08:50 AM BST, France - PMI Data for December:

- HCOB France Manufacturing PMI: actual 50.7; forecast 50.6; previous 47.8;

08:55 AM BST, Germany - PMI Data for December:

- HCOB Germany Manufacturing PMI: actual 47.0; forecast 47.7; previous 48.2;

09:00 AM BST, Euro Zone - PMI Data for December:

- HCOB Eurozone Manufacturing PMI: actual 48.8; forecast 49.2; previous 49.6;

The euro area PMI weakened stronger than expected as production fell for the first time from Februrary 2025, driven by a sharp deterioration in demand, especially exports. New orders declined faster, prompting deeper cuts to purchasing, inventories and employment. Supply chains tightened and input costs rose, yet firms kept discounting prices. Despite current weakness, business optimism jumped to multi-year highs.

Contrasting changes in France and Germany

France was one of the bright spots of the report, with its PMI rebound driven by a sharp pickup in export demand, helping stabilise output and soften the decline in overall orders. Employment returned to growth, inventories were run down, and purchasing cuts eased. Cost pressures moderated, enabling modest price rises, while domestic demand and political uncertainty capped confidence

Germany’s PMI fell as demand weakened further, led by a sharp acceleration in export order declines. Output slipped after a long expansion, prompting deeper cuts to jobs, purchasing and inventories. Supply bottlenecks and rising input costs added pressure, while intense competition forced further price discounting despite higher costs.

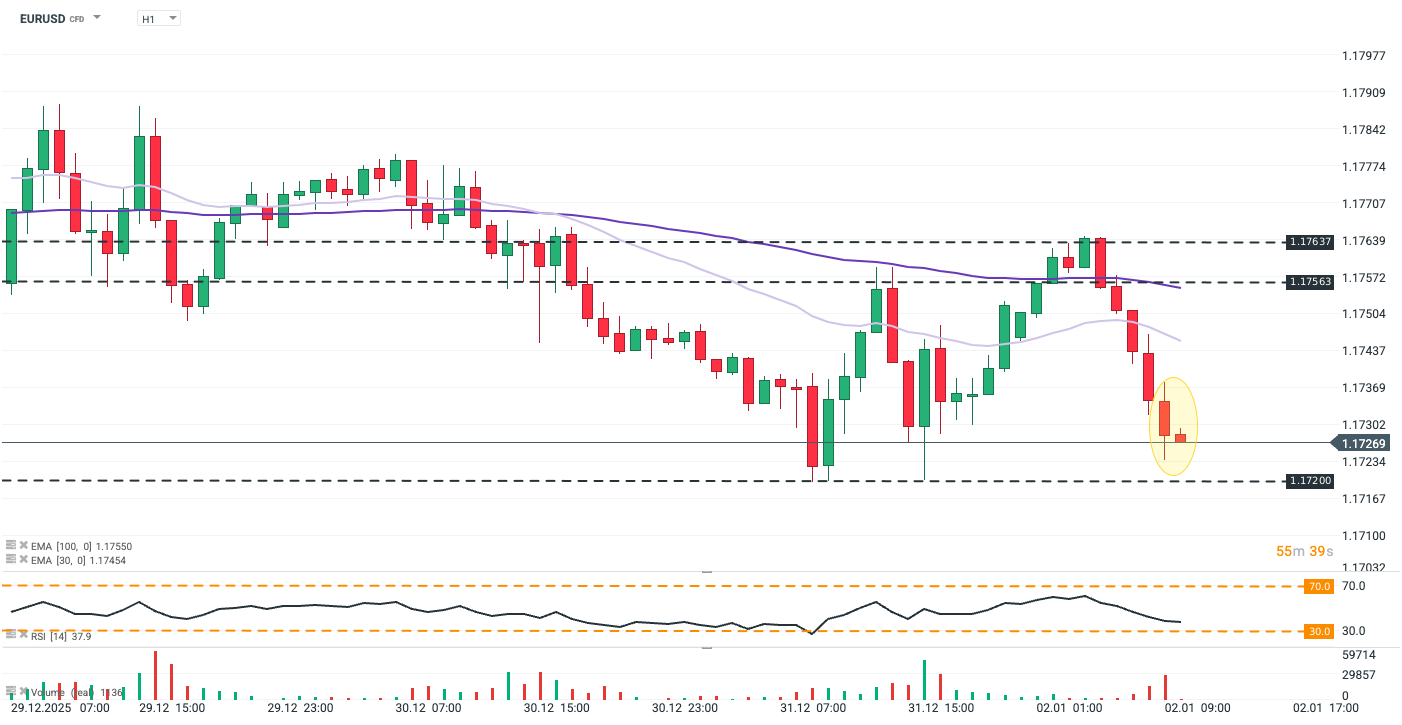

EURUSD (D1)

EURUSD extended its losses following the data release after earlier failing near key resistance around 1.1765. The pair has fallen roughly 0.5% over the past week, reflecting broader dollar strength amid more restrained US rate-cut expectations for Q1 2026. Immediate support sits near 1.1720, while a near-oversold RSI (approaching 30) should spark caution before chasing further downside.

Source: xStation5

Wall Street kicks off 2026 in the green 🗽US100 jumps 1%

BREAKING: S&P Manufacturing PMI data from the UK weaker than expected

Economic calendar: Markets await final US manufacturing PMI data🔎

Technical Analysis - GOLD (02.01.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.