- European stocks rose initially but reduced gains due to investor caution.

- ASML and Louis Vuitton reported strong growth, boosting indices.

- Spain's CPI rose 3% annually, raising concerns about ECB policy.

- French government finds common ground

- BASF with new price target

- European stocks rose initially but reduced gains due to investor caution.

- ASML and Louis Vuitton reported strong growth, boosting indices.

- Spain's CPI rose 3% annually, raising concerns about ECB policy.

- French government finds common ground

- BASF with new price target

European stock markets began Wednesday's session with clear gains, benefiting from positive sentiment from foreign markets and strong company results. Investors reacted optimistically to signals of economic improvement and more relaxed attitudes towards monetary policy. However, as the day progressed, enthusiasm gradually waned, and the main indices reduced some of the earlier gains, suggesting ongoing investor caution. EU50 contracts are up 0,6%.

On the corporate level, attention was primarily drawn to the results of ASML and Louis Vuitton today. Both companies presented solid reports, indicating growth in key business segments, which supported European indices in the first part of the day. Additionally, yesterday's relatively dovish comments from Jerome Powell after the close of the American session eased some market tension, and the positive effect of these comments was fully discounted only this morning. The political crisis in France, which in recent weeks has caused uncertainty among investors, seems to be entering a phase of stabilization after the new prime minister managed to secure support from the Socialist Party.

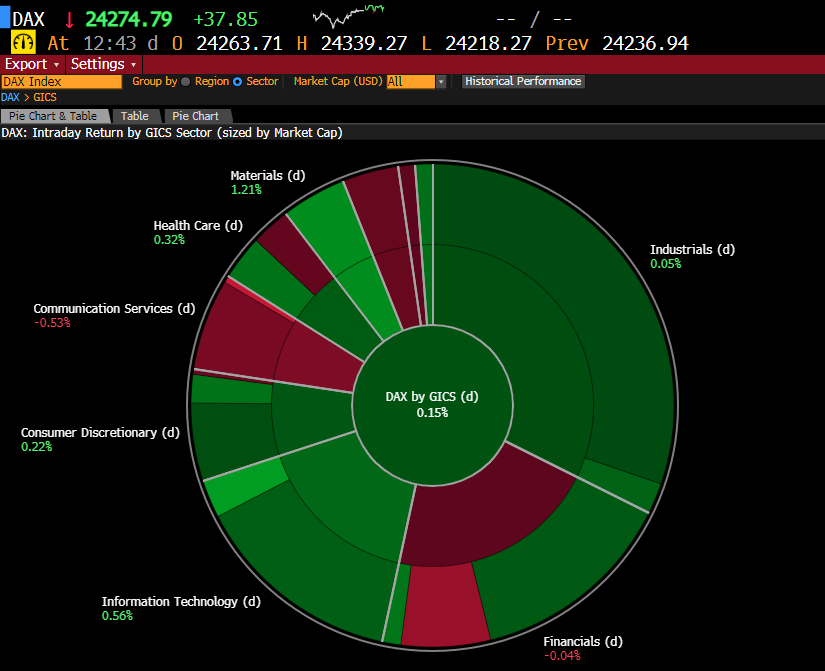

Source: Bloomberg Finance Lp

In the German index, the materials and chemicals segment, as well as IT, lead the gains. Pharmaceuticals and retailers also maintain growth. Media and telecommunications companies are mainly losing.

Macroeconomic Data:

The latest consumer inflation data in Spain has been published. The CPI index rose annually to 3%, while monthly it increased by 0.2%, which turned out to be above market expectations. Such a level of inflation may be concerning from the perspective of price stability and further monetary policy of the European Central Bank, but at the same time, it signals that consumption remains relatively high despite increasing pressure in the labor market.

DE40 (D1)

Source: xStation5

The price is slowly sliding towards support around 24,350 points, marked by recent lows and the long-term trend line. Buyers were unable to defend the FIBO 23.6 level, indicating weak demand. Further declines suggest a likely correction towards strong support at the FIBO 50 level, where the EMA100 average is also located. If buyers want to regain the initiative, they must overcome resistance at 24550 points, which could potentially open the way to another ATH.

Company News:

LVMH (MC.FR) - The fashion and luxury goods giant is up 13% in today's session after publishing phenomenal results. The company beat analyst consensus regarding revenues, recording sales growth with a particular emphasis on a 2% increase in key markets - China.

ASML (ASML.NL) — The Dutch company, a cornerstone of the entire semiconductor market, also published very good results. It did not manage to beat expectations regarding EPS, but revenue estimates were exceeded. The appetite for semiconductors seems insatiable, generating orders worth 5.4 billion euros — which was above expectations. The company is up 3%.

BASF (BAS.DE) - The chemical company is up 1% after City raised the company's target price.

BMW (BMW.DE) — The German automotive giant received a downgraded rating from Jefferies, changing the recommendation to "hold," pointing to Mercedes as a better investment proposition. Movement in the company's valuation remains limited.

Stellantis (STELA.IT) — The automotive conglomerate announced 13 billion investments in the USA to bypass tariffs. The stock price is up over 2%.

Lufthansa (LHA.DE) — Morgan Stanley downgraded the company's recommendation to "underweight," and the company reacts with a price drop of about 0.5%.

IMF raises its global growth outlook, supported by the AI-driven investment boom 🔎

Daily Summary: Powell pulls markets back up! 📈 EURUSD higher

EURUSD higher after Powell's speech! 💶📈

US OPEN: Wall street extends declines! 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.