-

Cocoa bean exports from the Ivory Coast fell 31% year-over-year between October 1 and 19.

-

Cocoa futures recently hit 20-month lows.

-

Cocoa grinding data show a 17% year-over-year decline in Asia (the lowest level in 9 years) and an almost 5% year-over-year drop in Europe (the lowest in 10 years).

-

The North American grind report surprised with a year-over-year increase of more than 3%.

-

Cocoa prices are attempting to rebound from multi-month lows despite negative fundamental news.

-

Production in the 2025/2026 harvest season is expected to increase.

-

Cocoa bean exports from the Ivory Coast fell 31% year-over-year between October 1 and 19.

-

Cocoa futures recently hit 20-month lows.

-

Cocoa grinding data show a 17% year-over-year decline in Asia (the lowest level in 9 years) and an almost 5% year-over-year drop in Europe (the lowest in 10 years).

-

The North American grind report surprised with a year-over-year increase of more than 3%.

-

Cocoa prices are attempting to rebound from multi-month lows despite negative fundamental news.

-

Production in the 2025/2026 harvest season is expected to increase.

Cocoa (COCOA) is attempting to recover after a major sell-off that pushed the ICE contract below $6,000 per ton. The market’s biggest concern right now lies in the weak cocoa grind data from Asia and Europe (down by more than 17% and 4.8%, respectively), which indicates potential demand-side problems. On the other hand, data from North America showed an unexpected year-over-year increase of 3.2%, reaching almost 112.8 thousand metric tons.

Apart from the U.S. grind report—which initially had little market impact—the recent price rebound can be partly attributed to short covering, following signs of a slowdown in cocoa exports from the Ivory Coast, the world’s largest cocoa producer.

According to government data released on Monday, Ivory Coast farmers shipped 133,209 metric tons of cocoa from ports between October 1 and 19 of the new season, representing a 31% decline compared with 192,804 tons in the same period last year.

COCOA (D1 timeframe)

Grinding data suggest that the number of global buyers has fallen amid the parabolic price rally, which has sharply increased chocolate and derivative product prices. Meanwhile, the harvest season in West Africa has begun fairly successfully, and total yields are expected to rise significantly year-over-year.

Additionally, the governments of Ivory Coast and Ghana have recently raised the prices paid to farmers for cocoa beans, which should stimulate sales and boost supply. The RSI indicator on the hourly chart remains below 30, reflecting market pessimism about a medium-term price recovery. At the same time, much of the negative news for prices seems already priced in, while several potentially supportive factors—such as the decline in Ivorian exports and higher North American grindings—could offer a temporary balance.

Source: xStation5

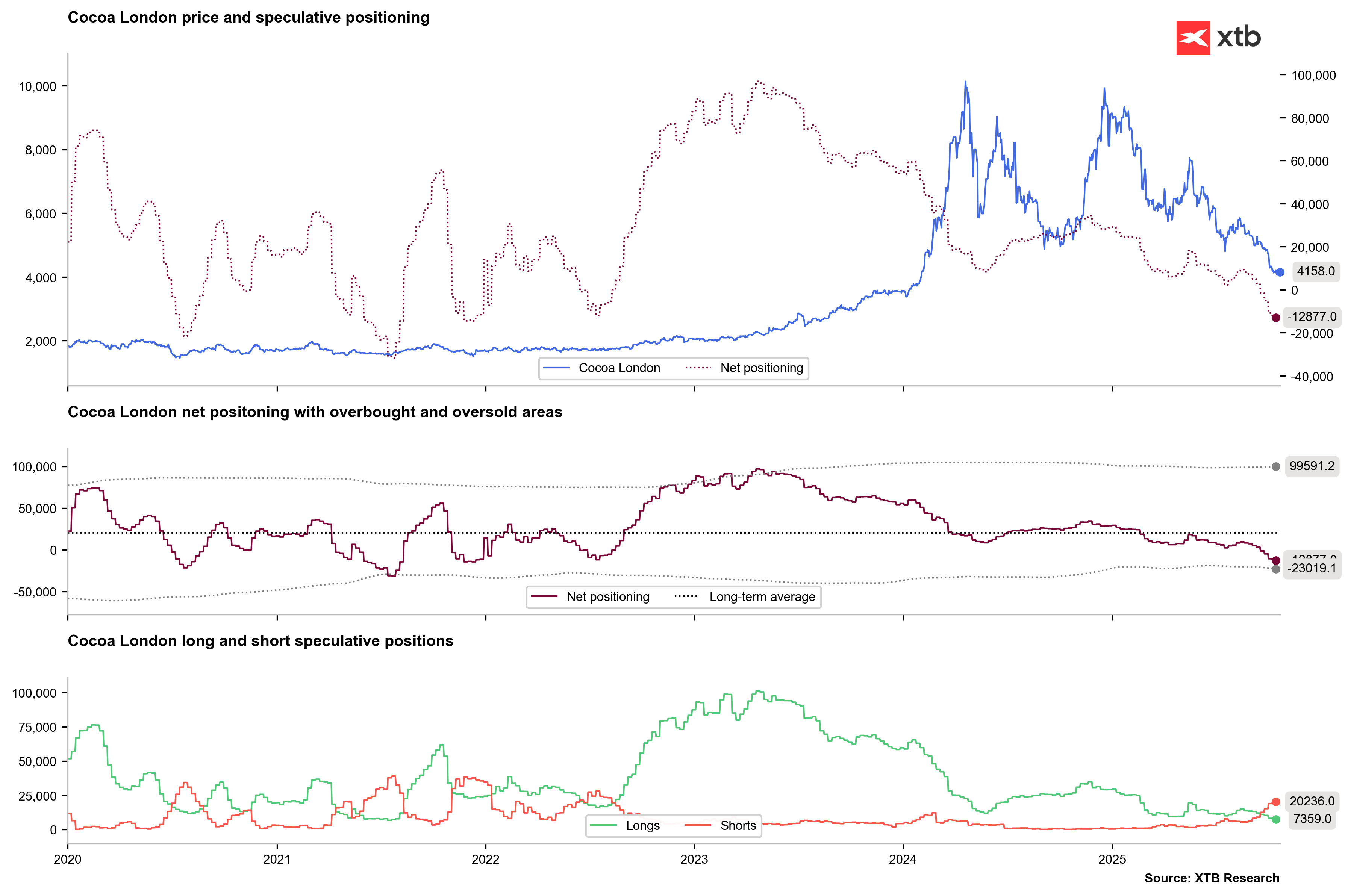

Looking at speculative fund positioning, data indicate that speculators have built their largest short position since autumn 2023; net positioning has fallen to levels signaling a “market oversold” condition.

Source: XTB Research, ICE Europe

Netflix disappoints with Q3 2025 results. Shares drop over 5% in after-hours trading!

Daily summary: Markets on Hold Ahead of Netflix Earnings

OpenAI threatens Google’s dominance. Alphabet shares under pressure.

UnitedHealth Invests in AI. Stock Price on the Rise!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.