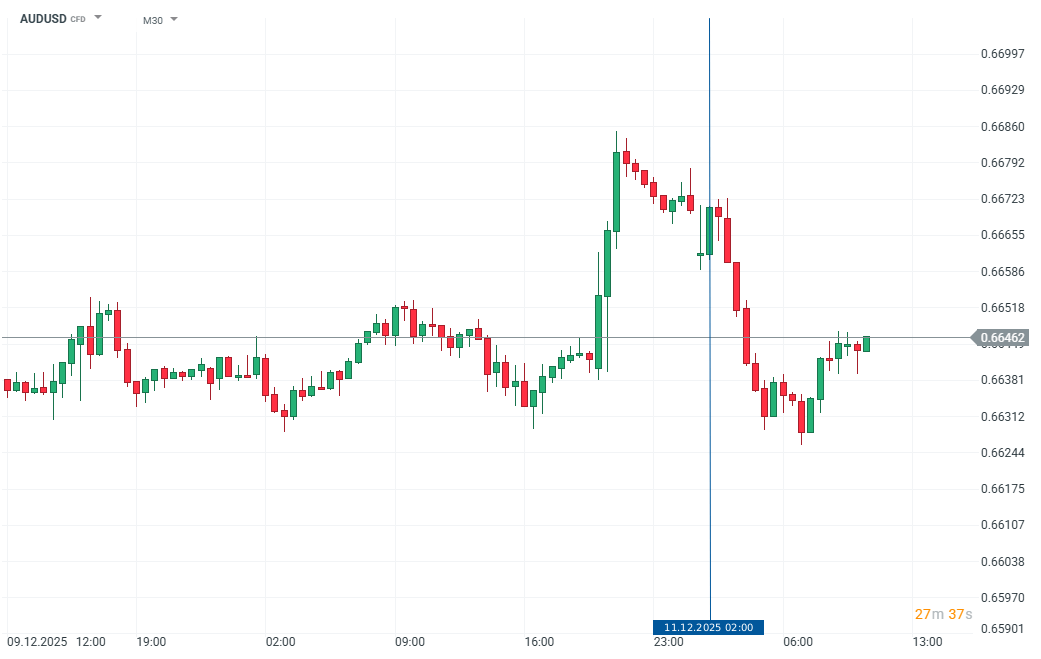

The Australian labor-market report for November came in weaker than expected. As a result, the FX market saw a significant selloff in the Australian dollar, which is currently down between 0.30–0.60% against other G10 currencies.

Employment unexpectedly fell by 21.3K — the largest monthly decline in nine months. The stabilization of the unemployment rate at 4.3% did not calm the market, because the data composition was weak: full-time employment collapsed by 56.5K, participation dropped to 66.7%, and underemployment rose to 6.2%, the highest level in more than a year. The simultaneous decline in both the employed and unemployed populations suggested that some people are leaving the labor force, reinforcing the narrative of a cooling — though not collapsing — labor market. These factors left the AUD under moderate pressure despite a weaker USD following yesterday’s 25 bp Fed rate cut.

Despite this weakness, the downside potential for AUD remains partly limited by the still-hawkish stance of the RBA. Governor Michele Bullock reminded this week that the Board actively discussed scenarios requiring a rate hike, stressing that “it is wrong to assume” the RBA is unwilling to tighten policy if inflation remains sticky. Economists broadly agree that the labor market is loosening gradually, while labor costs, rebounding inflation, and persistently high capacity utilization remain areas of concern for the Bank. As a result, the market does not expect rate cuts, and part of the market even sees a risk of a hike in 2026 if inflation accelerates again. For now, the mixed labor-market data complicate the short-term outlook but do not fundamentally alter the RBA’s stance.

AUDUSD has fallen 0.40% to 0.6645, erasing part of Wednesday’s gains triggered by the Fed decision.

Three Markets to Watch Next Week (12.12.2025)

Rivian Automotive: Rising star or a meteorite?

Technology companies declines 📉🖥️

🔝Silver Jumps 10% Weekly, up 120% YTD

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.