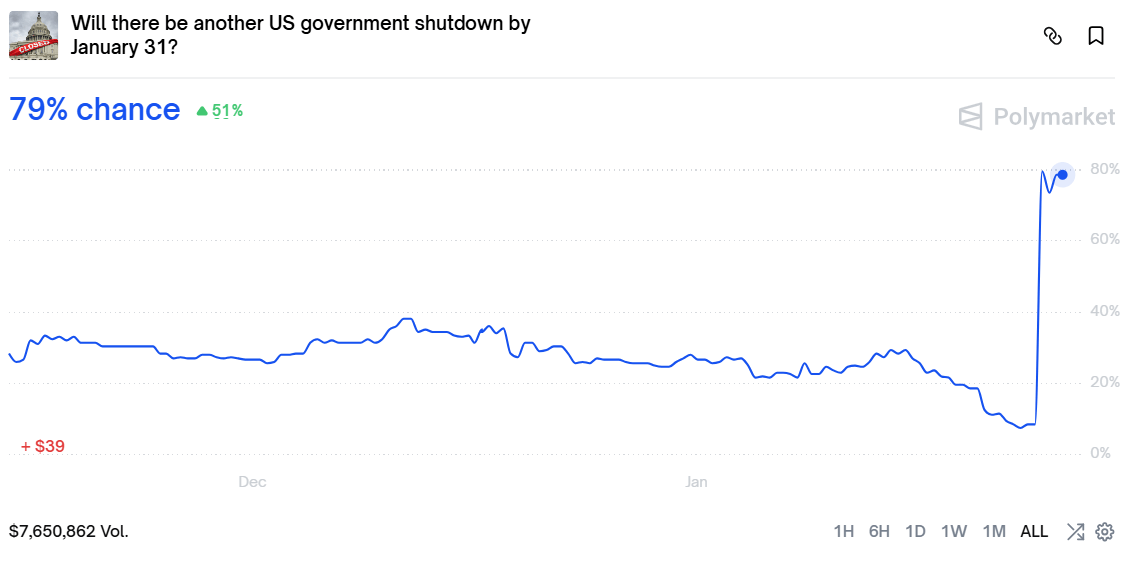

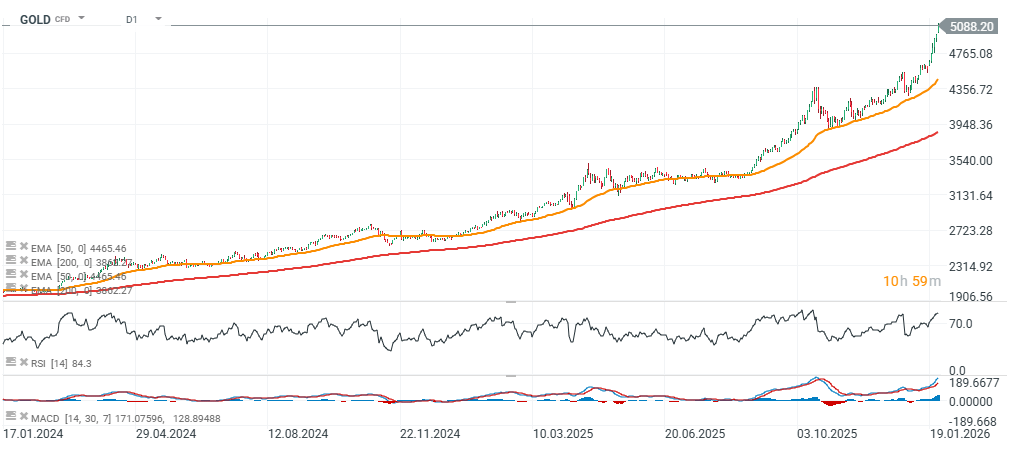

Gold prices are up more than 2% today, climbing to nearly $5,100 per ounce as the U.S. dollar weakens. Polymarket is now pricing in an 80% chance of a U.S. government shutdown after Senate Democrats, led by Chuck Schumer, vowed to block a spending bill unless funding for the Department of Homeland Security (DHS) is removed. This follows the killing of an American nurse in Minnesota by a Border Patrol agent, intensifying opposition concerns that DHS is abusing its powers.

- The US president, Donald Trumps stays for huge rate cuts from current 3.5% to 1% level, and now leading in Fed chair race, BlackRock's Rick Rieder remarts signals he is very dovish, commenting that cutting rates may even help fighting inflation.

- Broader uncertainty, destabilization and political polarization in the U.S. is another factor weighing on the dollar’s standing and directing market attention to the country’s rising debt burden, which is approaching $39 trillion and is expected to keep growing.

- A natural consequence of this environment is rising interest in precious metals -especially gold, which for centuries has served as a “safe haven,” preserving value over time. Capital is flowing into gold today, while the dollar is being sold (the U.S. Dollar Index futures contract, USDIDX, is slipping below 97).

In recent months, it has been hard to shake the impression that gold is not only pricing in the “past loss of purchasing power of fiat currencies,” but also already “consuming” the value by which currencies may weaken in the years ahead—if central banks come under pressure to keep interest rates structurally lower despite elevated inflation, in order to avoid cracks in the fiscal system.

Source: Polymarket

Source: xStation5

🔝Gold breaches $5100 as silver tests $110

Crypto news: Bitcoin slips back to $87k 📉 Bear market signal?

Economic calendar: Ifo data from Germany and retail sales in Poland 💡Wall Street earnings calendar❗

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.