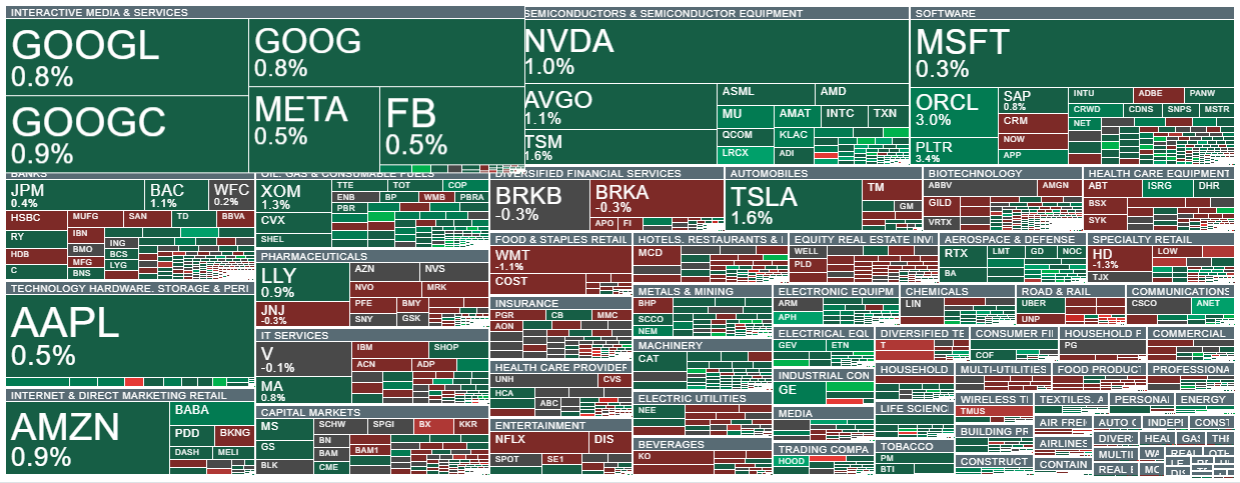

- U.S. equities moved higher again today, with the US100 (Nasdaq 100) gaining nearly 1%, driven by strength in semiconductor and Big Tech stocks.

-

U.S. macro data surprised to the upside: existing home sales matched forecasts, while the Kansas City Fed index came in significantly above expectations.

-

Gold recovered nearly 1%, rebounding from recent losses despite a stronger U.S. dollar index (USDIDX), which rose more than 0.15%.

-

J.P. Morgan analysts expect the Federal Reserve to end its quantitative tightening (QT) program next week, while markets are increasingly pricing in a 25 basis point rate cut.

-

The earnings season has been strong so far, with most companies beating profit and revenue estimates.

-

IBM shares are trading lower after results, while Honeywell is gaining on upbeat performance.

-

Crude oil prices are rising amid new U.S. sanctions on Russia, with Chinese refiners halting seaborne imports of Russian crude.

-

Vladimir Putin commented on the U.S. sanctions, expressing his willingness to continue dialogue and seek a diplomatic path toward peace in Ukraine with President Trump. He added that sanctions will not change the military situation on the front lines.

-

Eurozone consumer sentiment showed a slight improvement compared to the previous reading.

-

In Canada, August retail sales matched forecasts, although core sales (excluding autos) came in below expectations.

- U.S. equities moved higher again today, with the US100 (Nasdaq 100) gaining nearly 1%, driven by strength in semiconductor and Big Tech stocks.

-

U.S. macro data surprised to the upside: existing home sales matched forecasts, while the Kansas City Fed index came in significantly above expectations.

-

Gold recovered nearly 1%, rebounding from recent losses despite a stronger U.S. dollar index (USDIDX), which rose more than 0.15%.

-

J.P. Morgan analysts expect the Federal Reserve to end its quantitative tightening (QT) program next week, while markets are increasingly pricing in a 25 basis point rate cut.

-

The earnings season has been strong so far, with most companies beating profit and revenue estimates.

-

IBM shares are trading lower after results, while Honeywell is gaining on upbeat performance.

-

Crude oil prices are rising amid new U.S. sanctions on Russia, with Chinese refiners halting seaborne imports of Russian crude.

-

Vladimir Putin commented on the U.S. sanctions, expressing his willingness to continue dialogue and seek a diplomatic path toward peace in Ukraine with President Trump. He added that sanctions will not change the military situation on the front lines.

-

Eurozone consumer sentiment showed a slight improvement compared to the previous reading.

-

In Canada, August retail sales matched forecasts, although core sales (excluding autos) came in below expectations.

- European stocks advanced on Thursday. Germany’s DAX and France’s CAC40 each gained over 0.2%, while the UK’s FTSE 100 climbed more than 0.6%. London Stock Exchange Group shares jumped over 6% following strong Q3 results and the announcement of a new share buyback program. Unilever shares also rose after the company reported a nearly 4% year-over-year increase in sales, while Germany’s defense company MTU Aero gained on earnings.

- U.S. equities are trading higher today amid renewed optimism toward Big Tech, semiconductor stocks, and energy companies, which are benefiting from the recent rise in oil prices. As a result, the Nasdaq 100 is up over 0.9%, while the Dow Jones Industrial Average (DJIA) advances more than 0.3%.

- STMicroelectronics shares are the only major semiconductor stock declining, falling more than 14% after earnings. IBM is also under pressure after its growth pace disappointed investors. In contrast, Honeywell and Dow Inc. shares are gaining following stronger-than-expected results.

- The Kansas Fed Composite Index came in at 6 points, beating expectations of 2 and above the previous reading of 4. The Manufacturing benchmark rose sharply to 15 points from 4, signaling improving industrial activity.

- China’s state-owned refiners — PetroChina, Sinopec, CNOOC, and Zhenhua — have halted contracting new seaborne oil supplies from Russia. According to preliminary media reports, India is also reducing imports of Russian energy commodities.

- According to EIA data, natural gas inventories rose by 87 billion cubic feet (bcf) versus 84 bcf expected and 80 bcf previously. The report indicates rising production and a potential decline in demand, despite the start of the U.S. heating season.

- Vladimir Putin stated he still intends to meet with Donald Trump, emphasizing that Trump had not canceled but merely postponed the planned meeting with the Russian president. Putin warned that Ukrainian attacks deep inside Russia would lead to conflict escalation and trigger a strong, proportional response from Moscow.

- Shares of Argentine lender Banco Macro are up over 5%, extending gains after the U.S. Treasury Department reaffirmed its support for Argentina. Market optimism is also building ahead of the October 26 presidential election. A potential victory for Javier Milei could reinforce the positive sentiment in Argentine equities, which had recently declined following local election losses.

The energy and semiconductor sectors are today’s top performers in the U.S. market, while STMicroelectronics and Blackstone rank among the weakest large-cap stocks.

Source: xStation5

🔝US500 is 0.25% off its highs before CPI

BREAKING: EURGBP muted despite solid PMI data from the UK 🔎

Strong PMI from Germany, mixed data from France. Euro gains 🔎

Economic calendar: Delayed US CPI report due Today 📌

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.