- The company shows financial stability and high operational efficiency, and its results confirm the resilience of its business model even during market slowdowns.

- Current quotations are in a consolidation phase, and the market valuation remains cautious relative to fundamental potential, which may indicate room for improvement in the medium term.

- The company shows financial stability and high operational efficiency, and its results confirm the resilience of its business model even during market slowdowns.

- Current quotations are in a consolidation phase, and the market valuation remains cautious relative to fundamental potential, which may indicate room for improvement in the medium term.

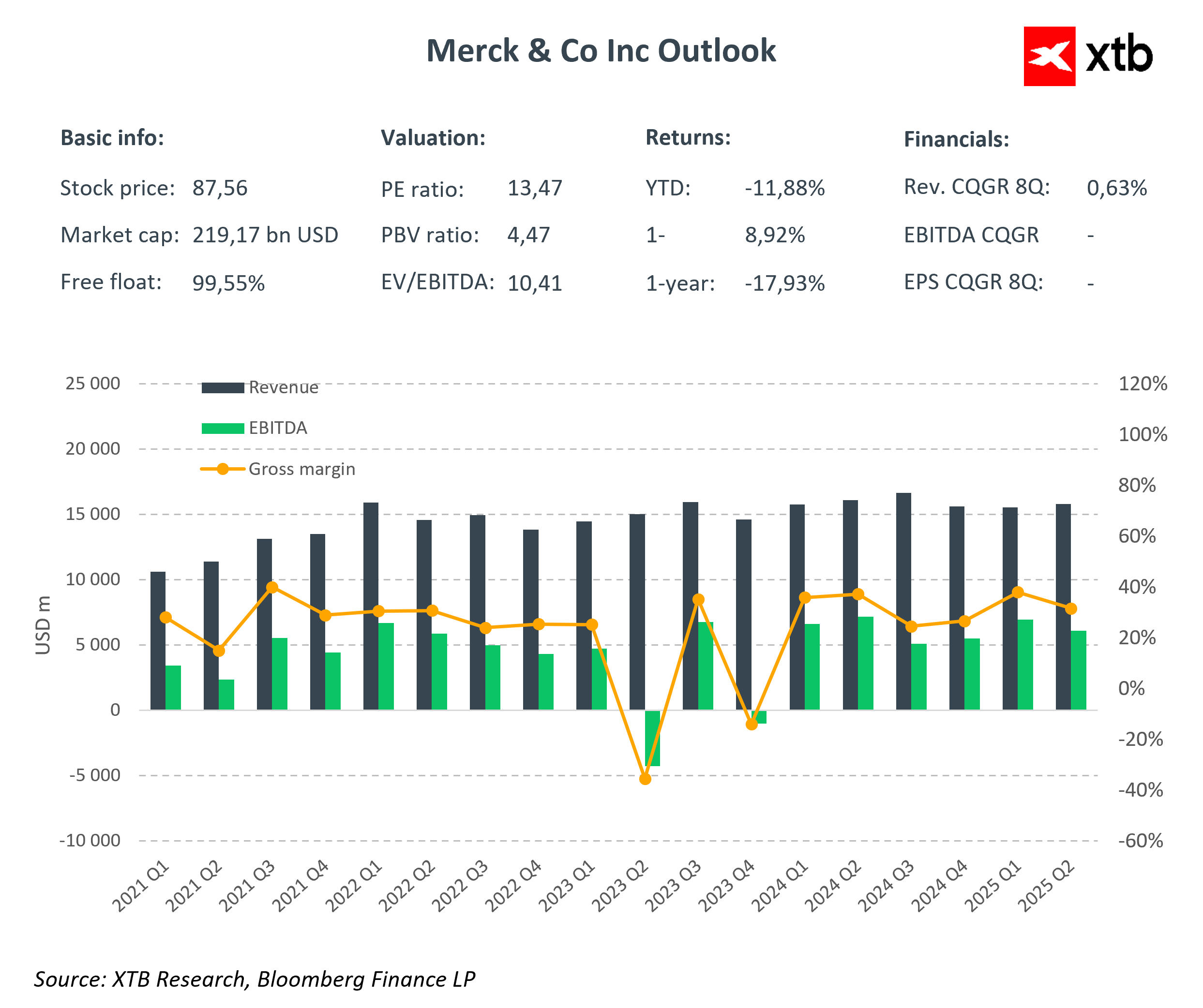

Since the beginning of the year, Merck & Company Inc. shares have lost value, despite the company’s fundamentals remaining strong and stable. Has the market overestimated the risks, or has a unique opportunity opened up for investors to buy undervalued assets in the pharmaceutical sector? It is worth emphasizing that pharmaceutical companies are often considered defensive, as investors tend to allocate capital to them during economic slowdowns, seeking safe havens. In this analysis, we will review the key market trends, financial results, and development strategy of Merck to assess whether this pharmaceutical giant deserves a higher valuation.

Merck & Company Inc. in the Context of the Global Pharmaceutical Market

Merck & Company Inc. is one of the most important players in the global pharmaceutical market. Known outside the United States and Canada as MSD, the company develops innovative drugs, vaccines, and biologic therapies that are transforming medicine. Its flagship product, Keytruda, is a true game changer in cancer treatment and a key growth driver for the company.

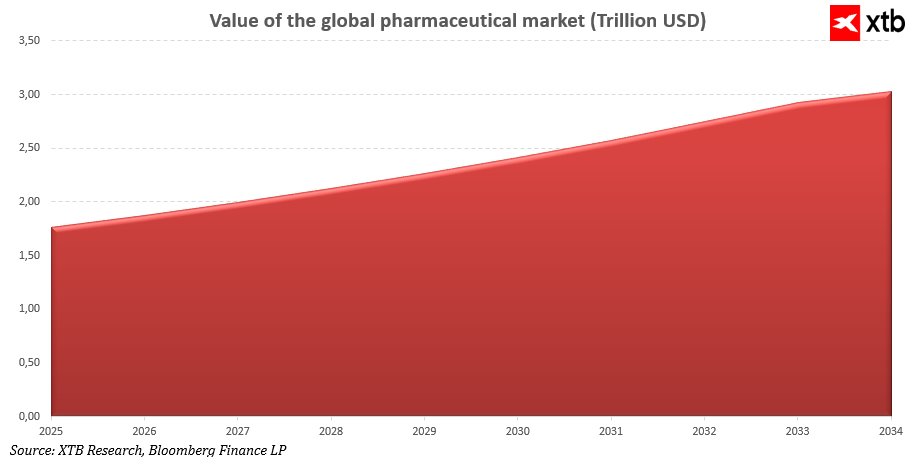

The pharmaceutical market in 2025 is valued at approximately $1.77 trillion and is forecasted to grow to $3.03 trillion over the next decade. This impressive growth is driven by three powerful trends. First, global populations are aging, and the increasing number of seniors boosts demand for modern drugs against chronic diseases. Second, the prevalence of conditions such as diabetes and cancer is rising, opening vast opportunities for innovation. Third, the development of biotechnology and artificial intelligence enables the introduction of increasingly effective and personalized therapies.

Merck primarily benefits from two megatrends driving the pharmaceutical market long-term. First, aging populations: the number of people over 65 is growing faster than ever before. This means higher demand for drugs that help manage chronic conditions such as diabetes, heart diseases, and cancers. Second, cancer incidence is increasing year by year. This results from multiple factors including lifestyle, environmental pollution, improved diagnostic methods detecting diseases earlier, as well as genetic and demographic factors.

This is an ideal situation for Merck. The company’s portfolio includes strong oncology therapies, including Keytruda, that address these needs and can significantly benefit from the growing market. Combined with innovations and modern research technologies, Merck is well-positioned to leverage these trends and grow faster than the market.

Beyond Keytruda, the company offers HPV vaccines, advanced diabetes medications, and therapies in infectious diseases and the immune system area. Merck continuously invests in scientific research, harnessing the potential of artificial intelligence and advanced data analytics. This accelerates drug discovery processes and enables the creation of personalized therapies tailored to individual patient needs.

Financial Analysis

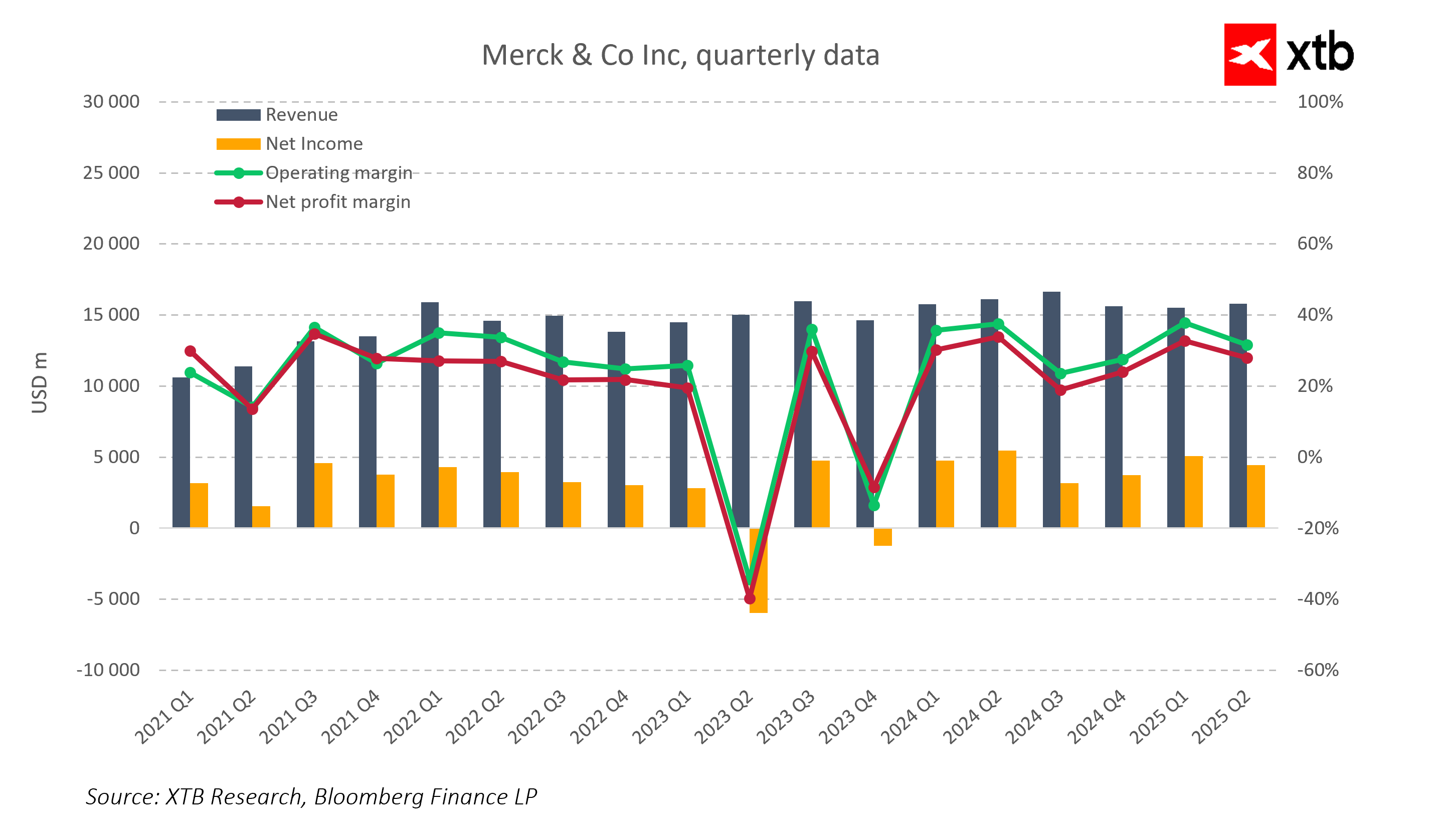

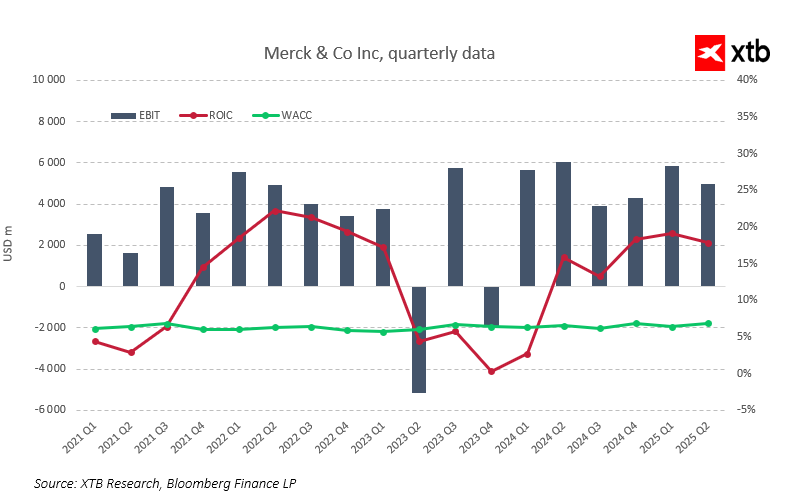

Merck & Co Inc is an example of a company that not only survived transitional difficulties but emerged stronger and more operationally efficient. Despite periodic market challenges, Merck demonstrates business stability and resilience. The company can quickly bounce back from adverse periods, reflecting the maturity and strength of its business model.

Financial data clearly show that Merck has solid fundamentals, steadily growing revenues, healthy margins, and a diversified product portfolio allowing it to maintain competitiveness even in a tough market environment.

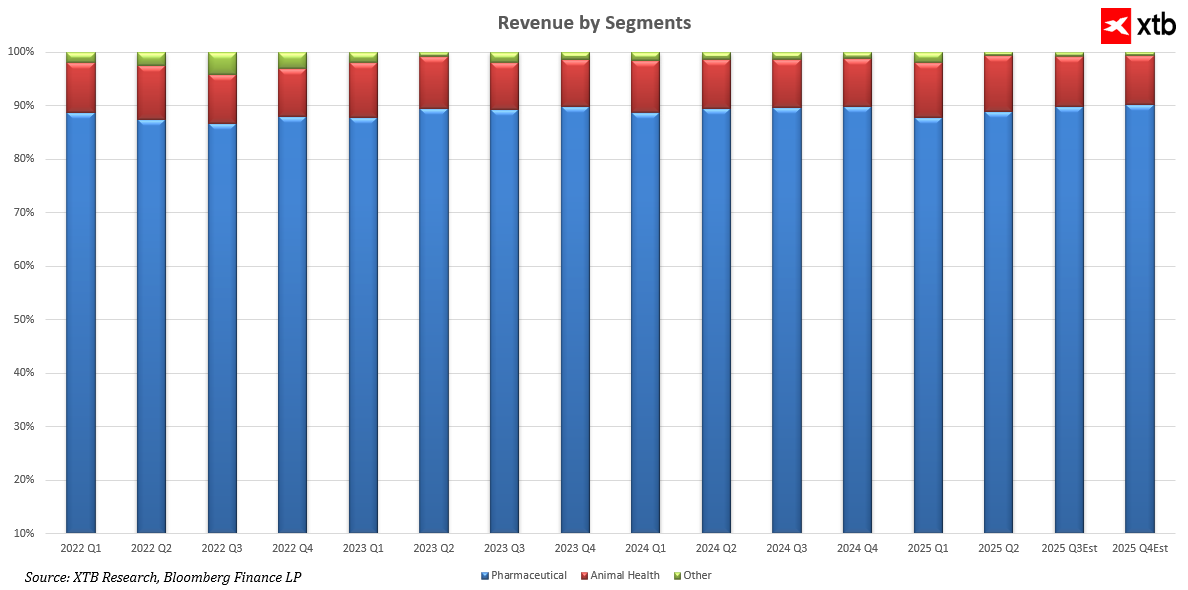

Revenue analysis indicates that the pharmaceutical segment remains the company’s driving force. Revenues in this area stay strong, ranging from about $12.1 billion to over $15 billion quarterly. Moreover, a rising trend has been observed over recent quarters, with forecasts for the second half of 2025 indicating further growth, confirming Merck’s strong position in innovative drugs and therapies.

The Animal Health segment, although smaller, remains a stable and slightly growing business with quarterly revenues between $1.2 billion and $1.6 billion, proving effective diversification of income sources. The "Other" segment is the smallest and more volatile but serves as a supplementary business that flexibly adapts to market needs.

The most important growth driver in Merck’s portfolio is the oncology segment, led by Keytruda. Keytruda posts consistent double-digit sales growth, exceeding 10% year-over-year, confirming its dominant position in cancer therapy. Other oncology products, such as Lynparza and Welireg, also show dynamic growth, with Welireg standing out for spectacular increases in recent quarters. This clearly demonstrates that innovative oncology therapies are a key pillar of the company’s stability and development.

In other segments, the situation is more varied. Vaccines like Gardasil and Pneumovax 23 are experiencing declines, the cardiology segment maintains moderate growth, while virology and diabetology face significant drops, indicating the need for strategy revision and further optimization efforts.

Despite temporary difficulties, Merck shows solid financial foundations. Although margins dipped occasionally in individual quarters, overall profitability remains high, with operating and net margins staying between 25% and 35%. This confirms the effectiveness of corrective measures and the resilience of the business model.

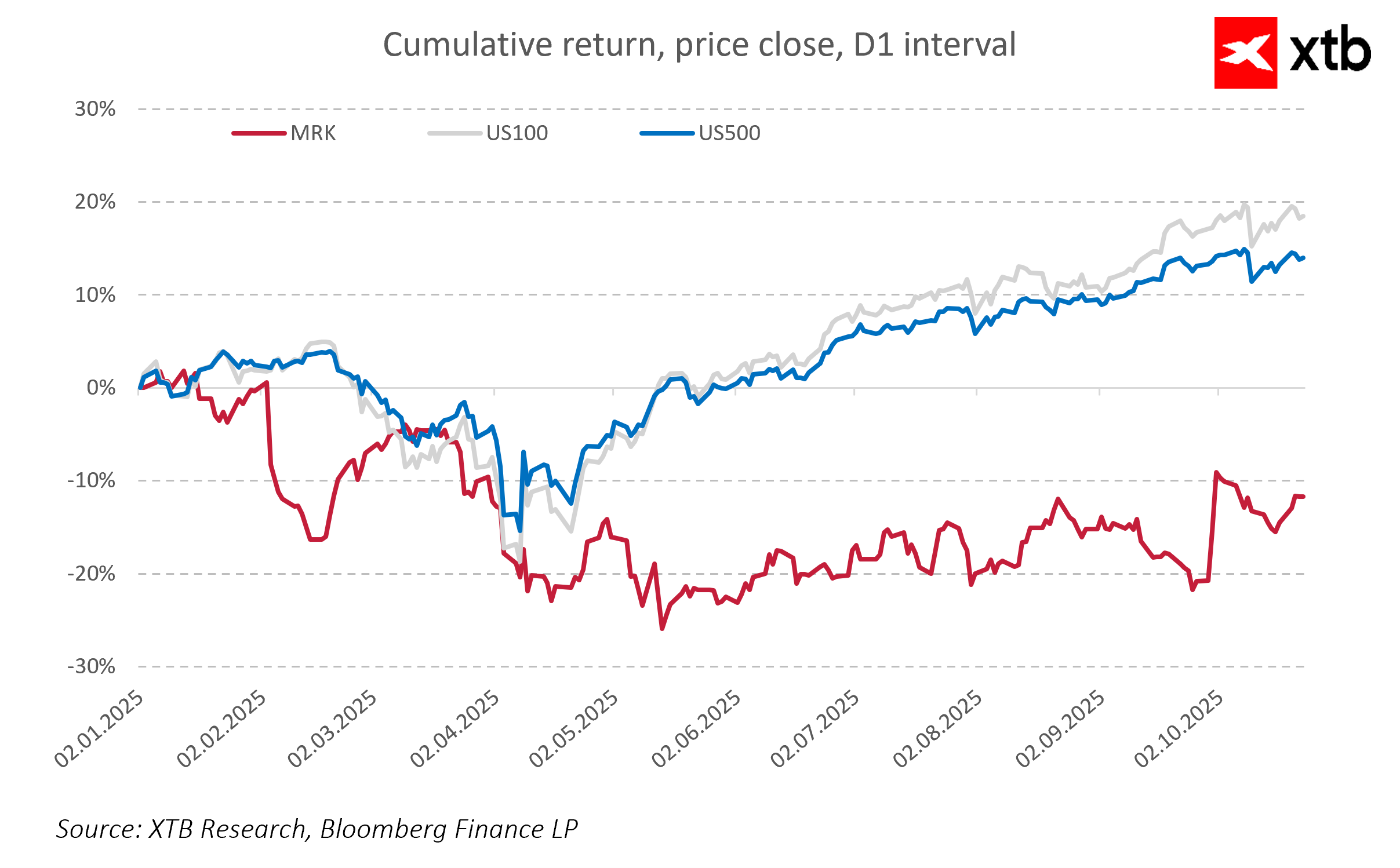

Since the beginning of the year, the company has underperformed relative to the broader market, including the S&P 500 and Nasdaq indices, indicating undervaluation. Despite solid financial fundamentals and stable growth prospects, Merck’s market valuation does not fully reflect the company’s quality and potential. This could present an attractive investment opportunity for investors seeking companies with significant growth potential and stable fundamentals.

Merck is a company that used a short-term crisis to strengthen its efficiency and profitability. High margins, stable revenue growth, and predictable cash flows are its greatest strengths in uncertain economic conditions. The dynamic development of oncology drugs, especially Keytruda, forms the foundation for further growth and reinforces Merck’s position as a leader in innovative cancer therapies. This is a solid and stable business with long-term potential that should attract investors seeking stable and promising companies.

Merck & Co Development Forecast for 2023–2029

After a period of stable growth and strong financial fundamentals, Merck faces a key challenge: can it maintain a dynamic growth path in the coming years? Global spending on drugs is rising, and demand for innovative therapies remains high; however, expiring licenses and increasing competition from generics may limit growth pace in the future. Merck primarily operates in the promising oncology segment, where Keytruda remains the main growth driver, and is developing innovative therapies such as Lynparza and Welireg. The pharmaceutical and Animal Health segments provide revenue diversification and stability, enhancing business resilience to changing market conditions.

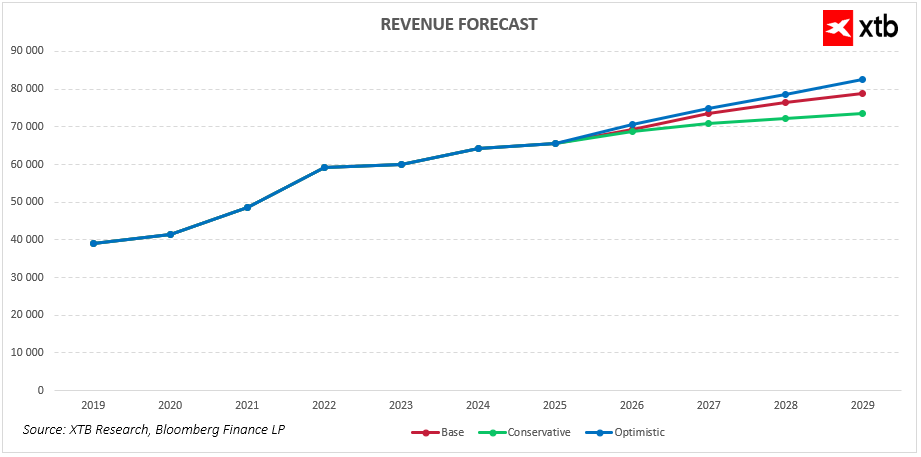

Considering these factors, we have prepared three realistic revenue growth scenarios for Merck in the coming years.

-

The baseline scenario assumes continued stable revenue growth, driven by maintaining a strong position in key segments, especially oncology. We expect moderate sales growth alongside a stable revenue base from pharmaceutical and Animal Health segments. Revenues under this scenario would increase from about $65 billion in 2025 to nearly $79 billion in 2029. This scenario reflects a balance between favorable market trends, industry maturity, and competitive pressure.

-

The optimistic scenario assumes faster growth due to expansion into new markets, successful investments in research and development, and sustained high growth rates in oncology. This variant also accounts for the potential introduction of new innovative products that will increase Merck’s share of the global pharmaceutical market. Revenues could exceed $82 billion in 2029, indicating strong growth potential and effective exploitation of market opportunities.

-

The conservative scenario considers higher risks, such as the expiration of key patents, rising generic competition, and potential regulatory challenges. In this scenario, revenue growth slows, reaching around $74 billion by the end of the forecast. Still, the company maintains resilience and financial stability thanks to portfolio diversification and efficient cost management.

Regardless of the scenario, Merck remains a company with strong fundamentals, healthy margins, and clear growth potential, especially in oncology.

Valuation of Merck & Co

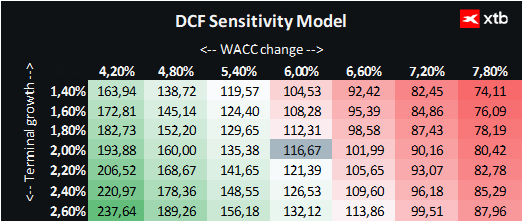

We present the valuation of Merck & Co Inc. using the discounted cash flow (DCF) method. It should be emphasized that this valuation is for informational purposes only and should not be considered investment advice or an exact valuation.

The analysis was based on the baseline financial forecast scenario, assuming stable revenue growth in coming years and maintaining healthy operating profitability. The model assumes a weighted average cost of capital (WACC) of 6%, which we consider appropriate for the pharmaceutical sector. This industry is characterized by stable cash flows, low earnings volatility, and a defensive risk profile, which historically translates to a relatively low cost of capital compared to other sectors.

It is worth noting that potential interest rate cuts by the Federal Reserve in upcoming quarters could further reduce the cost of capital, increasing the present value of future cash flows. For Merck, this effect could be moderately positive since the company maintains low debt levels and primarily finances itself with equity, increasing its resilience to macroeconomic changes.

The terminal growth rate was estimated at 2%. Other financial parameters were averaged based on results from the past five years.

Based on the analysis, the fair value of one Merck & Co share was estimated at approximately $116.67, compared to the current market price of $87.56. This indicates an upside potential of about 33% relative to the current market valuation. Considering strong financial fundamentals, high margins, a diversified product portfolio, and a dominant position in oncology, the current market valuation does not fully reflect Merck’s fundamental potential. Merck remains a stable, defensive business capable of generating predictable cash flows, making it an attractive choice for long-term investors.

Technical Chart Outlook

Currently, the stock price is consolidating within the $85–95 range. From a technical perspective, the price is gradually breaking out of a long-term downtrend, forming a rising channel. The EMA(30), EMA(50), and EMA(100) moving averages are beginning to converge and trend upward, suggesting a possible trend reversal. Maintaining the price above $88–90 supports a bullish scenario, and a breakout above $92–96 would open the path toward further gains near the $100 level.

Merck retains a defensive character and low volatility; thus, the current weakness can be seen as temporary undervaluation. Stable fundamentals, strong cash flows, and consistent dividend policy make the company attractive to long-term investors. Merck & Co remains one of the leading players in the global pharmaceutical sector, strengthening its position through the development of innovative oncology therapies.

STMicroelectronics shares down 14% amid mixed future outlook📉

US100 gains 0.5% 📈Kansas City Fed Index above estimates

NATGAS loses after the EIA inventories report

Beyond Meat after the sell-off📉Is short squeeze still possible?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.