TSMC’s results (TSM.US) have reignited Wall Street’s appetite for semiconductor stocks, lifting shares of Nvidia, Broadcom, and less headline-grabbin, but still very large names such as Lam Research (LRCX.US) and Applied Materials (AMAT.US). With revenue at the world’s largest chipmaker growing at a 35% y/y pace, the market is increasingly willing to price in a scenario where further AI-driven investment looks “almost inevitable.”

- This dynamic leads to two parallel narratives. The first is a reassessment of just how large the demand uplift could be across the broader semiconductor complex. The second is investors’ growing willingness to pay—often at record valuations for exposure to companies benefiting from the rally, as seen in memory-boom beneficiaries such as KLA Corp. (KLAC.US).

- KLA shares are rising to fresh all-time highs today. Major US financial institutions have raised their price targets for the stock, including Morgan Stanley and Wells Fargo, while Barclays also delivered a positive view. RBC Capital has initiated coverage of the company.

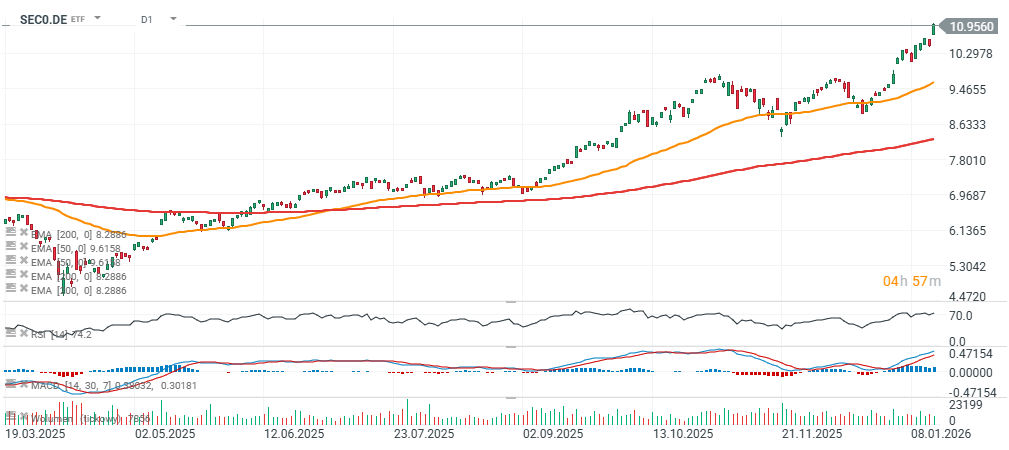

iShares MSCI Global Semiconductors ETF (SEC0.DE), D1 interval

Since April 5, 2025 (the tariff-related sell-off triggered by Trump’s reciprocal duties), the broad index of global semiconductor stocks has surged by roughly 120%.

Source: xStation5

KLA Corp riding the semiconductor bull market

In recent days, KLA Corp. has been one of Wall Street’s standout leaders. The company operates in semiconductor metrology and process control, and it has now moved into the spotlight of the world’s largest financial institutions.

- A wave of upgrades and higher price targets suggests Wall Street increasingly views KLA as one of the biggest potential winners of the next leg of investment in AI infrastructure. The key catalyst has been a shift in the narrative around the memory market (DRAM and NAND), which analysts argue is becoming a critical bottleneck for AI—nearly as important as GPUs and advanced processors themselves.

- The strongest signal came from Morgan Stanley, which upgraded KLA to overweight from equal-weight. The bank argues that the market is still underpricing the company’s exposure to the memory segment, which is returning to the spotlight as AI-driven demand accelerates.

Memory chips are becoming a key constraint on AI’s expansion. In practice, this means that as AI investment grows, it’s not enough to produce more compute chips—massive volumes of modern memory are also required, and performance requirements are rising just as quickly.

In this context, Morgan Stanley points to rising process-control intensity across both DRAM and NAND. The more complex the manufacturing process and the tighter the quality requirements, the more valuable KLA’s tools become—helping fabs reduce defects and improve yield. Morgan Stanley simultaneously lifted its price target for KLAC to $1,697 from $1,214, one of the highest projections among major institutions.

Wells Fargo joins in

Wells Fargo quickly followed, also upgrading KLA from equal-weight to overweight, while raising its price target from $1,250 to $1,600. The move can be read as a confirmation that the market is entering a phase where it’s not just “AI hype” that matters, but tangible capital spending: expanding capacity, modernizing processes, and pushing manufacturing toward more advanced nodes.

In this cycle, companies like KLA occupy a particularly strategic position in the value chain: without process control and metrology, it’s difficult to scale advanced semiconductor production at the quality levels the market demands.

Barclays: AI remains the key driver into 2026—and KLA is a pillar of the theme

Barclays also took a strong stance, raising its price target on KLA to $1,595 from $1,300, while maintaining an overweight rating. According to Barclays, 2026 is set to be another year in which:

-

proximity to the AI theme will be the dominant factor for semiconductor stock performance, and

-

investors will favor companies that are “central to the pillars of AI.”

Barclays highlights an increasingly important market reality: at some point, the narrative of “AI is growing” stops being sufficient, and the key question becomes how much of the opportunity can actually be implemented and monetized in the real economy. In such an environment, investors may prefer companies that aren’t just theoretical beneficiaries, but are genuinely essential to the semiconductor ecosystem. KLA fits that definition by supporting a critical part of the manufacturing process.

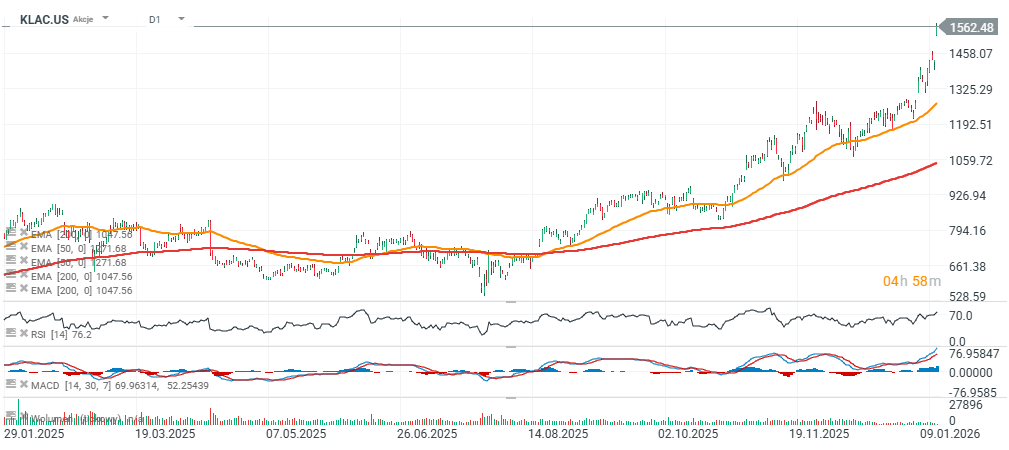

KLA Corp (KLAC.US) chart, D1

Source: xStation5

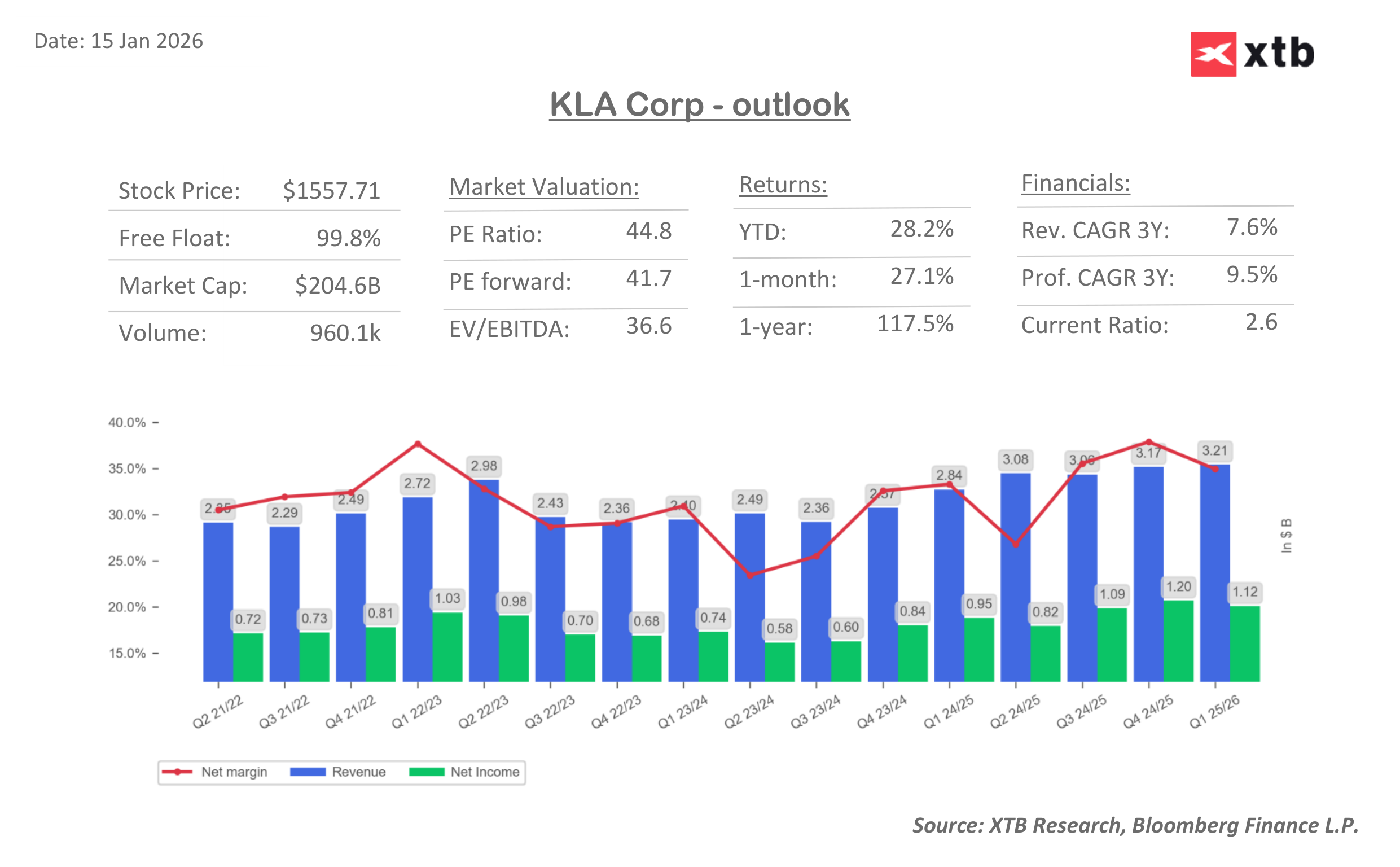

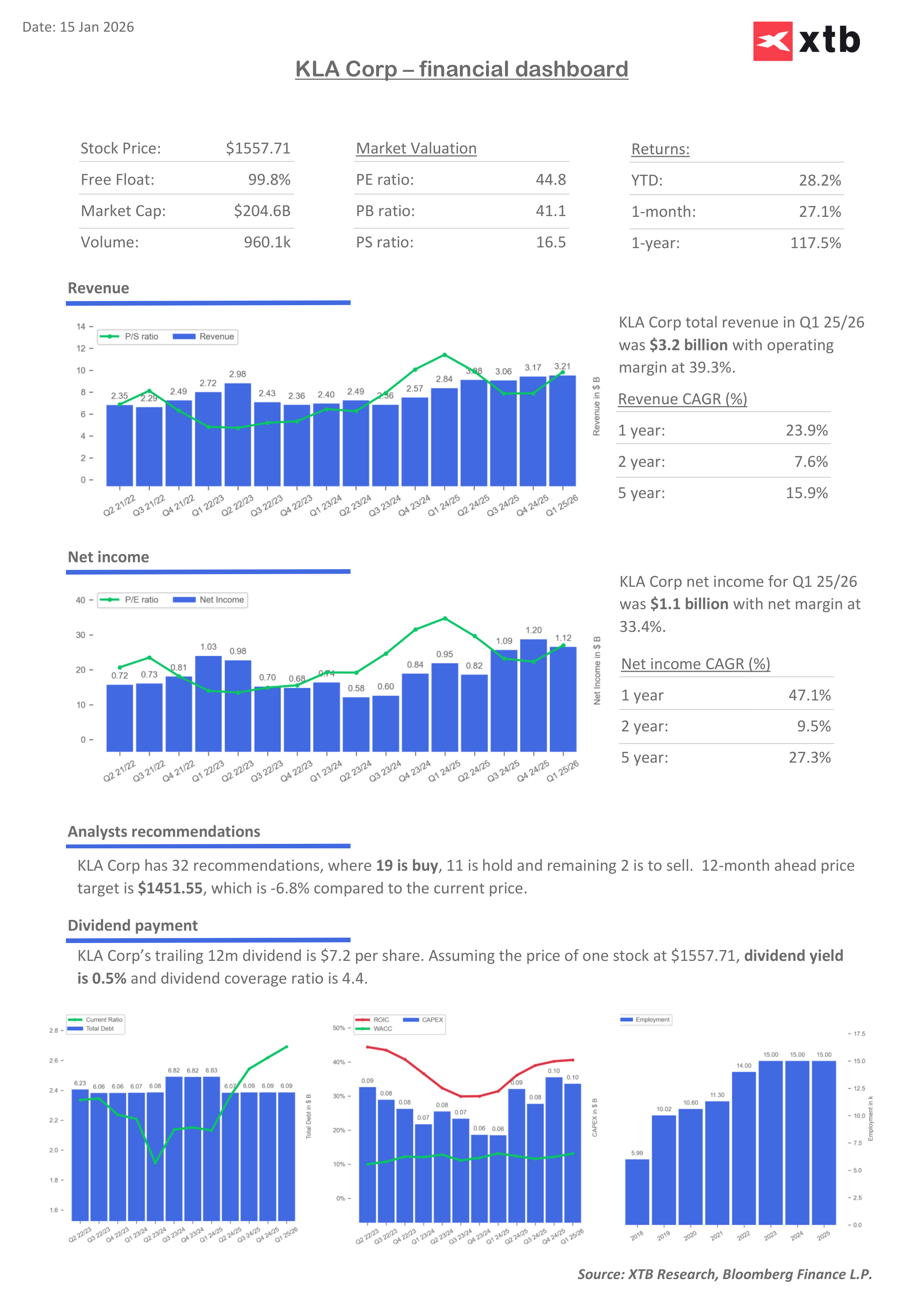

KLA is delivering a solid improvement in profitability and record-high revenues, but it’s hard to argue that this hasn’t come alongside richer valuations. The stock’s price-to-forward 12-month earnings multiple is already around 41, well above the Nasdaq 100 average, while the current P/E is close to 45. The price-to-sales ratio is also at historically elevated levels (though it was even higher at points in 2025). Return on invested capital (ROIC) has been rising since the second half of 2024, although it was higher in 2021–2022. At the same time, the company’s cost of capital (WACC) remains well below ROIC, implying that KLA is still generating real value for shareholders.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Largest in its class: What do BlackRock’s earnings say about the market?

US OPEN: Bank and fund earnings support valuations.

MIDDAY WRAP: Capital flows into European technology stocks 💸🔎

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.