-

Record Valuations: Silver and gold are hitting historic highs due to a weakening dollar 💵 and attacks on the Fed's independence 🏛️.

-

Geopolitical Triggers: Unrest in Iran and Venezuela, along with intervention threats from Donald Trump, are driving "safe haven" demand 🌎.

-

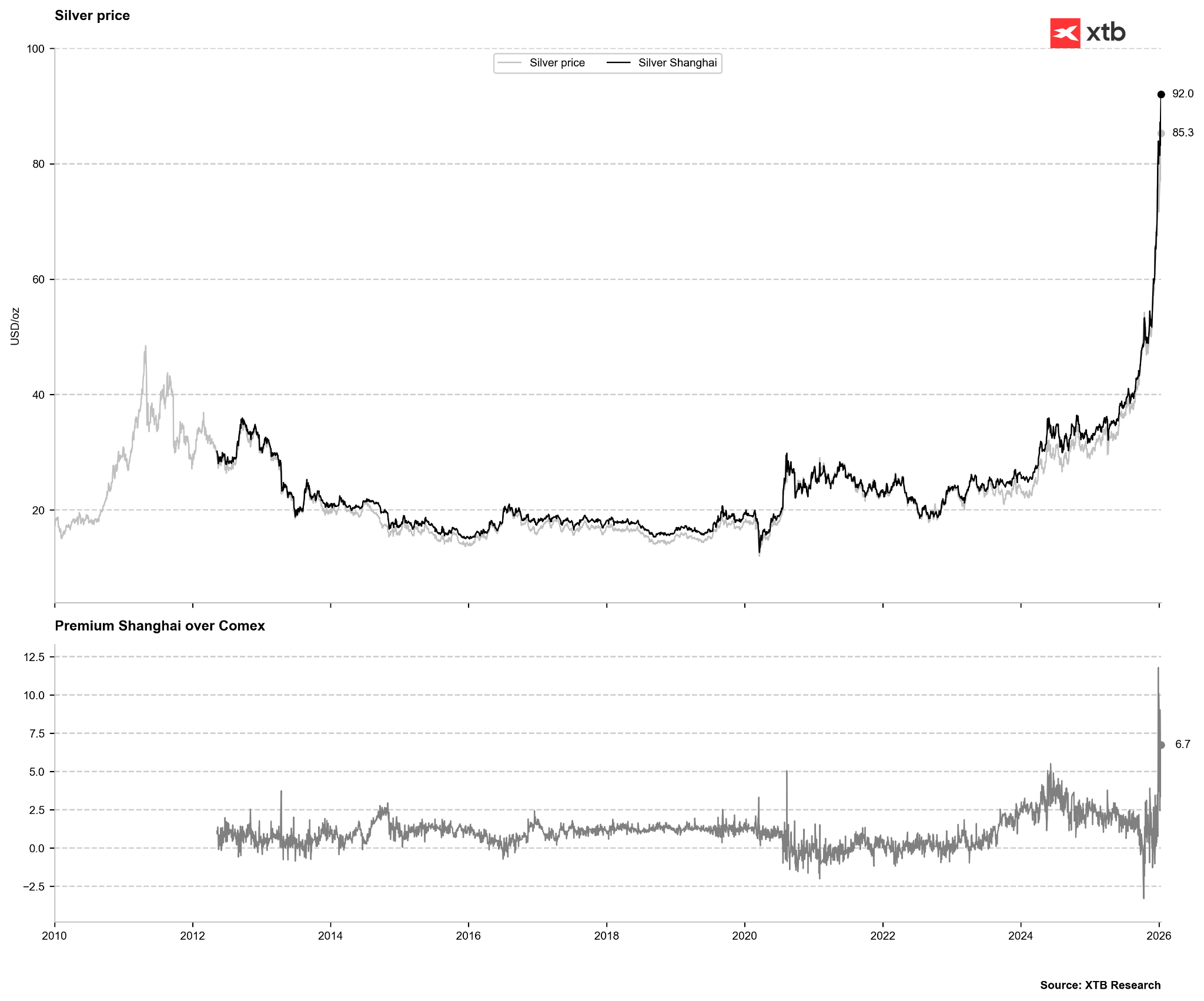

Shanghai Premium: Prices in Shanghai exceeding $90 indicate massive physical demand, pulling global rates higher 📈.

-

Record Valuations: Silver and gold are hitting historic highs due to a weakening dollar 💵 and attacks on the Fed's independence 🏛️.

-

Geopolitical Triggers: Unrest in Iran and Venezuela, along with intervention threats from Donald Trump, are driving "safe haven" demand 🌎.

-

Shanghai Premium: Prices in Shanghai exceeding $90 indicate massive physical demand, pulling global rates higher 📈.

Gold and silver futures have scaled new historic peaks today as the US administration intensifies its pressure on the Federal Reserve. The Department of Justice has launched a criminal investigation into Chair Jerome Powell’s testimony regarding the renovation of the Fed’s historic headquarters. Mr. Powell has categorized the probe as a "pretext" designed to exert political influence and force interest rate cuts. This direct challenge to the central bank’s credibility has triggered a sharp sell-off in the US dollar, providing a powerful tailwind for precious metals.

Geopolitical tensions further bolster the haven bid. Global "flashpoints" remain active, notably in Venezuela and Iran, where reports of large-scale casualties among anti-government protesters have emerged. President Donald Trump has refused to rule out intervention should the violence against protesters continue.

Simultaneously, acute concerns regarding physical metal availability in China are mounting. On the Shanghai Gold Exchange (SGE), silver prices have surged past the $90 per ounce mark.

The China price premium has jumped once again. Source: Bloomberg Finance LP

The China price premium has jumped once again. Source: Bloomberg Finance LP

Notably, earlier fears of a significant drop in COMEX open interest due to commodity index rebalancing have, thus far, failed to materialize. However, investors are closely watching the gold-to-silver ratio, which is currently approaching its historical average of approximately 50-53 points. While the ratio has dipped lower during past precious metal bull markets, mean reversion remains a powerful force. For context, the 10-year moving average of the ratio stands just above 80 points—well above the current 54 points.

Technical Outlook

Silver has decisively broken above the $80 level today, surpassing both its early January peak and the previous all-time high recorded in December. The market is currently testing the $85 region. Support is identified at $84, where price action on the last two candles suggests immediate buying interest. Source: xStation5

Economic Calendar: Quiet Tuesday Highlights Geopolitics and Weekly Oil Stocks (10.03.2026)

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Morning wrap (05.03.2026)

Iran: Situation overview and outlook

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.