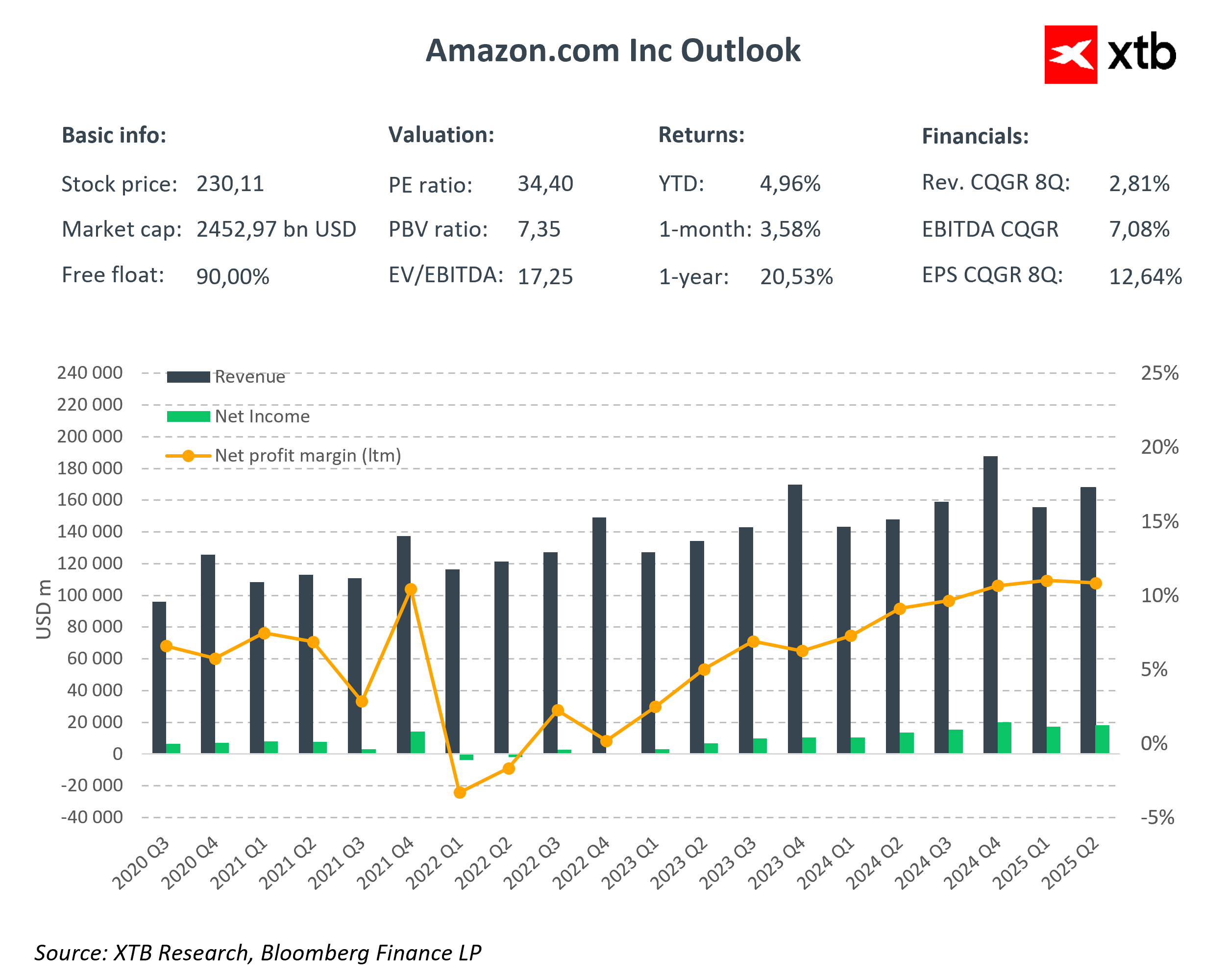

Amazon (AMZN.US) will report its Q3 2025 earnings today after the U.S. market close. Investors expect another solid quarter, though there is uncertainty surrounding the pace of cloud growth and the company’s positioning in AI. Consensus forecasts call for $177.8 billion in revenue and EPS of $1.58, up 12% and 10% y/y, respectively. This represents steady growth, though clearly slower than during the pandemic years.

The main focus will be on AWS, Amazon’s current profit engine. Although it accounts for only about 20% of total revenue, it generates around 40% of operating income. AWS’s operating margin fell last quarter from 36% to 33%, and its market share declined by roughly 2% in favor of Microsoft Azure and Google Cloud. Any sign of margin recovery or changes in AI-related market share will be crucial for sentiment.

Key expectations

- Revenue: $177.8B (+12% y/y)

- AWS revenue: $32.3B (+18% y/y)

- Advertising services: $17.3B (+21% y/y)

- Online store: $66.5B (+8% y/y)

- Third-party seller services: $41.9B (+11% y/y)

- EPS: $1.57–$1.58 (+10% y/y)

- Operating income: $23.7B (+4% y/y)

AI ambitions under scrutiny

Artificial intelligence remains the key growth driver for the entire tech sector. Investors expect management to explain how record-high capital expenditures will translate into future revenue growth. Currently, high CAPEX is weighing on free cash flow. Recent comments from Jeff Bezos emphasize that AI is the company’s “top priority,” spanning everything from logistics and automation to personalized shopping experiences.

Amazon’s stock remains below its all-time highs, unlike other Big Tech peers such as Apple, Microsoft, Alphabet, and Nvidia. Given the strong results from Microsoft and Alphabet yesterday, investors are likely to scrutinize Amazon’s report even more closely.

Stock of the week - NXP Semiconductors NV (30.10.2025)

US OPEN: Powell, MAG7 and Trump mix market's sentiment

Apple Preview: Will Asia spoil the earnings?

DAX: DE40 loses ahead of the EBC decision 📉Volkswagen under pressure

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.