until 17 October.

-

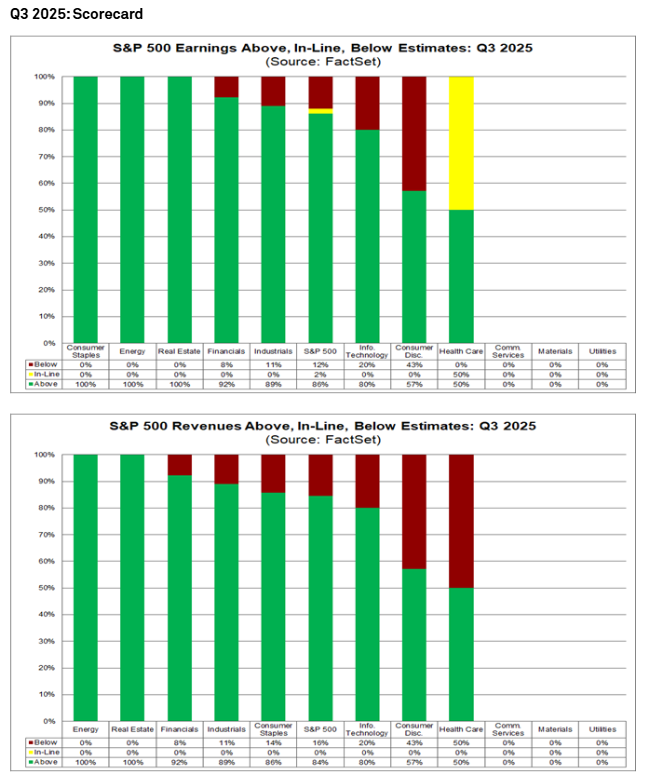

86% have reported earnings per share (EPS) above analysts’ estimates — higher than both the five-year (78%) and ten-year (75%) averages.

-

However, earnings have exceeded estimates by an average of 5.9%, which is below the five-year average of 8.4%.

This suggests that while companies continue to outperform, the overall strength of the surprises is fading compared to previous quarters. Of course, the early stages of the Q3 2025 earnings season show resilience in U.S. corporate profits. Strong results from the Financials and Technology sectors continue to drive growth, even as some industries — particularly Energy and Consumer Staples — face headwinds. With robust revenue trends and improving projections for 2026, the outlook for S&P 500 earnings remains positive, but valuations suggest expectations are already high.

Financials Lift the Index

Financial sector companies have been the main drivers of the earnings momentum. Their strong results have helped lift the overall earnings growth rate for the S&P 500.

-

Positive surprises in Financials outweighed weaker results and estimate cuts in the Health Care sector.

-

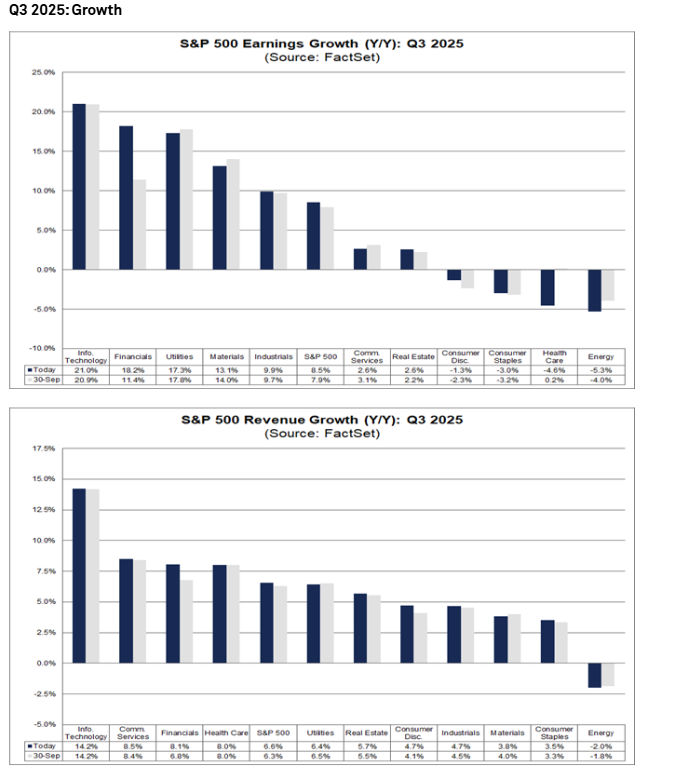

The blended earnings growth rate — which combines actual and projected results — now stands at 8.5%, up from 7.7% last week and 7.9% at the end of September.

If this rate holds, it will mark nine consecutive quarters of year-over-year earnings growth.

Sector Breakdown

-

Sectors with Growth: 7 out of 11 sectors are expected to post higher earnings year over year.

-

Leaders: Information Technology, Financials, Utilities, and Materials.

-

-

Sectors with Declines: 4 sectors are expected to see drops in earnings.

-

Laggards: Energy and Consumer Staples are seeing the largest declines.

-

Revenue Trends

Revenue growth remains solid across the index, continuing an impressive streak of expansion.

-

84% of reporting companies have posted revenues above expectations — well above long-term averages.

-

Reported revenues are 1.5% above estimates, slightly lower than the five-year average (2.1%) but still healthy.

-

The blended revenue growth rate is now 6.6%, compared to 6.3% at the end of Q3.

This marks the second-highest revenue growth since Q3 2022 and the 20th consecutive quarter of revenue expansion.

-

Information Technology continues to lead in revenue growth.

-

Energy remains the only sector showing a year-over-year revenue decline.

Looking Ahead: Analyst Expectations

Analysts are optimistic about the upcoming quarters. Forecasts for earnings growth are as follows:

-

Q4 2025: 7.5%

-

Q1 2026: 11.9%

-

Q2 2026: 12.8%

-

Full Year 2025: 11.0%

These projections indicate expectations for steady acceleration in corporate profitability through mid-2026. The S&P 500’s forward 12-month price-to-earnings (P/E) ratio stands at 22.4 — elevated compared to its five-year average (19.9) and ten-year average (18.6). However, it has edged slightly lower from 22.8 recorded at the end of September. This valuation suggests that the market remains expensive relative to historical norms.

Source: FactSet Research

Source: FactSet Research

Looking on the US500 (futures on S&P 500) we can see the short-term weakness. Despite the solid start of the Q3 Earnings Season, sentiment on Wall Street lags. Both Netflix and Tesla didn't surprise investors positively this week.

Source: xStation5

STMicroelectronics shares down 14% amid mixed future outlook📉

US100 gains 0.5% 📈Kansas City Fed Index above estimates

NATGAS loses after the EIA inventories report

Stock of the Week - Merck & Co Inc (23.10.2025)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.