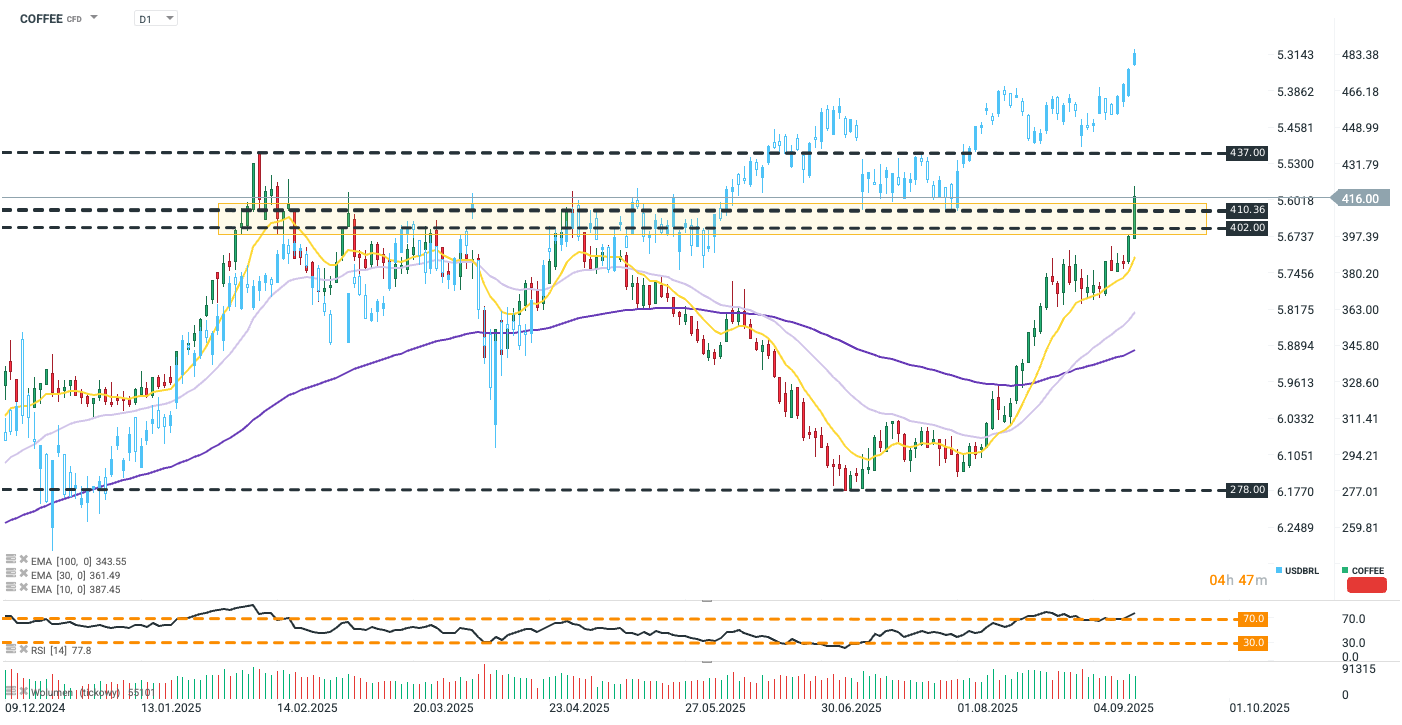

Arabica contracts extended Friday’s rebound by nearly 6%, pushing prices above the key resistance zone (402–410). Drought in Brazil, the world’s largest coffee producer, has reignited supply concerns, driving New York exchange prices above $4 per pound for the first time since April 2025.

Drought-stricken Brazil has been the main source of upward pressure in recent months, while conflicting weather forecasts for the coming weeks cast uncertainty over the September–November flowering. While Climatempo predicts a return of heavy rainfall, other sources say drought risk in the arabica belt remains too high to dismiss supply fears.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appNon-climatic factors are also at play. Brazil was excluded from US tariff relief on coffee due to deteriorating diplomatic relations following Jair Bolsonaro’s conviction, leaving coffee subject to 50% reciprocal tariffs. Prices are also supported by the sharp appreciation of the Brazilian real, up 14% against the dollar since the start of the year.

COFFEE is now at its highest level since April 2025, approaching January highs. In blue: the inverted USDBRL rate, at its strongest since June 2024. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.