- Markets expect revenues of approximately $2.26 billion (+25% YoY) and EPS of around $0.72.

- The AI Networking segment and hyperscale data centers remain the main growth drivers, accounting for ~65% of sales.

- Investors will closely watch management commentary on demand, cost pressures, and margins in the coming quarters.

- Markets expect revenues of approximately $2.26 billion (+25% YoY) and EPS of around $0.72.

- The AI Networking segment and hyperscale data centers remain the main growth drivers, accounting for ~65% of sales.

- Investors will closely watch management commentary on demand, cost pressures, and margins in the coming quarters.

Arista Networks is publishing its third-quarter 2025 results after today’s session, and expectations for the report are high. Strong demand for networking solutions for artificial intelligence (AI) infrastructure and hyperscale data centers is driving the company’s dynamic revenue growth. Arista is recognized as a key player in delivering advanced networking technologies, which allows it to maintain a leading position in the AI Networking sector.

Key Financial Data

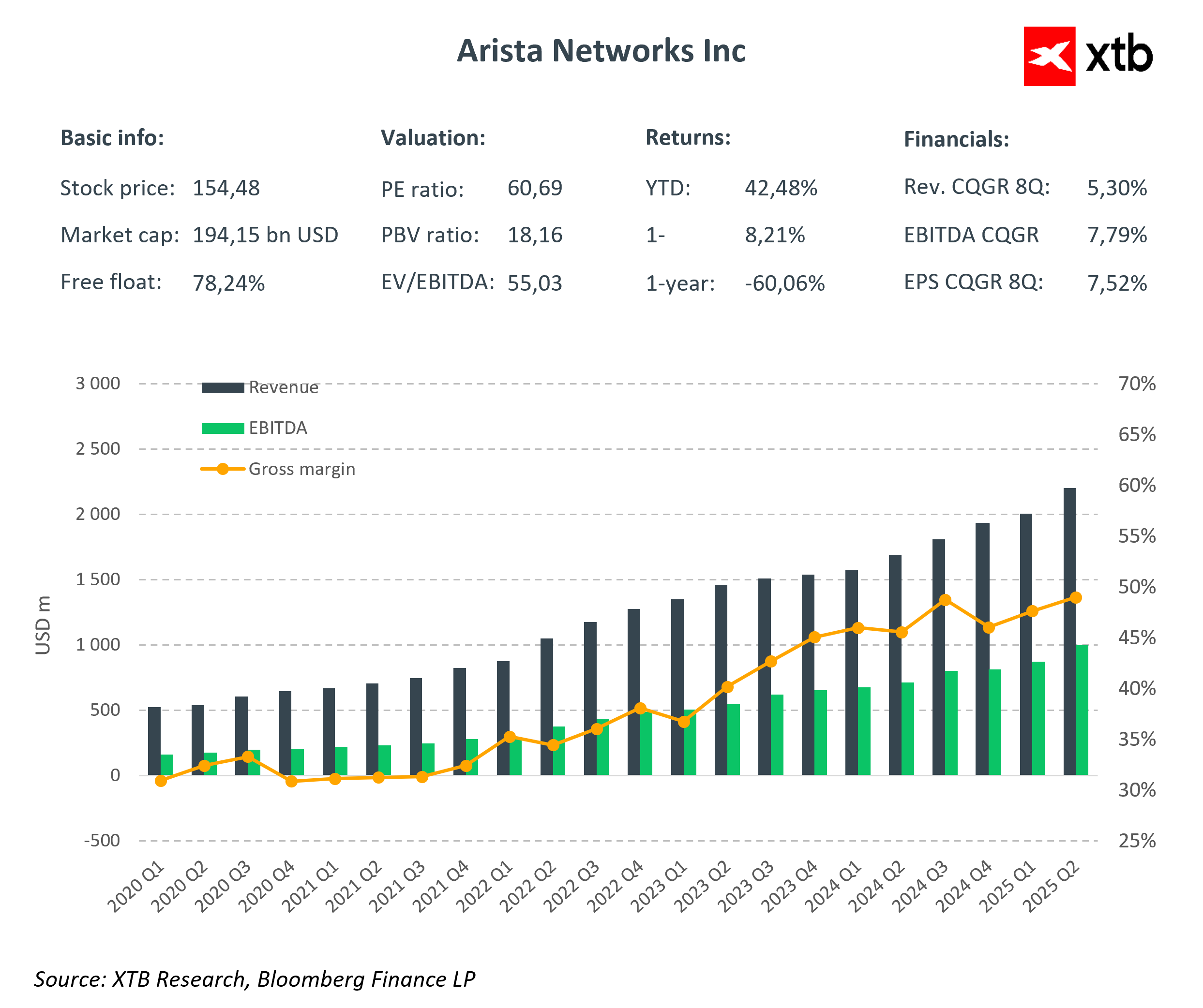

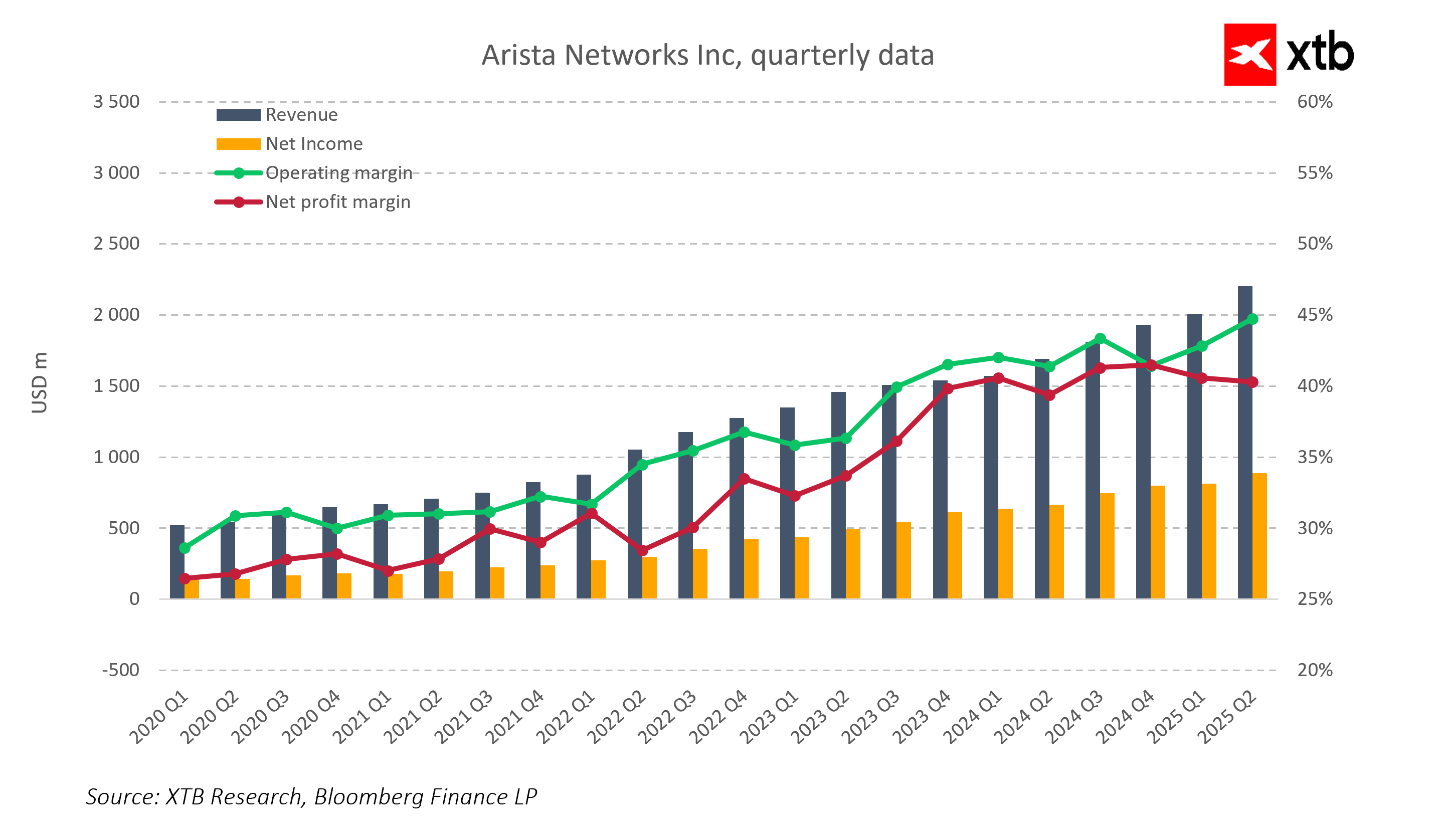

The market consensus indicates that Arista Networks’ Q3 2025 results should show continued solid revenue growth and sustained high profitability.

-

Q3 2025 revenues: $2.26–2.3 billion, representing approximately 25% year-over-year growth.

-

Product revenues: around $1.9 billion.

-

Service revenues: approximately $347 million.

-

Earnings per share (EPS): approximately $0.72, up more than 13% year-over-year.

-

Gross margin: estimated at 64.2%, slightly lower than the previous quarter.

-

Operating margin: around 47.5%, confirming continued strong profitability.

Q4 2025 forecasts:

-

Revenues: $2.33 billion

-

Gross margin: 63.2%

AI and Data Centers as the Main Growth Driver

The AI Networking segment and hyperscale data centers are currently Arista’s most important revenue sources, accounting for roughly 65% of total sales. Demand for ultra-high-speed Ethernet switches, including 100G, 400G, and 800G, continues to grow. Arista’s solutions support key clients such as Amazon, Google, Microsoft, Meta, and Oracle, providing reliable large-scale AI infrastructure. Estimates suggest that Arista’s AI-related revenues could reach $1.5 billion in 2025, and the further development of new scale-up networking technologies could become a significant revenue source from 2027 onwards.

Strong Profitability and Operational Stability

Despite cost pressures and supply chain challenges, Arista maintains one of the highest profitabilities in the industry. Operating margins remain near 47%, and cash flows from operations are strong. Service revenues provide additional financial stability and strengthen customer relationships, allowing the company to remain flexible in a competitive environment.

Outlook and Risks

Despite strong demand, Arista’s management has not raised its 2026 guidance following the September Investor Day. Market participants will closely monitor management’s commentary on optical component costs, pricing pressure from hyperscalers, and the potential for further margin expansion in a competitive environment. Key risks also include revenue concentration among a few large clients and the cyclical nature of investments in the data center sector.

Market Assessment

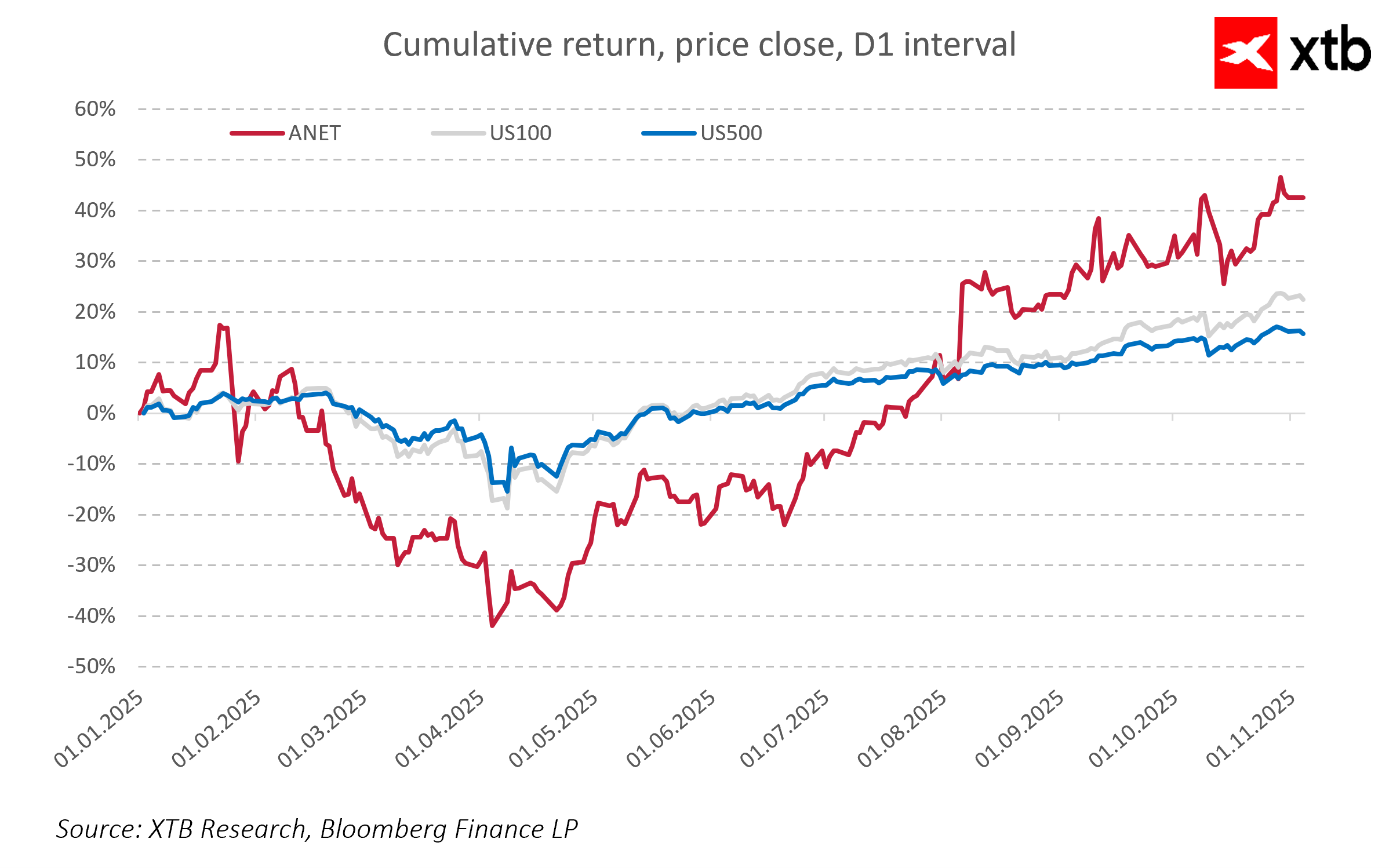

Over the past 12 months, Arista Networks’ share price has increased by approximately 40%, reflecting high market expectations for continued expansion in the AI segment. A key factor influencing investor reactions following the results will be the tone of guidance for upcoming quarters and the demand trends in AI Networking.

Summary

Arista Networks enters the year-end with a strong financial position, stable margins, and a growing presence in the AI market. The company continues to build a competitive advantage through innovative networking technologies, advanced software, and partnerships with major hyperscalers. Today’s quarterly report is expected to confirm that Arista remains one of the main beneficiaries of AI and cloud infrastructure growth, maintaining solid potential for further revenue and margin expansion in the coming quarters.

BREAKING: France's industrial production exceeds expectations!

Economic calendar: Key Macroeconomic Data from Europe and the US in Focus for Markets (05.11.2025)

BoJ minutes 🚩USDJPY tries to recover

Morning Wrap (05.11.2025)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.