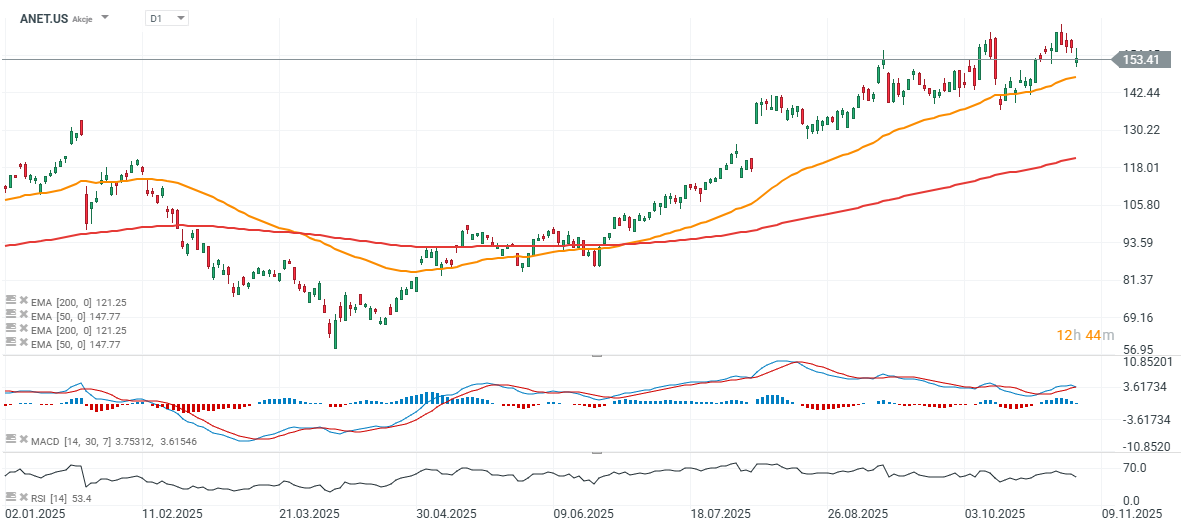

Despite stronger-than-expected revenue and profit in Q3 2025, shares of Arista Networks (ANET.US) — a leader in network switches and software for data centers — fell roughly 12% in the initial market reaction. Below are the key highlights from Arista’s third-quarter 2025 report. Year-to-date, the stock remains up over 40%, having rebounded nearly 60% since its April low. The decline reflects the company’s cautious and broadly in-line guidance for the current quarter and slightly lower margin outlook.

Strong Quarterly Results

-

Adjusted EPS: $0.75 vs. $0.71 expected (+25% YoY).

-

Revenue: $2.31 billion vs. $2.27 billion consensus, up 27.5% YoY.

Margins and Profitability

-

Non-GAAP gross margin: 65.2%, about 1 percentage point above forecasts.

-

Net income: $962 million, roughly 42% of revenue.

-

Cash and investments: $10.1 billion.

Business Momentum

-

Continued strength in cloud and AI networking, supported by partnerships with NVIDIA and OpenAI.

-

New product launches and geographic expansion reinforce Arista’s position as a key player in high-performance data-center infrastructure.

Outlook

-

Q4 revenue: $2.3–$2.4 billion (midpoint $2.35B vs. $2.33B expected).

-

Gross margin: 62–63%, slightly below the previous quarter.

-

FY 2025 revenue: around $8.87 billion (+26–27% YoY);

long-term target of $10.65 billion by 2026.

Management Commentary

-

CEO Jayshree Ullal highlighted strong execution and growing adoption of Arista’s “center-to-cloud” and AI-driven networking vision.

-

CTO Ken Duda emphasized the performance edge of Arista’s hardware in handling AI workloads.

Risks and Watchpoints

-

Component supply volatility could delay shipments.

-

Rising competition in AI and cloud networking segments.

-

Margins sensitive to product mix and broader macroeconomic softness.

Arista once again delivered a strong quarter, beating expectations on both the top and bottom lines. However, a softer margin outlook, in-line revenue guidance, and a broader tech-sector pullback prompted short-term profit-taking. Long term, Arista remains well positioned to capitalize on growing demand for AI-driven and cloud-based networking solutions.

Source: xStation5

Analyst Call Summary

Demand vs. Supply

-

Demand far exceeds supply, with shipments constrained by component availability (38–52 weeks lead time). This created temporary bottlenecks in quarterly results and led to a cautious tone in guidance.

Blue Box

-

A hybrid solution positioned between commodity whitebox systems and full Arista EOS platforms.

-

Lower margins than EOS products; expected to remain niche in 2026 (single-digit number of customers) but strategically vital for scale-up use cases.

Front-End ↔ Back-End

-

Ongoing convergence (currently 800G, moving toward 1.6T).

-

Arista stresses that servicing both layers represents a unique competitive advantage that is hard to replicate.

Product, Technology & Partnerships

-

EtherLink / ESUN / UEC: development of Ethernet Scale-Up Networking standards for AI workloads.

-

AVA (Autonomous Virtual Assist) and NetDL: leveraging AI to design, operate, and optimize networks.

-

Broad ecosystem partnerships with NVIDIA, AMD, Broadcom, OpenAI, Anthropic, Oracle Accelerate, and others.

Financial Highlights & Guidance

-

Q3: non-GAAP gross margin 65.2% (favorable mix + inventory);

net income 41.7% of sales; operating expenses 16.6% of revenue. -

Cash/investments: $10.1B; strong cash flow of ~$1.3B.

-

Purchase commitments: increased to $7B (from $5.7B) to support longer lead times and new products.

-

Deferred revenue: $4.7B; volatile due to acceptance clauses in AI contracts.

-

Q4 guidance: revenue $2.3–$2.4B; GM 62–63%; OM 47–48%; ETR ~21.5%.

-

FY 2025: growth 26–27% (~$8.87B); GM ~64%; campus $750–800M; AI ≥ $1.5B.

-

FY 2026: revenue ~$10.65B (+20% YoY); GM 62–64%; OM 43–45% (lower due to strategic investments).

Management Narrative & Takeaways

-

The company rejects the “deceleration” label, attributing fluctuations to shipment timing, not demand.

-

Product margins dip below 60% amid a heavier cloud/AI mix; software/services less profitable than some analysts expected.

-

Arista maintains a partner-led model (cabling, power, cooling, XPU integration); some sales may use JDM/Blue Box arrangements.

-

Management expects scaling to become easier after 2026–2027.

-

No visible threat from NVIDIA’s networking division in Arista’s core markets.

Bottom line: Demand driven by AI remains at record highs, but longer lead times and the AI/cloud mix are slightly compressing margins. The Blue Box strategy represents a calculated trade-off with strong long-term scale-up potential. The front/back convergence trend continues to play in Arista’s favor thanks to its comprehensive stack (hardware + EOS + software tools).

Guidance for 2025–2026 remains solid though cautious, reflecting deferred customer acceptances in AI-driven projects.

DE40: European stocks under tech pressure

Economic calendar: Key Macroeconomic Data from Europe and the US in Focus for Markets (05.11.2025)

Morning Wrap (05.11.2025)

🚀 AMD Confirms AI Thesis with Strong Results and Confident Guidance

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.