Monday’s session across commodities markets secured its place in the history books as a day of shattered psychological barriers. Investors, seeking shelter from escalating political and geopolitical uncertainty, have driven bullion prices to unprecedented heights. Gold gained more than 2% today, marking its sixth consecutive day of gains, while silver surged by as much as 7% in its third straight day of appreciation.

Gold reaches new heights

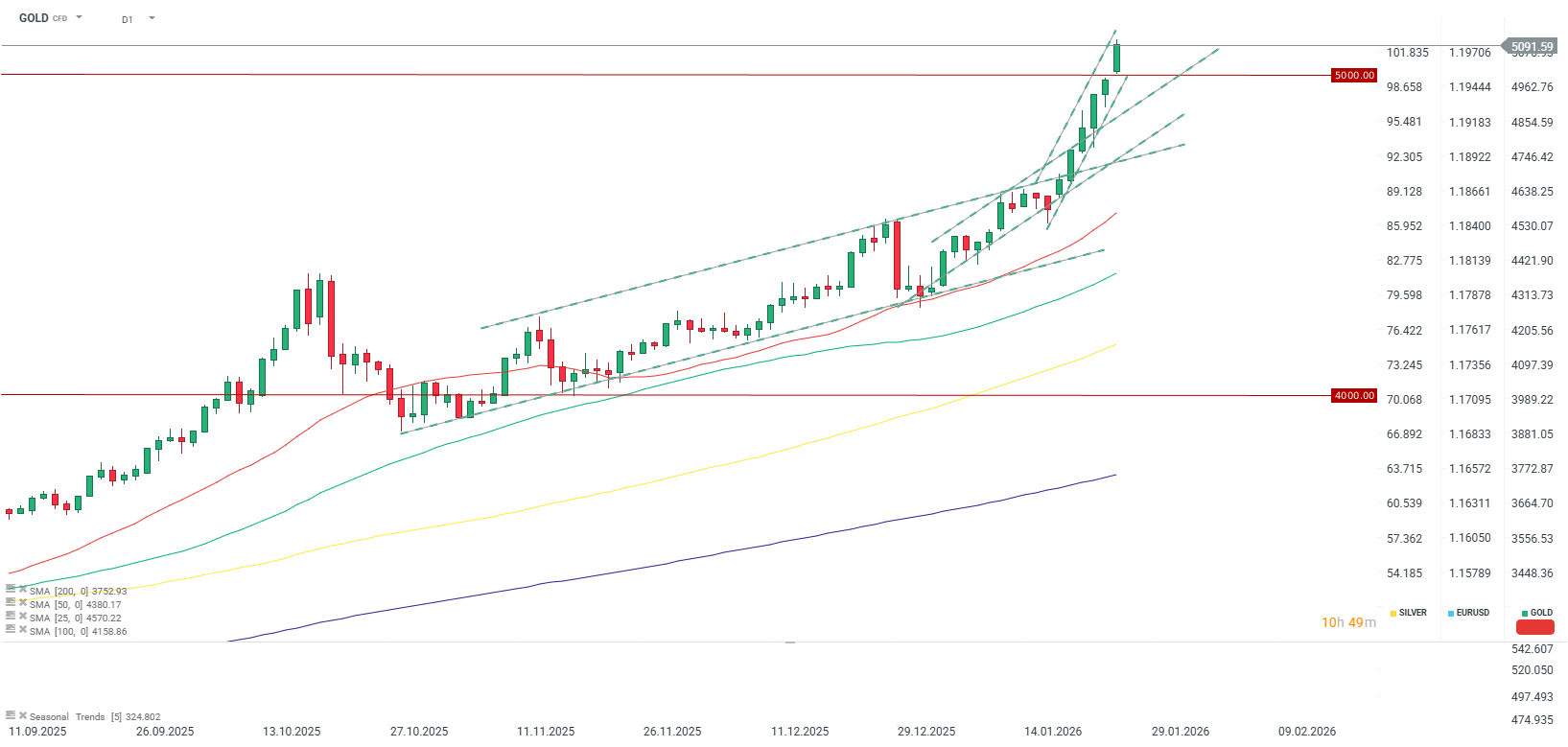

Spot gold prices crossed the $5,000 per ounce threshold for the first time in history on Monday.

-

The yellow metal established a fresh all-time record, peaking near $5,111 per ounce.

-

Prices are currently experiencing a minor technical retracement just below these peaks.

-

This surge continues the powerful momentum seen last week, when gold systematically breached the $4,700, $4,800, and $4,900 milestones.

Gold hits successive milestones almost daily, further accelerating its upward trajectory. Source: xStation5

Silver rally and industrial demand

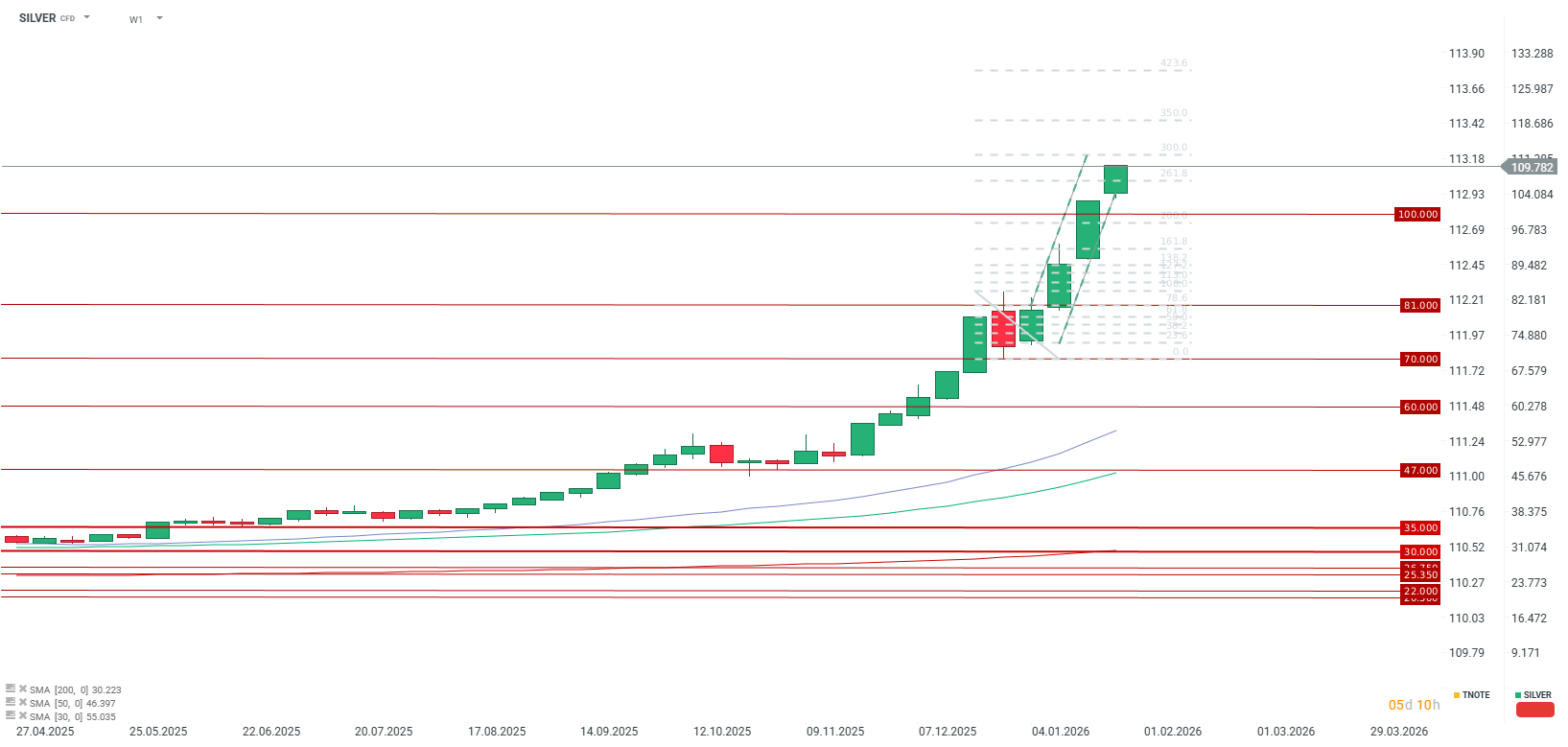

Silver has refused to be overshadowed, exhibiting even greater volatility than gold.

-

On Monday, silver prices touched a record high of $110 per ounce.

-

This follows a decisive break above the $100 level on Friday.

-

Analysts point to unprecedented demand, fueled by both silver's safe-haven status and robust industrial requirements.

-

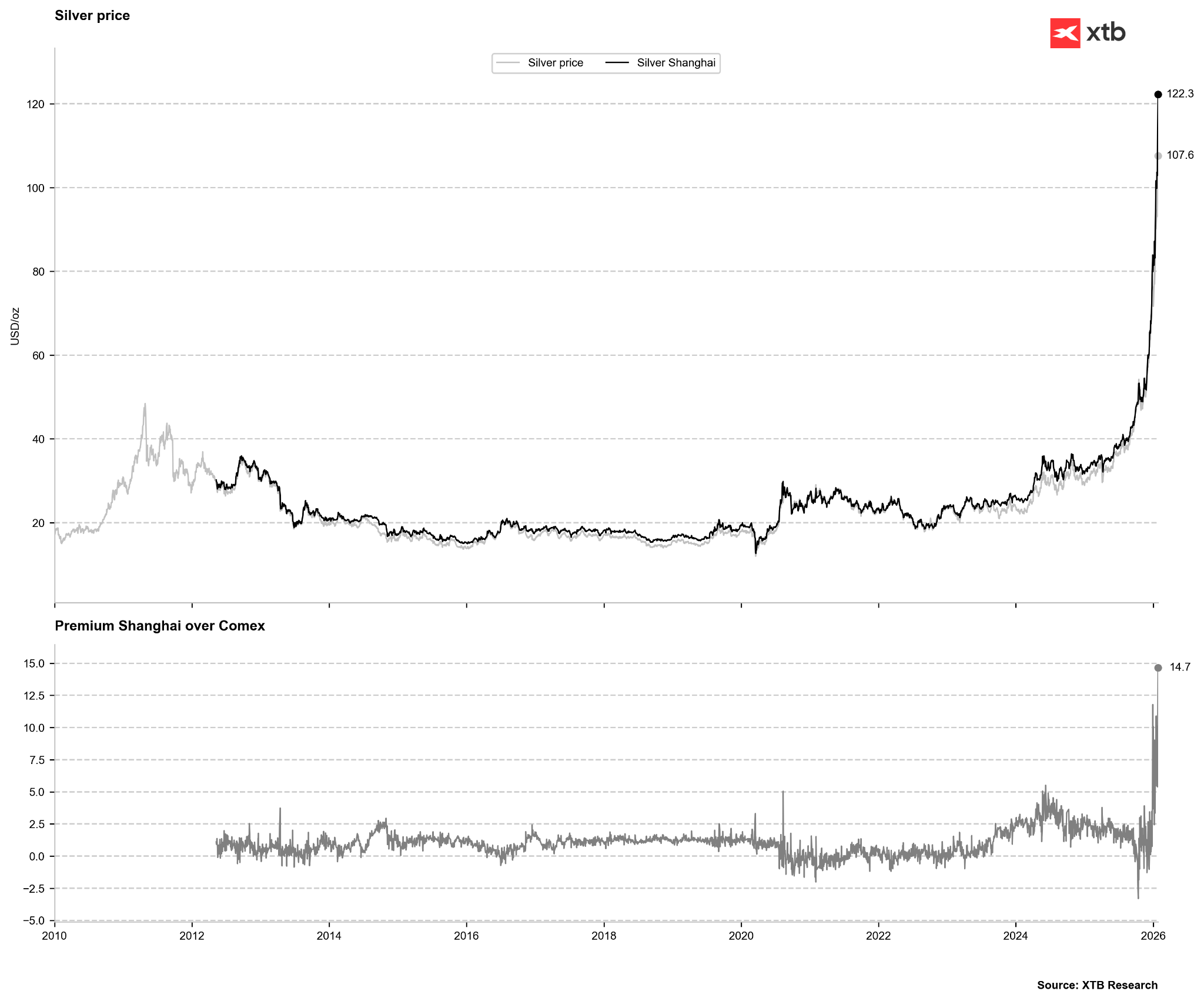

While the metal is considered strategic in both China and the US, the primary industrial pull is emanating from the former. This is evidenced by a substantial price premium on the Shanghai Gold Exchange relative to New York spot prices.

Silver prices have nearly tripled in value over the past 12 months. Source: xStation5

Drivers of the global bullion fever

The current "gold rush" is being propelled by a convergence of systemic risks:

-

US Political Uncertainty: President Donald Trump’s threat to impose 100% tariffs on Canada should Ottawa pursue a trade deal with China has ignited fears of a fresh escalation in global trade wars.

-

Geopolitics: Persistent tensions between Russia and Ukraine, ongoing conflicts in the Middle East, and simmering instability in Venezuela continue to keep geopolitical risk premiums high.

-

Fed Anticipation: Markets are focused on Wednesday’s Federal Reserve interest rate decision. While rates are expected to remain unchanged, investors are scanning for "dovish" guidance that could further fuel the rally. Conversely, recent US data suggests a potentially more "hawkish" stance may be required.

-

Supply Scarcity: Silver has remained in a structural deficit for several years. Concerns are now mounting regarding the physical availability of the metal for delivery, particularly in China, though heightened activity is also being observed on the COMEX exchange.

The price premium in China stands near $15 compared to US prices, indicating extremely high demand for physical silver in Shanghai. While the US market remains largely "paper-based," pressure for physical delivery on Chinese contracts continues to mount. Source: Bloomberg Finance LP, XTB

The price premium in China stands near $15 compared to US prices, indicating extremely high demand for physical silver in Shanghai. While the US market remains largely "paper-based," pressure for physical delivery on Chinese contracts continues to mount. Source: Bloomberg Finance LP, XTB

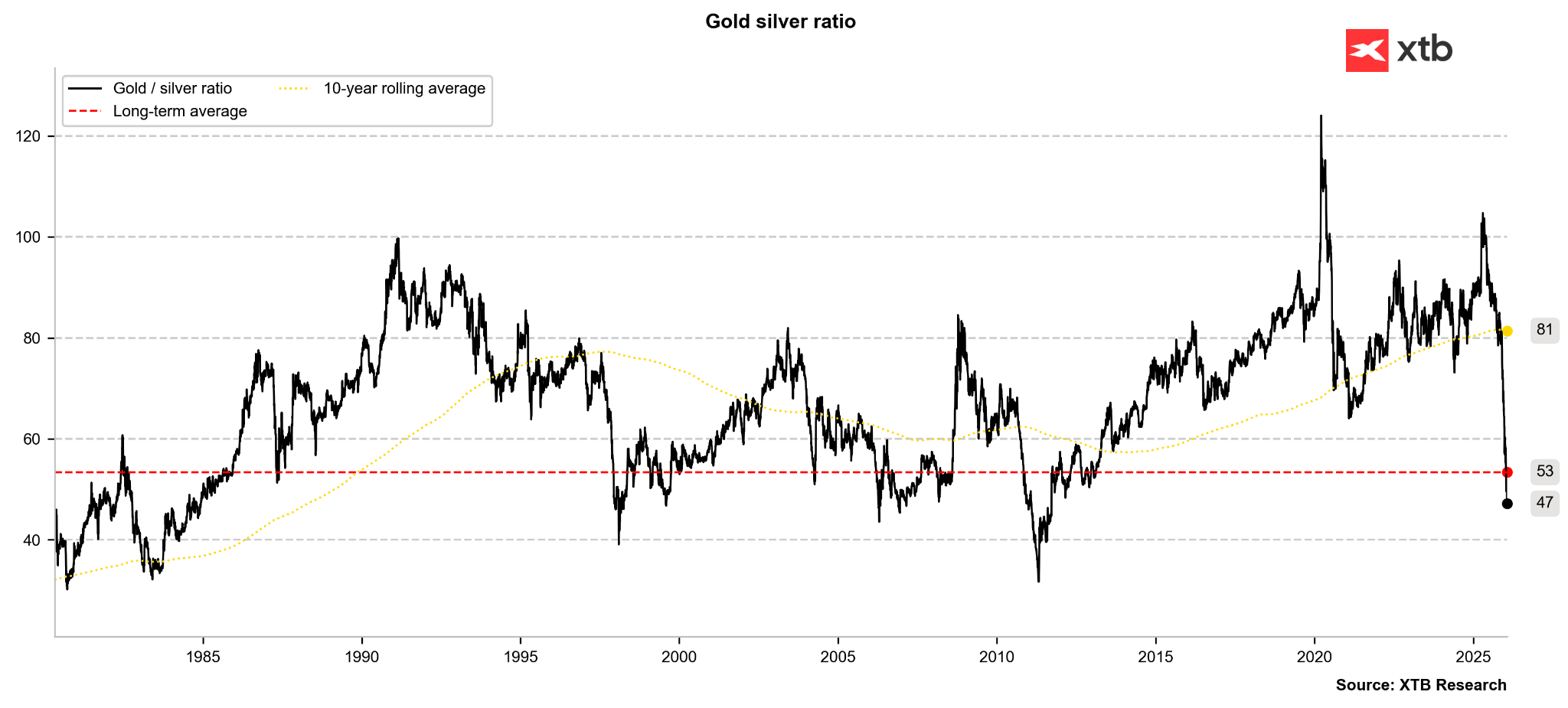

The gold-to-silver ratio is dropping decisively below the 50-point mark. Assuming gold reaches $5,300 and the ratio compresses to 40, silver would theoretically be valued at $132.50. Source: Bloomberg Finance LP, XTB

The gold-to-silver ratio is dropping decisively below the 50-point mark. Assuming gold reaches $5,300 and the ratio compresses to 40, silver would theoretically be valued at $132.50. Source: Bloomberg Finance LP, XTB

Crypto news: Bitcoin slips back to $87k 📉 Bear market signal?

Gold surges over 2% and is approaching $5,100 on the back of a weaker dollar 📈

Economic calendar: Ifo data from Germany and retail sales in Poland 💡Wall Street earnings calendar❗

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.