The pound is the second best performer in the G10 FX space at the start of the week as the dollar crumbles ahead of the Fed meeting on Wednesday. The pound is at its highest level since July, even though yields are falling and the FTSE 100 is lagging a broader European equity market rally.

The move in the pound is worth noting. GBP/USD is testing the $1.36 level, if it breaks above here then the door opens to $1.3790, the high of the year so far. Momentum is on the upside for the pound for a few reasons. FX investors are pricing in the prospect of US corporate investment into the UK. This is unusual, President Trump does not usually like the idea of US firms investing elsewhere, however, the UK has a special place in his heart, and this week’s state visit by President Trump could warm the market towards UK assets once more. This is showing up in the pound on Monday.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appBOE move on QT boosts the pound

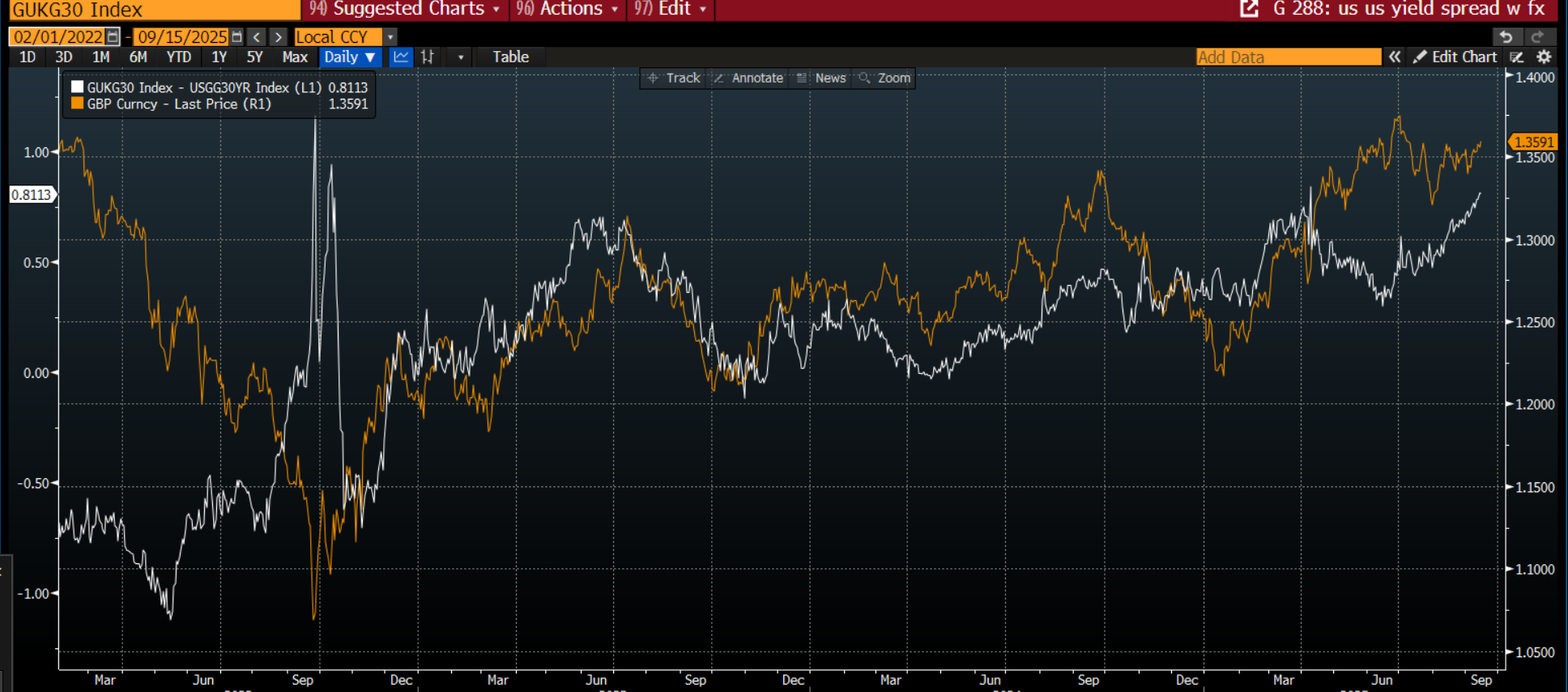

The second driver is the Bank of England. If the BOE does reduce or pause its quantitative tightening programme, as expected, this could reduce pressure on UK bond yields. The market is pricing this in already, UK Gilts are outperforming across the curve, the 10-year yield is lower by 3bps so far today and the 30-year yield is lower by 2.8bps so far. As you can see below, the UK and US 30-year yield spread has an inverse correlation with GBP/USD, so if the yield spread narrows, we could see a strengthening of the pound in the future. Obviously if the BOE disappoints the market with QT, then we could see the pound come under downward pressure later this week.

Chart 1: UK and US 30-year bond yield spread and GBP/USD

Source: XTB and Bloomberg

While a pause in QT will not bring an end to the UK’s fiscal problems, the UK will still have a large deficit and a problem with public sector spending, it could ease concerns about an immediate funding crisis, especially as we lead up to November’s contentious budget.

French stocks brush off downgrade news

French stocks have taken the sovereign debt downgrade from Fitch in their stride, possibly because some of the largest French companies now have a better credit rating than France, including LVMH. The Cac is leading European stocks higher on Monday, French luxury names and French banks are leading the index. The French banks are benefitting from Fitch’s stable outlook for France’s credit rating, which could give the new government some breathing room ahead of the new budget. Added to this, the fact that French stocks, French bonds and the euro are rallying today suggests that the downgrade news was already priced in by the market.

Tech drives S&P 500 to a fresh record high

It's the start of a new week and the US market has jumped at the open and US stocks have made fresh record highs. Tesla is the second-best performer after Elon Musk announced that he bought $1bn of stock, this comes after Musk was awarded a $1 trillion stock package if he can get the company to ambitious valuation and performance milestones in the coming years. This is quite the turnaround for Tesla, in recent days the stock has moved back into the green for the YTD, after a near 45% decline earlier this year due to Trump and Musk’s spat. The latest surge in the share price is not down to sales, there are still concerns about EV sales and competition, and is more a sign of a shift in strategy with Musk at the helm. Investors are buying into him turning Tesla around and bringing the company and the stock price back to its winning ways.

Tech is once again asserting its dominance as the main driver of the US stock market. Alphabet is higher by 3.2% today and is the third US tech company to reach a £3 trillion valuation. Added to this, Oracle is also rising sharply and is up another 4% on Monday as President Trump is expected to announce a sale of TikTok to US buyers, which may include Oracle.

Gold hits another record high, as inflation hedges drive the yellow metal

Overall, today’s price action suggests that there is optimism across financial markets. Stocks look to be rallying into this Fed meeting, as hopes remain high that the Fed will burnish their dovish credentials and signal multiple rate cuts in the coming months on Wednesday. This is driving the Vix, Wall Street’s fear gauge, to near its lowest level of the year so far, and the gold price is also benefitting. Gold investors are wary of Fed rate cuts due to high levels of inflation in the US economy. The gold price is higher by another $14 today and has hit another record.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.