- Bitcoin remains in consolidation after a >30% Q4 correction, with risk-off sentiment and equity correlation limiting upside.

- Focus has shifted to Davos, where U.S. crypto regulation — especially the CLARITY Act — is under intense debate.

- Coinbase’s withdrawal of support has delayed legislation, but talks continue and a revised bill is still expected.

- Bitcoin remains in consolidation after a >30% Q4 correction, with risk-off sentiment and equity correlation limiting upside.

- Focus has shifted to Davos, where U.S. crypto regulation — especially the CLARITY Act — is under intense debate.

- Coinbase’s withdrawal of support has delayed legislation, but talks continue and a revised bill is still expected.

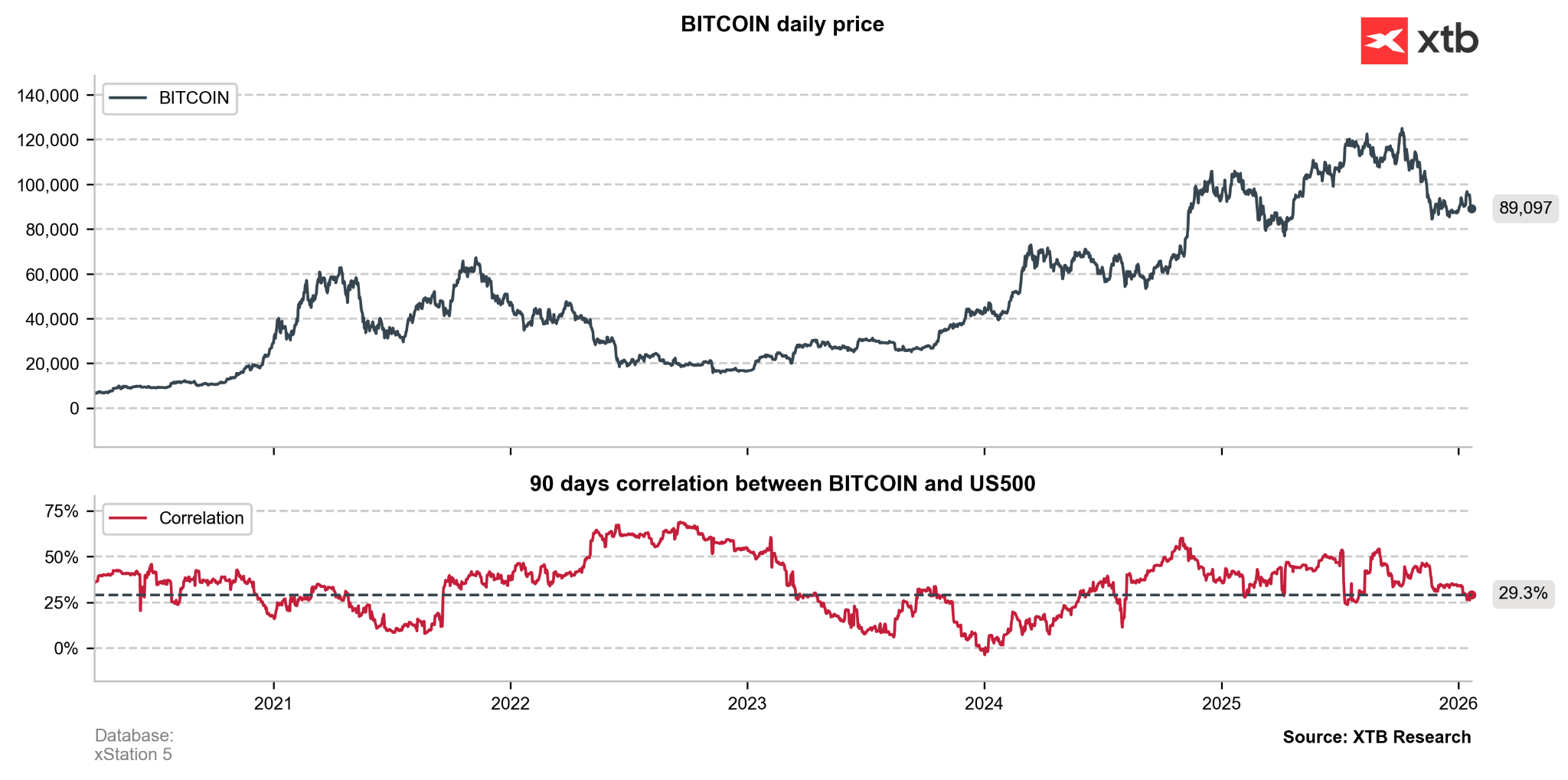

Bitcoin has been going through a difficult period recently. After a correction of more than 30% in Q4 2025, the world’s largest cryptocurrency has remained in consolidation. In recent weeks, Bitcoin even attempted to break higher from this range, but rising international tensions led to a reduction in investors’ risk appetite, pushing Bitcoin back below USD 90,000.

Bitcoin remains more strongly correlated with the US500 index than with gold. The decline in risk appetite is also weighing on demand for cryptocurrencies more broadly.

Market attention has now shifted to Davos, where cryptocurrency regulation—particularly the US CLARITY Act—has become one of the key topics of discussion among policymakers, banks, and leaders from the crypto industry.

Coinbase CEO Brian Armstrong used the opportunity to openly criticize the current version of the CLARITY Act (Crypto Market Structure Act), arguing that it overly favors the traditional financial sector and risks stifling innovation. Coinbase has withdrawn its support for the bill, as it expands the powers of the SEC, restricts DeFi, slows tokenization, and effectively bans interest payments on stablecoins. Armstrong’s stance—“no bill is better than a bad bill”—surprised lawmakers and parts of the industry, leading to delays in the Senate Banking Committee’s work and backlash from some policymakers. At the same time, Armstrong emphasized that discussions remain constructive, the White House is engaged, and a revised bill—more clearly delineating the responsibilities of the SEC and the CFTC—remains likely. Importantly, Davos also highlighted growing institutional acceptance of cryptocurrencies, with major banks and exchanges openly discussing asset tokenization and 24/7 blockchain-based markets, underscoring why clear regulation is now seen as urgent.

Estimated next steps for the CLARITY Act:

- The Senate Banking Committee is expected to review the bill after the legislative pause, addressing the scope of SEC authority, rules on stablecoin yields, and DeFi regulation.

- Continued bipartisan negotiations, with rising pressure from the industry to reach a compromise before legislative momentum fades.

- A possible reintroduction of a revised version of the bill later this month or early next month, featuring a clearer division of responsibilities between the SEC and the CFTC.

Bitcoin is rebounding today by 1.20% to USD 89,300 after yesterday’s nearly 5.00% correction to around USD 88,000.

Source: xStation 5

Daily Summary: Trump signals restraint over Greenland, easing market jitters

⏫US500 climbs over 1%

US OPEN: Trump pivot lifts Wall Street sentiment

Market Wrap: Wall Street and Europe lose ground; markets await Trump in Davos🛣️

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.